Tickmill’s robust infrastructure ensures your funds withdrawal is straightforward and secure. The process is designed with your convenience in mind, integrating advanced security protocols to protect your assets at every step. From initiating your request to receiving your money, we keep you informed and in control.

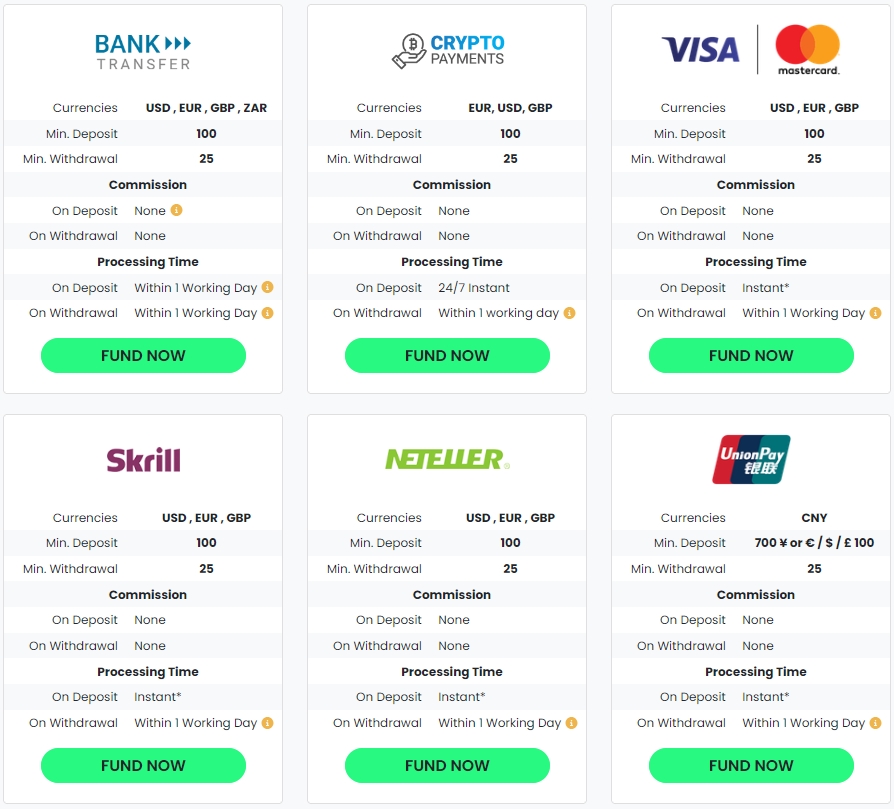

Exploring the available withdrawal methods is crucial for planning your Tickmill payout. Tickmill offers a variety of trusted options, catering to diverse preferences and regional requirements. Each method balances speed, security, and accessibility.

Here’s a snapshot of common withdrawal methods:

| Method | Typical Processing Time | Key Considerations |

|---|---|---|

| Bank Wire Transfer | 1-3 business days | Suitable for larger amounts, may incur bank fees. |

| E-wallets (e.g., Skrill, Neteller) | Within 24 hours | Fastest option, requires matching deposit method. |

| Credit/Debit Cards | 1-3 business days | Funds returned to the original card used for deposit. |

Before initiating your funds withdrawal, keep a few key points in mind to ensure a seamless experience. Verification requirements, often referred to as KYC (Know Your Customer), play a vital role in maintaining security and regulatory compliance. Always ensure your account is fully verified to avoid any delays. Tickmill also operates with clear guidelines regarding minimum and maximum withdrawal limits, and any potential fees are transparently communicated based on your chosen withdrawal method.

Ready to request your Tickmill Withdrawal? Follow these simple steps:

- Log in to your Tickmill Client Area using your credentials.

- Navigate to the “Withdrawal” section within your dashboard.

- Select your preferred withdrawal method from the available options.

- Enter the amount you wish to withdraw and confirm your details.

- Submit your request. You will receive an email confirmation once the process begins.

For an even smoother Tickmill payout, ensure your personal and banking details are always up-to-date in your client area. Double-checking these details before submitting a request can prevent unnecessary complications. If you ever have questions, Tickmill’s dedicated support team is ready to assist, making sure your withdrawal experience is as stress-free as possible.

Your security remains Tickmill’s top priority throughout the entire funds withdrawal process. We employ advanced encryption technologies and stringent verification protocols to safeguard your personal information and financial transactions. This commitment to security provides you with confidence every time you access your capital.

Accessing your trading profits should never be a source of anxiety. With Tickmill, your withdrawal is designed to be swift, secure, and straightforward. Experience the ease of managing your funds with a broker that truly prioritizes your financial freedom.

- Understanding Tickmill Withdrawal Options

- Step-by-Step Guide: How to Initiate a Tickmill Withdrawal

- Log In to Your Client Area

- Navigate to the Withdrawal Section

- Select Your Trading Account

- Choose Your Preferred Withdrawal Method

- Enter the Withdrawal Amount

- Confirm Your Details

- Submit Your Request

- Logging Into Your Client Area

- Submitting Your Withdrawal Request

- Available Withdrawal Methods on Tickmill

- Popular Withdrawal Options

- Key Considerations for Your Funds Withdrawal

- At a Glance: Common Withdrawal Methods

- Bank Wire Transfers

- E-Wallets (Skrill, Neteller, PayPal)

- Credit/Debit Cards

- Tickmill Withdrawal Times: What to Expect

- Our Internal Processing Speed

- Typical Client Receipt Times by Withdrawal Method

- Factors Influencing Your Tickmill Payout Speed

- Tips for a Faster Funds Withdrawal

- Processing Speed by Method

- Are There Any Tickmill Withdrawal Fees?

- Small Withdrawal Amounts

- Third-Party Charges

- Currency Conversion

- Bank Wire Transfers

- Minimum and Maximum Tickmill Withdrawal Limits

- Verification Process for Your Tickmill Withdrawal

- Why Verification is Essential for Your Funds Withdrawal

- Key Steps in the Verification Journey

- Documents You Might Need to Provide

- Tips for a Seamless Tickmill Payout

- KYC Requirements

- Troubleshooting Common Tickmill Withdrawal Issues

- Account Verification Delays

- Incorrect Withdrawal Method or Details

- Insufficient Funds or Minimum Thresholds

- Processing Time Exceeded

- Ensuring a Smooth and Secure Tickmill Withdrawal

- Comparing Tickmill Withdrawal Methods: Pros and Cons

- Bank Wire Transfer

- Credit/Debit Cards

- E-Wallets (e.g., Skrill, Neteller, FasaPay)

- Quick Comparison of Tickmill Withdrawal Methods

- Withdrawing Profits: Tax Implications and Best Practices

- Understanding Tax Implications of Your Withdrawals

- Best Practices for a Seamless Tickmill Payout

- Important Tickmill Withdrawal Policies to Know

- Account Verification: Your First Step

- Available Withdrawal Methods

- Processing Times and Fees

- Minimum and Maximum Withdrawal Limits

- Important Considerations for a Smooth Withdrawal

- Contacting Tickmill Support for Withdrawal Assistance

- Direct Channels for Support

- What to Prepare Before Contacting Support

- When to Seek Assistance for Withdrawal Methods

- Mobile Tickmill Withdrawal: A Quick Overview

- Why Choose Mobile for Your Funds Withdrawal?

- Your Quick Guide to Mobile Tickmill Withdrawal

- Key Considerations for Your Tickmill Payout

- Maximizing Efficiency in Your Tickmill Withdrawal Process

- Frequently Asked Questions

Understanding Tickmill Withdrawal Options

Navigating the financial markets with confidence means having a clear understanding of how to manage your capital, including accessing your earnings efficiently. A smooth and reliable process for your funds is not just a convenience; it’s a cornerstone of a positive trading experience. We understand that a seamless Tickmill Withdrawal process is paramount for every trader.

