Ready to unlock the potential of the world’s leading economies? With Tickmill Stock Indices, you gain direct access to the pulse of global markets. We cut through the complexity, empowering you to participate in major market movements with confidence and precision. This isn’t just about trading; it’s about seizing opportunities wherever they arise across the globe. Discover the power of trading indices and elevate your strategy today.

- What Are Stock Indices and Why Do They Matter?

- Why Stock Indices Are Crucial Market Barometers

- How You Can Engage with Stock Indices

- Understanding Index Composition and Weighting

- How Are Index Components Chosen?

- Demystifying Index Weighting

- Why Does This Matter for Your Trading?

- Types of Stock Indices Globally

- Why Choose Tickmill for Trading Stock Indices?

- Unrivaled Trading Conditions for Index Trading

- Access a Diverse Range of Global Indices

- Advanced Platforms and Powerful Tools

- Commitment to Security and Support

- Exploring Tickmill’s Diverse Stock Indices Offering

- What Are Tickmill Stock Indices?

- Advantages of Trading Stock Indices with Tickmill

- Discover a World of Global Indices

- Unlock Potential with CFD Indices

- Ready to Start Your Index Trading Journey?

- Advantages of Trading Stock Index CFDs with Tickmill

- Broad Market Exposure

- Ultimate Trading Flexibility

- Cost-Efficient Execution

- Robust Platforms and Support

- Navigating Global Markets with Major Tickmill Indices

- Why Trade Global Indices with Tickmill?

- Key Advantages for Your Index Trading

- US Market Giants (S&P 500, Dow Jones, NASDAQ 100)

- European & Asian Powerhouses (DAX, FTSE 100, Nikkei 225)

- Germany’s Economic Bellwether: The DAX

- The UK’s Market Barometer: FTSE 100

- Asia’s Tech and Export Giant: Nikkei 225

- Tickmill’s Competitive Conditions for Index Trading

- Mastering Risk Management in Tickmill Stock Indices Trading

- Understanding Market Volatility

- Essential Risk Management Tools

- Crafting Your Risk-Reward Ratio

- The Psychology of Trading

- How to Get Started Trading Tickmill Stock Indices

- 1. Build Your Knowledge Base

- 2. Open Your Tickmill Account

- 3. Explore and Select Your Preferred Indices

- 4. Develop Your Trading Strategy and Manage Risk

- Accessing Tickmill Indices on Popular Trading Platforms

- Your Gateway to Global Indices: Top Platforms Supported

- Seamless Trading Experience: What to Expect

- Getting Started with Tickmill Stock Indices

- Effective Strategies for Trading Stock Indices

- Understanding the Market Landscape

- Core Trading Approaches

- Essential Risk Management Practices

- Leveraging Tools and Analysis

- Technical Analysis Approaches

- Fundamental Analysis Insights

- The Impact of Economic News on Stock Index Prices

- Educational Resources for Tickmill Index Traders

- Explore Our Learning Pathways

- Why Education Transforms Your Trading

- Ready to Elevate Your Trading?

- Understanding Rollover and Dividends in Index CFDs

- Decoding Rollover in Index CFDs

- How Rollover Works for Traders:

- Navigating Dividends with Index CFDs

- Dividend Adjustments Explained:

- Why Dividends Matter for Your Strategy:

- Tickmill Client Support for Indices Trading

- What Makes Tickmill’s Indices Trading Support Stand Out?

- How to Connect with Our Support Team

- Frequently Asked Questions

What Are Stock Indices and Why Do They Matter?

Ever wondered how you can get a snapshot of an entire market, or even a nation’s economy, with just one number? That’s precisely the power of stock indices. Think of them as a basket holding shares of several companies. Their value moves up or down based on the combined performance of those underlying companies.

They aren’t actual assets you can buy directly, but rather a calculated measure that reflects market trends and investor sentiment. Each index has its own specific criteria for which companies it includes and how it weights them, offering unique insights into different sectors or regions.

Why Stock Indices Are Crucial Market Barometers

Stock indices play a vital role in the financial world. They offer a quick, clear view of market health and direction. Here’s why they matter so much:

- Market Health Indicator: An index’s performance often signals the overall health of an economy or a specific industry sector. A rising index suggests growth and investor confidence, while a falling one can point to economic headwinds.

- Benchmarking Tool: Investors use stock indices to compare the performance of their own portfolios. If your portfolio grows more than the relevant index, you’re likely outperforming the market.

- Diversification Gateway: Engaging in index trading allows you to gain exposure to a broad range of companies and sectors through a single position. This can help diversify your portfolio without needing to research and invest in individual stocks.

- Global Economic Insight: Following various global indices gives you a panoramic view of economic conditions worldwide. From the US to Europe, Asia, and beyond, these indices tell a story about global financial shifts.

- Risk Management: By investing in an index rather than a single stock, you spread your risk. The impact of one company performing poorly is often cushioned by the performance of others within the same index.

How You Can Engage with Stock Indices

While you can’t own a stock index directly, there are popular ways to participate in their movements. One common method involves trading cfd indices. This allows you to speculate on the price direction of an index without actually owning the underlying assets. It offers flexibility, enabling you to potentially profit from both rising and falling markets.

Understanding these powerful market indicators is key to navigating the financial landscape. They provide invaluable information for traders, investors, and economists alike. Ready to explore how you can engage with these market opportunities? Discover the potential of Tickmill Stock Indices and how they can fit into your trading strategy.

Understanding Index Composition and Weighting

Ever wondered what truly makes up the widely followed financial benchmarks like the S&P 500 or the DAX? It is more than just a list of companies. Understanding index composition and weighting is absolutely fundamental for anyone looking to engage in index trading, especially when navigating global indices.

An index is a collection of selected stocks, bonds, or other assets designed to represent a specific market segment or a country’s economy. The companies included, their number, and how much influence each one holds, are critical factors. This foundational knowledge empowers you to make informed decisions when you trade popular instruments, including CFD indices.

How Are Index Components Chosen?

Index providers do not just pick companies at random. A rigorous selection process ensures the index accurately reflects its target market. Here are common criteria:

- Market Capitalization: Often, only the largest and most influential companies in a sector or country qualify.

- Liquidity: Stocks must be actively traded, ensuring ease of buying and selling without significant price impact.

- Sector Representation: To provide a broad market view, indices often seek to include companies from diverse sectors.

- Geographic Focus: Some indices focus on a single country, while others encompass multiple regions, providing a broader look at global indices.

These components are not static. Index committees regularly review and adjust the list, adding new companies and removing those that no longer meet the criteria. This keeps the index relevant and representative.

