Embarking on your trading journey requires a reliable partner, and understanding a broker’s complete offering is the first step toward informed decisions. This comprehensive guide cuts through the complexities, providing you with the insights you need to evaluate if Tickmill aligns with your trading goals. We’ll explore everything from their robust platforms and diverse instruments to their commitment to security, ensuring you have the full picture. Many aspiring and seasoned traders consistently seek platforms that offer competitive advantages and unwavering reliability. Discover how Tickmill aims to deliver just that, fostering a transparent and efficient environment for your trading ambitions.

Before committing your capital, understanding a broker’s core strengths and potential drawbacks is essential. This detailed analysis covers everything from regulatory compliance to trading conditions, ensuring you get the full picture. Many traders wonder, is Tickmill legit? We address this crucial question head-on, evaluating their robust regulatory framework and unwavering commitment to client fund safety.

Tickmill has carved out a significant niche in the competitive brokerage landscape, known for its focus on low-cost trading, robust technology, and diverse asset offerings. They aim to provide a transparent and efficient trading environment for both novice and experienced traders.

Key Trading Features to Consider:

- Asset Classes: Trade a wide range of instruments including Forex, Stock Indices, Commodities, Bonds, and Cryptocurrencies.

- Trading Platforms: Access popular platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), recognized for their advanced charting tools and automated trading capabilities.

- Account Types: A variety of account options cater to different trading styles and capital sizes, from their Classic account to their Pro and VIP accounts, each with distinct commission structures and spreads.

- Execution Speed: Tickmill prides itself on ultra-fast order execution, a critical factor for strategies like scalping and high-frequency trading.

Unpacking trust and security remains paramount in any broker review. When considering Tickmill, legitimacy is a key concern for potential clients, and their strong regulatory standing provides significant reassurance. Tickmill operates under the regulation of several top-tier financial authorities, which adds a significant layer of security and oversight, ensuring they meet stringent financial standards.

Regulatory Oversight Highlights:

- Financial Conduct Authority (FCA) in the UK

- Cyprus Securities and Exchange Commission (CySEC) in Cyprus

- Financial Sector Conduct Authority (FSCA) in South Africa

- Financial Services Authority (FSA) in Seychelles

- Labuan Financial Services Authority (Labuan FSA) in Malaysia

This multi-jurisdictional regulation is a strong indicator of their commitment to maintaining high operational standards and protecting client interests. They segregate client funds from company operational capital, further enhancing safety.

“A broker’s regulatory status isn’t just a badge; it’s a promise of accountability and client protection. Tickmill’s extensive regulation history speaks volumes about their operational integrity.”

Beyond compliance, evaluating the overall performance and user experience forms a critical part of our assessment. Many traders consistently give a high Tickmill rating for its competitive pricing, especially its remarkably low spreads and commissions on its Pro and VIP accounts. This makes it an exceptionally attractive option for high-volume traders seeking cost-effective execution.

Here’s a quick look at the advantages and disadvantages:

| Pros | Cons |

|---|---|

| Regulated by multiple top-tier authorities. | Limited range of proprietary trading tools. |

| Very competitive spreads and low commissions. | Cryptocurrency CFD offering could be broader. |

| Fast order execution and reliable platforms (MT4/MT5). | Customer support response times can vary. |

| Extensive range of tradable assets. | Some educational content is geared towards beginners. |

The platforms offer a user-friendly interface combined with robust charting tools, making them accessible yet powerful. Customer support is available in multiple languages, though response times can occasionally fluctuate. They also provide a decent educational section, though some advanced traders might seek more in-depth analytical content.

Choosing the right broker is a deeply personal decision, influenced by your trading style, experience level, and financial goals. This comprehensive Tickmill Review aimed to equip you with the detailed information necessary for that choice. Their strong regulatory standing, competitive pricing, and reliable trading infrastructure make them a compelling option for many seeking a reputable trading partner.

