Embark on your trading journey with confidence. Tickmill Trading Accounts open up a world of diverse market opportunities, tailored to meet the unique demands of every trader. Whether you are taking your first steps into the financial markets or you’re a seasoned professional looking for superior conditions, we have the perfect solution for you. Discover competitive pricing, lightning-fast execution, and robust support designed to enhance your trading experience.

We understand that one size doesn’t fit all. That’s why Tickmill offers a selection of sophisticated trading accounts, each crafted to provide specific advantages. Explore our comprehensive range and find the ideal match for your trading style and goals.

- Why Choose Tickmill for Your Trading Accounts?

- Explore Our Tailored Account Types

- Opening Your Live Accounts with Tickmill

- Understanding Tickmill: A Brief Overview

- Types of Tickmill Trading Accounts Explained

- Classic Account

- Pro Account

- VIP Account

- Islamic Account (Swap-Free)

- Demo Account

- The Classic Account: Ideal for Beginners

- Key Features Tailored for Novices

- Why This Account Type Suits You

- The Pro Account: Designed for Experienced Traders

- The VIP Account: For Professional Volume Traders

- What Sets the VIP Account Apart?

- Comparing Tickmill Pro and Classic Accounts

- The Classic Account: Ideal for New Traders

- The Pro Account: Built for Experienced & High-Volume Traders

- Choosing Your Perfect Account Type

- What is a Tickmill Demo Account and How to Use It?

- Why Use a Tickmill Demo Account?

- How to Get Started with Your Tickmill Demo Account

- Maximizing Your Demo Experience

- Key Features of Tickmill Trading Accounts

- Diverse Account Options for Every Trader

- Ultra-Competitive Spreads and Low Commissions

- Superior Execution Speed

- Flexible Leverage Choices

- Robust Trading Platforms

- Seamless Account Opening Process

- Available Financial Instruments

- Execution Speed and Technology

- Spreads and Commissions Across Tickmill Account Types

- Tickmill’s Account Offerings: A Cost Perspective

- The Classic Account: Simplicity and Transparency

- The Pro Account: Designed for Active Traders

- The VIP Account: Elite Conditions for High-Volume Traders

- Understanding Spreads and Commissions in Your Live Accounts

- Comparative Snapshot of Tickmill Account Costs

- Leverage Options Available with Tickmill

- Funding Your Tickmill Trading Account: Deposits and Withdrawals

- Deposit Methods and Currencies

- Flexible Deposit Methods

- Supported Currencies for Your Account Types

- Deposit Details at a Glance

- Withdrawal Process and Times

- Platforms Supported for Tickmill Account Holders

- MetaTrader 4 (MT4)

- MetaTrader 5 (MT5)

- Eligibility Requirements for Opening a Tickmill Account

- Benefits of Choosing Tickmill for Your Trading Needs

- Unmatched Trading Conditions

- A Spectrum of Tailored Account Types

- Superior Execution Speed and Reliability

- Dedicated Customer Support and Trustworthy Regulation

- Empowering Educational Resources

- Customer Support for Tickmill Trading Account Queries

- How to Connect with Our Support Team

- What We Can Help You With

- Our Commitment to Your Success

- Security Measures for Tickmill Accounts and Client Funds

- How to Choose the Best Tickmill Account for You

- Understand Your Trading Profile

- Explore Tickmill Account Types

- The Classic Account: Ideal for New Traders

- The Pro Account: For Cost-Conscious and Active Traders

- The VIP Account: Exclusivity for High-Volume Traders

- Islamic Account Option: Swap-Free Trading

- Comparative Overview of Tickmill Trading Accounts

- Finalizing Your Choice

- Conclusion: Maximizing Your Potential with Tickmill Trading Accounts

- Frequently Asked Questions

Why Choose Tickmill for Your Trading Accounts?

Selecting the right broker is crucial. With Tickmill, you gain access to a platform built on transparency, reliability, and innovation. Here’s what sets our trading accounts apart:

- Ultra-Low Spreads: Benefit from some of the industry’s tightest spreads, reducing your trading costs.

- Exceptional Execution: Experience rapid order execution with minimal slippage, even during volatile periods.

- Robust Regulation: Trade with peace of mind under the supervision of leading financial authorities.

- Diverse Instruments: Access a wide array of instruments, from forex and indices to commodities and cryptocurrencies.

- Dedicated Support: Our expert customer service team is always ready to assist you on your trading journey.

Explore Our Tailored Account Types

Your trading strategy deserves an account that empowers it. Tickmill’s account types are designed to cater to various experience levels and trading volumes. From classic forex accounts to specialized professional setups, we provide the tools you need to succeed.

Let’s take a closer look at some of the distinct features offered across our main trading accounts:

| Account Type | Ideal For | Key Features |

|---|---|---|

| Classic Account | Beginner and intermediate traders | Commission-free trading, competitive spreads, simple structure. |

| Pro Account | Experienced traders, scalpers, EAs | Raw spreads from 0.0 pips, low commissions, deep liquidity. |

| VIP Account | High-volume traders, institutions | Lowest commissions, dedicated account manager, bespoke trading conditions. |

Opening Your Live Accounts with Tickmill

Ready to dive into the markets? Opening one of our live accounts is a straightforward and secure process. We make it easy for you to get started, ensuring a seamless transition from registration to your first trade.

Our intuitive platform guides you through each step, verifying your identity quickly and efficiently. Soon, you will be able to fund your account and begin exploring the vast possibilities that Tickmill Trading Accounts offer. We stand ready to provide all the resources and support you need to make informed trading decisions.

Don’t just trade; thrive with Tickmill. Your gateway to truly diverse market opportunities awaits. Join us today and elevate your trading experience!

Understanding Tickmill: A Brief Overview

Navigating the complex world of financial markets demands a reliable partner. Tickmill stands out as a globally recognized broker, empowering traders with access to a wide array of instruments. Since its inception, Tickmill has built a strong reputation for offering competitive trading conditions and robust technology, serving both novice and experienced market participants.

We believe that a secure and efficient trading environment is paramount for success. This commitment drives everything we do, from our platform stability to the dedicated support we provide.

When you consider joining our community, you gain access to a platform designed for peak performance. We prioritize your trading journey by focusing on:

- Competitive spreads and commissions

- Superior trade execution speed

- Advanced trading platforms (MetaTrader 4 and MetaTrader 5)

- Comprehensive educational resources

- Dedicated multilingual customer support

Tickmill offers a diverse selection of Tickmill Trading Accounts, each designed to meet specific needs and trading styles. Whether you are interested in forex, indices, commodities, or cryptocurrencies, our range of trading accounts provides the flexibility you require. We ensure you have clear options when selecting your live accounts, allowing you to choose the best fit for your strategy and capital. Our specialized forex accounts, for example, are tailored to deliver optimal conditions for currency trading.

Ultimately, Tickmill strives to be more than just a broker; we aim to be your strategic partner in the financial markets, offering the tools and environment you need to thrive. Explore the various account types we offer and discover how we can elevate your trading experience.

Types of Tickmill Trading Accounts Explained

Choosing the right trading account is a pivotal step for any trader looking to succeed in the financial markets. At Tickmill, we understand that every trader has unique needs and strategies. That’s why we’ve meticulously crafted a range of Tickmill Trading Accounts designed to cater to various experience levels and trading styles. Our diverse account types ensure you find the perfect fit to optimize your trading journey and unlock your full potential.

Classic Account

The Classic Account serves as an excellent starting point for new traders or those who prefer straightforward trading conditions. It offers a balance of simplicity and competitive features, making it a popular choice among our live accounts.

- Key Features:

- No commissions on trades.

- Competitive spreads starting from 1.6 pips.

- Minimum deposit of just 100 USD (or equivalent).