At Tickmill, we prioritize making your funds withdrawal experience straightforward, secure, and swift. We know that getting your capital and profits quickly matters, which is why we’ve meticulously designed our systems for optimal efficiency. You’ll discover a comprehensive range of reliable withdrawal methods, each crafted to suit your unique needs and ensure your experience is consistently positive.

We offer diverse avenues for your Tickmill payout, each designed for convenience and reliability. Choose the method that best aligns with your preferences and financial setup:

- Bank Wire Transfer: This is a classic, highly secure way to transfer larger sums directly to your bank account. It serves as an ideal choice for substantial withdrawals, offering robust security.

- E-Wallets (Skrill, Neteller, PayPal): For those who value speed and digital convenience, e-wallets provide an excellent solution. Funds often arrive faster, making them a popular choice for quick access to your profits.

- Credit/Debit Cards: A familiar and accessible method, this option allows you to withdraw funds directly back to your card. It offers simplicity and wide acceptance, making it a hassle-free choice for many.

While the withdrawal process is designed to be simple, understanding a few key details will ensure your withdrawal goes without a hitch. Here’s a quick overview of what to expect:

| Withdrawal Method | Typical Processing Time | Potential Fees |

|---|---|---|

| Bank Wire Transfer | 1-3 business days | May incur bank charges |

| E-Wallets | Usually within 24 hours | Minimal or no Tickmill fees |

| Credit/Debit Cards | Up to 1 business day | No Tickmill fees (card issuer might charge) |

“We believe your funds are yours to command. Our commitment is to ensure you can access them with confidence and ease, every single time.”

Our dedicated support team stands ready to assist you should you have any questions regarding your Tickmill Withdrawal. Experience the peace of mind that comes with reliable and efficient funds withdrawal processes. Join us today and discover a trading environment where your financial success and convenience are always the top priority.

Step-by-Step Guide: How to Initiate a Tickmill Withdrawal

Ready to access your trading profits? Initiating a Tickmill Withdrawal is a straightforward process when you know the steps. Let’s walk through exactly how to get your funds back into your account, ensuring a smooth and hassle-free experience. Our aim is to make your Tickmill payout as simple as possible!

Follow these easy steps to complete your funds withdrawal:

-

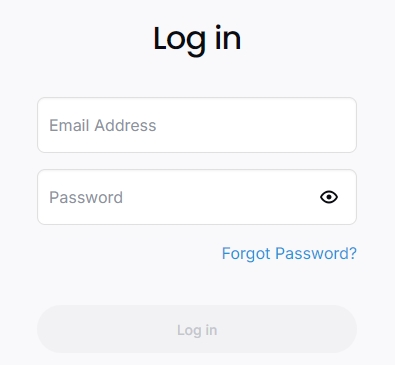

Log In to Your Client Area

Your journey begins in the secure Tickmill Client Area. This is your personal hub for managing all aspects of your trading account. Simply enter your credentials to gain access.

-

Navigate to the Withdrawal Section

Once logged in, look for the ‘Withdrawal’ or ‘Funds’ section. It’s typically found in the main menu or dashboard. Click on it to proceed with your Tickmill Withdrawal request.

-

Select Your Trading Account

If you manage multiple trading accounts, you’ll need to specify which one you wish to withdraw funds from. This ensures the correct account balance is debited.

-

Choose Your Preferred Withdrawal Method

Tickmill offers various withdrawal methods. Select the option that best suits your needs, often matching your deposit method for security reasons. Common withdrawal methods include bank wire transfers, e-wallets, and credit/debit cards. Always check the specific options available in your region.

-

Enter the Withdrawal Amount

Clearly state the amount you wish to withdraw. Pay close attention to any minimum or maximum limits that may apply to your chosen method or account type. Make sure your available balance covers the amount.

-

Confirm Your Details

Before finalizing, review all the information you’ve entered. Double-check the amount, selected account, and your chosen withdrawal method to prevent any delays or errors in your funds transfer.

-

Submit Your Request

Once everything looks correct, submit your Tickmill Withdrawal request. You’ll usually receive a confirmation email detailing your submission and the expected processing time. Tickmill strives for efficient processing of all requests.

Understanding the nuances of the Tickmill payout process can save you time and provide peace of mind. While the steps are clear, sometimes a quick look at processing times or potential fees can be helpful. Here’s a brief overview:

| Aspect | Details to Note |

|---|---|

| Processing Time | Typically processed within one business day, though actual receipt of funds depends on your chosen method and bank. |

| Fees | Tickmill generally covers withdrawal fees for specific methods above certain amounts, but always check their official policy for the latest details. |

| Verification | Ensure your account is fully verified to avoid any hold-ups with your funds withdrawal. |

Completing a Tickmill Withdrawal shouldn’t be a hurdle. By following this guide, you’re well-equipped to manage your trading capital effectively. Join thousands of satisfied traders who confidently manage their funds with Tickmill!

Logging Into Your Client Area

Your personal client area is the command center for your trading journey. It’s where you manage every aspect of your account, from reviewing your trading activity to initiating a Tickmill Withdrawal. Gaining access is straightforward and secure, putting you in complete control of your investments.

Follow these simple steps to log in and unlock your account’s full potential:

- First, navigate directly to the official Tickmill website. Look for the prominent “Client Login” or “Login” button, typically found in the top right corner of the homepage.

- Click this button to open the secure login portal. This action directs you to a dedicated page designed to protect your sensitive information.

- Enter your unique email address and the password you created during registration into the designated fields. Always double-check for any typos to ensure a smooth login process.

- Finally, hit the “Login” button. You’ll instantly gain access to your personalized dashboard, ready to manage your account.

Once inside, you unlock a world of powerful account management tools. Review your trading history, make deposits, request a funds withdrawal, and explore the various withdrawal methods available to you. Your client area is also where you can track the status of your tickmill payout requests, ensuring full transparency. Logging in is your first step to taking command of your trading experience and managing your finances with ease.

Submitting Your Withdrawal Request

Ready to access your trading profits? Submitting your Tickmill withdrawal request is a straightforward process, designed for your convenience and peace of mind. We make sure your funds withdrawal experience is smooth and efficient, getting your earnings back to you without unnecessary delays.

Here is how you initiate your Tickmill payout:

- Log In Securely: First, access your personal client area using your credentials. This secure portal is your hub for all account management.

- Find the Withdrawal Section: Once logged in, navigate directly to the “Withdrawal” section. It is prominently displayed for easy access.

- Select Your Method: Choose your preferred withdrawal method from the available options. Tickmill supports various reliable withdrawal methods to suit your needs.

For a successful and swift transfer, you need to provide a few key pieces of information. Accuracy is vital here:

| Information Category | What You’ll Provide |

|---|---|

| Amount | Specify the exact amount for your Tickmill payout. Ensure it is within your available balance. |

| Method Confirmation | Re-confirm your chosen withdrawal method (e.g., bank transfer, e-wallet, credit/debit card). |

| Recipient Details | Carefully input your bank account number, e-wallet ID, or other relevant details corresponding to your chosen method. |

Before you hit the final submit button, take a moment for a quick checklist. This prevents common hold-ups and ensures your funds withdrawal progresses smoothly:

- Account Verification: Make sure your account verification is complete. Unverified accounts may experience delays.

- Open Positions: Confirm you have no open trading positions that might impact your withdrawable balance.

- Available Funds: Verify your free margin and available balance cover the requested withdrawal amount.

We process all requests promptly, aiming for efficiency with every Tickmill withdrawal. A well-prepared request helps us deliver your funds even faster!

Available Withdrawal Methods on Tickmill

Accessing your hard-earned profits should always be straightforward and stress-free. At Tickmill, we prioritize a seamless funds withdrawal experience, offering a variety of secure and efficient options to suit your needs. Understanding your choices for a Tickmill Withdrawal is key to managing your trading capital effectively.

