Welcome to the exciting world of market opportunities with Tickmill Stocks! Navigating the global financial landscape requires the right tools, insightful knowledge, and a reliable partner. We empower you to dive into the market with confidence, offering a comprehensive platform for your stock trading ambitions.

Whether you are an experienced investor or just starting out, Tickmill provides the resources you need to engage with leading company stocks. Discover a straightforward path to potentially grow your portfolio and participate in the movements of top global brands.

- Why Choose Tickmill for Your Equities Trading?

- Understanding Your Options: Shares CFD Trading

- Key Benefits of Trading Shares with Tickmill

- Ready to Start Your Stock Trading Journey?

- Understanding Tickmill: A Leading Broker for Stock Trading

- What are Stocks and Why Trade Them on Tickmill?

- Defining Equities: What You’re Really Buying

- The Appeal of Stock Market Participation

- Key Advantages of Trading Stocks with Tickmill

- Unrivaled Market Access

- Competitive Pricing on Shares CFD

- Advanced Trading Platforms and Tools

- Dedicated Support and Educational Resources

- Competitive Pricing and Execution

- Tickmill’s Trading Platforms for Stock Investors

- MetaTrader 4: Your Gateway to Equities Trading

- MetaTrader 5: Enhanced Features for Diverse Stock Opportunities

- Why Tickmill’s Platforms Excel for Stock Investors

- MetaTrader 5: Your Gateway to Stocks

- Exploring the Range of Stocks Available on Tickmill

- Step-by-Step: Opening a Tickmill Stocks Trading Account

- Step 1: Begin Your Registration

- Step 2: Complete Account Verification

- Step 3: Fund Your Trading Account

- Step 4: Select Your Trading Platform

- Step 5: Place Your First Trade

- Funding and Withdrawals for Your Tickmill Stocks Account

- Depositing Funds: Quick and Secure

- Withdrawing Your Earnings: Simple and Reliable

- How to Place Your First Stock Order on Tickmill

- Understanding Tickmill Stock Trading Costs and Commissions

- Commissions

- Spreads

- Overnight (Swap) Fees

- Other Potential Fees

- Essential Risk Management Strategies for Stock Traders

- Educational Resources and Market Analysis for Tickmill Stock Users

- Mastering the Market with Comprehensive Learning Tools

- Unlocking Opportunities with Advanced Market Analysis

- Dedicated Customer Support for Tickmill Stocks Clients

- Tickmill Stocks vs. Other Investment Products

- The Direct Appeal of Tickmill Stocks

- Spotlight: Tickmill Stocks vs. Shares CFDs

- Broader Horizons: Stocks vs. Other Investment Products

- Stocks vs. Forex Trading

- Stocks vs. Commodities

- Stocks vs. Bonds

- Why Your Equities Trading Journey Starts Here

- Advanced Tools and Features for Savvy Stock Traders

- Maximizing Your Tickmill Stocks Trading Experience

- Frequently Asked Questions

Why Choose Tickmill for Your Equities Trading?

Selecting the right broker is crucial for success in equities trading. Tickmill stands out by offering a robust and user-friendly environment designed for serious traders. We provide access to a wide array of company stocks from major exchanges, ensuring you have diverse options at your fingertips.

Our commitment to competitive conditions means you benefit from tight spreads and transparent pricing, which are vital for maximizing your potential returns.

Experience seamless execution and powerful analytical tools, all crafted to enhance your trading experience.

Understanding Your Options: Shares CFD Trading

When you trade shares with Tickmill, you’re primarily engaging in Contracts for Difference (CFDs). Shares CFD trading offers incredible flexibility, allowing you to speculate on the price movements of underlying company stocks without actually owning the shares themselves. This means you can potentially profit from both rising and falling markets.

CFDs also provide the advantage of leverage, which can amplify your trading power. However, it’s important to remember that leverage also increases risk.

Our platform makes it easy to understand and manage these dynamics, giving you control over your positions in the market.

Key Benefits of Trading Shares with Tickmill

We are dedicated to providing an unparalleled trading experience. Here’s what makes Tickmill a preferred choice for thousands of traders globally:

- Global Market Access: Trade shares from the world’s leading stock exchanges.

- Competitive Pricing: Benefit from transparent spreads and low commissions on shares CFD trading.

- Advanced Platforms: Utilize MetaTrader 4 and MetaTrader 5, packed with features for comprehensive analysis and execution.

- Educational Resources: Access a wealth of learning materials to sharpen your trading skills and market understanding.

- Dedicated Support: Our expert customer service team is ready to assist you every step of the way.

Ready to Start Your Stock Trading Journey?

Embarking on your stock trading adventure with Tickmill Stocks is simple. Open an account, fund it, and gain immediate access to a world of company stocks. Our platform is intuitive, making it easy for you to analyze market data, place trades, and manage your portfolio effectively.

Join Tickmill today and unlock your potential in the share market. Your ultimate guide to trading shares begins now!

Understanding Tickmill: A Leading Broker for Stock Trading

Are you looking to dive into the dynamic world of financial markets? Then understanding Tickmill, a prominent name in the brokerage industry, is your first smart move. Many traders choose Tickmill for their diverse opportunities, especially when it comes to engaging with Tickmill Stocks. We empower you to navigate global markets with confidence, offering robust platforms and competitive conditions designed for success.

Tickmill provides a comprehensive environment for stock trading enthusiasts. Whether you are new to the market or a seasoned investor, our focus remains on delivering an exceptional trading experience. We ensure access to a wide array of instruments, making your journey into equities trading both accessible and rewarding.

Tickmill stands out for several compelling reasons, particularly for those interested in company stocks and other market assets. Our commitment to transparent pricing and superior execution sets us apart. We understand that in fast-moving markets, every millisecond counts, and our technology reflects this understanding.

Consider these key advantages when choosing Tickmill for your investments:

- Broad Market Access: Trade a vast selection of global shares CFDs, giving you exposure to major companies across various sectors.

- Competitive Conditions: Benefit from tight spreads and low commissions, optimizing your potential returns from stock trading.

- Advanced Platforms: Utilize industry-leading trading platforms like MetaTrader 4 and 5, equipped with powerful tools for analysis and execution.

- Robust Regulation: Enjoy peace of mind knowing you are trading with a well-regulated broker that prioritizes client security.

- Dedicated Support: Access professional, multilingual customer service ready to assist you on your trading journey.