- Access to all major forex instruments and CFDs.

- Who is it for?

Ideal for beginner traders getting accustomed to market dynamics, and those who prioritize commission-free trading with predictable costs.

Pro Account

For more experienced traders seeking tighter spreads and lower trading costs, the Pro Account stands out. This account is built for those ready to take their trading to the next level, offering an ECN-like environment.

- Key Features:

- Significantly tighter spreads, starting from 0.0 pips.

- Low commission of 2 USD per side per 100,000 traded.

- Minimum deposit of 100 USD (or equivalent).

- Fast execution speeds essential for active trading strategies.

- Who is it for?

Best suited for scalpers, day traders, and those employing expert advisors (EAs) who benefit from minimal spreads and rapid order execution.

VIP Account

The VIP Account is the pinnacle of our offerings, reserved for high-volume traders who demand the absolute best conditions. This account provides unparalleled execution and the most competitive pricing among our forex accounts.

- Key Features:

- Ultra-tight spreads, starting from 0.0 pips.

- Lowest commission rate of 1 USD per side per 100,000 traded.

- Minimum balance requirement of 50,000 USD (or equivalent).

- Priority support and personalized services.

- Who is it for?

Tailored for professional traders, institutional clients, and those with substantial trading capital who require superior conditions and dedicated assistance.

Islamic Account (Swap-Free)

In adherence to Sharia law, Tickmill also provides Islamic trading accounts. These are available across the Classic, Pro, and VIP account types, offering a swap-free environment.

- Key Features:

- No swap or rollover interest on overnight positions.

- Compliant with Islamic finance principles.

- All other features mirror the Classic, Pro, or VIP account chosen.

- Who is it for?

Designed for Muslim traders who need to trade in a Sharia-compliant manner, ensuring their trading activities align with their faith.

Demo Account

Before committing to any of our live accounts, we strongly recommend utilizing a Tickmill Demo Account. This risk-free environment allows you to practice strategies and familiarize yourself with the platform using virtual funds under real market conditions.

| Feature | Classic Account | Pro Account | VIP Account |

|---|---|---|---|

| Min. Deposit | 100 USD | 100 USD | 50,000 USD |

| Spreads From | 1.6 pips | 0.0 pips | 0.0 pips |

| Commission | None | 2 USD/side | 1 USD/side |

Selecting the right Tickmill Trading Account is a critical decision that influences your trading efficiency and profitability. We encourage you to explore these account types further and choose the one that aligns perfectly with your individual trading strategy and capital. Join Tickmill today and experience a premium trading environment tailored to your needs.

The Classic Account: Ideal for Beginners

Are you just starting your journey into the exciting world of trading? The Classic Account is your perfect entry point among the various Tickmill Trading Accounts. We designed this specific account type with new traders in mind, focusing on simplicity and ease of use. It provides a straightforward path to engaging with global markets, helping you build confidence and understanding without unnecessary complexities.

Choosing the right start matters, and the Classic Account offers a balanced environment for learning. It allows you to gain real-world trading experience without demanding a large initial commitment or complex fee structures.

Key Features Tailored for Novices

The Classic Account simplifies your trading experience, letting you concentrate on market analysis and strategy. Here’s what makes it stand out:

- Accessible Minimum Deposit: Start trading with a modest amount, reducing your initial risk.

- Zero Commission Trading: Enjoy trading without commissions on all your transactions, making cost calculation straightforward.

- Competitive Spreads: Benefit from tight spreads on major currency pairs, providing excellent trading conditions.

- Diverse Instruments: Access popular forex pairs, indices, and commodities, giving you ample opportunities to explore.

- Standard Leverage Options: Use leverage responsibly to amplify your trading power, with options suitable for beginners.

Why This Account Type Suits You

Many of our new clients choose the Classic Account as their first live account. It’s truly one of the best trading accounts for those transitioning from demo to live trading. You get to experience real market conditions in a supportive setup.

| Benefit | Description |

|---|---|

| Ease of Use | Navigate your trades with a clear, simple cost structure. |

| Risk Management | Lower entry barrier helps you manage risk effectively as you learn. |

| Learning Focus | Concentrate on market movements, not on complex fee calculations. |

This forex account empowers you to trade confidently. It removes common barriers, allowing you to focus on developing your skills and understanding market dynamics. When you are ready to start trading on a live account, the Classic Account offers a reliable and user-friendly platform.

The Pro Account: Designed for Experienced Traders

For those who navigate the financial markets with confidence and a sharp strategy, Tickmill offers the powerful Pro Account. This is one of our premier Tickmill Trading Accounts, meticulously crafted to meet the demanding requirements of seasoned investors. If you’re an active trader seeking optimal conditions and superior execution, this account type elevates your trading experience significantly.

We understand that experienced traders need more than just a basic setup. The Pro Account focuses on providing an environment where your strategies can truly thrive. It’s an ideal choice among our various live accounts, designed for serious participants in the global markets.

Here’s what you gain with a Pro Account:

- Ultra-Tight Spreads: Benefit from highly competitive spreads, often starting from 0.0 pips on major forex pairs, ensuring lower trading costs on your forex accounts.

- Low Commission Structure: We keep commissions minimal, making high-volume trading more cost-effective. You retain more of your profits with every successful trade.

- Rapid Execution Speeds: Experience lightning-fast order execution, crucial for scalpers, day traders, and those using automated strategies (EAs). No re-quotes mean precision in your entries and exits.

- Extensive Asset Selection: Access a broad spectrum of instruments, including a wide array of currency pairs, indices, and commodities. This allows for diverse portfolio management and strategy implementation across your trading accounts.

- Flexible Leverage: Tailor your trading exposure with competitive leverage options, empowering you to manage risk and potential returns according to your personal trading style and experience.

- Dedicated Support: Gain access to expert client support, ready to assist with any queries or technical needs, ensuring a smooth and uninterrupted trading journey.

The Pro Account is more than just another option among our account types; it’s a commitment to providing advanced tools and superior conditions for those who know exactly what they need to succeed. Elevate your trading with a Pro Account and experience the Tickmill difference.

The VIP Account: For Professional Volume Traders

For those who navigate the markets with precision and significant volume, the Tickmill VIP account stands as a testament to our commitment to serious traders. This premium offering is specifically tailored for individuals who command substantial capital and execute high-frequency trades, demanding the very best in trading conditions.

We understand that professional volume traders require more than just basic trading accounts. You need an environment optimized for scale, efficiency, and cost-effectiveness. The VIP account delivers precisely that, offering an exceptional suite of features designed to enhance your trading edge across various financial instruments, including our robust forex accounts.

What Sets the VIP Account Apart?

- Unmatched Spreads: Experience some of the tightest spreads in the industry, starting from 0.0 pips on major currency pairs. This dramatically reduces your transaction costs, especially crucial for high-volume strategies.

- Ultra-Low Commissions: Benefit from significantly reduced commission rates, allowing you to maximize the profitability of each trade you execute. Our transparent fee structure ensures you always know your costs upfront.

- Superior Execution Speed: Enjoy lightning-fast order execution. We leverage cutting-edge technology to ensure minimal slippage, even during volatile market conditions, giving you a competitive advantage.

- Dedicated Support: Gain access to a personalized account manager who understands your unique trading needs and can offer tailored support.

This isn’t just another one of our many account types; it’s a specialized solution. The VIP account is crafted for professional traders who demand institutional-grade conditions from their live accounts. If your trading volume consistently exceeds 50 million USD in notional value per calendar month, you are ready to explore the exclusive benefits of this elite option.

“In the world of high-volume trading, every pip and every millisecond counts. Our VIP account is built to make those moments work for you.”