Ready to explore further or perhaps compare them with other top brokers? Understanding these nuances is crucial for long-term success in the markets. We encourage you to weigh these points against your personal trading requirements. Join us to stay updated with more expert analyses and brokerage insights!

- Is Tickmill a Reputable Broker?

- Regulatory Compliance: The Foundation of Trust

- Security Measures and Client Fund Protection

- Industry Recognition and Trader Feedback

- Tickmill Regulatory Oversight

- Tickmill Trading Platforms Overview

- MetaTrader 4 (MT4): The Industry Standard

- MetaTrader 5 (MT5): The Next Evolution

- Tickmill WebTrader: Trade Directly from Your Browser

- Mobile Trading Apps: Power in Your Pocket

- MetaTrader 4 (MT4) Features

- MetaTrader 5 (MT5) Capabilities

- WebTrader and Mobile Trading Options

- Available Trading Instruments at Tickmill

- Forex

- Stock Indices

- Commodities

- Bonds

- Cryptocurrencies (CFDs)

- Understanding Tickmill Account Types

- Tickmill Classic Account

- Tickmill Pro Account

- Tickmill VIP Account

- Islamic (Swap-Free) Account

- Tickmill Demo Account

- Comparing Your Choices

- Classic Account Benefits

- Pro Account Advantages

- VIP Account for High-Volume Traders

- Tickmill Spreads, Commissions, and Fees

- Spreads: Your Gateway to the Market

- Commissions: A Transparent Approach

- Other Fees: What Else to Consider

- Deposits and Withdrawals with Tickmill

- Funding Your Tickmill Account

- Withdrawing Your Earnings from Tickmill

- Quick Look: Deposit and Withdrawal Methods & Times

- Final Thoughts on Tickmill’s Fund Management

- Tickmill Regulation and Security Measures

- Regulated Entities and Oversight

- Safeguarding Client Funds

- Operational Security Measures

- Customer Support and Service Quality

- Tickmill Research and Analytical Tools

- Comprehensive Market Analysis

- Economic Calendar

- Advanced Trading Calculators

- Robust Charting Capabilities

- Educational Resources

- Educational Resources for Traders

- Mobile Trading Experience with Tickmill

- What the Tickmill Mobile App Offers

- Performance and Reliability

- Mobile Trading at a Glance

- Tickmill vs. Competitors: A Comparison

- Regulation and Trust: Is Tickmill Legit?

- Trading Costs: Spreads and Commissions

- Platform Offerings and Tools

- Asset Diversity and Market Access

- Customer Support and Educational Resources

- Pros and Cons of Trading with Tickmill

- Who is Tickmill Best Suited For?

- Final Verdict on This Tickmill Review

- Frequently Asked Questions

Is Tickmill a Reputable Broker?

When you enter the dynamic world of online trading, a primary concern for any discerning individual is the legitimacy and reliability of their chosen platform. The question, “is Tickmill legit?” is absolutely vital. Our comprehensive Tickmill review aims to address this head-on, giving you a clear picture of their standing in the industry.

After decades of collective experience assessing countless platforms, we understand what truly defines a reputable broker. It boils down to a combination of strong regulatory oversight, robust security measures, and a track record of transparent operations. Tickmill meets these critical benchmarks, solidifying its position as a trustworthy entity.

Regulatory Compliance: The Foundation of Trust

The bedrock of any secure brokerage is its regulatory framework. Tickmill operates under the watchful eyes of several highly respected financial authorities globally. These licenses are not just pieces of paper; they mandate stringent operational standards, client fund segregation, and regular audits. This adherence ensures they consistently maintain fair and ethical practices.

- Financial Conduct Authority (FCA): Operating under one of the world’s most rigorous regulators, ensuring high standards for UK and international clients.

- Cyprus Securities and Exchange Commission (CySEC): Providing oversight within the European Union, adhering to MiFID II directives.

- Financial Sector Conduct Authority (FSCA): Regulating their operations in South Africa.

- Seychelles Financial Services Authority (FSA): Extending their global reach with international oversight.