Beyond traditional company stocks, Tickmill also offers shares CFD. This provides flexibility for traders who wish to speculate on price movements without owning the underlying asset directly. This approach can be particularly appealing for those looking for diverse trading strategies.

| Feature | Benefit to Trader |

|---|---|

| Low Spreads | Reduces trading costs significantly. |

| Fast Execution | Ensures timely entry and exit from trades. |

| Flexible Leverage | Allows for amplified trading positions. |

Our goal is to make equities trading accessible and efficient for everyone. We believe in providing the tools and environment you need to make informed decisions and execute your strategies effectively. Ready to experience a new level of stock trading? Explore what Tickmill offers today and unlock your trading potential.

What are Stocks and Why Trade Them on Tickmill?

Ever wondered what makes the financial world tick? At its core, the market thrives on company stocks. Simply put, a stock represents a fractional ownership in a specific company. When you acquire a stock, you become a part-owner of that business, and your fortunes become tied to its performance. As the company grows and succeeds, the value of its stock can rise, offering you the potential for capital appreciation.

The allure of stock trading lies in this potential for growth, the excitement of market dynamics, and the opportunity to invest in businesses you believe in. Trading shares offers a pathway to participate directly in the global economy. It allows you to diversify your portfolio and potentially grow your wealth over time. But why choose Tickmill for your equities trading journey?

Tickmill provides a robust and accessible platform for engaging with the stock market, primarily through Shares CFD (Contract for Difference). This means you can speculate on the price movements of popular company stocks without owning the underlying asset directly. It opens up a world of flexibility and opportunity for traders of all experience levels.

Here’s why trading Tickmill Stocks stands out:

- Global Market Access: Gain exposure to a wide array of international company stocks from the world’s largest exchanges.

- Competitive Conditions: Experience trading with ultra-low commissions and tight spreads, designed to maximize your potential returns.

- Flexibility with Shares CFD: Utilize leverage to potentially amplify your trading power, and go both long (profiting from rising prices) or short (profiting from falling prices).

- Advanced Trading Platform: Access industry-leading platforms that offer powerful tools, real-time data, and intuitive interfaces for seamless execution.

- Exceptional Execution: Benefit from fast and reliable order execution, ensuring you can capitalize on market movements precisely when you need to.

“The stock market is a fascinating arena where information, innovation, and ambition converge to create dynamic opportunities. With Tickmill, you’re empowered to navigate this landscape with confidence.”

Trading shares cfd with Tickmill eliminates many of the traditional barriers associated with direct stock ownership. You get direct access to market fluctuations and can react swiftly to news and events impacting various company stocks. Whether you are aiming to diversify an existing portfolio or are just beginning your stock trading adventure, Tickmill offers the tools and conditions to support your goals. Join us and discover the potential of the global stock market today.

Defining Equities: What You’re Really Buying

When you dive into the world of investments, “equities” is a term you will hear often. Simply put, equities represent ownership in a company. Think of it this way: when you buy a share, you are purchasing a small slice of that business. This is the essence of company stocks.

Each share you own grants you a claim on the company’s assets and earnings. It means you become a part-owner, no matter how small your stake. This direct ownership is a cornerstone of traditional stock trading.

But what does this ownership actually entail? Here’s a quick breakdown:

- Voting Rights: For common stock, you often get a say in major company decisions, typically proportional to the number of shares you hold.

- Dividends: If the company performs well and its board decides to distribute profits, you could receive a portion of those earnings.

- Potential for Capital Appreciation: As the company grows and its value increases, the price of your shares can rise, potentially leading to profit if you decide to sell.

Understanding these fundamentals is crucial whether you’re interested in long-term investments or more dynamic approaches like shares CFD. With Tickmill Stocks, you gain access to a broad universe of these opportunities, allowing you to engage in equities trading with precision.

The Appeal of Stock Market Participation

The global financial markets exert a powerful pull, drawing in individuals eager to explore avenues for financial growth and wealth creation. Participating in the stock market isn’t just about making money; it’s about engaging with the dynamic heartbeat of the world economy.

For many, the appeal lies in the potential to see their capital grow over time. Unlike traditional savings, stock trading offers the chance to benefit directly from the success and innovation of leading companies worldwide. This direct connection to corporate performance makes the experience incredibly engaging.

Consider these key reasons why individuals are drawn to the stock market:

- **Growth Potential:** Historically, the stock market has offered significant returns, outpacing inflation and other asset classes over the long term. It’s a powerful tool for building substantial wealth.

- **Ownership and Influence:** When you buy company stocks, you become a partial owner, gaining a stake in a company’s future and sometimes even a say in its direction.

- **Diversification:** Stocks provide an excellent way to diversify an investment portfolio beyond real estate or bonds, spreading risk and opening up new opportunities.

- **Accessibility:** Modern platforms make it easier than ever to engage in equities trading, allowing more people to access this powerful financial tool.

Whether you aim for long-term investment in blue-chip companies or prefer the agility of shares cfd, the market offers a diverse range of strategies to fit various financial goals. The flexibility to trade on price movements without direct asset ownership provides a unique angle for those seeking different trading dynamics.

Engaging with Tickmill Stocks empowers you to tap into this vibrant world. It offers a gateway to explore countless investment opportunities, learn about market trends, and make informed decisions that align with your financial aspirations. The market awaits your participation, ready to offer new challenges and rewarding experiences.

Key Advantages of Trading Stocks with Tickmill

Embarking on the journey of trading company stocks requires a partner who truly understands the market’s pulse. When you choose Tickmill Stocks, you unlock a comprehensive suite of benefits designed to empower your investment strategy. We believe in providing an edge, making your stock trading experience efficient, transparent, and potentially more profitable.

Unrivaled Market Access

Diversity is key in equities trading, and Tickmill delivers. We open doors to a vast array of global markets, giving you the flexibility to diversify your portfolio and seize opportunities wherever they emerge. Access leading exchanges and invest in well-known companies without geographical limitations.

- Trade company stocks from major global economies.

- Access a wide selection of industries and sectors.

- Expand your investment horizons beyond local markets.

Competitive Pricing on Shares CFD

Cost-efficiency significantly impacts your bottom line. Tickmill understands this, offering highly competitive pricing structures for shares cfd. We focus on keeping your trading costs low so more of your potential profits stay with you.