Compare the distinct advantages of our VIP offering:

| Key Feature | Impact on Your Trading |

|---|---|

| Spreads from 0.0 pips | Significantly lowered trading expenses |

| Reduced Commissions | Enhanced net profitability per trade |

| High-Speed Execution | Minimized slippage, optimal entry/exit points |

| Personalized Service | Tailored support for complex trading needs |

Elevate your trading experience. The VIP account is a strategic choice for seasoned professionals looking to optimize their performance and gain a critical edge in the dynamic financial markets. It’s truly among the top Tickmill Trading Accounts for serious players.

Comparing Tickmill Pro and Classic Accounts

Navigating the world of online trading demands a clear understanding of your platform’s offerings. When exploring Tickmill Trading Accounts, a crucial step involves comparing the distinct advantages of the Classic and Pro accounts. This choice significantly impacts your trading experience, affecting everything from cost to execution.

The Classic Account: Ideal for New Traders

The Classic account is designed with simplicity and accessibility in mind, making it an excellent starting point for those new to the market or who prefer straightforward trading. It eliminates commission fees, simplifying cost calculations.

- No Commissions: You only pay the spread, making costs transparent and predictable.

- Wider Spreads: Spreads start from 1.6 pips, reflecting the commission-free structure.

- Minimum Deposit: An accessible entry point, allowing you to start trading with a smaller capital outlay.

- Execution: Fast, reliable execution with competitive pricing.

The Pro Account: Built for Experienced & High-Volume Traders

For more experienced traders, scalpers, or those engaged in high-volume strategies, the Pro account often proves more cost-effective. It offers tighter spreads in exchange for a small commission per trade, which can lead to significant savings over time.

- Tight Spreads: Spreads can go as low as 0.0 pips, especially on major currency pairs.

- Commission-Based: A small commission per side per lot is applied, compensating for the ultra-low spreads.

- Minimum Deposit: A slightly higher minimum deposit compared to the Classic, catering to more serious traders.

- Superior Execution: Often favored for its ECN-like environment, ensuring rapid order fulfillment.

To help you visualize the core differences between these two popular trading accounts, here’s a quick comparison:

| Feature | Classic Account | Pro Account |

| Minimum Deposit | Low (e.g., $100) | Moderate (e.g., $100) |

| Spreads From | 1.6 pips | 0.0 pips |

| Commissions | None | Low per side per lot |

| Ideal For | Beginners, long-term traders | Scalpers, high-volume, experienced traders |

Choosing Your Perfect Account Type

Deciding between these Tickmill account types comes down to your individual trading style, experience level, and preferred cost structure. If you value simplicity and prefer to only manage spread costs, the Classic account is likely your best fit among the various forex accounts. However, if you are an active trader who prioritizes the tightest possible spreads and understands how commissions factor into your overall trading expenses, the Pro account could offer a more advantageous pricing model.

Regardless of your choice, both live accounts provide access to Tickmill’s robust trading infrastructure and a wide range of instruments. Carefully assess your needs to select the platform that empowers your trading journey most effectively.

What is a Tickmill Demo Account and How to Use It?

A Tickmill demo account offers a crucial starting point for anyone looking to navigate the financial markets without risking real capital. Think of it as your personal, risk-free training ground. It’s an exact replica of the live trading environment, providing access to real-time market data but utilizing virtual funds. This means you can practice strategies, learn the platform, and build confidence before you commit to funding any of our various Tickmill Trading Accounts.

Why Use a Tickmill Demo Account?

Engaging with a demo account provides invaluable experience. It’s not just for beginners; even seasoned traders use it to test new strategies or familiarize themselves with market changes.

- Risk-Free Practice: Trade with virtual money, eliminating any financial risk while you learn.

- Platform Familiarization: Get comfortable with the MetaTrader 4 or MetaTrader 5 platforms, understanding order execution, charting tools, and technical indicators.

- Strategy Testing: Develop and refine your trading strategies in a live market simulation, observing how different approaches perform.

- Market Exploration: Discover various instruments, including major and minor currency pairs, without commitment. This helps you understand the nuances of different forex accounts.

- Confidence Building: Gain the necessary experience and self-assurance before transitioning to live accounts.

- Explore Account Types: See how different account types might behave, helping you decide which one aligns best with your trading style for when you open a real account.

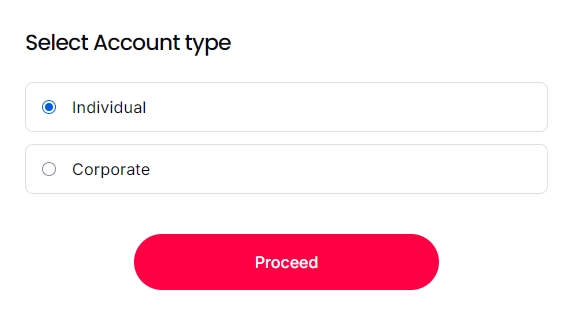

How to Get Started with Your Tickmill Demo Account

Setting up your demo account is quick and straightforward. We believe in making access to learning as easy as possible.

- Visit the Tickmill Website: Navigate to the demo account registration page.

- Complete the Registration Form: Provide some basic information like your name and email. We keep it simple.

- Choose Your Parameters: Select your desired virtual balance and preferred leverage. These settings mimic what you might choose for actual trading accounts.

- Download the Trading Platform: Install MetaTrader 4 or MetaTrader 5 on your device.

- Log In and Start Trading: Use the credentials provided to access your new demo account and begin your trading journey.

Maximizing Your Demo Experience

To truly benefit from your Tickmill demo account, treat it with the same seriousness you would a live account. This mindset will accelerate your learning and better prepare you for real market conditions.

“Every successful trade begins with solid preparation. Your Tickmill demo account is that preparation.”

Focus on consistency, analyze your trades, and don’t be afraid to experiment. Use the full range of tools available. Understand market movements for various asset classes. When you feel ready, the transition to our Tickmill Trading Accounts will feel natural and well-informed.

Key Features of Tickmill Trading Accounts

Exploring the world of online trading demands a platform that aligns with your unique strategy and financial goals. Tickmill Trading Accounts stand out by offering a comprehensive suite of features designed for both novice and seasoned traders. We prioritize transparency, efficiency, and a truly competitive trading environment, ensuring your journey is supported every step of the way.

Diverse Account Options for Every Trader

Tickmill understands that one size does not fit all. That’s why we’ve meticulously crafted various account types to cater to different trading styles and experience levels. Whether you’re focused on micro lots or substantial volumes, our diverse offerings provide a tailored experience. These include specialized forex accounts, giving you access to major, minor, and exotic currency pairs with highly competitive conditions.

- Classic Account: An ideal choice for those new to trading, offering straightforward pricing and commission-free trading.

- Pro Account: Designed for experienced traders seeking tighter spreads and lower commissions per lot.

- VIP Account: Tailored for high-volume traders, featuring the tightest spreads and the most advantageous commission structure.

Ultra-Competitive Spreads and Low Commissions

One of the hallmark features of Tickmill Trading Accounts is our commitment to low trading costs. We provide some of the industry’s tightest spreads, starting from 0.0 pips on major currency pairs, combined with transparent, low commissions on our Pro and VIP account types. This focus on cost efficiency means more of your capital works for you, directly impacting your potential profitability.

Superior Execution Speed

In the fast-paced world of financial markets, every millisecond counts. Our robust infrastructure ensures lightning-fast order execution. This means minimal slippage and immediate processing of your trades, giving you a critical advantage when market conditions are volatile. We leverage cutting-edge technology to connect you directly to deep liquidity pools, ensuring reliability and precision.

Flexible Leverage Choices

Tickmill Trading Accounts offer flexible leverage options, empowering you to manage your capital effectively. You can choose a leverage level that suits your risk tolerance and trading strategy. This flexibility allows you to amplify your trading power while maintaining control over your exposure, an essential tool for navigating the forex and CFD markets.