This multi-jurisdictional regulation is a powerful indicator that Tickmill takes its responsibilities seriously, offering protection and peace of mind to its diverse client base.

Security Measures and Client Fund Protection

Beyond regulatory licenses, genuine security protocols are essential. A thorough broker review always scrutinizes how a platform protects your capital and personal data. Tickmill implements industry-standard security measures, including:

- Segregated Client Funds: They hold client funds in separate bank accounts from their operational capital, ensuring your money remains secure even in unforeseen circumstances.

- Negative Balance Protection: This crucial feature ensures you cannot lose more money than you have in your account, safeguarding you from market volatility.

- Advanced Encryption: Employing robust SSL encryption protects all data transmission on their platforms, keeping your personal and financial information confidential.

These proactive steps demonstrate a commitment to safeguarding client assets, which significantly contributes to a strong Tickmill rating among traders globally.

Industry Recognition and Trader Feedback

A true measure of reputability also comes from the industry itself and, most importantly, from the traders who use the platform daily. Over the years, Tickmill has accumulated various industry awards and recognitions for its services, technology, and customer support. These accolades reflect their ongoing dedication to excellence.

Furthermore, when looking at various independent Tickmill review discussions online, a consistent theme emerges: traders appreciate their transparent pricing, fast execution, and responsive customer service. This positive sentiment from the trading community further reinforces the perception that Tickmill is a broker you can trust.

In conclusion, when asking “is Tickmill legit,” the evidence points to a resounding yes. Their strong regulatory framework, commitment to security, and positive industry standing provide a solid foundation for any trader looking for a reliable and reputable brokerage partner.

Tickmill Regulatory Oversight

Starting any financial journey demands trust, especially when choosing a broker. This is where regulatory oversight becomes paramount. When considering a broker, understanding their adherence to strict financial regulations is not just a preference; it’s a necessity. It provides a foundational layer of security and peace of mind for your investments. A thorough Tickmill review, therefore, places significant emphasis on this aspect.

Tickmill operates under the watchful eyes of several reputable financial authorities across different jurisdictions. These bodies ensure that the broker adheres to stringent capital requirements, client fund segregation, and transparent operational practices. Such oversight is a key indicator when evaluating any broker review, signifying accountability and investor protection.

Let’s break down some of the primary regulators overseeing Tickmill entities:

- Financial Conduct Authority (FCA): For its operations in the United Kingdom, Tickmill is authorized and regulated by the FCA, a highly respected financial regulator globally. This ensures a high level of consumer protection and market integrity for UK clients.

- Cyprus Securities and Exchange Commission (CySEC): In Europe, Tickmill falls under the regulation of CySEC, which complies with MiFID II directives. This means robust investor protection measures are in place, including participation in investor compensation schemes.

- Financial Services Authority (FSA) Seychelles: For its international clients, Tickmill Global is regulated by the FSA of Seychelles, providing a global reach while still maintaining a framework of supervision.

- Labuan Financial Services Authority (LFSA) Malaysia: Tickmill Asia is regulated by the LFSA, catering to the Asian market with a focus on compliance and security.

- Financial Sector Conduct Authority (FSCA) South Africa: In South Africa, Tickmill is authorized by the FSCA, ensuring local regulatory compliance for clients in the region.

This multi-jurisdictional regulation is critical. It addresses the fundamental question: is Tickmill legit? Absolutely. Each regulatory body imposes specific rules designed to protect client funds, ensure fair trading practices, and prevent financial misconduct. They conduct regular audits and monitor broker activities to maintain a secure trading environment.

For traders, this means your funds are typically held in segregated accounts, entirely separate from the company’s operational capital. This practice safeguards your money even in unlikely scenarios. A strong regulatory profile significantly boosts any broker’s overall Tickmill rating for reliability and trust, making it a crucial factor in your decision-making process.

Tickmill Trading Platforms Overview

Ready to explore the powerful engines driving your trading journey? Your choice of platform is paramount, and Tickmill understands this perfectly, offering a robust suite of options designed to meet every trader’s needs. As you conduct your comprehensive Tickmill Review, understanding these platforms will be key to unlocking your full potential.