Demystifying Index Weighting

Beyond simply being included, each component within an index carries a specific weight. This weight determines its impact on the index’s overall value. A higher-weighted stock will cause a larger shift in the index’s price compared to a lower-weighted one, even with the same percentage move in their individual share prices. Here are the primary weighting methods:

| Weighting Method | How it Works | Key Implication |

|---|---|---|

| Market-Cap Weighted | Companies with larger market capitalization have a greater influence. | Dominant method for major global indices (e.g., S&P 500). |

| Price-Weighted | Stocks with higher share prices impact the index more. | Simpler calculation, but share price changes (like splits) need adjustments (e.g., Dow Jones Industrial Average). |

| Free-Float Weighted | Only shares readily available for public trading are considered for market cap. | More accurate reflection of market supply and demand. |

| Equal-Weighted | Every component stock holds the same percentage weight, regardless of size. | Reduces dominance by mega-cap companies, often seen in specific sector indices. |

Why Does This Matter for Your Trading?

Understanding composition and weighting is not just academic; it directly influences your index trading strategy. For instance, in a market-cap weighted index, the performance of a few large companies can significantly sway the entire index. If you are trading CFD indices, knowing which companies carry the most weight allows you to better anticipate index movements based on news affecting those specific firms.

When you engage with Tickmill Stock Indices, this knowledge becomes a powerful tool. It helps you grasp why one index might react differently to market news compared to another, even if both represent similar economic regions. You gain a deeper appreciation for the underlying mechanics, enabling more strategic entries and exits. This insight is crucial for navigating the complexities of Tickmill Stock Indices and making well-informed decisions in your trading journey.

Types of Stock Indices Globally

The world of finance buzzes with activity, and at its core, you find stock indices. These powerful benchmarks offer a snapshot of a market’s health and performance. Understanding the vast landscape of Tickmill Stock Indices is key for any serious trader aiming to grasp global economic trends and opportunities.

Global markets present a fascinating array of these indicators, each reflecting different aspects of the economy. Let’s explore the diverse types that shape our financial landscape, giving you a clearer perspective on global indices.

National and Regional Powerhouses

Many stock indices serve as the economic pulse of a specific nation or region. They aggregate the performance of leading companies within that geographic boundary, offering valuable insights into local market sentiment.

- National Icons: Think of benchmarks like the S&P 500, representing the top 500 companies in the US, or the FTSE 100, tracking the largest UK-listed firms. These are often the first points of reference for assessing a country’s economic vigor.

- Regional Barometers: Beyond single nations, regional indices capture the collective strength of multiple economies. The Euro Stoxx 50, for instance, reflects the performance of 50 blue-chip companies across various Eurozone countries, giving a broader European market perspective.

Sector-Specific and Thematic Indices

Sometimes, the focus narrows to particular industries or investment themes. These specialized indices highlight the performance of companies within a defined sector, providing granular insights into specific economic drivers.

- Tech Innovators: The NASDAQ Composite is a prime example, heavily weighted towards technology and growth companies. It’s a go-to for understanding the health and innovation within the tech sector.

- Broad Market Indicators: Some indices aim for a wider scope, encompassing a vast number of companies across all sectors to give a truly comprehensive view of the entire market’s performance.

How Indices Get Their Numbers

Not all stock indices are built the same. Their construction methodology dictates how they calculate their values, which directly impacts their representation of market movements. While some use a simple price-weighted approach, most popular indices today employ a market-capitalization-weighted method.

| Methodology | Description |

|---|---|

| Price-Weighted | Gives more influence to stocks with higher share prices, often reflecting older index styles. |

| Market-Cap-Weighted | Assigns influence based on a company’s total market value, meaning larger companies have a greater impact on the index’s movement. |

Why Engage in Index Trading?

Understanding these diverse types opens up significant avenues for index trading. Traders can speculate on the overall direction of entire markets or specific sectors without needing to invest in individual stocks. This offers diversification and a way to capitalize on broad economic trends.

For those looking for flexibility, cfd indices provide an accessible way to engage with these market benchmarks. You can go long or short, reacting swiftly to market news and economic data. It’s a powerful tool for strategic market participation.

The variety of stock indices available means there’s always a benchmark to match your trading strategy and market focus. Dive deeper into the opportunities these global indicators present and elevate your trading expertise!

Why Choose Tickmill for Trading Stock Indices?

Tickmill offers a compelling package designed for traders who demand performance, reliability, and an edge in the market.

Diving into the fast-paced world of financial markets requires a broker you can trust. When it comes to stock indices trading, making the right choice significantly impacts your potential for success. We empower you to navigate the complexities of global indices with confidence and precision.

Unrivaled Trading Conditions for Index Trading

Tickmill stands out by providing an exceptional trading environment. We understand that sharp pricing and rapid execution are crucial for profitable index trading. That’s why we focus on offering:

- Ultra-Low Spreads: Benefit from highly competitive spreads, helping you keep more of your profits.

- Lightning-Fast Execution: Our robust infrastructure ensures your orders are executed quickly and efficiently, minimizing slippage.

- Deep Liquidity: Access to institutional-grade liquidity means smoother trading, even during volatile market periods.

Access a Diverse Range of Global Indices

Expand your trading horizons with our extensive selection of cfd indices. We provide access to some of the most prominent equity markets worldwide, allowing you to diversify your portfolio and capitalize on opportunities across different regions. Whether you’re tracking major economies or exploring emerging markets, Tickmill has you covered.

You can speculate on the price movements of key indices without owning the underlying assets, making it a flexible way to participate in broader market trends.

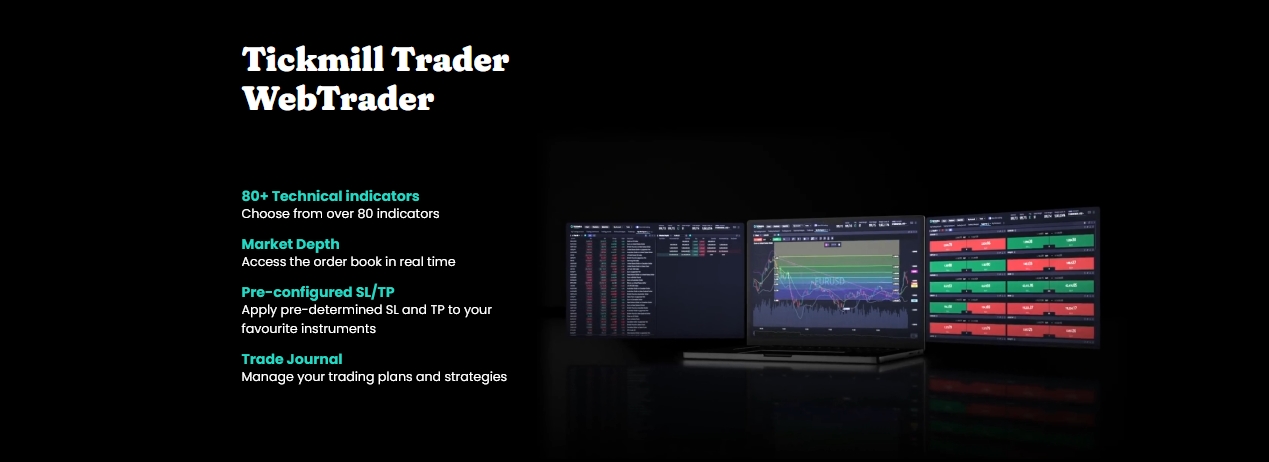

Advanced Platforms and Powerful Tools

Your trading success relies heavily on the tools at your disposal. Tickmill provides industry-leading platforms packed with features designed to enhance your trading experience:

- Intuitive interfaces for easy navigation.