We provide a comprehensive suite of withdrawal methods, ensuring you can transfer your funds quickly and securely. Your ease of mind is our priority when it comes to any tickmill payout.

Popular Withdrawal Options

Here’s a closer look at the primary withdrawal methods available:

- Bank Wire Transfer: A reliable and universally accepted method, bank wire transfers allow you to move larger sums directly to your bank account. While highly secure, processing times can be longer compared to other options, typically taking a few business days.

- Credit/Debit Cards (Visa/Mastercard): This remains a popular choice for many traders due to its familiarity and convenience. Withdrawals to credit or debit cards are usually processed back to the original card used for deposit, offering a straightforward path for your funds.

- E-Wallets (Skrill, Neteller, PayPal, Sticpay, etc.): For those seeking speed and efficiency, e-wallets stand out. These digital payment solutions often provide the fastest Tickmill payout times, making them an excellent option if you need quick access to your capital. They are a favored choice for many traders worldwide.

- Other Local Payment Solutions: Depending on your region, we may offer additional localized withdrawal methods designed to make your funds withdrawal even more convenient and tailored to your specific country’s banking landscape.

Key Considerations for Your Funds Withdrawal

When you initiate a Tickmill Withdrawal, keep these important points in mind to ensure a smooth process:

- We require account verification before your first funds withdrawal for security reasons. Complete your KYC (Know Your Customer) process beforehand.

- For anti-money laundering regulations, we generally process withdrawals back to the original source of your deposit.

- Processing times vary significantly between different withdrawal methods and financial institutions.

- Some payment providers or intermediary banks may apply their own fees, though Tickmill strives to offer commission-free withdrawals where possible.

- Each withdrawal method has specific minimum and maximum transaction limits.

At a Glance: Common Withdrawal Methods

This table summarizes key characteristics of our common withdrawal methods:

| Withdrawal Method | Typical Processing Time | Potential Fees (from provider) |

|---|---|---|

| Bank Wire Transfer | 1-3 Business Days | Varies (bank-dependent) |

| Credit/Debit Cards | 1-2 Business Days | Generally low/none |

| E-Wallets | Same Day – 1 Business Day | Varies (provider-dependent) |

Our commitment is to provide you with secure and efficient withdrawal methods. We continuously work to expand our range of options, ensuring you always have convenient ways to manage your funds. Explore the available withdrawal methods in your client area and choose the one that best suits your needs for a hassle-free Tickmill payout.

Bank Wire Transfers

When you’re ready to access your trading profits, Tickmill Withdrawal offers various options, and bank wire transfers stand out as a highly reliable choice for many traders. This traditional method involves directly transferring funds from your Tickmill account to your bank account, ensuring a secure path for your money.

Opting for a bank wire means your funds travel through established financial networks. It’s a straightforward process once initiated. You simply provide your bank details, and Tickmill processes the funds transfer directly to your designated account. This approach is often favored for larger sums, offering a robust solution for your Tickmill payout.

| Aspect | Details for Tickmill Clients |

|---|---|

| Processing Time | Expect 3-5 business days. This duration accounts for the comprehensive security protocols banks follow. |

| Fees | Tickmill often covers fees for larger withdrawals. Always consult their current policy. Your receiving bank might impose its own charges. |

| Security | Bank wires are among the most secure withdrawal methods. Robust verification protects your funds withdrawal. |

| Transfer Limits | This method is ideal for substantial transfers, though minimum limits apply. Verify the specific thresholds in your client area. |

| Currency Conversion | If your bank account currency differs from your Tickmill account, your bank will perform a conversion, which may include a currency exchange margin. |

While other withdrawal methods might offer quicker transfer times, the peace of mind that comes with the security and reliability of bank wire transfers is undeniable. It’s a preferred choice for traders prioritizing safety and dealing with larger capital. Ensuring your bank details are accurate is crucial for a smooth process, making it a dependable option among all available withdrawal methods.

E-Wallets (Skrill, Neteller, PayPal)

E-wallets provide a highly efficient and secure avenue for your Tickmill Withdrawal, and we know speed matters when you access your trading profits. Options like Skrill, Neteller, and PayPal are consistently popular choices among traders for their convenience and rapid transaction times.

When you choose an e-wallet for your funds withdrawal, you’re opting for a method that typically processes much faster than traditional banking channels. Once our team approves your request, your funds often become available in your e-wallet account within hours, sometimes even minutes. This makes it an excellent choice for those seeking quick access to their capital.

These leading e-wallet platforms offer significant advantages for your Tickmill payout:

- Speed: Enjoy rapid transfer times, getting your money sooner.

- Security: Benefit from robust encryption and fraud protection measures these services employ.

- Convenience: Manage your digital finances easily, simplifying subsequent transfers or online purchases.

- Accessibility: Use widely accepted payment solutions for broad global reach and flexibility.

Executing your Tickmill Withdrawal via e-wallets is straightforward. Simply navigate to your client area, select your preferred e-wallet from the available withdrawal methods, input the desired amount, and confirm your request. Our dedicated team promptly reviews and processes your submission.

While we prioritize swift processing, it’s worth noting that each e-wallet provider might have specific transaction limits or internal verification requirements. Additionally, you may encounter minor fees imposed by the e-wallet service itself for certain transactions, although we aim to keep our Tickmill payout process free of charges. We always recommend reviewing the terms and conditions of your chosen e-wallet provider for complete clarity.

| E-Wallet | Typical Tickmill Processing Time | Potential E-Wallet Side Fees |

|---|---|---|

| Skrill | Usually 1 business day | Varies by currency and transaction |

| Neteller | Usually 1 business day | Varies by currency and transaction |

| PayPal | Usually 1 business day | Varies by currency and transaction |

Credit/Debit Cards

When it comes to managing your trading capital, knowing your options for a smooth Tickmill withdrawal is paramount. Credit and debit cards stand out as one of the most familiar and straightforward withdrawal methods for many traders. Their widespread acceptance and ease of use make them a top choice for a swift Tickmill payout.

Initiating a funds withdrawal via your credit or debit card is a simple process. You typically log into your Tickmill client area, navigate to the withdrawal section, select the credit/debit card option, and specify the amount you wish to withdraw. Remember, for security and regulatory compliance, funds usually return to the exact card you used for your initial deposit.

Here’s a quick overview of what to expect when using credit/debit cards for your withdrawal:

- Supported Cards: Tickmill generally supports major card networks such as Visa and Mastercard, making it accessible for a wide range of users.

- Processing Time: After you submit your withdrawal request, Tickmill processes it efficiently. The funds usually reflect in your card account within 1 to 3 business days, although bank processing times can vary slightly.

- Fees: Tickmill is committed to transparent and cost-effective trading. They typically do not charge any fees for credit/debit card withdrawals, allowing you to maximize your Tickmill payout.

This method offers a reliable and convenient way to access your trading profits. Its familiarity means you likely already understand how it works, simplifying your overall financial management with Tickmill. Whether you’re making a small withdrawal or a larger funds transfer, credit and debit cards offer a dependable route.

| Feature | Detail |

|---|---|

| Acceptance | Visa, Mastercard |

| Processing Duration | 1-3 business days (after Tickmill processes) |

| Tickmill Fees | Typically None |

| Security | Funds returned to original deposit card |

Choosing credit/debit cards for your withdrawal ensures a predictable and secure path for your funds. It’s one of the most popular withdrawal methods for good reason, offering a balance of speed and convenience for traders globally.

Tickmill Withdrawal Times: What to Expect

You’ve worked hard for your trading success, and getting your profits should be a smooth, straightforward process. Understanding Tickmill Withdrawal times helps you manage your expectations and plan your finances effectively. We prioritize efficient handling of your funds, ensuring a reliable Tickmill Withdrawal experience.

When you initiate a withdrawal, two primary stages are involved: our internal processing and the external transfer by payment providers. We aim for transparency and speed at every step of your funds withdrawal.