MetaTrader 4 (MT4): The Industry Standard

The MetaTrader 4 (MT4) platform remains a global favorite for excellent reason. Tickmill provides full access to this classic, reliable, and highly functional platform. Its intuitive interface makes it approachable for newcomers while offering advanced features for seasoned traders. You get:

- Comprehensive Charting: Access an extensive array of charting tools and analytical objects.

- Technical Indicators: Utilize a wide selection of built-in indicators to analyze market movements.

- Expert Advisors (EAs): Automate your trading strategies with ease, allowing for hands-free execution.

- Mobile Trading: Stay connected to the markets with powerful mobile apps for iOS and Android.

Many a broker review highlights MT4 as a cornerstone, and its enduring popularity speaks volumes about its effectiveness and stability.

MetaTrader 5 (MT5): The Next Evolution

For traders seeking an even more advanced and versatile environment, MetaTrader 5 (MT5) steps up. This next-generation platform builds upon MT4’s strengths, offering enhanced capabilities and additional tools. It’s perfect if you’re looking to:

- Trade more asset classes, including futures and stocks.

- Access more timeframes for deeper market analysis.

- Utilize a greater number of technical indicators and graphical objects.

- Employ more pending order types for precise entry and exit strategies.

MT5 represents a significant upgrade, providing cutting-edge tools for sophisticated strategies.

Tickmill WebTrader: Trade Directly from Your Browser

Prefer trading without downloading any software? The Tickmill WebTrader offers incredible flexibility. This browser-based platform allows you to access your account and trade directly from any web browser on any operating system. It’s designed for convenience, delivering:

- Instant Access: No downloads, no installations – just log in and trade.

- Real-time Data: Stay updated with live market quotes and charting.

- Secure Trading: Enjoy a secure trading environment from anywhere with an internet connection.

The WebTrader ensures you never miss a market opportunity, whether you’re at home or on the go.

Mobile Trading Apps: Power in Your Pocket

The modern trader needs flexibility, and Tickmill’s dedicated mobile trading applications deliver just that. Available for both iOS and Android devices, these apps put the full power of your trading account right into your pocket. You can:

- Manage your account and monitor positions with ease.

- Execute trades swiftly and efficiently.

- Analyze charts and use technical indicators on a user-friendly interface.

- Access market news and analysis while on the move.

When asking “is Tickmill legit,” the seamless and secure mobile experience certainly reinforces their credibility and commitment to client convenience.

Here’s a quick comparison of the MetaTrader platforms:

| Feature | MetaTrader 4 (MT4) | MetaTrader 5 (MT5) |

| Ease of Use | Very user-friendly | User-friendly, more advanced |

| Timeframes | 9 | 21 |

| Indicators | 30 | 38+ |

| Pending Orders | 4 types | 6 types |

| Asset Classes | Forex, CFDs on indices, commodities | Forex, CFDs on indices, commodities, stocks, futures |

Each platform offers unique advantages, catering to different trading preferences and levels of experience. Evaluating these options forms a crucial part of your overall tickmill review and will significantly impact your trading success. Explore them to find the perfect match for your strategy and contribute to a positive tickmill rating!

MetaTrader 4 (MT4) Features

Diving into the heart of trading technology, MetaTrader 4 (MT4) stands out as a universally acclaimed platform. Its robust design and comprehensive toolkit make it a preferred choice for traders worldwide, and Tickmill proudly offers this powerhouse. A thorough Tickmill review often highlights the seamless integration and powerful capabilities MT4 brings to the trading experience.

MT4 empowers traders with precision, flexibility, and control. Here is a closer look at the key features that solidify its legendary status:

- Advanced Charting Tools: Visualize market movements with unparalleled clarity. MT4 provides interactive charts in various timeframes, from minute-by-minute to monthly, allowing for in-depth technical analysis. You get a suite of drawing tools, including lines, channels, Fibonacci levels, and geometric shapes, essential for identifying trends and patterns.