Robust Trading Platforms

Accessing the markets is seamless with our industry-leading trading platforms. Tickmill provides MetaTrader 4 (MT4) and MetaTrader 5 (MT5), recognized globally for their advanced charting tools, technical indicators, and automated trading capabilities. These platforms are available across multiple devices – desktop, web, and mobile – ensuring you can manage your Tickmill Trading Accounts from anywhere, at any time.

Seamless Account Opening Process

Starting your trading journey with Tickmill is straightforward. We’ve streamlined the process for opening live accounts, making it quick and hassle-free. Our user-friendly interface guides you through the necessary steps, allowing you to fund your account and begin trading efficiently. Our support team is always ready to assist if you have any questions during this process.

Available Financial Instruments

Unlock vast market potential with Tickmill Trading Accounts. Our platform offers an impressive array of financial instruments, empowering you to diversify your portfolio and seize opportunities across global markets. We understand that every trader has unique goals, which is why we provide access to a comprehensive selection tailored to various strategies and risk appetites.

Here’s a glimpse into the diverse range you can trade:

- Forex: Dive into the world’s most liquid market. Access over 60 currency pairs, including majors, minors, and exotics. Our competitive spreads on forex accounts make currency trading accessible and efficient, perfect for both seasoned and new traders.

- Stock Indices: Trade the performance of leading global economies. Speculate on major stock indices from Europe, Asia, and North America without owning the underlying assets. This offers a broad market exposure from a single position.

- Commodities: Tap into the raw materials market. Trade precious metals like Gold and Silver, and energy products such as Crude Oil. These instruments often serve as excellent hedges against inflation or market volatility, providing valuable diversification.

- Bonds: Add government bonds to your portfolio. These offer another avenue for diversification and can provide stability, especially during uncertain economic times. Explore opportunities in major sovereign debt markets.

- Cryptocurrencies: Explore the fast-evolving digital asset space. Trade popular cryptocurrencies against fiat currencies, leveraging the volatility and growth potential of this innovative market.

Choosing the right instruments for your strategy is crucial, and our various account types ensure you find the perfect fit. Whether you are interested in short-term speculation or long-term portfolio diversification, our live accounts give you direct access to these markets with superior execution and support. This broad offering means more opportunities for you to grow your trading capital and achieve your financial aspirations.

Execution Speed and Technology

In the fast-paced world of financial markets, lightning-fast execution isn’t just a luxury—it’s a necessity. Every millisecond counts, especially when market conditions shift rapidly. We understand this critical need, and our commitment to superior execution speed forms a cornerstone of the trading experience we offer across all our Tickmill Trading Accounts.

We empower your strategies with an infrastructure designed for speed and reliability. Our technology ensures your orders are processed and filled with exceptional swiftness, minimizing latency and helping you capitalize on fleeting market opportunities. This dedication is evident in our robust network and strategic server placements.

Our commitment to cutting-edge infrastructure directly benefits you:

- Ultra-Low Latency Servers: We house our servers in leading data centers, strategically located to be as close as possible to major liquidity providers. This co-location drastically reduces the physical distance data travels, translating into near-instantaneous order routing for your forex accounts.

- Optimized Network Connectivity: Our network is built on premium fiber optic connections, engineered to deliver data with minimal delay. This ensures a consistent and stable connection, critical for high-frequency trading and scalping strategies.

- Direct Market Access: We employ an execution model focused on providing direct access to the interbank market. This means fewer intermediaries and faster order processing, directly benefiting all our trading accounts.

What does this mean for you? It translates into a significant reduction in slippage, allowing your trades to be executed at or very close to your intended price. This precision is vital for managing risk and maximizing potential returns, regardless of your chosen account types.

Experience the difference speed makes. With our advanced technology, your live accounts operate on a level playing field, giving you the confidence to execute complex strategies and react decisively to market movements. We constantly monitor and upgrade our systems to maintain this competitive edge, ensuring you always have access to top-tier performance.

Spreads and Commissions Across Tickmill Account Types

Understanding the cost structure of your trading is paramount for profitability. At Tickmill, we believe in transparency, offering a clear breakdown of spreads and commissions across our diverse `account types`. Knowing these details helps you pick the perfect fit among the available `Tickmill Trading Accounts` for your unique trading style and goals.

Every trader has different needs. That’s why Tickmill provides several distinct options, each designed to optimize your trading experience. Your choice impacts not just the initial outlay but also your long-term success on our platform. Let’s dive into how spreads and commissions work across our various offerings.

Tickmill’s Account Offerings: A Cost Perspective

We’ve meticulously structured our `trading accounts` to cater to different levels of experience and trading frequency. From beginners to high-volume professionals, you’ll find an account that aligns with your strategy and helps manage your trading costs effectively.

The Classic Account: Simplicity and Transparency

Our Classic Account offers a straightforward approach, ideal for newer traders or those who prefer a simpler cost model. You trade commission-free on all instruments. Spreads for major currency pairs typically start from 1.6 pips. This means the cost of your trade is embedded directly in the spread, eliminating separate commission charges. It’s a great option if you prioritize ease of understanding and want to see your full trading cost upfront.

The Pro Account: Designed for Active Traders

For more active traders, the Pro Account offers significantly tighter spreads, starting from 0.0 pips on major `forex accounts`. To compensate for these razor-thin spreads, a competitive commission applies. You’ll pay $2 per side per lot ($4 per round turn per lot) for each transaction. This structure often results in lower overall trading costs for high-volume traders compared to spread-only models, making it a popular choice for scalpers and day traders looking for minimal entry and exit price discrepancies.

The VIP Account: Elite Conditions for High-Volume Traders

Our VIP Account takes the Pro Account’s benefits a step further. Tailored for traders with substantial equity and high trading volumes, this account delivers even lower commission rates. You can enjoy commissions as low as $1 per side per lot ($2 per round turn per lot), alongside the ultra-tight spreads. It represents the pinnacle of our `Tickmill Trading Accounts`, offering unparalleled trading conditions for the most demanding strategies. This account requires a higher equity balance, reflecting its premium benefits.

Understanding Spreads and Commissions in Your Live Accounts

When you trade with any of our `live accounts`, the spread is the difference between the bid and ask price of an instrument. This is a dynamic cost, fluctuating based on market liquidity and volatility. Commissions, on the other hand, are fixed charges per lot traded. We ensure full transparency, providing real-time data on both so you can make informed decisions.

Consider these points when evaluating your ideal account type:

- Trading Volume: High-volume traders often benefit more from commission-based accounts due to tighter spreads.

- Trading Strategy: Scalpers and high-frequency traders typically gravitate towards accounts with low spreads.

- Capital: Some `account types` have minimum equity requirements.

- Simplicity vs. Cost-Efficiency: Do you prefer all costs bundled into the spread, or do you prefer lower raw spreads with a separate commission?

Comparative Snapshot of Tickmill Account Costs

Here’s a quick comparison to help visualize the cost structures across our primary `trading accounts`:

| Account Type | Typical Spreads (Major Pairs) | Commission (Per Lot, Round Turn) | Ideal For |

|---|---|---|---|

| Classic | From 1.6 pips | None | Beginners, simplicity seekers |

| Pro | From 0.0 pips | $4 | Active traders, scalpers |

| VIP | From 0.0 pips | $2 | High-volume traders |

Choosing the right account based on its spreads and commissions is a critical step towards optimizing your trading performance with Tickmill. Take time to assess your trading frequency, capital, and strategy. We provide all the necessary tools and information to ensure you select the best fit from our `Tickmill Trading Accounts` roster, empowering you to trade with confidence and clarity.