Our Internal Processing Speed

Tickmill typically processes all withdrawal requests promptly. Our dedicated team reviews and approves requests quickly, usually within one business day. This internal efficiency is a cornerstone of our service, designed to get your money moving as soon as possible after your request.

Typical Client Receipt Times by Withdrawal Method

After we process your request, the actual time it takes for the funds to reach your account depends on the specific withdrawal methods you choose. Here’s a general overview:

| Withdrawal Method | Estimated Client Receipt Time |

|---|---|

| Bank Wire Transfer | 3-7 Business Days |

| Credit/Debit Card | 2-5 Business Days |

| E-Wallets (e.g., Neteller, Skrill, PayPal) | Same Day – 24 Hours |

| Other Local Payment Solutions | 1-3 Business Days |

Please note, these are general estimates. Public holidays, bank processing schedules, and specific regional payment provider policies can influence these timings.

Factors Influencing Your Tickmill Payout Speed

While we strive for quick service, several factors can impact the overall time it takes to complete your funds withdrawal:

- Account Verification: Ensure your trading account is fully verified before requesting a Tickmill Withdrawal. Unverified accounts may experience delays as we need to complete regulatory checks.

- Chosen Withdrawal Methods: As detailed above, some methods inherently process faster than others. E-wallets often provide the quickest Tickmill payout.

- Timing of Request: Submitting your withdrawal request during business hours (Monday to Friday) typically results in faster processing. Requests made on weekends or public holidays will be processed on the next business day.

- Bank and Payment Provider Delays: Once we release the funds, we depend on banks and other payment providers. Their internal processing times are outside our direct control but contribute to the total time.

- Currency Conversion: If your withdrawal involves currency conversion, this might add a small amount of time to the overall process.

Tips for a Faster Funds Withdrawal

Maximize the speed of your Tickmill Withdrawal by following these simple tips:

- Always ensure your account documentation is up-to-date and fully verified.

- Submit your withdrawal requests during our business hours.

- Consider using e-wallets as your preferred withdrawal methods for the quickest receipt of funds.

- Review any specific requirements for your chosen method before submitting the request.

We are committed to making your Tickmill Payout experience as efficient and straightforward as possible. Ready to experience seamless funds withdrawal? Join our community of traders today and manage your profits with confidence.

Processing Speed by Method

Understanding how quickly your funds reach you after a Tickmill withdrawal is crucial. We know you want fast access to your capital, and while we always strive for efficiency, the total time for your funds withdrawal often depends on the specific withdrawal methods you choose. Each option comes with its own set of processing times, influenced by both internal procedures and external financial institutions.

Here’s a breakdown of typical processing speeds you can expect when initiating your tickmill payout through various channels:

| Withdrawal Method | Our Processing Time | Estimated Funds Arrival |

|---|---|---|

| Bank Wire Transfer | 1 business day | 3-7 business days |

| Credit/Debit Cards | 1 business day | 1-5 business days |

| E-wallets (Skrill, Neteller, PayPal, etc.) | 1 business day | Instantly to 1 business day |

Why the difference? Our internal team works diligently to process every withdrawal request within one business day. This means we approve and send your funds promptly. However, the final leg of the journey – getting the money into your personal bank account or e-wallet – relies on the processing times of third-party payment providers and banks. For instance, a bank wire transfer often involves multiple intermediary banks, which can extend the delivery period.

For the quickest tickmill payout, e-wallet withdrawal methods often stand out. Once our internal processing is complete, these funds typically reflect in your e-wallet account almost instantly or within a few hours. Traditional bank transfers, while secure, naturally take longer due to banking protocols and international clearing processes.

We believe in transparency regarding your funds withdrawal. While we do our part swiftly, always consider the complete timeline for each method when planning your cash flow. Ready to experience seamless trading and straightforward withdrawals?

Are There Any Tickmill Withdrawal Fees?

Navigating the world of online trading means understanding every aspect of your transactions, especially when it comes to getting your money back. A common question we hear is, “Are there any Tickmill withdrawal fees?” Let’s clarify this crucial detail to ensure your Tickmill payout experience is as smooth and transparent as possible.

Tickmill generally prides itself on offering a cost-effective trading environment. For many clients, standard Tickmill withdrawal transactions come with no direct fees from Tickmill’s side. This policy aims to make your funds withdrawal process straightforward and free from unexpected charges when it comes to our part.

However, while Tickmill strives to keep your costs down, certain situations or external factors might introduce fees. You need to be aware of these potential charges from other parties. Here are the key points to consider:

-

Small Withdrawal Amounts

For very small funds withdrawal requests, Tickmill may impose a minor fee to cover processing costs. We recommend checking the current minimums on the official website to avoid these specific charges.

-

Third-Party Charges

This is a big one. Even if Tickmill does not charge you, your bank, credit card provider, or payment processor might levy their own fees. These third-party charges are entirely outside of Tickmill’s control and can vary significantly based on your chosen withdrawal methods and financial institution.

-

Currency Conversion

If your trading account currency differs from the currency of your bank account, an exchange rate conversion will occur. The payment provider or your bank typically applies a conversion fee for this service. This is not a direct Tickmill fee but an inherent part of international funds transfers.

-

Bank Wire Transfers

Some banks charge a fee for receiving international wire transfers. If you use a bank wire as one of your withdrawal methods, be prepared for this potential charge from your receiving bank.

Understanding these potential external costs helps you manage your expectations regarding your overall Tickmill payout. Always review the terms and conditions specific to your chosen withdrawal methods before initiating a request. This proactive approach ensures you have a clear picture of any costs involved in your funds withdrawal.

We believe in full transparency, empowering you to make informed decisions. While direct Tickmill withdrawal fees are largely absent for most transactions, staying informed about third-party charges is key. Ready to experience seamless trading and hassle-free withdrawals? Join Tickmill today and discover the difference!

Minimum and Maximum Tickmill Withdrawal Limits

Starting with a clear understanding of Tickmill withdrawal limits is essential for managing your trading capital effectively. Knowing the parameters for your funds withdrawal ensures a smoother process, helping you plan your financial movements without unexpected hurdles. Let’s explore what you need to know about minimums and maximums for your Tickmill payout.

Navigating Minimum Withdrawal Thresholds

When considering a funds withdrawal from your Tickmill account, the good news is that minimum limits are often quite flexible. For many popular withdrawal methods, Tickmill aims to keep these thresholds low, allowing traders to access even smaller profits. Typically, a minimum withdrawal amount might align with the processing fees associated with certain withdrawal methods, ensuring the transaction remains viable. However, it’s always wise to confirm the specific minimum for your chosen method before initiating a Tickmill withdrawal.

Exploring Maximum Tickmill Withdrawal Limits

Maximum limits for your Tickmill withdrawal are designed to balance security, regulatory compliance, and operational efficiency. These limits can vary significantly based on several factors, including the specific withdrawal methods you use, your account verification status, and internal risk management policies. Instead of a single, universal maximum, you might encounter different caps:

- Per Transaction Limits: A cap on the amount you can withdraw in a single transaction.

- Daily/Weekly Limits: Overarching limits on the total amount you can withdraw within a specific timeframe.

- Method-Specific Caps: Certain withdrawal methods, like bank wire transfers versus e-wallets, may have distinct maximums due to their inherent processing capabilities and costs.

These maximums are put in place to protect both you and the platform, ensuring responsible handling of substantial funds withdrawal requests.

Key Factors Influencing Your Tickmill Payout Limits

Your individual withdrawal experience can be shaped by more than just standard limits. Here are some critical considerations:

| Factor | Impact on Limits |

|---|---|

| Account Verification | Fully verified accounts often enjoy higher withdrawal limits compared to unverified or partially verified ones. |

| Chosen Withdrawal Method | Each of the available withdrawal methods has its own set of rules regarding minimums and maximums. |

| Regulatory Environment | Different regulatory jurisdictions Tickmill operates under may impose varying restrictions on funds withdrawal. |

Always review the most current information available in your client area before initiating a Tickmill payout. Staying informed about these minimum and maximum thresholds will streamline your financial operations and enhance your overall trading experience.