- Extensive Analytical Objects and Indicators: Access over 30 built-in technical indicators and 24 graphical objects. These tools help you predict price dynamics, determine entry and exit points, and refine your trading strategies. The platform supports custom indicators too, expanding your analytical arsenal.

- Expert Advisors (EAs) for Automated Trading: Embrace the power of automation. MT4 allows you to use Expert Advisors, which are automated trading systems. These EAs can analyze market conditions and execute trades automatically based on predefined rules, freeing up your time and removing emotional bias. This capability significantly enhances a trader’s potential for consistent performance.

- Multiple Order Types: Execute trades exactly as you intend. MT4 supports instant execution, market orders, and pending orders (Buy Limit, Sell Limit, Buy Stop, Sell Stop). This variety gives you precise control over your entry and exit strategies.

- Customization and Personalization: Tailor your trading environment to suit your preferences. Modify chart layouts, colors, and even create custom indicators and scripts using the MQL4 programming language. This level of personalization contributes to an efficient and comfortable trading experience.

- Secure and Reliable Environment: Your security is paramount. MT4 employs strong encryption for data transmission between the client terminal and the server, protecting your trading activities and personal information. This reliability reinforces why the question, “is Tickmill legit” often finds reassurance in the platforms it offers.

- Mobile Trading Capability: Stay connected to the markets no matter where you are. MT4 offers fully functional mobile applications for iOS and Android devices, ensuring you can manage your trades, monitor positions, and analyze charts on the go.

Ultimately, the inclusion of MetaTrader 4 significantly boosts the overall Tickmill rating in any comprehensive broker review. Its blend of powerful tools, automation capabilities, and user-friendly interface provides traders with a robust foundation for success. It is an indispensable platform that Tickmill offers to elevate your trading journey.

MetaTrader 5 (MT5) Capabilities

Tickmill offers the robust MetaTrader 5 (MT5) platform, a true powerhouse for modern traders. This advanced platform goes beyond its predecessor, providing a comprehensive toolkit for in-depth market analysis and sophisticated trading strategies. When you embark on your Tickmill review, you’ll quickly see how MT5 elevates the entire trading experience, making it a cornerstone of a top-tier broker review.

MT5 empowers traders with an expansive suite of analytical tools. You gain access to an unparalleled array of charting options, allowing for granular market inspection across various timeframes. This deep analytical capability is vital for making informed decisions.

- Advanced Charting: Explore detailed price action with 21 distinct timeframes, from minute charts to yearly, offering a complete market perspective.

- Extensive Indicators: Utilize over 38 built-in technical indicators, alongside a vast library of custom options, for precise trend identification and pattern recognition.

- Analytical Objects: Access 44 graphical objects like Fibonacci retracements and Gann lines, crucial for strategic analysis.

- Depth of Market (DOM): Gain real-time insights into bid and ask prices, crucial for understanding market liquidity and execution potential.

Beyond analysis, MT5 at Tickmill provides superior execution and diverse order types, supporting intricate trading strategies. Its enhanced architecture ensures reliable and fast trade placement.

| Feature | MT5 Advantage at Tickmill |

|---|---|

| Timeframes | 21 options (vs. 9 in MT4), for deeper market analysis |

| Pending Orders | 6 distinct types for more precise entry/exit strategies |

| Market Depth | Integrated Level II data for real-time liquidity insights |

For those who embrace automation, MT5’s algorithmic trading capabilities are a game-changer. The platform supports Expert Advisors (EAs), enabling automated trading around the clock without constant manual intervention.

- MQL5 Language: Develop complex EAs and custom indicators with a more powerful and flexible programming language.

- Enhanced Strategy Tester: Conduct multi-threaded backtesting and optimization of EAs with greater speed and accuracy, ensuring your automated strategies are robust.

- Trading Marketplace: Access thousands of ready-made trading robots and indicators, or even sell your own creations to a global community.