Enjoy tight spreads and transparent commission structures that are easy to understand.

| Feature | Benefit to You |

|---|---|

| Low Commissions | Reduce overall trading expenses. |

| Tight Spreads | Minimize entry and exit costs on trades. |

| Transparent Pricing | Clear understanding of all associated fees. |

Advanced Trading Platforms and Tools

Successful stock trading demands powerful tools. Tickmill provides access to industry-leading platforms packed with features that help you analyze the market, execute trades swiftly, and manage your positions effectively. Our platforms offer robust charting capabilities, real-time data, and a user-friendly interface for both novice and experienced traders.

“Our platforms offer comprehensive analytical tools and seamless execution, giving traders the control they need to navigate the markets confidently.”

- Intuitive interfaces for effortless navigation.

- Powerful charting and technical analysis indicators.

- Efficient order execution for timely market entry and exit.

Dedicated Support and Educational Resources

Whether you are new to equities trading or a seasoned pro, continuous learning and reliable support are crucial. Tickmill offers extensive educational resources, including webinars, tutorials, and market analysis, to sharpen your skills. Our dedicated customer support team stands ready to assist you, ensuring a smooth and uninterrupted trading journey.

We empower you with the knowledge and assistance you need to make informed decisions and optimize your approach to company stocks. Discover a supportive environment focused on your growth and success.

Competitive Pricing and Execution

In the dynamic world of financial markets, every penny counts. When you engage with Tickmill Stocks, you gain immediate access to a trading environment meticulously designed for optimal cost-efficiency and superior execution. Our commitment ensures your capital works harder, supporting your strategic goals in stock trading without unnecessary friction.

We understand that trading costs directly impact your profitability. That’s why we’ve engineered a pricing model that stands out for its transparency and competitiveness. Expect some of the industry’s lowest commissions and tightest spreads across a broad spectrum of assets, from individual company stocks to diverse shares cfd offerings. This focus on affordability empowers you to maximize your returns on every trade.

Beyond attractive pricing, execution quality defines your trading experience. We pride ourselves on delivering lightning-fast, reliable order execution. Our state-of-the-art infrastructure processes your trades in milliseconds, significantly reducing the risk of slippage and ensuring your orders are filled precisely at the desired price, even during periods of high market volatility. This precision is crucial for both rapid equities trading strategies and longer-term positions.

Here’s what our commitment to competitive pricing and execution means for your trading:

- Reduced Trading Costs: More of your capital remains available for strategic investments, not eaten up by fees.

- Enhanced Profitability: Lower transaction costs directly translate into higher potential net gains on successful trades.

- Minimal Slippage: Get the prices you expect, ensuring your entry and exit points are honored with precision.

- Fair Trading Environment: Transparent pricing and reliable execution foster confidence and a level playing field for all traders.

Our goal is to provide a seamless and highly efficient platform for your stock trading endeavors. We empower you with the tools and conditions necessary to act swiftly and decisively, knowing you are operating within a cost-effective and robust execution framework.

Tickmill’s Trading Platforms for Stock Investors

Embarking on your journey into the world of Tickmill Stocks demands more than just opportunity; it requires robust, intuitive, and feature-rich trading platforms. At Tickmill, we understand that your success in stock trading hinges on having the right tools at your fingertips. We provide industry-leading platforms designed to empower your decisions and streamline your access to global financial markets.

MetaTrader 4: Your Gateway to Equities Trading

MetaTrader 4 (MT4) stands as a beacon of reliability for traders worldwide, and it’s no different for those engaging with Tickmill Stocks. This platform is renowned for its user-friendly interface and powerful analytical capabilities, making it a solid choice for both novice and experienced investors focusing on equities trading.

- Advanced Charting Tools: Visualize market trends with a comprehensive suite of charting options. Perform in-depth technical analysis on company stocks with ease.

- Customizable Interface: Tailor your workspace to match your trading style. Arrange charts, watchlists, and order windows for optimal efficiency.

- Expert Advisors (EAs): Automate your strategies. MT4 supports algorithmic trading, allowing you to execute trades based on predefined rules without constant manual intervention.

- Real-Time Data: Gain immediate access to price quotes and market news, crucial for making timely decisions in the fast-paced stock trading environment.

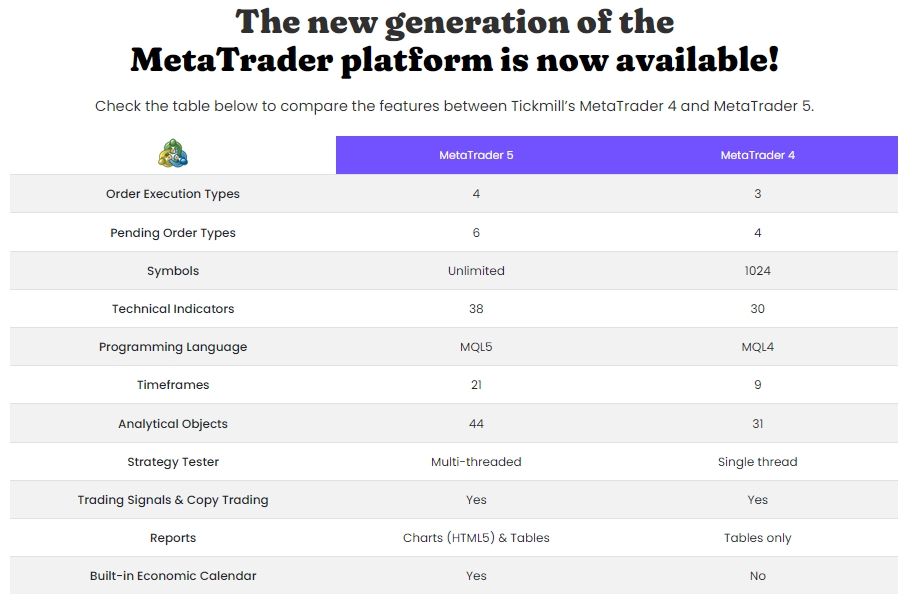

MetaTrader 5: Enhanced Features for Diverse Stock Opportunities

For investors seeking even greater depth and functionality, MetaTrader 5 (MT5) elevates the trading experience for Tickmill Stocks. MT5 offers an expanded array of tools and analytical capabilities, making it ideal for those who demand more from their stock trading platform, including access to shares CFD.

- More Timeframes: Access a broader selection of timeframes for detailed analysis, providing deeper insights into price movements of company stocks.