- Advanced charting tools for in-depth technical analysis.

- A wide array of indicators and drawing tools.

- One-click trading functionality for quick entry and exit.

- Mobile trading apps to keep you connected on the go.

These platforms ensure you have everything you need to analyze markets, execute trades, and manage your risk effectively when trading Tickmill Stock Indices.

Commitment to Security and Support

We prioritize the safety of your funds and provide unwavering support. Tickmill operates under strict regulatory oversight, giving you peace of mind as you trade. Our dedicated customer service team is always ready to assist you with any queries, ensuring a smooth and uninterrupted trading journey.

When you choose Tickmill, you’re not just getting access to markets; you’re gaining a reliable partner committed to your trading success.

Ready to experience the Tickmill difference? Open an account today and start your journey into stock indices trading with a trusted broker.

Exploring Tickmill’s Diverse Stock Indices Offering

Ready to navigate the world’s most dynamic financial markets? Tickmill offers you an unparalleled gateway to major global economies through our extensive range of Tickmill Stock Indices. We empower traders like you to capitalize on the performance of leading corporations and entire market sectors without the complexity of trading individual stocks.

Our platform provides direct access to these powerful instruments, making index trading a straightforward and exciting endeavor. Whether you aim for diversification or seek to speculate on broader market movements, our offering delivers the tools you need.

What Are Tickmill Stock Indices?

At its core, a stock index represents a basket of shares from top companies, reflecting the overall health and performance of a specific industry or national economy. When you engage with Tickmill Stock Indices, you trade on the price movements of these aggregated benchmarks.

This approach gives you broad market exposure, moving beyond the risks associated with single stock investments. Instead of researching individual companies, you focus on macroeconomic trends and sector performance, offering a powerful way to diversify your portfolio and manage risk effectively.

Advantages of Trading Stock Indices with Tickmill

Choosing Tickmill for your index trading offers several distinct benefits that enhance your trading experience. We focus on providing competitive conditions and robust execution.

- Broad Market Exposure: Gain instant exposure to entire economic sectors or national markets with a single position.

- Diversification Opportunities: Integrate stock indices into your strategy to spread risk across various assets and regions.

- Two-Way Trading: Profit from both rising and falling markets. Go long when you anticipate growth, or short if you expect a decline.

- Leverage: Amplify your potential returns with competitive leverage, giving you significant market exposure with a smaller capital outlay (always be mindful of associated risks).

- Cost-Effective: Benefit from tight spreads and transparent pricing, ensuring you keep more of your potential profits.

Discover a World of Global Indices

Tickmill takes pride in offering a comprehensive selection of global indices, providing diverse opportunities across different continents and market types. Our offering includes some of the world’s most recognized benchmarks.

You can access indices representing major economies, allowing you to react quickly to global news and economic shifts. From the vibrant tech sectors to established industrial giants, our range covers it all, giving you the power to truly diversify and explore new horizons.

Unlock Potential with CFD Indices

When you trade cfd indices with Tickmill, you enter a Contract for Difference on the underlying index. This mechanism allows you to speculate on price movements without ever owning the actual assets. It provides flexibility and efficiency that traditional investing often lacks.

Here’s what makes cfd indices particularly attractive:

| Feature | Benefit |

|---|---|

| Margin Trading | Trade larger positions with a smaller initial investment. |

| No Physical Ownership | Avoids the complexities and costs associated with buying and holding individual stocks. |

| Instant Execution | Place trades quickly to seize fleeting market opportunities. |

| Access to Major Indices | Easily trade on the performance of leading global indices from a single account. |

These features combine to create a dynamic trading environment for anyone interested in the broader market trends reflected by stock indices.

Ready to Start Your Index Trading Journey?

Embark on your journey into the world of Tickmill Stock Indices today. Explore the diverse opportunities across global indices and leverage the power of cfd indices to enhance your portfolio. Our platform stands ready to support your index trading ambitions with competitive conditions and robust technology. Join us and discover the potential!

Advantages of Trading Stock Index CFDs with Tickmill

Unlock unparalleled opportunities in the financial markets by exploring Tickmill Stock Indices. Trading stock index CFDs with Tickmill offers a suite of powerful advantages designed to empower your trading journey and help you navigate the global markets with confidence. We make sure you have the right tools and conditions to thrive.

Broad Market Exposure

Gain access to an impressive selection of global indices from around the world. With Tickmill, you can easily diversify your portfolio across leading economies and sectors, seizing opportunities no matter where they arise. Trade popular stock indices and broaden your market horizons.

Ultimate Trading Flexibility

Experience the remarkable flexibility of cfd indices. This allows you to speculate on both rising and falling markets, giving you more ways to potentially profit. Leverage amplifies your potential returns, letting you control larger positions with a smaller initial outlay. It’s a dynamic approach to index trading.

Cost-Efficient Execution

Tickmill offers competitive spreads on stock indices, helping to keep your trading costs low. We prioritize transparent pricing, ensuring you can focus on your strategy without worrying about excessive fees eating into your profits. Your capital works harder for you here.

Robust Platforms and Support

Execute trades swiftly on our powerful platforms, equipped with advanced charting tools, real-time data, and seamless functionality. Make informed decisions quickly and efficiently. Plus, our dedicated support team stands ready to assist you on your index trading journey, providing expert guidance whenever you need it.

Consider these key benefits:

- Access a wide range of global indices.

- Benefit from flexible CFD trading, going long or short.

- Enjoy competitive spreads and low trading costs.

- Utilize powerful trading platforms with advanced features.

- Receive dedicated customer support.

Trading stock indices as CFDs with Tickmill means you are equipped with the tools, flexibility, and support to pursue your financial goals effectively. Join us and discover the difference a professional trading environment makes.

Navigating Global Markets with Major Tickmill Indices

The world’s financial markets never sleep, offering constant opportunities and challenges. For traders looking to tap into the broader economic trends rather than individual company performance, Tickmill Stock Indices provide a powerful solution. They offer a unique way to participate in the pulse of various economies, giving you a vantage point on market sentiment across the globe.

Think of stock indices as a basket of leading companies from a specific stock exchange or sector. They act as a barometer for a country’s economy or an industry’s health. With Tickmill, you can engage in index trading, speculating on the collective movement of these market bellwethers without owning individual shares. This approach simplifies market access and offers a clear view of overall market direction.

Why Trade Global Indices with Tickmill?