Our comprehensive analysis reveals that Tickmill leverages MT5’s full potential, ensuring a high-performance trading environment. It’s clear that is Tickmill legit when you consider the robustness and comprehensive nature of their platform offering. This contributes positively to any Tickmill rating considerations.

The advanced features of MetaTrader 5, combined with Tickmill’s commitment to low spreads and rapid execution, create an exceptionally powerful trading solution. Dive into a thorough Tickmill review to experience these capabilities firsthand and elevate your trading game.

WebTrader and Mobile Trading Options

Understanding a broker’s platform offerings is a crucial part of any comprehensive broker review. Tickmill excels by providing flexible and powerful trading solutions for both web and mobile users. They ensure you get a consistent, high-quality experience whether you are at your desk or navigating markets on the go.

Effortless Trading with Tickmill WebTrader

Tickmill’s WebTrader platform brings robust trading capabilities directly to your web browser. You won’t need any software downloads, giving you immediate access to your account and the financial markets from any computer with an internet connection. It’s the perfect solution for traders valuing convenience without sacrificing essential tools.

- Instant Access: Log in and begin trading instantly, from anywhere in the world.

- Full Functionality: Utilize advanced charting tools, execute various order types, and access real-time market data effortlessly.

- Intuitive Interface: Navigate seamlessly through a user-friendly design, making position management and portfolio monitoring straightforward.

This browser-based platform keeps you connected to market movements, streamlining your trading journey. It’s a standout feature for anyone conducting a thorough Tickmill Review.

Mobile Trading: Your Market, Anywhere

For traders needing ultimate flexibility, Tickmill delivers dedicated mobile trading applications for both iOS and Android devices. These apps transform your smartphone or tablet into a fully functional trading station, ensuring you capitalize on opportunities no matter where you are.

Tickmill’s mobile platforms offer these core benefits:

| Feature | Benefit |

|---|---|

| Live Quotes & Charts | Stay informed with up-to-the-minute market data and analytical tools. |

| Complete Trading Control | Open, close, and modify trades directly from your device with ease. |

| Account Management | Handle deposits, withdrawals, and monitor your balance conveniently. |

| Push Notifications | Receive instant alerts on market events or order executions. |

The mobile applications beautifully translate the desktop experience, optimized for smaller screens and responsive touch interaction. They empower you to react swiftly to market changes and manage your investments efficiently. This level of access and reliability helps confirm why traders consider Tickmill legit.

Ultimately, whether you opt for the versatile WebTrader or the dynamic mobile app, Tickmill focuses on providing a consistent and highly reliable trading environment. This commitment to technology and user experience significantly bolsters the overall Tickmill rating among its global user base. Both platforms prioritize rapid trade execution and secure access, forming the foundation of a trustworthy trading experience. Discover these platforms for yourself and see how they can enhance your trading strategy.

Available Trading Instruments at Tickmill

A comprehensive look at Tickmill’s offerings quickly reveals a robust selection of trading instruments. Traders conducting a thorough Tickmill review will find a diverse portfolio designed to cater to various strategies and market interests. This broad range often plays a significant role in a positive broker review and contributes to a strong overall Tickmill rating. For those asking “is Tickmill legit?” – the extensive and varied asset classes certainly underscore its serious commitment to a global trading audience.Forex

Dive into the world’s most liquid market with an impressive selection of currency pairs. Tickmill provides access to major, minor, and exotic pairs, allowing you to capitalize on global economic events and currency fluctuations. Enjoy competitive spreads and rapid execution across these instruments.

- Major Pairs: Trade popular pairs like EUR/USD, GBP/USD, and USD/JPY.

- Minor Pairs: Explore opportunities with crosses such as EUR/GBP and AUD/NZD.

- Exotic Pairs: Discover less common, yet potentially high-volatility pairs.

Stock Indices

Gain exposure to leading global economies by trading CFDs on major stock indices. These instruments allow you to speculate on the performance of entire stock markets without purchasing individual shares. This offers a convenient way to diversify your portfolio and hedge existing positions.