Verification Process for Your Tickmill Withdrawal

Ensuring the security of your funds is paramount, and a robust verification process is a cornerstone of this commitment. When you initiate a Tickmill Withdrawal, our verification steps safeguard your account against unauthorized access and comply with strict regulatory standards. This procedure is designed to protect you, the trader, by confirming your identity before any funds withdrawal leaves your account.

Why Verification is Essential for Your Funds Withdrawal

Think of verification as your financial bodyguard. It creates a secure environment for all your transactions, including your Tickmill payout. This isn’t just a regulatory checkbox; it’s a vital layer of protection:

- Preventing Fraud: We ensure that only you can access and withdraw your hard-earned capital.

- Regulatory Compliance: Adhering to international Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations is non-negotiable.

- Seamless Experience: A fully verified account means quicker processing for all your future withdrawal requests.

Key Steps in the Verification Journey

Getting your account verified for a smooth Tickmill Withdrawal is a straightforward process. Here’s what you can expect:

- Initial Account Setup: You likely completed a basic identity verification when first opening your Tickmill account. This establishes your primary profile.

- Withdrawal Request: When you submit a withdrawal request, our system automatically checks your current verification status.

- Document Submission (If Required): If there are any outstanding verification elements, or if you’re using a new withdrawal method, you may need to submit additional documents.

- Review and Approval: Our dedicated team reviews your submitted documents promptly, ensuring everything meets the necessary criteria.

- Confirmation: Once approved, your Tickmill payout proceeds without delay.

Documents You Might Need to Provide

To ensure a secure Tickmill Withdrawal, we typically require specific documents. Having these ready can significantly speed up your funds withdrawal. Please ensure all documents are clear, valid, and show all four corners.

| Category | Required Document Examples | Purpose |

|---|---|---|

| Proof of Identity | Valid Passport, National ID Card, Driver’s License | Confirms your unique identity and date of birth. |

| Proof of Residence | Utility Bill (electricity, water, gas), Bank Statement, Government-issued Tax Bill | Verifies your residential address (must be dated within the last 3-6 months). |

| Proof of Payment Method | Bank Statement (showing account holder and bank name), Screenshot of e-wallet (showing account holder and ID) | Ensures the withdrawal method matches your verified identity, preventing third-party transactions. |

These documents help us match your identity with the chosen withdrawal methods, bolstering security.

Tips for a Seamless Tickmill Payout

Follow these simple tips to ensure your verification process for any funds withdrawal is as quick and hassle-free as possible:

- Provide Clear Copies: Ensure all document images are high-resolution, legible, and show all edges.

- Check Validity: Make sure your identity documents are current and not expired.

- Match Details: The name and address on your documents must precisely match the details registered on your Tickmill account.

- Respond Promptly: If our team requests additional information, provide it quickly to avoid delays in your Tickmill Withdrawal.

- Use Consistent Methods: Whenever possible, use the same withdrawal methods you’ve previously verified.

By understanding and preparing for the verification process, you empower yourself for efficient and secure management of your funds, ensuring every Tickmill Withdrawal is handled with the utmost care.

KYC Requirements

Understanding Know Your Customer (KYC) requirements is crucial for a smooth and secure experience with any financial platform, and Tickmill is no exception. This essential process safeguards your investments and ensures compliance with global anti-money laundering regulations. It’s all about verifying your identity, protecting your account, and ultimately, making your Tickmill withdrawal process secure.

Before you can initiate your first funds withdrawal, you will complete the KYC verification. This is a standard procedure across the industry, designed to prevent fraud and ensure that payouts go to the rightful account holder. Think of it as a one-time security check that builds trust and efficiency for all your future transactions.

Here’s a look at the typical documents you’ll need to provide:

- Proof of Identity: This confirms who you are. Commonly accepted documents include:

- Valid Passport (picture page)

- National ID Card (both sides)

- Driver’s License (both sides)

- Proof of Address: This verifies where you live. Accepted documents usually are:

- Utility Bill (electricity, water, gas, internet – not older than 6 months)

- Bank Statement (not older than 6 months)

- Government-issued tax declaration (not older than 6 months)

Submitting these documents is straightforward. You typically upload them directly through your secure client area. Once submitted, our dedicated team promptly reviews your information. This verification process typically concludes quickly, paving the way for hassle-free Tickmill payout requests through your preferred withdrawal methods.

“Completing KYC upfront means your funds withdrawal requests get processed faster and safer. It’s a small step for significant peace of mind.”

Rest assured, Tickmill handles all your personal data with the utmost confidentiality and in full compliance with data protection regulations. We prioritize the security of your information and your funds, making KYC a cornerstone of our commitment to you.

Troubleshooting Common Tickmill Withdrawal Issues

Even with robust systems in place, occasional hiccups can occur during a funds withdrawal. Experiencing a delay or an unexpected issue with your Tickmill withdrawal can be frustrating, but most problems have straightforward solutions. As an experienced trader, you want quick access to your capital. This guide walks you through the most common challenges and how to resolve them efficiently, ensuring your Tickmill payout arrives smoothly.

Account Verification Delays

One of the primary reasons for a delayed Tickmill withdrawal is often related to account verification. Regulatory compliance requires brokers to confirm your identity and address to prevent fraud and money laundering. If your account isn’t fully verified, or if your documents are outdated, your withdrawal request might pause.

- Check Your Verification Status: Log into your Tickmill client area. Ensure all required Know Your Customer (KYC) documents, like ID and proof of residence, are approved and current.

- Update Expired Documents: If an uploaded document, such as your passport or utility bill, has expired, you must submit an updated version.

- Resolution: Proactively ensure your profile is fully verified before initiating a Tickmill payout. If you believe everything is in order but still face delays, contact Tickmill support directly to inquire about your specific verification status.

Incorrect Withdrawal Method or Details

A common pitfall involves choosing the wrong withdrawal method or entering incorrect details. Due to anti-money laundering (AML) policies, you must typically withdraw funds back to the original source you used for deposits.

Always double-check your recipient details. A small typo can cause significant delays in your funds reaching you, or worse, lead to complications that require extensive investigation.

Consider these points:

| Issue Type | What to Check |

|---|---|

| Mismatching Names | Ensure the name on your bank account or e-wallet matches your Tickmill trading account name. |

| Wrong Bank Details | Verify account numbers, SWIFT/IBAN codes, and bank names are precise. |

| Unsupported Withdrawal Methods | Confirm Tickmill supports your chosen withdrawal method for your region and currency. |

If you’ve made an error, immediately contact Tickmill support. They can guide you on the steps to correct the information, though this might cause some additional processing time.

Insufficient Funds or Minimum Thresholds

Sometimes, what appears as a Tickmill withdrawal issue is simply a misunderstanding of your available balance or minimum withdrawal requirements.

- Minimum Withdrawal Amounts: Tickmill, like many brokers, sets minimum amounts for each withdrawal method. Attempting a funds withdrawal below this threshold will result in an error. Check the specific requirements for your chosen withdrawal methods on the Tickmill website.

- Available Margin vs. Free Margin: Ensure you are withdrawing from your ‘free margin’ – the funds not currently tied up in open trades or required as margin. Attempting to withdraw funds used for margin can lead to a rejection.

- Commission/Fees: Factor in any potential withdrawal fees that might apply, especially for smaller amounts or certain methods. These fees can reduce your available withdrawal balance below the minimum if not accounted for.

Processing Time Exceeded

You initiated your Tickmill withdrawal, but the funds haven’t arrived within the advertised timeframe. This can be frustrating, but external factors often play a role.