- Additional Technical Indicators: Utilize an extended library of built-in indicators and graphical objects to refine your market analysis.

- Integrated Economic Calendar: Stay ahead of market-moving events directly within the platform, helping you anticipate potential volatility in equities trading.

- Depth of Market (DOM): View real-time market depth to understand supply and demand for specific assets, a valuable tool when trading Tickmill Stocks.

- Multiple Order Types: Execute complex trading strategies with a wider range of pending orders and order fill policies, enhancing your control over shares CFD transactions.

“Choosing the right trading platform is like selecting the perfect co-pilot for your investment journey. It should provide clarity, control, and an unwavering commitment to performance.”

Why Tickmill’s Platforms Excel for Stock Investors

Our commitment to providing top-tier platforms ensures you have a competitive edge in stock trading. We focus on delivering a seamless and reliable experience:

| Feature | Benefit for Stock Investors |

|---|---|

| Robust Security | Protect your capital and personal data with advanced encryption. |

| Lightning-Fast Execution | Minimize slippage and ensure timely entry/exit for your company stocks trades. |

| Mobile Accessibility | Trade Tickmill Stocks on the go from any device, never missing an opportunity. |

| Comprehensive Tools | Access everything you need for analysis, strategy, and execution in one place. |

Whether your focus is on long-term investment in company stocks or short-term speculation through shares CFD, our platforms empower you with precision and confidence. Explore the power of MetaTrader with Tickmill and transform your approach to equities trading.

MetaTrader 5: Your Gateway to Stocks

Unlock unparalleled opportunities in the global stock market with MetaTrader 5 (MT5). This powerful platform is more than just a trading terminal; it is your comprehensive portal to world-class **company stocks** and dynamic **stock trading** experiences.

MT5 empowers you with a robust suite of tools designed for serious traders. Whether you are delving into traditional **equities trading** or exploring the flexibility of **shares cfd**, MT5 provides the environment you need to execute your strategies with precision. Imagine accessing real-time market data, advanced charting, and sophisticated analytical features, all from a single, intuitive interface. You can track various **Tickmill Stocks** and other global equities, making informed decisions easier than ever.

Here’s what makes MetaTrader 5 an exceptional choice for your stock market ventures:

- **Advanced Charting Tools:** Dive deep into market trends with a vast array of technical indicators and analytical objects. Customize your charts to spot patterns and identify entry and exit points for your chosen **company stocks**.

- **Market Depth (Level II Data):** Gain crucial insights into supply and demand for individual **Tickmill Stocks**. This transparency helps you understand market sentiment and potential price movements.

- **Flexible Order Types:** Execute complex trading strategies with a full spectrum of order types, including market, pending, and stop orders. Manage your risk effectively whether you trade spot equities or **shares cfd**.

- **Integrated Economic Calendar:** Stay ahead of major market events that could impact your **stock trading**. Get real-time updates on economic releases directly within the platform.

- **Multi-Asset Capabilities:** While focused on stocks, MT5 allows you to manage multiple asset classes from one account, streamlining your overall trading experience.

MetaTrader 5 simplifies complex **equities trading** by consolidating essential tools. It supports your analytical needs and helps you execute trades seamlessly. Ready to elevate your trading game? Join us and experience the power of MT5 for yourself.

Exploring the Range of Stocks Available on Tickmill

Unlock vast opportunities in the global markets with the diverse array of Tickmill Stocks. We provide you with access to some of the world’s most prominent companies, allowing you to participate directly in their growth stories. Our platform empowers you to build a robust portfolio tailored to your investment goals.

We believe in offering extensive market access. That means bringing you top-tier company stocks from major exchanges worldwide. You gain exposure to diverse sectors, from technology giants and automotive leaders to consumer staples and innovative startups. This global reach ensures you always find exciting prospects for your equities trading.

Our offering extends beyond simple ownership. You can engage with these popular assets through Contracts for Difference (CFDs), providing flexibility and various trading strategies. Shares CFD trading allows you to speculate on price movements without owning the underlying asset directly, opening up both long and short positions.

Here’s a glimpse into the advantages of trading shares CFDs:

- Leverage Opportunities: Magnify your potential market exposure with less capital.

- Go Long or Short: Profit from both rising and falling market prices.

- No Physical Ownership: Avoid the complexities of owning actual shares.

- Dividend Adjustments: Receive adjustments that reflect dividend payments.

Tickmill makes stock trading straightforward and efficient. You can manage your positions, monitor market developments, and execute trades with precision. Our goal is to equip you with the tools and access necessary to confidently navigate the ever-changing stock market.

Choosing Tickmill for your equities trading means partnering with a broker committed to providing a comprehensive and user-friendly experience. We offer competitive conditions designed to enhance your trading journey.

| Feature | Your Advantage |

|---|---|

| Global Access | Trade top company stocks from multiple regions. |

| Flexible Instruments | Utilize shares CFD for dynamic trading. |

| Competitive Conditions | Benefit from tight spreads and fast execution. |

Ready to explore the exciting world of Tickmill Stocks? Dive into the vast selection and discover new potential for your portfolio today.

Step-by-Step: Opening a Tickmill Stocks Trading Account

Ready to dive into the exciting world of financial markets? Opening a Tickmill Stocks trading account is a straightforward process, designed to get you trading quickly and securely. We guide you through each essential step, ensuring a smooth start to your investment journey.

Step 1: Begin Your Registration

Your journey starts with a simple online registration. This initial stage gathers your basic personal details. Expect to provide:

- Your full name and contact information

- Your country of residence

- A valid email address

Choose your preferred account type during this stage. It’s quick, intuitive, and the first move towards accessing robust stock trading opportunities.

Step 2: Complete Account Verification

Security and regulatory compliance are paramount. After your initial registration, you’ll need to verify your identity and address. This standard process protects both you and your investments. You typically upload clear copies of:

- A valid government-issued ID (passport, driver’s license)

- A recent proof of address (utility bill, bank statement)

Our team efficiently reviews these documents, usually within a short timeframe, allowing you to proceed with confidence in your equities trading endeavors.

Step 3: Fund Your Trading Account

Once your account is verified, it’s time to add funds. Tickmill offers a variety of secure and convenient deposit methods. Choose the option that best suits you to power your first trades.

Here’s a quick look at typical funding options:

| Method | Description | Processing Time |

|---|---|---|

| Bank Transfer | Direct transfer from your bank account | 1-3 business days |

| Credit/Debit Card | Instant deposit with Visa/Mastercard | Instant |

| E-wallets | Popular digital payment solutions | Instant |

Always check for any minimum deposit requirements before proceeding.