Some of the widely traded indices include:

| Region | Index Examples |

|---|---|

| Europe | DAX 40, FTSE 100, Euro Stoxx 50 |

| North America | S&P 500, Dow Jones 30, Nasdaq 100 |

| Asia | Nikkei 225 |

Commodities

Hedge against inflation or speculate on supply and demand dynamics with a selection of popular commodities. Tickmill provides access to key energy products and precious metals, offering crucial trading opportunities during times of economic uncertainty or growth.

- Precious Metals: Trade Gold and Silver against the US Dollar.

- Energy: Access benchmark oil contracts like WTI Crude Oil and Brent Crude Oil.

Bonds

Explore the fixed-income market by trading CFDs on government bonds. Bonds offer a unique instrument for diversifying your trading strategies, providing exposure to sovereign debt and interest rate movements. They can serve as a vital component of a balanced portfolio, particularly during periods of market volatility.

Tickmill typically offers popular government bond CFDs, such as:

- German Bund

- UK Gilt

- US Treasury Bond

Cryptocurrencies (CFDs)

Tap into the dynamic world of digital assets by trading cryptocurrency CFDs. This allows you to speculate on the price movements of major cryptocurrencies without the need for owning the underlying assets or managing a crypto wallet. Trade long or short based on your market outlook.

Key crypto CFDs available include:

- Bitcoin (BTC/USD)

- Ethereum (ETH/USD)

- Litecoin (LTC/USD)

- Ripple (XRP/USD)

The extensive array of trading instruments at Tickmill empowers traders with flexibility and choice. This broad market access is a strong point in any detailed Tickmill review, reinforcing its position as a versatile platform. You gain the power to diversify your portfolio and react to global events across multiple asset classes, solidifying its positive Tickmill rating within the competitive broker review landscape.

Understanding Tickmill Account Types

Choosing the right trading account is a crucial step for any trader, whether you’re just starting out or you’re a seasoned professional. It directly impacts your trading costs, available features, and overall experience. As part of our comprehensive Tickmill review, we’ll walk you through the various account types available, ensuring you can make an informed decision that aligns perfectly with your trading strategy.

Tickmill offers a diverse range of accounts designed to cater to different trading styles and experience levels. This flexibility is one of the many reasons why our broker review often highlights Tickmill’s commitment to its clients. They provide transparent options, giving you clarity on what to expect.

Tickmill Classic Account

The Classic Account is an excellent entry point for new traders or those who prefer a simpler pricing structure. It offers competitive spreads with no commissions charged on trades.

- Minimum Deposit: Accessible for most traders.

- Spreads: Start from 1.6 pips.

- Commissions: Zero commissions on trades.

- Execution: Lightning-fast execution speeds.

- Key Benefit: Ideal for traders who prefer predictable trading costs without commission calculations.

Tickmill Pro Account

For active traders and scalpers, the Pro Account is often the preferred choice. It’s designed for those who prioritize tighter spreads, even if it means paying a small commission per trade.

- Minimum Deposit: Same accessible minimum as the Classic account.

- Spreads: Exceptionally tight, starting from 0.0 pips.

- Commissions: A competitive commission per side per standard lot traded.

- Execution: Ultra-low latency and fast execution.

- Key Benefit: Perfect for high-frequency trading and strategies sensitive to spread costs.

Tickmill VIP Account

The VIP Account is tailored for high-volume traders who execute substantial transactions. It offers the most competitive pricing structure, rewarding serious traders with even lower costs.

- Minimum Balance: Requires a higher account balance to qualify.

- Spreads: Among the industry’s lowest, starting from 0.0 pips.

- Commissions: Significantly reduced commission rates compared to the Pro Account.

- Execution: Premium execution with deep liquidity.

- Key Benefit: Designed for professional traders seeking the best possible trading conditions.