Trading global indices offers immense advantages for diversifying your portfolio and capitalizing on economic shifts. Here are some compelling reasons:

- Broad Market Exposure: Gain exposure to an entire market or sector with a single position, instantly diversifying beyond individual stocks.

- Reduced Volatility: While individual stocks can be highly volatile, a diversified index often experiences smoother price movements.

- Access to Major Economies: Trade on the performance of leading economies worldwide, from the US and Europe to Asia and Australia.

- Two-Way Opportunities: With cfd indices, you can potentially profit from both rising and falling markets, offering flexibility regardless of market direction.

- Efficiency: Enter and exit positions on major indices quickly, allowing you to react promptly to significant economic news and events.

Key Advantages for Your Index Trading

Tickmill is committed to providing a superior trading environment for global indices. We understand what traders need to navigate these complex markets effectively. Our platform combines robust technology with transparent conditions to empower your trading decisions.

| Feature | Benefit to You |

|---|---|

| Competitive Spreads | Lower trading costs, helping to preserve your capital. |

| Flexible Leverage | Amplify your potential returns with carefully managed risk. |

| Rapid Execution | Ensure your trades are placed precisely when you intend. |

| Diverse Selection | Access a wide array of major indices from around the world. |

Exploring the world of Tickmill Stock Indices opens doors to understanding and potentially benefiting from macro-economic shifts. It’s an efficient way to broaden your trading horizons and engage with the momentum of major markets. Discover how these instruments can fit into your trading strategy today.

US Market Giants (S&P 500, Dow Jones, NASDAQ 100)

The US market stands as a global powerhouse, its performance often setting the tone for economies worldwide. Three dominant stock indices encapsulate the might and dynamics of this financial landscape: the S&P 500, the Dow Jones Industrial Average, and the NASDAQ 100. Understanding these titans is crucial for anyone engaging in index trading, as they offer unique insights and compelling opportunities.

The S&P 500: America’s Broad Benchmark

The S&P 500 represents the performance of 500 of the largest publicly traded companies in the United States. It offers a comprehensive snapshot of the US equity market, making it a critical barometer for the overall health of the American economy. When you look at the S&P 500, you observe a diverse cross-section of industries, from technology to healthcare, consumer staples to financials. Traders often use it to gauge broad market sentiment and identify major trends in US stock indices.

The Dow Jones Industrial Average: A Historic Snapshot

Often simply called “the Dow,” the Dow Jones Industrial Average is one of the oldest and most recognized stock indices globally. It tracks the performance of 30 significant, publicly owned companies based in the United States. While smaller in number compared to the S&P 500, these companies are often “blue-chip” firms, leaders in their respective sectors. The Dow is a price-weighted index, giving more influence to stocks with higher prices, offering a different lens on market movements compared to its peers.

The NASDAQ 100: The Home of Innovation

For those interested in technology and growth, the NASDAQ 100 stands out. This index comprises 100 of the largest non-financial companies listed on the NASDAQ stock market. It is heavily weighted towards technology, telecommunications, retail, and biotechnology sectors, reflecting the innovative spirit of the modern economy. Trading the NASDAQ 100 means tapping into companies at the forefront of digital transformation and global expansion, making it a popular choice for tracking high-growth cfd indices.

Why Focus on These US Market Giants?

- Broad Market Exposure: The S&P 500 offers diversification across various sectors.

- Industry Leadership: The Dow Jones highlights the performance of established market leaders.

- Growth Potential: The NASDAQ 100 captures the dynamism of innovative, tech-driven companies.

- Liquidity: High trading volumes mean tighter spreads and easier execution.

Whether you are seeking diversification, looking to capitalize on tech trends, or aiming to track the overall US economy, these stock indices present compelling options. Engaging with platforms like Tickmill Stock Indices allows you to access these powerful markets efficiently. Understanding the nuances of each index empowers you to make informed decisions and navigate the exciting world of index trading.

Ready to explore the potential of these US market giants? Understanding their movements is a fundamental step toward mastering the markets.

European & Asian Powerhouses (DAX, FTSE 100, Nikkei 225)

Dive into the vibrant markets of Europe and Asia with some of the world’s most influential stock indices. These benchmarks offer a unique window into regional economic health and present compelling opportunities for index trading. Understanding their drivers is key to navigating the global financial landscape.

Germany’s Economic Bellwether: The DAX

The DAX stands as a prime indicator of Germany’s robust economy, tracking the performance of 40 major German blue-chip companies. It represents a significant portion of the European market, making it a crucial component among global indices.

- Market Snapshot: Reflects industrial strength, innovation, and export-driven growth.

- Key Sectors: Dominated by automotive, chemicals, pharmaceuticals, and technology giants.

- Volatility: Often responsive to eurozone economic data and global trade narratives.

The UK’s Market Barometer: FTSE 100

When you consider UK market movements, the FTSE 100 instantly comes to mind. This index comprises the 100 largest companies listed on the London Stock Exchange by market capitalization. It offers a diverse cross-section of global industries, making it a highly liquid instrument for cfd indices trading.

| Characteristic | Description |

|---|---|

| Global Exposure | Many constituent companies have significant international operations. |

| Sector Diversity | Spans financials, energy, mining, consumer goods, and healthcare. |

| Currency Sensitivity | Can react strongly to movements in the British Pound. |

Asia’s Tech and Export Giant: Nikkei 225

Across the continent, Japan’s Nikkei 225 leads the charge as a key benchmark for Asian markets. This price-weighted index tracks 225 prominent Japanese companies, providing deep insight into the nation’s technological prowess and export-oriented economy. It’s a cornerstone for those focused on East Asian stock indices.

Observing the Nikkei 225 offers perspectives on global supply chains, consumer electronics, and automotive industries. Its movements often set the tone for the trading day across Asia.

“Monitoring these leading stock indices provides traders with invaluable insights into regional economic shifts and global market sentiment. Each index tells a unique story about its underlying economy.”

These European and Asian powerhouses are more than just numbers; they represent dynamic economies and a wealth of trading potential. Exploring Tickmill Stock Indices can open doors to engaging with these markets.

Tickmill’s Competitive Conditions for Index Trading

Ready to explore the dynamic world of index trading? Tickmill offers an exceptional environment, meticulously designed for success. Our competitive conditions make trading Tickmill Stock Indices a smart choice for both novice and experienced traders looking to capitalize on global market movements.

We understand that every pip and every second counts. That’s why we’ve optimized our platform to deliver superior trading conditions for a wide range of global indices. Here’s what sets Tickmill apart:

-

Ultra-Low Spreads: Experience some of the market’s tightest spreads on major stock indices. Lower costs mean more of your potential profits stay with you, maximizing your returns from market fluctuations.

-

Rapid Trade Execution: Never miss an opportunity with our lightning-fast execution speeds. Your orders process quickly and reliably, a critical advantage in the fast-paced world of index trading.