Step 4: Select Your Trading Platform

Tickmill provides access to powerful, user-friendly trading platforms. These platforms are your gateway to the market, allowing you to analyze charts, manage your positions, and execute trades. Choose the platform that aligns with your trading style and experience level.

“Our platforms offer robust tools and real-time data, giving you the edge in managing your investments, whether you’re interested in shares cfd or direct company stocks.”

You can access the platform directly from your web browser or download a dedicated desktop application for an enhanced experience.

Step 5: Place Your First Trade

With your account funded and your platform ready, you are now set to place your very first trade! Navigate to the market watch, select a specific company stocks you’re interested in, decide on your trade size, and execute your order. Take your time to familiarize yourself with the platform’s features before making a live trade. Explore demo accounts first if you wish to practice.

Opening a Tickmill Stocks account puts you in control of your financial future. We provide the tools and support; you bring the ambition. Start today!

Funding and Withdrawals for Your Tickmill Stocks Account

Managing your funds seamlessly is crucial for an effective stock trading experience. At Tickmill, we understand this completely. That’s why we’ve streamlined the process for funding and withdrawing from your Tickmill Stocks account, ensuring you can focus on making informed decisions in the market.

Getting started with your equities trading journey should be effortless. We offer a variety of secure and convenient deposit methods designed to get your capital ready for trading company stocks quickly and safely.

Depositing Funds: Quick and Secure

- Bank Wire Transfer: A reliable option for larger sums, offering maximum security. While typically taking a few business days, it’s a trusted method for many traders.

- Credit/Debit Cards: Instant deposits are available via major credit and debit cards. This is a popular choice for its speed and ease of use, allowing you to react swiftly to market opportunities.

- E-Wallets: Solutions like Neteller and Skrill provide near-instant processing. They are ideal for quick top-ups and offer an extra layer of privacy.

- Other Local Payment Methods: Depending on your region, we may offer additional localized payment solutions for your convenience.

Here’s a snapshot of common deposit methods and their typical processing times:

| Method | Typical Processing Time | Availability |

|---|---|---|

| Credit/Debit Card | Instant | 24/7 |

| E-Wallets (Neteller, Skrill) | Instant | 24/7 |

| Bank Wire Transfer | 1-5 Business Days | During Banking Hours |

Withdrawing Your Earnings: Simple and Reliable

When it’s time to enjoy the fruits of your stock trading efforts, our withdrawal process is just as straightforward. We prioritize security and efficiency to ensure your funds reach you without unnecessary delays. Whether you’re trading shares cfd or traditional equities, the process remains consistent.

To request a withdrawal from your Tickmill Stocks account:

- Log in to your secure client area.

- Navigate to the “Withdrawal” section.

- Select your preferred withdrawal method, which typically matches your deposit method for security reasons.

- Enter the amount you wish to withdraw and confirm your request.

Our dedicated back-office team processes withdrawal requests promptly. We aim to process all requests within one business day. Depending on your chosen method, the funds will then appear in your account within a few hours for e-wallets, or up to several business days for bank transfers.

We believe that managing your capital should be the least of your worries when navigating the markets. Our robust and transparent funding and withdrawal procedures for your Tickmill Stocks account reflect our commitment to providing a superior trading environment. Experience this peace of mind by joining Tickmill today.

How to Place Your First Stock Order on Tickmill

Ready to dive into the exciting world of stock trading? Taking that initial step to place your first stock order on Tickmill might seem daunting, but it’s an incredibly straightforward process. With Tickmill, you gain access to a wide range of company stocks, allowing you to invest in the businesses you believe in. We will walk you through each step, making your entry into the market smooth and confident.

Before You Begin: Essential Preparations

A little preparation goes a long way. Before you execute your trade on Tickmill Stocks, ensure these foundational elements are in place:

- Fund Your Account: Make sure your Tickmill trading account has sufficient funds. You can easily deposit money using various secure payment methods.

- Research Your Stocks: Have a clear idea of which company stocks you want to buy. Understand the company’s fundamentals, recent news, and market performance. This research is crucial for successful equities trading.

- Understand Order Types: Familiarize yourself with different order types (market, limit, stop). Knowing when to use each empowers your trading strategy.

- Navigate the Platform: Spend a few minutes exploring the Tickmill trading platform. Locate the search bar, order panel, and your account overview.

Placing Your Order: A Step-by-Step Guide

Follow these simple steps to place your first order and begin your journey with Tickmill Stocks:

- Log In to Your Tickmill Account: Access your secure trading platform. If you have not set up an account yet, it is a quick process to get started.

- Search for Your Desired Stock: Use the search bar, usually found at the top or side of the platform. Type in the company name or ticker symbol (e.g., AAPL for Apple Inc.). The platform will display relevant results, including pricing data and other details for the selected company.

- Open the Order Panel: Once you have selected your stock, click on it. An order panel or ‘New Order’ window will typically appear, ready for your instructions.

- Specify Order Details: This is where you tell Tickmill exactly what you want to do:

- Volume/Quantity: Decide how many shares you wish to buy or sell.

- Order Type: Choose between a Market Order (executes immediately at the current best available price) or a Limit Order (executes at a specific price you set or better). Other options like Stop Orders are also available.

- Take Profit/Stop Loss (Optional): For risk management, consider setting Take Profit (automatically closes your trade when it reaches a certain profit level) and Stop Loss (automatically closes your trade if it drops to a certain loss level) orders.

- Direction: Select whether you want to ‘Buy’ or ‘Sell’. For your first purchase, you will select ‘Buy’.

- Review and Confirm: Double-check all the details you have entered. Ensure the stock, quantity, order type, and price (for limit orders) are correct. Mistakes can be costly in stock trading.

- Place Your Order: Click the ‘Place Order’ or ‘Buy’ button to submit your trade. You will usually receive a confirmation message that your order has been successfully placed.

Understanding Key Order Types

While placing your order for shares cfd or company stocks, knowing these fundamental order types is vital:

| Order Type | Description | When to Use |

|---|---|---|

| Market Order | Executes immediately at the best available current market price. | When you want to buy or sell quickly, prioritizing speed over a specific price. |

| Limit Order | Places an order to buy or sell at a specific price you define, or better. | When you want to control the price you pay or receive, waiting for the market to hit your target. |

After Placing Your Order: What’s Next?