Leverage Options Available with Tickmill

Leverage stands as a powerful tool in a trader’s arsenal, allowing you to amplify your market exposure with a relatively small capital outlay. It’s the ability to control a larger position than your account balance would typically permit. At Tickmill, we understand the importance of flexible yet responsible leverage, tailoring options to suit various trading styles and regulatory environments.

Our approach provides you with the capability to magnify your potential returns, though it’s crucial to remember that it also equally magnifies potential losses. We empower our clients with transparent leverage choices across our diverse range of Tickmill Trading Accounts, ensuring you have the control you need.

The maximum leverage you can access often depends on several key factors:

- Regulatory Jurisdiction: Different regulatory bodies impose varying maximum leverage limits to protect retail traders. Tickmill operates under several reputable regulators, each with its own specific guidelines.

- Account Type: Your chosen account type, whether it’s our Classic, Pro, or VIP offering, may come with distinct leverage caps. Each of these account types is designed with specific trader needs in mind.

- Instrument Traded: The asset class you trade also impacts available leverage. Forex accounts, for instance, typically offer higher leverage compared to indices or commodities.

- Account Equity: As your account equity grows, maximum leverage may adjust downwards in a tiered system. This mechanism helps manage overall risk exposure for both the trader and the broker.

- Client Classification: Professional clients often have access to higher leverage levels than retail clients, subject to meeting specific eligibility criteria.

When you open your live accounts with Tickmill, you’ll find that our leverage options are clearly outlined, giving you a full understanding of your trading capacity. We always encourage traders to choose a leverage level that aligns with their personal risk tolerance and trading strategy.

Here’s a simplified look at how leverage can vary by instrument:

| Instrument Category | Typical Maximum Leverage* |

|---|---|

| Major Forex Pairs | Higher |

| Minor Forex Pairs | Moderate to High |

| Indices | Moderate |

| Commodities (e.g., Gold, Oil) | Moderate |

*Specific values depend on regulation, account type, and equity.

Leverage is a double-edged sword. Use it wisely, and it can be a powerful accelerator for your trading goals. Misuse it, and it can lead to rapid capital erosion. Education and risk management are paramount.

Explore our various trading accounts today and discover the flexible leverage options that best suit your trading journey. We provide all the tools and resources you need to make informed decisions about your trades and manage your exposure effectively.

Funding Your Tickmill Trading Account: Deposits and Withdrawals

Seamlessly managing your capital is essential for successful trading. At Tickmill, we ensure that funding your Tickmill Trading Accounts, and withdrawing your profits, is a straightforward, secure, and efficient process. We understand that quick access to your funds empowers your trading journey.

Effortless Deposits: Getting Started with Your Live Account

Ready to jump into the market? Depositing funds into your live accounts is designed to be user-friendly. We offer a variety of convenient payment methods to suit your preferences, ensuring you can start trading without unnecessary delays.

- Credit/Debit Cards: Widely accepted, offering instant processing and incredible convenience for most users.

- E-Wallets: Solutions like Neteller and Skrill provide fast, secure, and often instant deposits. These are great for active traders.

- Bank Wire Transfer: Ideal for larger sums, offering robust security. While reliable, processing times can be longer, typically 2-7 business days.

- Other Local Payment Methods: Depending on your region, we may support various local banking options or payment gateways to make deposits even easier.

We work to keep deposit fees low, often absorbing transaction costs ourselves. Always check the specific terms for your chosen method on the Tickmill client area to understand minimum deposit requirements and any potential third-party charges.

Secure Withdrawals: Accessing Your Profits

When it’s time to enjoy your earnings, withdrawing funds from your trading accounts is just as crucial. Our withdrawal process is built with security and speed in mind, ensuring your funds reach you safely and promptly.

Key Principles for Withdrawals:

- Method Matching: For security and anti-money laundering regulations, withdrawals generally must be made using the same method and to the same account from which the original deposit was made.

- Account Verification: To protect your funds, we require account verification before your first withdrawal. This is a standard industry practice to confirm your identity and prevent fraud.

- Processing Times: Our team typically processes withdrawal requests within one business day. The time it takes for funds to reflect in your account then depends on your chosen payment provider. E-wallets are usually the fastest, while bank wires can take several days.

We pride ourselves on transparent fee structures. While Tickmill generally covers deposit fees, withdrawal fees might apply depending on the method and amount. Full details are always available in your client portal.

Important Considerations for All Tickmill Account Types

| Consideration | Impact on Funding |

|---|---|

| Account Verification | Mandatory for withdrawals; speeds up future transactions. |

| Currency Conversion | Potential charges if your deposit/withdrawal currency differs from your account’s base currency. |

| Third-Party Fees | While Tickmill strives to minimize fees, your bank or payment provider may apply their own charges. |

| Funding Limits | Each payment method may have minimum and maximum transaction limits. |

Our dedicated support team is always ready to assist with any questions regarding deposits or withdrawals, ensuring your experience with Tickmill remains smooth and efficient. Focus on your trading strategy, and let us handle the logistics of your capital management.

Deposit Methods and Currencies

Seamless funding is crucial for any trader, and we understand that flexibility in deposit methods and supported currencies enhances your overall trading experience. Accessing your Tickmill Trading Accounts should be straightforward, secure, and swift, allowing you to focus on market opportunities.

We provide a comprehensive range of options to ensure you can easily fund your trading accounts, no matter where you are in your trading journey. From traditional banking solutions to modern e-wallets, your convenience is our priority.

Flexible Deposit Methods

Choose from a variety of trusted deposit methods designed to cater to different preferences and regions. Each option is selected for its reliability and efficiency.

- Bank Wire Transfer: A classic, secure method for larger deposits. Ideal for those who prefer traditional banking.

- Credit/Debit Cards (Visa, Mastercard): Instant funding with minimal fuss. Securely deposit funds directly from your card to your live accounts.

- E-wallets (Skrill, Neteller, PayPal, SticPay, FasaPay, WebMoney, etc.): Fast and convenient, e-wallets offer a popular choice for traders seeking quick processing times and easy access.

Supported Currencies for Your Account Types

We support a selection of major currencies to simplify your funding process and help you avoid unnecessary conversion fees. When you open your forex accounts, you can often choose a base currency that aligns with your financial setup.

- USD – United States Dollar

- EUR – Euro

- GBP – British Pound

- PLN – Polish Zloty

- And several other local currencies, depending on your region.

When you select a base currency for your trading accounts, all your deposits, withdrawals, and trading activity will reflect in that currency, making financial management transparent.

Deposit Details at a Glance

We believe in transparency regarding your funds. Here’s a quick overview of what you can expect:

| Method | Processing Time | Fees (Our Side) |

|---|---|---|

| Bank Wire | 1-3 Business Days | None |

| Credit/Debit Cards | Instant | None |

| E-wallets | Instant | None |

Please note that while we do not charge fees for deposits, your bank or payment provider might apply their own charges, particularly for international transfers. Always review their terms before initiating a deposit to any of your live accounts.

Ready to fund your trading journey? Explore the seamless deposit process and choose the method that best suits your needs for your Tickmill Trading Accounts today.

Withdrawal Process and Times

Once you’ve experienced successful trading and are ready to access your profits, Tickmill makes the withdrawal process straightforward and secure. We understand that timely access to your funds is crucial, which is why we’ve streamlined our system to ensure efficiency across all our trading accounts.

Initiating a withdrawal from your Tickmill live accounts is simple. Just follow these steps:

- Log in to your Client Area using your credentials.

- Navigate to the ‘Withdrawal’ section.

- Select your preferred withdrawal method from the available options.

- Specify the amount you wish to withdraw.

- Confirm your request.