What to remember about processing times:

- Internal Processing vs. Bank Transfer: Tickmill typically processes withdrawals within one business day. However, bank transfers, especially international ones, can take an additional 3-5 business days to reflect in your account.

- Weekends and Public Holidays: These do not count as business days. If you initiate a Tickmill payout on a Friday, it might only begin processing on Monday.

- Intermediary Banks: For international wire transfers, multiple intermediary banks might be involved, each adding to the overall processing time.

If the expected time has passed, first check your bank statements thoroughly. If the funds are still missing, gather your transaction ID and the exact date and time of your withdrawal request, then reach out to Tickmill’s customer support for a detailed investigation.

Ensuring a Smooth and Secure Tickmill Withdrawal

Navigating the world of online trading demands confidence, not just in your strategies, but also in the platform you choose. A critical aspect that builds this trust is a seamless and secure process for accessing your earnings. When it comes to managing your profits, understanding the Tickmill Withdrawal process is key. We ensure you can move your funds with ease and peace of mind.

Your Path to a Successful Tickmill Withdrawal

Getting your money out should never be a chore. We’ve streamlined the entire procedure to be as straightforward as possible. Here’s a quick overview of what you can expect:

- Account Verification: Before your first funds withdrawal, completing our robust account verification (KYC) is mandatory. This protects your account and adheres to regulatory standards. It’s a one-time process designed for your security.

- Initiating Your Request: Log into your secure client area. Navigate to the withdrawal section, choose your preferred method, and specify the amount. Our intuitive interface guides you through each step.

- Processing and Confirmation: Once submitted, our dedicated team processes your request efficiently. You will receive notifications confirming the status of your Tickmill Withdrawal.

Exploring Your Tickmill Withdrawal Methods

We understand that flexibility is important. That’s why we offer a variety of convenient withdrawal methods to suit your needs. Whether you prefer traditional banking or modern e-wallets, your options are clear and accessible for efficient funds withdrawal.

| Method | Description |

|---|---|

| Bank Wire Transfer | Ideal for larger amounts, directly to your bank account. |

| Skrill | Fast and secure e-wallet option. |

| Neteller | Another popular e-wallet for quick transactions. |

| FasaPay | A convenient e-payment gateway, often used in specific regions. |

| UnionPay | A widely used card payment option, particularly in Asia. |

Please note: The availability of specific withdrawal methods may vary based on your region and local regulations.

Understanding Tickmill Payout Timelines

You’ve worked hard for your profits, and you want them quickly. The time it takes for your funds to reach you after a Tickmill Withdrawal request can vary. Several factors influence the Tickmill payout speed:

- Chosen Method: E-wallets typically process faster than bank wire transfers.

- Bank Processing Times: Traditional bank transfers may take longer due to interbank clearing procedures.

- Working Hours: Requests submitted outside business hours or on weekends may experience slight delays.

- Verification Status: Ensuring your account is fully verified helps avoid any hold-ups.

Tips for a Seamless Funds Withdrawal Experience

We want every Tickmill Withdrawal to be a smooth one. Follow these simple tips to ensure your funds reach you without any hitches:

- Verify Your Account Fully: Complete all KYC steps upfront to prevent delays on your first withdrawal.

- Match Withdrawal & Deposit Methods: Where possible, withdraw using the same method you used for deposits. This helps with anti-money laundering regulations.

- Check Your Details: Double-check all banking or e-wallet information before submitting your withdrawal request. A tiny typo can cause significant delays.

- Be Aware of Minimums/Maximums: Familiarize yourself with any withdrawal limits that may apply to your chosen method.

Your financial security and seamless access to your funds are paramount. We invest heavily in robust systems to ensure every Tickmill Withdrawal is not just efficient, but also incredibly secure.

At Tickmill, we prioritize your convenience and security. Our commitment to transparent processes ensures that your journey from trading success to receiving your Tickmill payout is always clear and dependable. Join us and experience a truly professional trading environment where your funds are always within reach.

Comparing Tickmill Withdrawal Methods: Pros and Cons

Getting your money when you need it is crucial. At Tickmill, we understand you want a smooth and efficient Tickmill withdrawal experience. Choosing the right withdrawal methods can significantly impact how quickly you receive your funds and any associated costs. We’ve laid out the details for you to make an informed decision about your next funds withdrawal.

Let’s explore the primary options available, breaking down the advantages and disadvantages of each to help you choose the best path for your tickmill payout.

Bank Wire Transfer

Bank wire transfers are a traditional and highly secure way to manage your withdrawal, especially for larger sums. It moves money directly from your Tickmill account to your bank account.

- Pros:

- High Security: Banks offer robust security protocols, making it a very safe option for substantial funds withdrawal.

- No Limits (Generally): You can typically withdraw larger amounts compared to other methods.

- Cons:

- Slower Processing: This method can take 2-5 business days to clear, sometimes even longer depending on international banking routes.

- Higher Fees: Banks often charge fees for wire transfers, which can eat into your tickmill payout.

Credit/Debit Cards

Using your credit or debit card for a Tickmill withdrawal offers a blend of convenience and speed, especially if you initially funded your account this way.

- Pros:

- Convenience: Most people already have a card, making this a readily accessible option for withdrawal.

- Faster Than Bank Wires: Processing times are generally quicker, typically 1-3 business days.

- Lower Fees: Tickmill often incurs the processing fees, meaning more of your money reaches you.

- Cons:

- Withdrawal Limits: Often, you can only withdraw up to the amount you initially deposited via that card. Any profit must go via bank wire.

- Bank Processing: While Tickmill processes quickly, your bank might take additional time to reflect the funds withdrawal in your account.

E-Wallets (e.g., Skrill, Neteller, FasaPay)

E-wallets have become incredibly popular for their speed and ease, making them excellent withdrawal methods for those who prioritize quick access to funds.

- Pros:

- Rapid Processing: E-wallet withdrawals are often the fastest, sometimes processing within minutes or up to 24 hours once approved. This means a quicker tickmill payout.

- Low to No Fees: Many e-wallets offer cost-effective transactions, reducing the impact on your withdrawn amount.

- Convenient: Manage your funds digitally with ease.

- Cons:

- Account Required: You need an active e-wallet account, which might involve a separate verification process.

- Geographic Restrictions: Not all e-wallets are available in all regions, limiting options for some users.

- Limits: While often generous, there can be daily or transaction limits.

Quick Comparison of Tickmill Withdrawal Methods

To give you a clearer picture, here’s a quick summary of the key characteristics:

| Method | Typical Processing Time (after approval) | Potential Fees (from Tickmill’s side) | Convenience Level |

|---|---|---|---|

| Bank Wire Transfer | 2-5 Business Days | Usually Covered by Tickmill above certain thresholds, otherwise bank fees may apply | Medium |

| Credit/Debit Card | 1-3 Business Days | Usually Covered by Tickmill | High |

| E-Wallets | Up to 24 Hours | Usually Covered by Tickmill | High |

Choosing the best Tickmill withdrawal method depends on your priorities. Do you value speed, low fees, or maximum security for a large funds withdrawal? Each option presents a unique set of trade-offs. Always review the latest terms and conditions on Tickmill’s official site to ensure you have the most current information regarding any withdrawal policies and potential third-party charges.

Withdrawing Profits: Tax Implications and Best Practices

Congratulations on a successful trading journey! Seeing your hard-earned profits materialize is incredibly rewarding. Now comes the exciting part: realizing those gains through a smooth Tickmill Withdrawal. However, navigating the world of funds withdrawal isn’t just about clicking a button. It requires a keen understanding of both the practical steps for a successful tickmill payout and the often-overlooked tax implications. This section guides you through best practices, ensuring your profits remain yours, free from unexpected surprises.A smart approach to your withdrawal process means you can enjoy your success without future headaches. Let’s delve into what you need to know.