Once your order is live, monitor its status in the ‘Positions’ or ‘Orders’ section of your Tickmill account. For limit orders, you will see if it is pending execution. For market orders, you will see your open position. Stay informed, review your portfolio regularly, and adapt your strategy as needed. Your journey into successful equities trading has officially begun!

Understanding Tickmill Stock Trading Costs and Commissions

Diving into the world of Tickmill Stocks opens up exciting opportunities. Smart investors know success isn’t just about market moves; it’s also about understanding the real cost of every trade. Knowing your trading costs is paramount for long-term profitability and making informed decisions when engaging in stock trading.

At Tickmill, we believe in clear, straightforward pricing. Let’s break down the typical costs associated with trading company stocks and other equities.

-

Commissions

When you trade Tickmill Stocks, commissions are often the primary fee. These are charges for executing your trades. We offer competitive commission structures, ensuring you pay a fair price for the service. These fees can vary based on the specific market or asset, often being a small amount per share or a percentage of the total trade value.

-

Spreads

For those exploring shares cfd, the spread is another critical element. This is simply the difference between the buy and sell price of an asset. A tighter spread means less cost to enter and exit positions, directly impacting your bottom line and making your equities trading more efficient.

-

Overnight (Swap) Fees

Holding company stocks or CFDs overnight means you might incur swap fees. These are charges or credits applied daily for positions kept open past market close. They reflect interest rate differentials and can add up, particularly for long-term positions. It is always wise to factor these into your strategy.

-

Other Potential Fees

While less common, consider potential charges like currency conversion fees if your trading account’s base currency differs from the currency of the asset you are trading. Also, certain payment providers might apply withdrawal fees. We champion transparency in all these areas, making sure you are always in the know.

Understanding these costs gives you a powerful edge. It allows you to accurately calculate potential profits and manage your capital effectively. Transparency in pricing ensures you have a clear picture of your investment performance with Tickmill Stocks.

“Every penny saved in fees is a penny earned in profit. Informed traders make better decisions.”

Here’s a quick overview of common cost types for clarity:

| Cost Type | Applies To | Description |

|---|---|---|

| Commission | Stock Trading, Shares CFD | A fee for executing a trade. |

| Spread | Shares CFD | Difference between buy and sell price. |

| Overnight/Swap | Long-held positions (CFDs, some stocks) | Daily charges/credits for holding positions past market close. |

By grasping these cost components, you gain a clearer picture of your actual investment performance. Tickmill strives for transparent pricing, empowering you to manage your capital effectively across all your company stocks and shares cfd positions. Be informed, trade smart.

Essential Risk Management Strategies for Stock Traders

Navigating the dynamic world of financial markets requires more than just keen insight; it demands robust risk management. For anyone engaging in stock trading, especially with Tickmill Stocks, protecting your capital is paramount. Without a solid strategy, even winning trades can lead to significant setbacks. Let’s explore foundational principles to safeguard your investments and foster sustainable growth.

Before placing a single trade, take the time to truly understand your personal risk tolerance. This crucial self-assessment dictates how aggressively or conservatively you approach the market. An honest appraisal prevents emotional decisions during market volatility, ensuring you stick to your predefined limits rather than reacting impulsively. Once you know your boundaries, you can effectively implement these core strategies:

- Position Sizing: This is fundamental. Never allocate an excessive portion of your capital to a single trade. Determine a fixed percentage of your total trading account (e.g., 1-2%) you’re willing to risk on any given trade. Adhering to this rule is a cornerstone for long-term survival in equities trading, allowing you to absorb losses without being wiped out.

- Stop-Loss Orders: These are your non-negotiable safety nets. A stop-loss order automatically closes your position if the price moves against you to a predetermined level. It precisely defines your maximum loss on any particular trade, preventing minor pullbacks from turning into catastrophic losses. Implement them diligently for every company stocks position.

- Diversification: Avoid the classic mistake of putting all your eggs in one basket. Spread your investments across different sectors, industries, or even asset classes. This strategy significantly mitigates the impact of poor performance from any single stock or market segment, adding a layer of resilience to your overall portfolio. While focusing on individual company stocks, remember to maintain a broader view.

- Risk-Reward Ratio: Before entering any trade, objectively calculate your potential profit against your potential loss. Aim for trades where the potential reward significantly outweighs the risk – a minimum of 2:1 or even 3:1 is often recommended. If a trade doesn’t meet your minimum acceptable ratio, skip it and wait for a better opportunity.

- Leverage Awareness (for Shares CFD): When trading products like shares cfd, leverage amplifies both potential gains and losses. It’s vital to understand how margin requirements work and always maintain sufficient capital to cover potential adverse market movements. Leverage is a powerful tool that requires disciplined handling and acute awareness of its magnified risks.

As a seasoned trader once wisely observed:

“The primary goal of a successful trader is to preserve capital. Profits will follow naturally if you master risk management.”

Implementing these strategies creates a disciplined, robust framework for your stock trading activities. It shifts the focus from chasing quick gains to sustainable, managed growth. Start with these fundamentals, apply them consistently, and watch your confidence grow as you navigate the markets effectively and responsibly.

Educational Resources and Market Analysis for Tickmill Stock Users

Navigating the dynamic world of financial markets demands more than just capital; it requires knowledge, strategy, and keen insight. For those engaging with Tickmill Stocks, we understand this fundamental truth. That is why we equip you with a robust suite of educational resources and cutting-edge market analysis tools designed to empower your journey. We believe informed traders are confident traders, ready to seize opportunities in stock trading and beyond.Mastering the Market with Comprehensive Learning Tools

Whether you are just starting out or looking to refine your strategies, our educational materials simplify complex concepts, making them accessible and actionable. We empower you to understand market mechanics, risk management, and effective trading techniques without overwhelming jargon. Our goal is to transform curiosity into competence. Here is a glimpse of the valuable resources awaiting you:- Expert-Led Webinars: Join live sessions with seasoned analysts who break down current market trends and trading strategies. These interactive experiences offer direct learning and Q&A opportunities.

- In-Depth Guides and Tutorials: Access a library of written content covering everything from basic terminology to advanced charting techniques. Learn at your own pace about the intricacies of company stocks and how to analyze them.

- Video Lessons: Visual learners thrive with our concise video series, demonstrating practical applications of trading principles and platform features.