-

Transparent Cost Structure: We pride ourselves on clear and fair pricing. Enjoy competitive commissions on your cfd indices trades, helping you manage your overall trading expenses effectively and without surprises.

-

Extensive Market Access: Diversify your portfolio with a broad selection of global indices. From the US to Europe and Asia, you can access key markets and explore various cfd indices opportunities, all from one platform.

-

Flexible Leverage Options: Tailor your trading strategy with flexible leverage options. This allows you to amplify your market exposure while maintaining control over your risk management, aligning with your personal trading approach.

“Tickmill empowers traders with the tools and conditions needed to truly capitalize on market movements in index trading.”

Choosing the right broker for index trading can significantly impact your success. Tickmill provides a robust platform, competitive pricing, and unparalleled support for trading various stock indices. Discover the difference our conditions make and elevate your index trading experience today.

| Benefit for You | How Tickmill Delivers |

|---|---|

| Cost Efficiency | Tight spreads and competitive commissions reduce your trading overhead. |

| Market Opportunity | Access a wide range of global indices and cfd indices to diversify strategies. |

| Reliable Execution | Fast order processing ensures your trades go through when you need them to. |

| Strategic Flexibility | Leverage options and diverse instruments empower your trading approach. |

Mastering Risk Management in Tickmill Stock Indices Trading

Effective risk management isn’t just about limiting losses; it’s about optimizing your potential for consistent gains in index trading. Without proper controls, even promising market analysis can lead to significant setbacks.

Trading Tickmill Stock Indices offers exciting opportunities, but success hinges on a robust risk management strategy. Navigating the dynamic world of stock indices demands a disciplined approach to protect your capital and ensure long-term sustainability. Effective risk management isn’t just about limiting losses; it’s about optimizing your potential for consistent gains in index trading.

Understanding Market Volatility

Global indices, including various cfd indices, can experience periods of high volatility. This means prices move rapidly and unpredictably. Acknowledging this inherent characteristic of stock indices is your first step in building a resilient trading plan. Your strategy must account for potential sharp swings, which influence everything from position sizing to stop-loss placement.

Essential Risk Management Tools

Successful index trading relies on practical tools to manage exposure. Implement these consistently to keep your capital secure:

- Stop-Loss Orders: These are non-negotiable. A stop-loss order automatically closes your trade when the market reaches a predetermined price, effectively capping your potential loss on any single position.

- Take-Profit Orders: Just as important as limiting losses is securing your gains. A take-profit order closes your trade when it hits a target price, ensuring you lock in profits before the market potentially reverses.

- Position Sizing: Never risk more than a small percentage of your total trading capital on any single trade. Properly sizing your positions for Tickmill Stock Indices means you can withstand several losing trades without depleting your account.

Crafting Your Risk-Reward Ratio

Before entering any trade on stock indices, clearly define your expected risk versus your potential reward. A favorable risk-reward ratio is crucial for profitability. This means aiming for trades where your potential profit significantly outweighs your potential loss. For example, risking $1 to potentially gain $2 or $3 dramatically improves your chances of long-term success, even if you don’t win every trade.

Consider this simple comparison:

| Ratio Type | Description | Impact on Index Trading |

|---|---|---|

| 1:1 Ratio | Potential gain equals potential loss. | Requires a high win rate to be profitable. |

| 1:2 Ratio | Potential gain is twice the potential loss. | Allows for more losing trades while remaining profitable. |

| 1:3 Ratio | Potential gain is three times the potential loss. | Strongest position for long-term account growth. |

The Psychology of Trading

Emotional discipline is perhaps the most overlooked aspect of risk management in trading global indices. Fear and greed can sabotage even the best-laid plans. Sticking to your pre-defined strategy, even when markets are volatile, prevents impulsive decisions. Avoid chasing trades or holding onto losing positions out of hope. Your plan for cfd indices trading should be your unwavering guide.

“A well-defined risk management plan is your shield against market chaos and your compass towards consistent profitability in stock indices trading.”

Mastering risk management in Tickmill Stock Indices trading empowers you to navigate market fluctuations with confidence. It transforms uncertainty into a calculated endeavor, giving you the edge needed for sustained success. Develop your strategy, stick to your rules, and watch your trading journey flourish.

How to Get Started Trading Tickmill Stock Indices

Embarking on the journey of index trading with Tickmill Stock Indices opens up a world of market potential. You can tap into the performance of major global indices, all from one powerful platform. We make it straightforward for you to begin, whether you are taking your first steps or looking to diversify your portfolio. Let’s outline how you can start trading Tickmill Stock Indices effectively.

1. Build Your Knowledge Base

Before placing your first trade, understanding the fundamentals is crucial. Learn about what moves the market and how different global indices reflect economic health. Focus on the benefits of index trading, such as diversification and access to broader market trends without investing in individual stocks. Familiarize yourself with CFD indices; these instruments allow you to speculate on price movements without owning the underlying asset. Tickmill provides resources to help you grasp these concepts, empowering your decisions.

2. Open Your Tickmill Account

Setting up your trading account is the first practical step. It’s a quick and secure process designed for ease of use. Here’s a brief overview:

- Visit the Tickmill website and click ‘Open Account’.

- Complete the registration form with your personal details.

- Choose your preferred account type (e.g., Pro, Classic, VIP) suited for Tickmill Stock Indices trading.

- Submit necessary verification documents to comply with regulatory standards.

- Fund your account using one of our convenient deposit methods.

Once approved and funded, you gain access to our advanced trading platforms.

3. Explore and Select Your Preferred Indices

With your account ready, dive into the range of global indices available for index trading. Tickmill offers a diverse selection, allowing you to choose markets that align with your strategy. Our platform provides real-time data, charts, and analysis tools to help you identify opportunities.

Consider these popular examples when planning your trades:

| Index Name | Region |

|---|---|

| Germany 40 | Europe |

| US 500 | USA |

| UK 100 | Europe |

Each of these options, along with many other CFD indices, presents unique trading dynamics based on their respective economies.

4. Develop Your Trading Strategy and Manage Risk

Successful index trading relies on a well-thought-out strategy and disciplined risk management. Define your entry and exit points, set stop-loss orders to limit potential losses, and use take-profit levels to secure gains. Start with smaller positions as you gain experience with Tickmill Stock Indices. Never trade more than you can afford to lose, and continuously refine your approach based on market analysis and performance review.

Ready to experience the excitement of the global markets? Join Tickmill today and begin your journey trading stock indices with confidence and powerful tools at your fingertips.

Accessing Tickmill Indices on Popular Trading Platforms

Ready to tap into the broad market movements and diversify your trading portfolio? Unlocking the potential of Tickmill Stock Indices is straightforward, especially with access across several industry-leading trading platforms. We understand that seamless integration and a powerful interface are crucial for effective index trading. That’s why Tickmill ensures you can connect with markets effortlessly, no matter your preferred trading environment.