We process all withdrawal requests promptly, aiming to complete our internal review within one business day. Your security remains paramount throughout this process, ensuring that your funds are always handled with the utmost care.

Tickmill offers a variety of payment methods to suit your needs, ensuring you can withdraw funds conveniently from your forex accounts. These methods include bank wire transfers, credit/debit cards, and popular e-wallets.

Understanding the timeline for receiving your funds involves two main stages: Tickmill’s internal processing time and the external payment provider’s processing time. Here’s a general overview:

| Withdrawal Method | Tickmill Processing | Estimated External Processing |

|---|---|---|

| Bank Wire Transfer | 1 business day | 1-3 business days |

| Credit/Debit Cards | 1 business day | Up to 1 business day (after Tickmill processing) |

| E-wallets (e.g., Skrill, Neteller) | 1 business day | Instant to 1 business day |

Please note that these external processing times are estimates. Factors like bank holidays, currency conversions, and the policies of the specific payment provider can influence the actual delivery time. We always strive to expedite our part of the process for all account types.

For your initial withdrawal, remember that account verification is a crucial step to ensure the security of your funds and comply with regulatory requirements. We typically process withdrawals back to the original source of deposit where possible, aligning with anti-money laundering regulations. Should you have any questions about your specific Tickmill Trading Accounts or need assistance with a withdrawal, our dedicated support team is ready to help.

Join the thousands of traders who trust Tickmill for their trading journey and efficient financial management. Open your account today and experience seamless trading and withdrawals!

Platforms Supported for Tickmill Account Holders

Choosing the right trading platform is a pivotal decision for your success. With Tickmill Trading Accounts, you’re not just getting access to markets; you’re gaining entry to industry-leading platforms engineered for performance and precision. We empower our clients with tools that match their trading style, ensuring a smooth and efficient experience, regardless of their chosen account types or level of expertise.

Our commitment is to provide robust and reliable solutions that cater to the diverse needs of traders worldwide. Let’s explore the powerful platforms ready to elevate your trading journey.

MetaTrader 4 (MT4)

MetaTrader 4 stands as the undisputed champion for forex accounts, offering a powerful yet incredibly user-friendly environment. It’s the platform of choice for millions, renowned for its stability, comprehensive charting capabilities, and customizability. Whether you’re analyzing trends or executing complex strategies, MT4 provides everything you need at your fingertips.

- Intuitive Interface: Navigate markets with ease, making it ideal for both beginners and experienced traders.

- Advanced Charting Tools: Utilize a vast array of technical indicators and graphical objects for in-depth market analysis.

- Expert Advisors (EAs): Automate your trading strategies to capitalize on market opportunities around the clock.

- Robust Security: Trade with confidence knowing your data and transactions are protected.

- Versatile Access: Manage your live accounts from anywhere via desktop, web browser, or our dedicated mobile app for iOS and Android.

MetaTrader 5 (MT5)

For those seeking an even more advanced trading experience and expanded market access, MetaTrader 5 is the natural evolution. MT5 brings enhanced functionality, superior analytical capabilities, and support for a broader range of financial instruments. It’s perfect for traders who demand the cutting edge in technology and wish to diversify their portfolio beyond traditional forex.

- More Timeframes: Dive deeper into market analysis with 21 different timeframes.

- Additional Analytical Tools: Access a richer selection of technical indicators and graphical objects for precision analysis.

- Expanded Order Types: Implement sophisticated trading strategies with new pending order types.

- Integrated Economic Calendar: Stay informed about key economic events directly within the platform.

- Multi-Asset Trading: Seamlessly trade not just forex, but also other asset classes, offering greater diversification.

Both MetaTrader 4 and MetaTrader 5 are engineered to deliver speed, stability, and the comprehensive tools necessary for informed decision-making across all trading accounts. Your platform choice significantly influences your trading success, and we ensure you have the best options available to match your specific account types and goals.

Consider this quick overview of their key compatibility:

| Feature | MetaTrader 4 | MetaTrader 5 |

|---|---|---|

| Desktop Application | Supported | Supported |

| Web Trader (Browser-Based) | Supported | Supported |

| Mobile App (iOS/Android) | Supported | Supported |

| Algorithmic Trading (EAs) | Supported | Supported |

| Integrated Economic Calendar | No | Yes |

Ready to take control of your trading future? Explore these robust platforms and discover which one perfectly aligns with your trading ambitions. Open your live accounts with Tickmill today and start experiencing a truly professional trading environment.

Eligibility Requirements for Opening a Tickmill Account

Ready to dive into the dynamic world of online trading? Tickmill offers robust Tickmill Trading Accounts designed to empower traders like you. Before you jump in, understanding the simple eligibility criteria ensures a smooth start to your journey.

Opening one of our diverse trading accounts is straightforward, but certain fundamental requirements ensure compliance and security for all our clients. We need to confirm you meet these core standards.

- **Age Requirement**: You must be at least 18 years old or the legal age of majority in your country of residence, whichever is higher. This is a fundamental legal prerequisite for engaging in financial contracts.

- **Legal Capacity**: You need to possess the full legal capacity to enter into binding contracts. This means you understand the terms and conditions and can make independent financial decisions.

- **Residency**: Tickmill serves clients from many regions worldwide. However, due to regulatory restrictions, we cannot offer services in certain jurisdictions. You will need to confirm your country is eligible during the application process.

To ensure a secure trading environment and comply with international Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, we require specific documentation. This protects both you and us.

| Document Type | Purpose |

|---|---|

| Proof of Identity | Verify your legal name and date of birth (e.g., passport, national ID card, driver’s license). |

| Proof of Residency | Confirm your residential address (e.g., utility bill, bank statement, government-issued residency certificate, typically dated within the last three months). |

Beyond basic identification, we conduct a suitability assessment. This helps us understand your trading experience, knowledge of financial markets, and risk tolerance. It’s about ensuring our forex accounts align with your financial profile and goals.

Whether you’re exploring different account types for the first time or ready to open live accounts, Tickmill streamlines the process. We encourage you to complete our quick online application. Our team is always ready to guide you through any step, helping you select the best fit for your trading ambitions.

Benefits of Choosing Tickmill for Your Trading Needs

Choosing the right broker is a pivotal decision for anyone engaging in the financial markets. Tickmill stands out as a premier choice for traders globally, offering a robust and intuitive platform designed to meet diverse needs. When you open one of our Tickmill Trading Accounts, you’re not just gaining access to markets; you’re partnering with a firm committed to your trading success.

Unmatched Trading Conditions

We understand that every pip and every cent counts in your trading journey. That’s why Tickmill provides some of the most competitive spreads and low commissions in the industry. This dedication to cost-efficiency helps you maximize your potential returns, ensuring more of your profits stay where they belong—with you. Our transparent pricing model means you always know what to expect, allowing you to focus purely on your strategy.

A Spectrum of Tailored Account Types

Your trading style is unique, and your brokerage experience should reflect that. Tickmill offers a diverse selection of trading accounts, meticulously crafted to align with various preferences, from new market entrants to seasoned professionals. We ensure there’s a perfect fit for everyone.

- Versatile Account Types: Discover options ranging from classic accounts suitable for all traders to pro accounts designed for those seeking raw spreads and deeper liquidity.

- Specialized Forex Accounts: Access dedicated forex accounts engineered for competitive pricing and optimal execution in the dynamic currency markets.

- Seamless Live Accounts: Transition effortlessly to live accounts once you’re ready to engage with real market conditions, all supported by our robust and reliable infrastructure.

This ensures you find the ideal environment to execute your strategies effectively across a wide range of instruments.

Superior Execution Speed and Reliability

In the fast-paced world of trading, speed is paramount. Experience lightning-fast execution on every trade with Tickmill. Our cutting-edge infrastructure minimizes latency, giving you the crucial edge needed in volatile markets. Reliable trade execution means fewer slippages and greater control over your entry and exit points, allowing you to seize opportunities precisely as they arise.