- Glossary of Terms: Quickly look up definitions for financial terms, ensuring you always speak the market’s language.

Unlocking Opportunities with Advanced Market Analysis

Understanding market sentiment and future price movements is crucial for successful trades. Our comprehensive market analysis tools provide the insights you need to make well-informed decisions, whether you are dealing with shares cfd or direct stock investments. We distill vast amounts of data into actionable intelligence, saving you time and enhancing your strategic outlook. Our analysis covers various aspects:Fundamental Analysis Insights:

Delve into the economic health of companies and broader industries. Understand how financial reports, news events, and macroeconomic indicators influence the value of company stocks. This approach helps you identify long-term investment potential and evaluate intrinsic value.

Technical Analysis Tools:

Utilize powerful charting tools and indicators to spot patterns, predict price movements, and determine optimal entry and exit points. We provide access to various indicators, drawing tools, and customizable charts to help you visualize market behavior and identify trends in equities trading.

| Benefit | Description |

|---|---|

| Informed Decisions | Base your trading choices on expert research and real-time data. |

| Risk Management | Identify potential market risks and opportunities more effectively. |

| Strategic Edge | Gain a competitive advantage by understanding market dynamics before others. |

Dedicated Customer Support for Tickmill Stocks Clients

When you engage in stock trading, having reliable support is paramount. At Tickmill, we understand the dynamic nature of the markets and the importance of swift, expert assistance. That’s why our dedicated customer support team stands ready to assist all Tickmill Stocks clients, ensuring a seamless and confident trading experience. We believe your success in equities trading is directly linked to the quality of guidance you receive.

Our commitment to your success means providing support that truly makes a difference. Here’s what sets our team apart:

- Expert Knowledge: Our support specialists possess deep market understanding, ready to assist with anything from platform navigation to intricate queries about company stocks and shares cfd.

- Prompt Responses: Time is critical in trading. We prioritize rapid, effective solutions to keep you focused on your Tickmill Stocks strategy.

- Personalized Approach: You are not just a ticket number. Our team offers tailored assistance, understanding your specific needs and challenges.

- Multilingual Assistance: We connect with traders from diverse backgrounds, offering support in several languages for clear communication.

Reaching our dedicated team is straightforward. We offer multiple channels to ensure you can always get the help you need, when you need it:

| Channel | Availability | Best For |

|---|---|---|

| Live Chat | 24 hours a day, 5 days a week | Immediate questions, platform troubleshooting |

| 24 hours a day, 7 days a week | Detailed inquiries, documentation requests | |

| Phone | During business hours | Direct conversations, urgent matters |

Our commitment goes beyond just answering questions. We empower you to make informed decisions when trading company stocks. Whether you are new to stock trading or an experienced investor looking to optimize your shares cfd strategy, our team acts as a crucial resource. This dedicated support elevates your overall journey with Tickmill Stocks, fostering an environment where you can truly thrive. We are here to ensure every aspect of your equities trading experience is smooth and efficient.

Experience the difference true dedication makes. Join the Tickmill Stocks community and discover a supportive partner committed to your trading success.

Tickmill Stocks vs. Other Investment Products

Navigating the financial markets can feel like choosing your path in a vast, dynamic landscape. Each investment product offers unique opportunities and challenges. If you’re considering expanding your portfolio, understanding how Tickmill Stocks stands apart from other options is crucial. We empower you to make informed decisions for your financial journey.

The Direct Appeal of Tickmill Stocks

When you engage with Tickmill Stocks, you’re tapping into the core of global commerce. This isn’t just about speculation; it’s about connecting directly with some of the world’s most influential company stocks. Our platform provides a streamlined avenue for stock trading, offering clear advantages for those seeking transparent access to market movements and long-term growth potential.

Here’s what makes our stock offering compelling:

- Direct Market Exposure: Get closer to the companies you believe in.

- Diversification Power: Add a robust layer of stability and growth potential to your overall portfolio.

- Transparent Pricing: Understand your costs without hidden surprises, fostering greater confidence in your trades.

- Dividend Potential: Benefit from potential dividend payments, providing an additional income stream.

Spotlight: Tickmill Stocks vs. Shares CFDs

It’s important to distinguish between trading actual company stocks and engaging in shares cfd (Contracts for Difference). While both allow you to profit from price movements, their underlying mechanisms differ significantly. Tickmill offers various instruments to suit diverse strategies.

| Feature | Tickmill Stocks (Actual Shares) | Shares CFDs |

|---|---|---|

| Ownership | You own a portion of the company. | You speculate on price movement, no ownership. |

| Dividends | You receive dividends (if declared). | You receive an adjustment mirroring dividends. |

| Leverage | Typically lower or no leverage for direct ownership. | High leverage often available, amplifying gains and losses. |

| Funding Costs | No overnight funding fees for held shares. | Overnight funding costs (swaps) often apply. |

Trading shares cfd offers flexibility with leverage, letting you take larger positions with less capital. However, it also comes with increased risk, including potential overnight funding charges. Our direct equities trading option, on the other hand, often appeals to those prioritizing long-term capital appreciation and direct company ownership.

Broader Horizons: Stocks vs. Other Investment Products

Beyond CFDs, a world of other investment products exists. Let’s briefly compare the experience of stock trading with some of these alternatives:

Stocks vs. Forex Trading

Forex trading involves currency pairs, focusing on national economic performance and geopolitical events. While highly liquid and active 24/5, it’s often characterized by high volatility and rapid price changes. Equities trading, in contrast, connects you to individual company performance, industry trends, and long-term innovation. The drivers are fundamentally different, appealing to distinct analytical approaches.

Stocks vs. Commodities

Commodities (like gold, oil, or agricultural products) are tangible assets driven by supply and demand, often influenced by global events and weather patterns. They can serve as inflation hedges. Company stocks, however, represent a stake in a specific business, offering growth potential tied to corporate success and market expansion rather than raw material prices.

Stocks vs. Bonds

Bonds are debt instruments, offering fixed interest payments and generally lower risk than stocks, but also lower returns. They prioritize capital preservation and stable income. Tickmill Stocks provides exposure to growth and capital appreciation, albeit with higher inherent market risk. Your choice depends on your risk tolerance and investment objectives.

“Diversity is key in any robust portfolio. Understanding the unique characteristics of each asset class helps you build a strategy that truly aligns with your financial goals.”