Your Gateway to Global Indices: Top Platforms Supported

Tickmill empowers traders by offering access to a wide array of stock indices through platforms known for their robust features and user-friendly design. You get to choose the interface that best suits your style, ensuring a comfortable and efficient trading experience.

- MetaTrader 4 (MT4): A classic for a reason! MT4 offers an intuitive interface, advanced charting tools, and a secure environment to trade Tickmill’s offering of global indices. Many traders prefer MT4 for its reliability and extensive customization options, including Expert Advisors (EAs).

- MetaTrader 5 (MT5): Stepping up the game, MT5 provides even more features, including additional timeframes, more technical indicators, and a wider range of order types. It’s an excellent choice for traders looking for enhanced analytical tools and multi-asset capabilities for their index trading strategies.

- Tickmill Mobile Apps: Trade on the go! Our dedicated mobile applications bring the full power of Tickmill’s indices directly to your smartphone or tablet. Manage positions, analyze charts, and react to market news instantly, ensuring you never miss an opportunity, whether you’re interested in major global indices or specific cfd indices.

Seamless Trading Experience: What to Expect

Accessing Tickmill Stock Indices on these platforms is designed for simplicity and efficiency. Here’s what you gain:

| Feature | Benefit for Index Trading |

|---|---|

| Real-time Data | Stay informed with live price feeds for all global indices, making quick decisions possible. |

| Advanced Charting | Utilize powerful analytical tools to spot trends and patterns across various stock indices. |

| Flexible Order Types | Execute trades precisely with market, limit, stop-loss, and take-profit orders, perfect for managing risk in cfd indices. |

| Automated Trading | Implement your strategies with Expert Advisors (EAs) on MT4/MT5, ideal for sophisticated index trading. |

Getting Started with Tickmill Stock Indices

Connecting to Tickmill’s comprehensive range of global indices is a breeze. First, you open an account with Tickmill. Next, download and install your preferred trading platform – whether it’s MT4, MT5, or our dedicated mobile app. Once logged in with your Tickmill credentials, simply navigate to the “Market Watch” section within the platform. There, you will find all available stock indices, including various cfd indices, ready for you to add to your watchlist and begin trading. We provide clear instructions and support to ensure you’re up and running quickly.

Take control of your financial future by accessing a world of opportunities. Dive into the exciting realm of Tickmill Stock Indices and experience the power of market access at your fingertips.

Effective Strategies for Trading Stock Indices

Trading stock indices offers an exhilarating opportunity to participate in broader market movements without committing to individual company shares. It’s about tapping into the pulse of the economy, capturing potential gains from the collective performance of top companies. Mastering this domain requires a blend of sharp analysis, disciplined execution, and robust strategies. Let’s explore how you can approach index trading effectively, making informed decisions that align with your financial goals.Understanding the Market Landscape

Before diving into specific strategies, grasp the fundamentals of what you are trading. Stock indices are benchmarks that reflect the performance of a basket of stocks, often representing a particular sector, exchange, or economy. When you engage in index trading, you are essentially speculating on the direction of these market aggregates.- Market Barometer: Stock indices serve as critical indicators of economic health and investor sentiment across various regions.

- Diversification: Trading global indices allows you to gain exposure to multiple economies and industries through a single position.

- Accessibility: Platforms offering cfd indices make it easier to access these markets, allowing for both long and short positions without direct ownership of underlying assets.

Core Trading Approaches

Successful index trading hinges on a well-defined strategy. While numerous approaches exist, trend following and breakout strategies are popular choices among seasoned traders.Trend Following: This strategy involves identifying and riding the prevailing market direction. If an index shows a consistent upward movement, a trend follower would seek to buy, aiming to profit as the trend continues. Conversely, they would look for selling opportunities in a downtrend. This method capitalizes on the momentum of Tickmill Stock Indices over time.

Breakout Strategy: Traders employing this approach look for price movements that push beyond established support or resistance levels. A breakout often signals the start of a new trend or a significant shift in market sentiment. Spotting these critical junctures early can present lucrative opportunities.

| Strategy Type | Primary Focus | Best Suited For |

|---|---|---|

| Trend Following | Long-term market direction | Patient traders, less frequent activity |

| Breakout Trading | Momentum shifts, new trends | Active traders, shorter-term opportunities |

Essential Risk Management Practices

No strategy, however effective, is complete without rigorous risk management. Protecting your capital is paramount in the volatile world of cfd indices.“Smart trading is not about avoiding losses entirely, but about managing them effectively to preserve capital for future opportunities.”

Always define your maximum acceptable loss per trade before you enter the market. Implement stop-loss orders to automatically close a position if the price moves against you beyond a predefined point. Position sizing is another critical element; never allocate too much of your capital to a single trade. A small, controlled loss is always preferable to a catastrophic one.

Leveraging Tools and Analysis

Making informed decisions requires robust analysis. Combine technical and fundamental analysis to get a comprehensive view of the market.- Technical Analysis: Use charts, indicators (like moving averages, RSI, MACD), and price action to identify patterns, support/resistance levels, and potential entry/exit points for global indices.

- Fundamental Analysis: Stay updated on macroeconomic data, geopolitical events, and corporate earnings that can influence the overall market and specific stock indices. Economic calendars are invaluable resources here.

- Sentiment Analysis: Understand the prevailing mood of the market. Is there fear, greed, or uncertainty? Market sentiment can significantly impact short-term price movements.

By integrating these analytical tools, you build a clearer picture, enhancing your ability to anticipate market movements and execute trades on Tickmill Stock Indices with greater precision. Developing a consistent methodology and adhering to it, even through challenging periods, is key to long-term success in index trading.

Technical Analysis Approaches

Mastering index trading often hinges on a solid analytical framework. Technical analysis offers a powerful lens through which to view market dynamics, providing valuable insights for trading Tickmill Stock Indices. This method evaluates financial instruments and forecasts future price movements by studying past market data, primarily price and volume. It’s about understanding market psychology and historical patterns to anticipate future behavior.

At its heart, technical analysis operates on three fundamental principles:

- Market action discounts everything: All available information – economic, political, psychological – is already reflected in the price.

- Price moves in trends: Prices generally follow defined paths, and identifying these trends is key to successful index trading.

- History repeats itself: Human psychology tends to react to similar situations in similar ways, leading to recurring price patterns on charts.

Traders employ a diverse toolkit to analyze stock indices. These tools help identify trends, momentum, and potential turning points, crucial for informed CFD indices trading decisions.

- Trend Indicators: Moving Averages (Simple, Exponential) smooth out price data to reveal the direction of a trend. The Moving Average Convergence Divergence (MACD) shows the relationship between two moving averages, helping spot changes in momentum and direction.

- Momentum Oscillators: The Relative Strength Index (RSI) measures the speed and change of price movements, indicating overbought or oversold conditions. The Stochastic Oscillator works similarly, comparing a closing price to a range over a given period.

- Volatility Measures: Bollinger Bands show a dynamic range around a simple moving average, helping assess price volatility and potential reversals.