Understanding Tax Implications of Your Withdrawals

Tax regulations on trading profits vary significantly across different countries and jurisdictions. What’s considered taxable income in one region might be treated differently elsewhere. This isn’t a “one size fits all” scenario, and ignoring it can lead to hefty penalties.Consider these crucial points regarding your profits:

- Jurisdictional Rules: Your country of residence dictates how your trading profits are taxed. Some classify profits as capital gains, others as regular income, or even a blend.

- Capital Gains vs. Income: Understand the distinction. Capital gains tax often applies to profits from asset sales, typically at a different rate than standard income tax.

- Tax-Free Thresholds: Many jurisdictions offer a tax-free allowance for investment income or capital gains. Knowing this can help you plan your withdrawals.

- Reporting Obligations: You are generally responsible for reporting your trading income to the relevant tax authorities. Tickmill does not report on your behalf.

- Record Keeping: Maintain meticulous records of all your trades, deposits, and withdrawal transactions. This documentation is invaluable if you ever face an audit.

Always consult a qualified tax advisor in your jurisdiction. Their expertise is invaluable for navigating complex tax laws and optimizing your financial strategy around your funds withdrawal.

Best Practices for a Seamless Tickmill Payout

Once you’ve considered the tax landscape, focusing on efficient withdrawal methods is the next step. A streamlined process ensures your money reaches you quickly and securely.Follow these best practices for your Tickmill Withdrawal:

- Verify Your Account: Ensure your Tickmill account is fully verified. This often involves submitting identity and residency documents. Unverified accounts may face withdrawal limits or delays.

- Choose Appropriate Withdrawal Methods: Tickmill offers various withdrawal methods, including bank wire transfers, e-wallets, and credit/debit cards. Select the method that best suits your needs in terms of speed, fees, and convenience.

- Understand Fees and Limits: Each withdrawal method may have specific fees and minimum/maximum limits. Review these details before initiating your funds withdrawal to avoid surprises.

- Match Deposit Method: For anti-money laundering (AML) purposes, Tickmill typically requires you to withdraw funds using the same method you used for your initial deposit, up to the deposited amount. Profits can then often be withdrawn via bank transfer or other approved methods.

- Allow for Processing Times: While Tickmill processes requests quickly, external factors like bank processing times or e-wallet network speeds can affect how long it takes for funds to appear in your account. Plan accordingly.

- Keep Records: Beyond tax purposes, keeping personal records of your Tickmill payout requests, transaction IDs, and receipt dates helps you track your funds and resolve any potential discrepancies.

By diligently following these guidelines, your Tickmill Withdrawal experience will be efficient, transparent, and most importantly, contribute positively to your overall financial management.

Important Tickmill Withdrawal Policies to Know

Understanding the specific policies surrounding your Tickmill withdrawal is crucial for a smooth and efficient experience. We believe in transparency, ensuring you always know what to expect when accessing your earnings. Navigating the process for a quick funds withdrawal should be straightforward, and knowing these key policies upfront helps achieve just that.

Account Verification: Your First Step

Before any withdrawal can be processed, your trading account must be fully verified. This is a standard regulatory requirement designed to protect your security and prevent fraud. Completing this step early on ensures no delays when you are ready to request a Tickmill payout. We typically require:

- Proof of Identity (e.g., passport, national ID card)

- Proof of Residence (e.g., utility bill, bank statement from the last three months)

Timely submission of clear documents speeds up the verification process, setting you up for quick future transactions.

Available Withdrawal Methods

Tickmill offers a variety of convenient withdrawal methods to suit your preferences. We always aim to send funds back to the original source of deposit, following anti-money laundering regulations. If that’s not possible, alternative methods are available after careful consideration. Here’s a look at some common options:

| Method | Typical Processing Time | Key Considerations |

|---|---|---|

| Bank Wire Transfer | 1-3 business days | Suitable for larger amounts, may incur bank fees. |

| Credit/Debit Cards | Up to 1 business day | Return to original card used for deposit. |

| E-wallets (e.g., Skrill, Neteller) | Within 1 business day | Fastest option, usually free of charge from our side. |

Always review the most current list of available options directly on the Tickmill platform or through our client support.

Processing Times and Fees

We process all withdrawal requests promptly. Once you submit a request, our finance team reviews it on business days. Typically, we aim to process requests within one business day. However, the time it takes for funds to reach your account depends on the specific withdrawal methods chosen and the processing times of the respective financial institutions.

Regarding fees, Tickmill does not charge internal fees for most standard deposit and funds withdrawal transactions. However, intermediary banks or payment providers might impose their own charges for international transfers, especially with bank wire options. We recommend checking with your bank or payment provider for any potential third-party fees you might incur.

Minimum and Maximum Withdrawal Limits

Each payment method comes with its own set of minimum and maximum limits for a single Tickmill payout request. These limits are in place to ensure security and efficiency for all transactions. You can find specific details regarding these limits within your client area when initiating a withdrawal request. Our system will guide you through the permissible amounts for your chosen method.

Important Considerations for a Smooth Withdrawal

- Match Payment Details: Ensure the name on your withdrawal method matches the name on your Tickmill trading account. This is a critical security measure.

- Original Source Rule: Whenever possible, funds return to the same method and account used for the initial deposit. This prevents money laundering.

- Currency Conversion: If your trading account currency differs from your withdrawal account currency, your bank or payment provider will perform a currency conversion, potentially incurring exchange rate fees.

- Documentation: Keep all your verification documents up-to-date. If any change occurs, update your profile immediately to avoid future delays.

We work hard to make your Tickmill withdrawal process as simple and fast as possible. By understanding these key policies, you empower yourself to manage your funds with confidence and ease. Our support team is always ready to assist if you have any questions about your next funds withdrawal.

Contacting Tickmill Support for Withdrawal Assistance

Navigating the financial markets requires focus and precision, and when it comes to managing your earnings, a smooth process is paramount. Sometimes, questions or specific situations arise during a Tickmill Withdrawal. That’s precisely when reaching out to Tickmill’s dedicated support team becomes invaluable. They stand ready to assist, ensuring your funds withdrawal experience is as straightforward and efficient as possible.

Direct Channels for Support

Tickmill provides several accessible ways to connect with their customer service experts. Choose the method that best suits your urgency and preference:

- Live Chat: For immediate assistance, the live chat feature on the Tickmill website offers real-time interaction. It’s perfect for quick questions about your withdrawal status or general inquiries.

- Email Support: If your query requires detailed explanations or involves sensitive information, sending an email is a robust option. You can attach screenshots or supporting documents, allowing the team to investigate thoroughly.

- Phone Support: For direct conversation and personalized guidance, a phone call connects you directly with a support agent. This is often the quickest route for complex issues requiring immediate resolution.

What to Prepare Before Contacting Support

To streamline your Tickmill payout inquiry and receive the fastest possible resolution, have some key information ready. This preparation helps the support team quickly identify your account and understand your specific situation regarding funds withdrawal.

| Information Needed | Why It’s Important |

|---|---|

| Your Account ID (Login) | Allows agents to quickly locate your trading account. |

| Date and Time of Withdrawal Request | Helps pinpoint specific transactions. |

| Amount Requested for Withdrawal | Crucial detail for verifying the transaction. |

| Withdrawal Method Used | Different withdrawal methods have varying processing times and requirements. |

| Any Error Messages Received | Provides valuable clues for troubleshooting. |

Having these details at hand significantly reduces back-and-forth communication and accelerates the support process.

“Proactive communication is key. Don’t hesitate to contact Tickmill support if you encounter any uncertainty with your Tickmill Withdrawal. They are there to help.”

When to Seek Assistance for Withdrawal Methods

You might contact support for various reasons, from understanding specific withdrawal methods to resolving unexpected delays. Perhaps you need clarification on verification documents, or you’re curious about the typical processing times for a specific Tickmill payout channel. Whether it’s a technical glitch or a simple question about policy, their team provides clear, concise answers. They empower you with the knowledge to manage your funds effectively and confidently.