Why Your Equities Trading Journey Starts Here

Choosing where to conduct your equities trading is a significant decision. Tickmill provides robust tools, competitive conditions, and dedicated support for your journey into company stocks. Whether you are aiming for growth, diversification, or leveraging market opportunities, our platform is designed to facilitate your goals effectively.

Ready to explore the world of direct stock trading with clarity and confidence? Discover how Tickmill Stocks can fit into your investment strategy today. Join our community of informed traders and start building your future.

Advanced Tools and Features for Savvy Stock Traders

Navigating the dynamic world of financial markets demands more than just basic understanding; it requires a sophisticated toolkit. Savvy traders know that success hinges on leveraging cutting-edge technology and insightful data. With Tickmill Stocks, you gain access to a comprehensive suite of advanced tools and features designed to elevate your stock trading experience.

We empower you to make informed decisions and execute strategies with precision, whether you are delving into equities trading or exploring shares cfd. Our platform goes beyond the essentials, providing everything you need to gain an edge.

Unrivalled Charting and Analytical Power

Deep dive into market trends with our state-of-the-art charting capabilities. You can customize charts to your exact specifications, applying a vast array of technical indicators and drawing tools. Identify patterns, gauge momentum, and forecast price movements with confidence. Our robust analytical suite ensures you have every angle covered before placing a trade.

- Interactive charts with multiple timeframes

- Extensive library of technical indicators (moving averages, RSI, MACD, etc.)

- Customizable drawing tools for trendlines, Fibonacci retracements, and more

- Comparison tools to benchmark company stocks against their peers

Real-Time Data and Market Intelligence

Stay ahead of the curve with instantaneous access to crucial market information. Our platform delivers real-time price feeds, news updates, and economic calendars directly to your fingertips. This constant stream of data is vital for making timely decisions in fast-moving markets.

Gain deeper insights into specific company stocks with integrated fundamental data and analyst reports, helping you understand the true value behind the ticker symbol.

Precision Order Types and Execution

Execute your trading strategies with unmatched precision using our diverse range of order types. Beyond standard market and limit orders, you can deploy advanced strategies to manage risk and capitalize on specific market conditions.

| Order Type | Description |

|---|---|

| Stop-Loss Orders | Automatically limit potential losses if the market moves against your position. |

| Take-Profit Orders | Secure gains by automatically closing a position once a target price is reached. |

| Trailing Stop Orders | Protect profits while allowing positions to continue gaining if the market moves favorably. |

| OCO (One-Cancels-the-Other) | Place two conditional orders, where the execution of one automatically cancels the other. |

Comprehensive Risk Management Framework

Protecting your capital is paramount in stock trading. Tickmill Stocks provides sophisticated risk management tools that allow you to define your exposure and mitigate potential downsides proactively. We offer transparent margin requirements and tools to calculate your potential risk per trade before you commit.

“Effective risk management isn’t just a feature; it’s the foundation of sustainable trading success.”

Manage your positions effectively, setting clear boundaries for your trades and safeguarding your investments in shares cfd and other assets.

Maximizing Your Tickmill Stocks Trading Experience

Unlock the full potential of your market journey with Tickmill. We understand that effective stock trading is about more than just opening an account; it requires strategy, insight, and the right tools. Here, we guide you through optimizing your approach to Tickmill Stocks, ensuring you’re well-equipped to navigate the dynamic world of equities.

Successful trading begins with a well-defined plan. Before you dive into company stocks, take time to research and understand market trends. Our platform offers access to a wide range of analytical tools designed to help you make informed decisions. Whether you are interested in long-term investments or short-term gains, a clear strategy is your compass for navigating Tickmill Stocks.

- Thorough Research: Investigate the companies behind the company stocks you consider. Look at their financial health, industry position, and future prospects.

- Risk Management: Never trade without a stop-loss order. Protect your capital by defining your risk tolerance for each trade.

- Diversification: Spread your investments across different sectors to mitigate risk. Avoid concentrating your entire portfolio in one area.

For many traders, exploring shares cfd offers distinct advantages. These contracts for difference allow you to speculate on price movements without owning the underlying asset. This can open up opportunities for both rising and falling markets, providing flexibility in your trading approach and enhancing your overall stock trading strategy.

“Leverage can amplify returns, but it also magnifies risk. Use it wisely and with a clear understanding of its implications for your capital.”

Consider these points when evaluating shares cfd:

| Benefit | Description |

|---|---|

| Leverage Potential | Trade with a fraction of the full value of the shares, potentially amplifying returns. |

| Short-Selling | Profit from falling markets by opening a sell position without owning the asset. |

| Accessibility | Access a broad range of global company stocks easily, expanding your trading horizons. |

Continuous learning is paramount in the world of stock trading. Stay updated with market news, economic indicators, and geopolitical events that can impact company stocks. Tickmill provides resources and a supportive environment to help you refine your equities trading skills and stay ahead of the curve. Engage with our educational materials and expert insights to sharpen your analysis.

Ready to elevate your Tickmill Stocks experience? Leverage the powerful features and comprehensive market access Tickmill offers. Start making more confident and strategic decisions today and optimize your journey in the financial markets.

Frequently Asked Questions

What are Tickmill Stocks?

Tickmill Stocks refers to the offering on the Tickmill platform that allows traders to engage with leading company stocks, primarily through Contracts for Difference (CFDs). This enables speculation on price movements without direct ownership of the underlying shares.

Why choose Tickmill for equities trading?

Tickmill is chosen for its robust and user-friendly environment, offering global market access, competitive pricing (tight spreads and low commissions), advanced trading platforms (MetaTrader 4 and 5), comprehensive educational resources, and dedicated customer support.

What are Shares CFDs and how do they differ from direct stock ownership?

Shares CFDs allow you to speculate on the price fluctuations of company stocks without actually owning the shares. This offers flexibility for both rising and falling markets and leverage opportunities, unlike direct ownership which involves possessing the actual stock and typically lower leverage.

How can I open a Tickmill Stocks trading account?

Opening an account with Tickmill involves a straightforward online registration, completing an identity and address verification process, funding your account using various secure deposit methods, selecting your preferred trading platform, and then placing your first trade.

What are the typical costs associated with trading stocks on Tickmill?

The primary costs include commissions charged for executing trades, spreads (the difference between buy and sell prices, mainly for CFDs), and potential overnight (swap) fees for positions held open past market close. Tickmill aims for transparent and competitive pricing across these components.