Dedicated Customer Support and Trustworthy Regulation

Navigating the global markets can sometimes lead to questions or require assistance. Our dedicated multilingual support team is readily available to assist you, ensuring a smooth and uninterrupted trading experience. Beyond support, your security remains our highest priority. Tickmill operates under strict regulatory frameworks, providing a safe, transparent, and compliant trading environment. We implement robust measures to protect your funds and personal information, giving you complete peace of mind.

Empowering Educational Resources

Knowledge is power, especially in trading. Tickmill empowers you with a wealth of educational resources, from insightful webinars and expert market analysis to comprehensive tutorials. We help you refine your strategies, stay informed about market trends, and continuously grow as a trader. Continuous learning is a cornerstone of sustained success, and we provide the tools to foster it.

In essence, choosing Tickmill means opting for a broker that genuinely prioritizes your trading journey. Join Tickmill today and discover the distinct advantage a truly client-focused brokerage can offer.

Customer Support for Tickmill Trading Account Queries

Navigating the world of online trading brings exciting opportunities, but even the most seasoned traders sometimes need a helping hand. That’s why top-tier customer support is absolutely vital. At Tickmill, we understand this completely, dedicating ourselves to providing exceptional assistance for all your Tickmill Trading Accounts queries, ensuring your trading journey remains smooth and supported.

Our commitment means you always have a trusted resource available, whether you’re setting up new trading accounts, have questions about your existing live accounts, or need help with specific platform features. We believe prompt, knowledgeable support empowers you to make informed decisions and focus on your trading strategies.

How to Connect with Our Support Team

We offer multiple channels to ensure you can reach us conveniently, whatever your preference or the urgency of your query. Our goal is to provide accessible and efficient solutions for every user.

- Live Chat: For immediate assistance, our live chat feature connects you directly with a support agent. It’s perfect for quick questions about platform functionality, funding your trading accounts, or general inquiries. Get real-time answers without delay.

- Email Support: When your query requires more detailed explanation or involves sending documents related to your forex accounts or other live accounts, our email support is the ideal channel. Our team works diligently to provide comprehensive and thoughtful responses.

- Phone Assistance: For urgent matters or when you prefer to speak directly with an expert, our dedicated phone lines are available. This allows for direct, personal interaction to quickly resolve critical issues concerning your Tickmill Trading Accounts.

- Extensive FAQ Section: Our comprehensive Frequently Asked Questions database is a powerful self-service tool. Here, you can find immediate answers to common questions about various account types, trading conditions, and technical troubleshooting tips.

What We Can Help You With

Our knowledgeable support team is equipped to assist with a wide array of inquiries, ensuring you get the most out of your Tickmill Trading Accounts. We’re here to guide you through every step.

| Query Category | Examples of Assistance |

|---|---|

| Account Management | Guidance on opening new trading accounts, understanding different account types, managing live accounts settings. |

| Funding & Withdrawals | Troubleshooting deposit issues, clarifying withdrawal processes, explaining payment methods for your forex accounts. |

| Technical Support | Help with platform setup, resolving connectivity issues, optimizing your trading environment. |

| General Inquiries | Answering questions about trading conditions, available instruments, and any other aspect of your Tickmill Trading Accounts. |

From understanding the nuances of various account types to resolving technical glitches, our team has the expertise to support you effectively.

Our Commitment to Your Success

We pride ourselves on offering responsive, multilingual support provided by a team that truly understands the intricacies of the financial markets. Every interaction aims to leave you feeling confident and well-informed. Our agents are not just problem-solvers; they are educators, ready to explain complex concepts regarding your trading accounts in clear, concise language.

Reliable customer support is more than just answering questions; it’s about building trust and fostering a secure trading environment. We encourage you to reach out whenever you have a question about your Tickmill Trading Accounts. Our team stands ready to assist, ensuring you have the support needed to pursue your trading goals with confidence.

Security Measures for Tickmill Accounts and Client Funds

Your peace of mind truly matters when you engage in online trading. We understand that safeguarding your capital and personal information is not just a feature, but the absolute foundation of a trusted trading relationship. At Tickmill, we implement a multi-layered approach to security, ensuring comprehensive protection for your assets and data.

Strict Regulatory Oversight and Compliance

We operate under stringent regulatory frameworks, which mandate the highest standards of financial conduct and client protection. These regulations are not merely guidelines; they are strict rules we live by, providing an essential safety net for all our clients. We continuously adhere to industry best practices, ensuring transparency and accountability in every aspect of our operations.

- Licensed Entities: Our operating entities hold licenses from reputable financial authorities. This ensures ongoing scrutiny and compliance with investor protection rules.

- Regular Audits: Independent auditors regularly review our financial statements and operational procedures, verifying our adherence to regulatory requirements and sound financial practices.

One of the most critical security measures we employ is the segregation of client funds. This means we hold all client capital in separate bank accounts, distinct from our company’s operational funds. This crucial safeguard ensures that your money remains untouched, even in the highly unlikely event of insolvency. Your funds are always accessible to you.

“We keep your funds safe and separate, never mixing them with company capital. This dedication to security underpins every action we take.”

Negative Balance Protection

We offer negative balance protection across all our Tickmill Trading Accounts. This vital feature ensures that you cannot lose more money than you have deposited. Should market volatility cause your account balance to fall below zero, we automatically adjust it back to zero. This protection prevents you from incurring debts to the broker, offering a significant layer of risk management.

Consider the benefits of this protection:

| Scenario | Without Protection | With Tickmill Protection |

|---|---|---|

| Unexpected Market Volatility | Account can go into negative, owing money to broker. | Account reset to zero, no debt incurred. |

| Maximum Loss | Potentially more than deposited capital. | Limited to deposited capital only. |

Advanced Data Security and Privacy

Protecting your personal and financial data is paramount. We deploy state-of-the-art security technologies to safeguard your information from unauthorized access, disclosure, alteration, or destruction. Our robust infrastructure ensures that your sensitive data remains confidential and secure at all times.

- SSL Encryption: All data transmitted between your device and our servers uses Secure Socket Layer (SSL) encryption, keeping your information private.

- Firewalls: We employ advanced firewall systems to protect our servers and network infrastructure from external threats.

- Secure Data Centers: Our data is stored in highly secure data centers with physical and electronic surveillance.

Universal Security Across All Account Types

The comprehensive security measures we have in place apply uniformly to all our trading accounts, regardless of the specific account types you choose. Whether you opt for one of our standard forex accounts or specialized live accounts, you gain the same robust protection. We are committed to fostering a secure and trustworthy environment for every trader, giving you the confidence to focus on your trading strategies without worry.

Choosing Tickmill means choosing a partner dedicated to the highest standards of client fund and data security. We build trust through transparency, rigorous compliance, and advanced technological safeguards. Join us and experience trading with confidence.

How to Choose the Best Tickmill Account for You

Selecting the right Tickmill trading account is a pivotal step in your trading journey. The diverse range of Tickmill trading accounts caters to various experience levels, capital sizes, and trading strategies. Making an informed choice ensures you get the most out of your trading experience with favorable conditions tailored to your style. We will help you navigate the options and pinpoint the ideal fit among the available account types.

Understand Your Trading Profile

Before you dive into the specifics of each offering, take a moment to assess your own trading profile. This self-assessment is crucial for matching your needs with the most suitable Tickmill account.

- Experience Level: Are you a beginner, intermediate, or seasoned professional? Some account types offer simpler structures, while others provide advanced features for experienced traders.

- Trading Style: Do you prefer scalping, day trading, swing trading, or long-term positions? Your chosen style influences your ideal spread and commission structure.