- Support and Resistance Levels: These are price zones where buying or selling pressure has historically been strong enough to halt or reverse the price trend. Identifying these levels is vital for entry and exit points in global indices.

- Chart Patterns: Patterns like Head & Shoulders, Triangles, Flags, and Double Tops/Bottoms are visual formations that often signal future price movements or reversals for Tickmill Stock Indices.

Applying these tools leads to various trading methodologies, each suited to different market conditions and trader temperaments:

- Trend Following: This strategy aims to capture profits by identifying and riding the direction of a prevailing trend. You buy when a trend starts upwards and sell when it turns downwards. It works well with strong, sustained movements in global indices.

- Reversal Trading: For those looking to catch market turns, reversal trading focuses on identifying the end of a trend and the beginning of a new one. This often involves looking for specific chart patterns or divergences in momentum indicators.

- Range Trading: When stock indices move sideways, bouncing between clear support and resistance levels, range traders buy near support and sell near resistance, profiting from the oscillation. This approach requires careful risk management.

- Breakout Trading: This strategy capitalizes on prices moving past significant support or resistance levels, signaling the potential start of a new trend. Traders enter positions as the price ‘breaks out’ of a consolidation zone.

Ultimately, the most effective technical analysis approach for trading Tickmill Stock Indices or any CFD indices is one that aligns with your personal trading style, risk tolerance, and time horizon. Constant learning and adaptation are crucial for success in index trading.

Fundamental Analysis Insights

Diving into the world of Tickmill Stock Indices requires more than just glancing at charts. True mastery comes from understanding the underlying economic forces that drive market movements. This is where fundamental analysis becomes your compass, offering crucial insights into the health and direction of entire economies.

Think of fundamental analysis as peeling back the layers to see why stock indices are moving the way they are. Instead of focusing solely on price patterns, you’re examining the macroeconomic landscape. For successful index trading, understanding these deep-seated drivers is paramount. It helps you anticipate potential shifts and position yourself wisely, whether you’re looking at short-term opportunities or long-term trends.

What exactly should you monitor when performing fundamental analysis for global indices? Here are the critical factors:

- Economic Data Releases: Keep a close eye on GDP reports, inflation rates (like CPI), unemployment figures, and manufacturing PMIs. Strong economic data often signals a robust corporate earnings outlook, which typically supports higher stock indices. Conversely, weak data can trigger sell-offs.

- Central Bank Policies: Interest rate decisions from major central banks (like the Fed, ECB, or BoJ) profoundly influence market sentiment. Higher rates can increase borrowing costs for companies and reduce consumer spending, often dampening enthusiasm for equity markets. Lower rates tend to have the opposite effect.

- Geopolitical Developments: Major political events, trade disputes, or international conflicts can create significant market volatility. These events introduce uncertainty, leading investors to re-evaluate their positions on various stock indices.

- Corporate Earnings: While you’re not analyzing individual company reports for index trading, aggregate earnings for the major constituents of an index provide a strong indicator of overall market health. A general trend of stronger-than-expected earnings can propel cfd indices upward.

By integrating these fundamental insights into your trading strategy, you move beyond mere speculation. You gain a deeper appreciation for the forces at play, allowing you to make more informed decisions when engaging with Tickmill Stock Indices. It’s about building a robust framework for understanding market direction, giving you an edge in complex and dynamic markets.

The Impact of Economic News on Stock Index Prices

Understanding the pulse of the market means recognizing how economic news shapes the value of stock indices. For anyone engaged in index trading, this isn’t just theory; it’s the core of strategic decision-making. Every announcement, from inflation figures to employment reports, creates ripples that can send markets soaring or plummeting.

Economic news acts as a powerful catalyst, directly influencing investor sentiment and, consequently, the demand for underlying assets within stock indices. When traders and institutions digest new information, they re-evaluate their positions, leading to rapid price adjustments across various global indices and specific sectors. This constant recalibration makes the market dynamic and, for informed traders, presents incredible opportunities when trading cfd indices.

Key Economic Indicators That Move Markets:

- Inflation Reports: High inflation often signals potential interest rate hikes, which can weigh on corporate earnings and dampen investor enthusiasm for equities, impacting stock indices negatively.

- Employment Data: Strong job growth and low unemployment usually point to a healthy economy, boosting consumer spending and corporate profits. This positive outlook often translates into gains for global indices.

- Interest Rate Decisions: Central bank policy changes have an immediate and significant effect. A rate cut might stimulate economic growth, pushing stock indices higher, while a hike can have the opposite effect.

- Gross Domestic Product (GDP): As the broadest measure of economic activity, robust GDP growth indicates a thriving economy, generally leading to a bullish sentiment in index trading.

- Manufacturing and Services PMIs: These surveys provide a snapshot of business conditions. Positive readings suggest expansion, which often supports equity markets.

The speed at which markets react to these announcements is often astounding. What seems like a small piece of data can trigger substantial volatility, especially in highly leveraged products like cfd indices. Traders must prepare to act decisively, but always with a well-thought-out strategy.

“Economic data is not just numbers; it’s the narrative that drives market expectations. Ignoring it means trading blind.”

At Tickmill Stock Indices, we empower you with the tools and insights to navigate these critical market movements. Understanding the intricate relationship between economic news and stock index prices prepares you to make more informed decisions, helping you seize opportunities as they emerge in the fast-paced world of index trading.

Ready to apply this knowledge and explore the potential of global markets? Stay tuned for more insights and resources that sharpen your trading edge.

Educational Resources for Tickmill Index Traders

Understanding the markets is paramount for success, especially when you navigate the dynamic world of Tickmill Stock Indices. We believe in empowering every trader with the knowledge to make informed decisions. Our extensive educational hub offers a treasure trove of resources, designed to sharpen your skills and deepen your market insight.

Whether you are new to index trading or a seasoned pro looking to refine your strategies, our expert-crafted content helps you grasp complex concepts with clarity. We break down the intricacies of stock indices, making advanced topics accessible and actionable.

Explore Our Learning Pathways

We provide diverse learning formats to suit every style and schedule. Here’s a glimpse into the resources awaiting you:

- In-Depth Articles & Guides: Our comprehensive library covers everything from the fundamentals of global indices to advanced technical analysis. Learn about market drivers, risk management, and strategic entry/exit points for your trades.

- Expert Webinars & Video Tutorials: Join our live sessions with seasoned analysts who share their insights on current market trends and trading tactics. Access an archive of on-demand videos that walk you through platform features and trading strategies step-by-step.

- Interactive E-books & Courses: Dive into structured learning paths with our downloadable e-books and self-paced courses. These resources offer a deeper exploration into specific aspects of cfd indices trading, helping you build a robust foundation.

- Glossary & FAQ Section: Quickly look up financial terms or find answers to common questions. Our easy-to-navigate sections ensure you are never in the dark about market terminology or platform functionality.