Tickmill’s commitment to client satisfaction extends to their support services. They work diligently to ensure every Tickmill Withdrawal proceeds smoothly, offering professional and timely assistance whenever you need it.

Mobile Tickmill Withdrawal: A Quick Overview

In today’s fast-paced world, managing your finances on the go is not just a luxury; it’s a necessity. That’s why we bring you a swift look at the Tickmill Withdrawal process directly from your mobile device. Get ready to experience unparalleled convenience as you access your funds with just a few taps.

Why Choose Mobile for Your Funds Withdrawal?

Your smartphone is more than just a communication tool; it’s a powerful financial hub. Opting for a mobile withdrawal offers distinct advantages:

- Instant Access: Initiate your funds withdrawal anytime, anywhere.

- User-Friendly Interface: Navigate a streamlined process designed for efficiency.

- Secure Transactions: Benefit from robust security features built into the mobile platform.

- Real-time Updates: Stay informed about the status of your Tickmill payout directly on your device.

Your Quick Guide to Mobile Tickmill Withdrawal

Performing a withdrawal on Tickmill’s mobile platform is straightforward. Here’s a simplified path to get your funds:

- Log In: Access your Tickmill account via the mobile app or web browser.

- Navigate to Wallet: Find the “Wallet” or “Funds” section within your account dashboard.

- Select Withdrawal: Choose the “Withdrawal” option to begin the process.

- Pick Your Method: Select your preferred withdrawal methods from the available options.

- Enter Details: Input the desired amount and any necessary payment details.

- Confirm & Submit: Review your request and confirm to finalize the Tickmill Withdrawal.

Key Considerations for Your Tickmill Payout

While the mobile experience is seamless, keeping a few points in mind ensures a smooth funds withdrawal:

- Verification: Ensure your account is fully verified to avoid delays. This is crucial for all withdrawal requests.

- Available Methods: Different withdrawal methods may have varying processing times and potential fees. Check these details before you proceed.

- Currency Conversion: Be aware of any currency conversion rates if your account and withdrawal currency differ.

- Tickmill Payout Times: While we process requests swiftly, external bank or payment provider processing times can influence when funds appear in your account.

Embrace the convenience of mobile finance. Your funds are always within reach, and managing your investments has never been easier. Take control of your finances today!

Maximizing Efficiency in Your Tickmill Withdrawal Process

Navigating the world of online trading requires not just a keen eye for market movements but also a smooth, reliable way to manage your capital. When it comes to accessing your hard-earned profits, an efficient Tickmill Withdrawal process is paramount. We understand you want your funds readily available, and our goal is to ensure your experience is as streamlined and fast as possible. This guide helps you optimize every step, ensuring you get your money without unnecessary delays.

Understanding the Tickmill Withdrawal Journey

Getting your funds from your trading account doesn’t have to be complicated. The core of any successful withdrawal lies in preparation and understanding the steps involved. Think of it as a clear path: submit your request, allow for processing, and then receive your capital. Each stage has its nuances, which, when understood, greatly enhance the overall speed of your funds withdrawal.

Key Factors Influencing Your Payout Speed

The speed at which you receive your tickmill payout can vary, and several factors play a significant role. Being aware of these helps you proactively manage expectations and even accelerate the process.

- Account Verification Status: A fully verified account is non-negotiable for any withdrawal. Ensure all your documentation is up-to-date and approved before initiating a request. This is the bedrock of fast processing.

- Chosen Withdrawal Method: Different withdrawal methods have varying processing times. E-wallets are often quicker than bank transfers, for example.

- Time of Request: Submitting your withdrawal during business hours, especially early in the week, can sometimes lead to faster processing compared to weekend or holiday requests.

- Jurisdictional Requirements: Local banking regulations or payment provider policies can sometimes introduce additional processing time.

Selecting Your Ideal Withdrawal Methods

Tickmill offers a diverse range of withdrawal methods to suit various preferences. Each option comes with its own set of advantages regarding speed and potential fees. It’s smart to choose a method that aligns with how you deposited funds, as this often simplifies compliance checks and speeds up the overall funds withdrawal. Exploring the available options helps you make an informed decision for your next tickmill payout.

Consider these popular categories:

| Method Category | Typical Processing Benefit | Key Consideration |

|---|---|---|

| E-Wallets (e.g., Skrill, Neteller) | Often fastest for receiving funds post-processing. | Ensure your e-wallet account is fully verified. |

| Bank Transfers | Reliable for larger sums. | Can take longer due to interbank processing times. |

| Credit/Debit Cards | Convenient, often linked to deposits. | Refunds typically go back to the original card. |

Practical Tips for a Seamless Tickmill Withdrawal

Want to ensure your Tickmill Withdrawal goes off without a hitch? Here are some actionable tips:

- Verify Your Account Fully: Before you even think about a withdrawal, confirm your account is completely verified. Incomplete verification is the number one cause of delays.

- Match Deposit & Withdrawal Methods: Whenever possible, withdraw funds back to the same method you used for depositing. This significantly reduces potential compliance checks.

- Double-Check Details: Always confirm your banking details, e-wallet IDs, or card numbers. A small typo can lead to significant delays in your funds withdrawal.

- Be Mindful of Cut-off Times: Some payment providers or banks have daily cut-off times. Submitting your request earlier in the day often means it gets processed sooner.

- Understand Fees: While Tickmill strives to offer commission-free withdrawals, always be aware of potential fees from your bank or payment provider.

Troubleshooting Common Withdrawal Hurdles

Even with the best preparation, sometimes a withdrawal might encounter a snag. Don’t worry, most issues are easily resolved:

“Experiencing a delay? The first step is to check your email for any communications from Tickmill regarding your withdrawal status or any required additional information.”

Common issues include:

- Incomplete Documentation: You might need to provide updated ID or proof of address.

- Mismatching Account Names: The name on your Tickmill account must perfectly match the name on your chosen withdrawal methods account.

- Withdrawal Limit Exceeded: Ensure your request is within the minimum and maximum limits for your chosen method.

- Bonus Terms: If you’ve used a bonus, confirm you’ve met all the trading requirements before attempting a tickmill payout.

For any persistent issues, our dedicated support team is ready to assist. Ensuring a smooth Tickmill Withdrawal is our priority, and we empower you with the knowledge to make it effortless.

Frequently Asked Questions

What are the primary withdrawal methods available on Tickmill?

Tickmill offers several popular withdrawal methods, including Bank Wire Transfers, E-wallets (such as Skrill, Neteller, and PayPal), and Credit/Debit Cards (Visa/Mastercard). The availability of specific methods may vary depending on your region.

How long does it typically take for a Tickmill withdrawal to be processed and reach my account?

Tickmill generally processes withdrawal requests within one business day. After internal processing, the time it takes for funds to reach your account varies: E-wallets typically deliver funds within the same day to 24 hours, Credit/Debit Cards take 2-5 business days, and Bank Wire Transfers usually take 3-7 business days.

Does Tickmill charge any fees for processing withdrawals?

Tickmill strives to provide a cost-effective trading environment and generally does not charge direct fees for most standard withdrawal transactions. However, third-party charges from your bank, credit card provider, or e-wallet service, as well as currency conversion fees, may apply and are outside of Tickmill’s control.

What are the KYC requirements I need to fulfill for a Tickmill withdrawal?

To ensure security and comply with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, your Tickmill account must be fully verified before your first withdrawal. This typically involves submitting valid proof of identity (e.g., passport, national ID) and proof of residence (e.g., utility bill, bank statement).

What factors can influence the speed of my Tickmill payout?

Several factors can affect withdrawal speed, including your account’s verification status, the specific withdrawal method chosen, the timing of your request (submitting during business hours is often faster), and potential delays from intermediary banks or payment providers involved in the transfer process.