- Capital Available: How much capital do you plan to deposit? Different Tickmill trading accounts have varying minimum deposit requirements.

- Preferred Instruments: Will you primarily trade forex, indices, commodities, or a mix? Ensure your chosen account offers competitive conditions for your desired assets.

- Risk Tolerance: Consider your comfort level with risk and how it impacts your strategy and capital management.

Explore Tickmill Account Types

Tickmill offers several distinct account types, each designed with unique features to serve different trader profiles. Understanding these differences is key to making the best decision for your live accounts.

The Classic Account: Ideal for New Traders

If you are just starting out or prefer a straightforward approach, the Classic account is an excellent choice. It offers commission-free trading with competitive spreads, making it easy to calculate your costs without the added complexity of commissions. This is a great entry point into forex accounts.

The Pro Account: For Cost-Conscious and Active Traders

The Pro account is a popular option for traders who seek tighter spreads and are comfortable with a commission-based structure. It’s often favored by active traders and those employing strategies like scalping, where every pip counts. You get access to deeper liquidity and raw interbank spreads, typically with a small, transparent commission per lot.

The VIP Account: Exclusivity for High-Volume Traders

Designed for high-volume traders, the VIP account offers the tightest spreads and the lowest commissions. This exclusive account type recognizes significant trading activity and rewards it with premium conditions. If your trading volume is substantial, the VIP account can significantly reduce your overall trading costs.

Islamic Account Option: Swap-Free Trading

For traders following Sharia law, Tickmill also provides an Islamic (swap-free) option across its Classic, Pro, and VIP trading accounts. This ensures compliance by removing swap charges or credits on overnight positions.

Comparative Overview of Tickmill Trading Accounts

To help you compare the main Tickmill trading accounts at a glance, we have prepared a short table highlighting their key differentiating features:

| Account Type | Minimum Deposit | Typical Spreads From | Commission (per side, per lot) | Best For |

|---|---|---|---|---|

| Classic | 100 USD/EUR/GBP | 1.6 pips | 0 | Beginners, long-term traders, simplicity |

| Pro | 100 USD/EUR/GBP | 0.0 pips | 2 USD/EUR/GBP | Active traders, scalpers, lower spreads |

| VIP | 50,000 USD/EUR/GBP | 0.0 pips | 1 USD/EUR/GBP | High-volume traders, professionals |

Finalizing Your Choice

Now that you understand the different Tickmill trading accounts and have assessed your own needs, you can confidently choose the best option. Remember, your ideal account is one that aligns perfectly with your trading strategy, capital, and experience level. Do not hesitate to start with a demo account to familiarize yourself with the platform and conditions before transitioning to one of the live accounts. Your journey to effective trading begins with this critical decision.

Conclusion: Maximizing Your Potential with Tickmill Trading Accounts

You’ve journeyed through the comprehensive landscape of what Tickmill brings to the table, particularly regarding its robust selection of Tickmill Trading Accounts. It’s clear that your trading success hinges not just on strategy, but also on the foundation your broker provides. Tickmill stands out by offering a finely tuned environment designed to empower traders at every level.

We craft our account types to meet a spectrum of needs, from the budding enthusiast to the seasoned professional. Whether you’re focused on high-volume forex trading or seeking ultra-tight spreads, you’ll find an option that aligns with your specific goals. Our commitment is to provide transparent, low-cost trading, helping you keep more of your hard-earned profits.

Why Tickmill’s Trading Accounts Stand Out:

- Tailored Solutions: Each account is designed with distinct features, ensuring a perfect fit for diverse trading styles and capital requirements.

- Competitive Conditions: Benefit from some of the industry’s most attractive spreads and commissions, directly impacting your bottom line.

- Reliable Execution: Experience lightning-fast order execution, crucial for navigating volatile markets and seizing opportunities.

- Robust Support: Gain access to expert assistance and educational resources, enhancing your trading knowledge and confidence.

Choosing the right forex accounts is a pivotal decision. Tickmill doesn’t just offer platforms; we provide a complete ecosystem. Our live accounts are more than just access points; they are gateways to a world of global markets, backed by stability and innovation. We remove the barriers, allowing you to concentrate purely on your trading strategy.

“Your potential in the market is limitless. We provide the tools and environment to unlock it.”

Ready to experience the difference? It’s time to elevate your trading journey. Explore the Tickmill Trading Accounts, find the perfect match for your ambitions, and start building your legacy in the financial markets today. Your next successful trade awaits.

Frequently Asked Questions

What types of trading accounts does Tickmill offer?

Tickmill offers several tailored trading accounts, including the Classic Account for beginners, the Pro Account for experienced traders and scalpers, and the VIP Account for high-volume traders. They also provide Islamic (Swap-Free) accounts across these types and a Demo Account for risk-free practice.

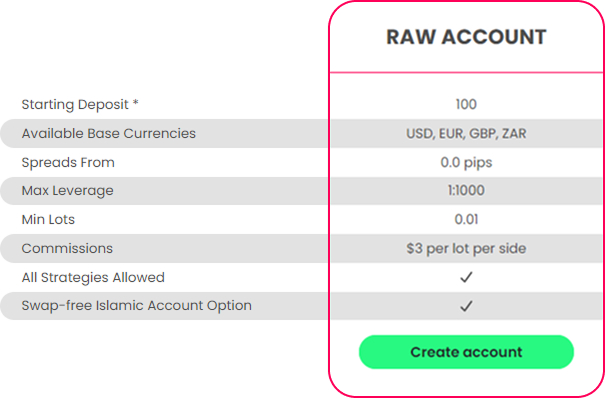

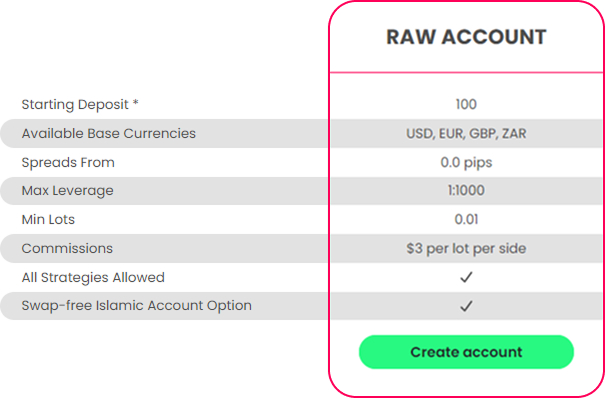

What are the main differences between Tickmill’s Classic, Pro, and VIP accounts?

The Classic Account is commission-free with spreads from 1.6 pips, ideal for beginners. The Pro Account offers tighter spreads (from 0.0 pips) with a low commission ($2 per side per 100,000 traded), suited for active traders. The VIP Account has the lowest commission ($1 per side per 100,000 traded) and ultra-tight spreads, requiring a higher minimum balance ($50,000) for professional volume traders.

How can a Tickmill Demo Account benefit me?

A Tickmill Demo Account allows you to practice trading strategies, familiarize yourself with the MetaTrader platforms, and explore various financial instruments using virtual funds in a risk-free, real-time market environment. It helps build confidence and prepare you for live trading without any financial commitment.

What financial instruments are available for trading with Tickmill accounts?

Tickmill Trading Accounts provide access to a diverse range of financial instruments, including over 60 Forex currency pairs, major Stock Indices, Commodities (like Gold, Silver, Crude Oil), Bonds, and popular Cryptocurrencies.

What security measures does Tickmill implement to protect client funds?

Tickmill employs strict regulatory oversight, segregates client funds in separate bank accounts from operational capital, and offers negative balance protection to ensure clients cannot lose more than their deposited amount. Additionally, advanced data security measures like SSL encryption and firewalls protect personal and financial information.