Why Education Transforms Your Trading

Knowledge acts as your most powerful tool. It transforms guesswork into calculated decisions. Our educational materials equip you with the foresight to anticipate market movements and the confidence to execute your trades effectively.

“An informed trader is a confident trader. Our mission is to provide you with the insights and tools to master the markets.”

By leveraging our resources, you gain a competitive edge. You learn to interpret economic indicators, understand geopolitical impacts on stock indices, and develop a disciplined approach to your trading activities. This proactive learning approach helps mitigate risks and uncover new opportunities within the market.

Ready to Elevate Your Trading?

Accessing these invaluable resources is straightforward. Head over to our education center and begin your journey toward becoming a more proficient index trader. We continually update our content, ensuring you always have access to the most relevant and cutting-edge market insights.

Start exploring today and unlock your full potential with Tickmill Stock Indices.

Understanding Rollover and Dividends in Index CFDs

Diving into the world of Tickmill Stock Indices offers exciting opportunities, but truly mastering index trading requires a firm grasp of a few critical concepts. Rollover and dividends are two such elements that significantly impact your positions in CFD indices. Let’s demystify them and ensure you trade with complete confidence.

Decoding Rollover in Index CFDs

Index CFDs, unlike direct stock ownership, derive their value from underlying futures contracts. These contracts have finite expiry dates. Rollover is the necessary process of closing an expiring futures contract and simultaneously opening a new one with a later expiry date to maintain continuous trading of global indices. This mechanism prevents your positions from simply expiring.

How Rollover Works for Traders:

- Automatic Transition: Most providers, including Tickmill Stock Indices, handle the rollover process automatically for their clients. You do not need to manually close and reopen positions.

- Price Adjustment: You will notice a price adjustment on your open positions. This reflects the difference in price between the expiring contract and the new contract. It is purely a technical adjustment, not a profit or loss.

- Potential Gaps: Sometimes, significant price differences between contracts can lead to a slight ‘gap’ at the rollover time. Understand this as a market reality, not an error.

Understanding rollover ensures you are not surprised by these adjustments. It is a standard operational procedure designed to keep your index trading seamless.

Navigating Dividends with Index CFDs

When you engage in index trading via CFDs, you do not own the constituent stocks of the underlying stock indices. However, movements in those underlying companies, specifically dividend payouts, still affect your CFD positions through dividend adjustments.

Dividend Adjustments Explained:

Think of it as an economic equivalent. If a company within the index pays a dividend, the value of that index typically falls by a corresponding amount on the ex-dividend date. Your CFD position reflects this:

| Position Type | Dividend Impact | Explanation |

|---|---|---|

| Long Position | Receive a credit | Your account gets credited with a dividend equivalent, offsetting the index’s fall. |

| Short Position | Incur a debit | Your account gets debited a dividend equivalent, reflecting the index’s fall. |

These adjustments ensure that your profit or loss accurately reflects the performance of the underlying stock indices, factoring in all relevant market movements. Ignoring them could lead to miscalculating your trade outcomes.

Why Dividends Matter for Your Strategy:

- Accurate P&L: Dividend adjustments are crucial for precise profit and loss calculations, especially for positions held over longer periods.

- Strategy Impact: For certain index trading strategies, particularly those involving holding positions through ex-dividend dates, these adjustments become a significant factor in overall returns.

- Transparency: Providers generally offer detailed information on upcoming dividend adjustments, allowing you to plan ahead.

By understanding both rollover and dividends, you equip yourself with the knowledge to make more informed decisions when trading CFD indices. These are not hidden costs or sudden surprises, but integral parts of how global indices operate within the CFD framework. Stay informed, stay ahead!

Tickmill Client Support for Indices Trading

Navigating the dynamic world of index trading requires more than just sharp market insights; it demands robust, responsive support. At Tickmill, we understand this critical need, which is why our client support for Tickmill Stock Indices is designed to empower you every step of the way. Whether you’re a seasoned professional or just starting your journey with global indices, having expert assistance readily available can significantly enhance your trading experience and confidence.

Our dedicated support team stands ready to assist you with any queries related to your index trading activities. We focus on providing swift, accurate, and comprehensive help, ensuring you can concentrate on your strategies without unnecessary interruptions. From platform guidance to account management and specific questions about CFD indices, our professionals are here to make your trading as smooth as possible.

What Makes Tickmill’s Indices Trading Support Stand Out?

We pride ourselves on offering a support experience that genuinely prioritizes our clients. Here’s what you can expect:

- Expert Knowledge: Our support staff is trained to understand the intricacies of index trading, offering precise answers to your questions about various global indices.

- Multilingual Assistance: Trade with comfort in your preferred language, as our team speaks numerous languages to serve our diverse global clientele.

- Accessibility: Reach us through multiple convenient channels, ensuring you get help when and how you need it.

- Efficiency: We value your time. Our goal is to resolve your inquiries quickly and effectively, minimizing downtime from your trading.

How to Connect with Our Support Team

Accessing help is straightforward. We offer various channels to ensure you can reach us at your convenience:

Contact Channels:

| Channel | Availability | Best For |

| Live Chat | 24/5 | Instant queries, platform help |

| Within business hours | Detailed inquiries, documentation | |

| Phone | Within business hours | Urgent issues, direct conversation |

We believe superior client support is a cornerstone of a successful trading partnership. Join Tickmill and experience firsthand the peace of mind that comes with knowing you have a professional, knowledgeable team supporting your index trading endeavors around the clock.

Frequently Asked Questions

What exactly are stock indices?

Stock indices are financial instruments that reflect the performance of a group of shares from a particular stock exchange or economy. They act as a barometer for a specific market or economic sector, representing a basket of leading company shares, allowing you to speculate on broad market movements.

Why choose Tickmill for trading stock indices?

Tickmill provides a robust platform with competitive spreads, ultra-fast execution, broad market exposure, flexible trading options with leverage, advanced tools, and strong risk management features. They offer access to diverse global indices and operate under strict regulatory oversight, designed for both seasoned professionals and those just starting their journey.

How does rollover work in index CFDs?

Rollover is the automatic process of closing an expiring futures contract and opening a new one with a later expiry date to maintain continuous trading of global indices. This results in a technical price adjustment on open positions, reflecting the difference between the expiring and new contracts, and is not a profit or loss. Most providers, including Tickmill, handle this automatically.

How do dividends affect CFD index trading?

When trading CFD indices, you do not own the underlying stocks. However, dividend payouts from companies within an index still affect CFD positions through dividend adjustments. If you hold a long position, your account is credited with a dividend equivalent; if short, it is debited, reflecting the index’s fall on the ex-dividend date.

What trading platforms are supported for Tickmill Stock Indices?

Tickmill supports industry-leading platforms such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5), along with dedicated Tickmill Mobile Apps. These platforms offer robust features, advanced charting, and seamless access to Tickmill’s diverse range of global indices, ensuring a comfortable and efficient trading experience.