Islamic (Swap-Free) Account

Tickmill also understands the diverse needs of its global clientele. They offer Islamic accounts, which are swap-free and fully compliant with Sharia law. These accounts are available as a modification of the Classic, Pro, and VIP accounts upon request, ensuring that religious principles are respected without compromising trading conditions.

- Compliance: No swap charges or interest on overnight positions.

- Availability: Can be applied to Classic, Pro, or VIP account types.

- Key Benefit: Ethical trading for clients observing Islamic finance principles.

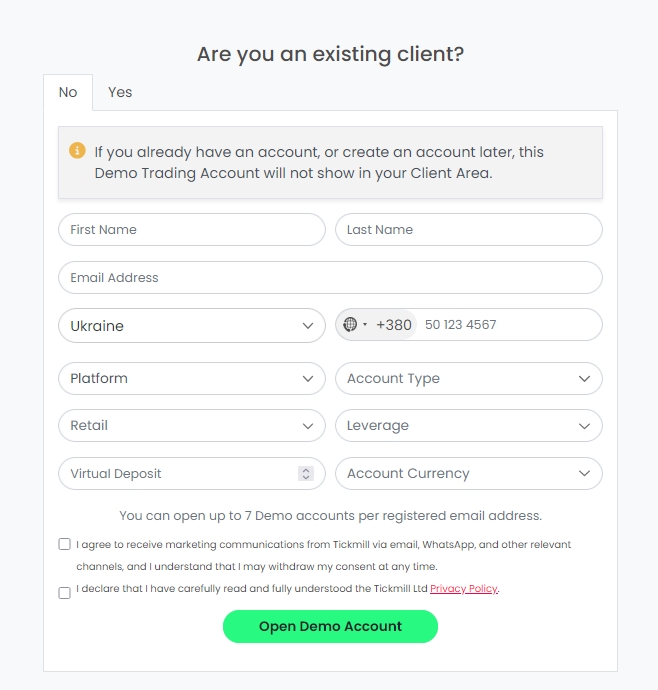

Tickmill Demo Account

Before committing real capital, Tickmill provides a robust demo account. This is an invaluable tool for beginners to practice and for experienced traders to test new strategies in a risk-free environment. It mirrors live market conditions, giving you a realistic trading experience without financial risk.

- Risk-Free: Trade with virtual funds.

- Real-Time Data: Access to live market prices.

- Practice: Hone your skills and test strategies.

- No Expiry: Unlimited access to your practice account.

Comparing Your Choices

To help you quickly grasp the core differences, here’s a brief comparison of the main trading accounts:

| Feature | Classic Account | Pro Account | VIP Account |

|---|---|---|---|

| Minimum Deposit | Standard | Standard | Higher |

| Spreads From | 1.6 pips | 0.0 pips | 0.0 pips |

| Commissions | Zero | Per lot | Reduced per lot |

| Best For | New traders, simple pricing | Active traders, scalpers | High-volume, professional traders |

The variety of account types highlights why is Tickmill legit in offering solutions for almost everyone. Their commitment to diverse trading needs speaks volumes about their operational integrity and client focus. Ultimately, your choice should reflect your trading volume, preferred instruments, and how sensitive you are to commissions versus spreads.

Consider your trading frequency and capital. If you’re looking for an excellent Tickmill rating based on account options, their tiered structure certainly delivers. Explore these options thoroughly and open an account that empowers your trading journey today!

Classic Account Benefits

The Classic Account at Tickmill stands out as a preferred choice for many traders, offering a streamlined, cost-effective trading experience. When conducting a thorough Tickmill review, you’ll quickly discover why this account type receives consistently high marks for its user-friendly structure and valuable advantages. It’s meticulously designed to provide an excellent foundation, especially if you prioritize simplicity and transparent pricing in your trading journey.

Here’s a closer look at the key benefits that make the Classic Account an attractive option:

- Zero Commission Trading: Forget about per-trade commissions. The Classic Account operates on a commission-free model, which means your trading costs are primarily encapsulated within the spread. This simplifies expense tracking and can significantly reduce your overall trading costs, making it a compelling feature in any comprehensive broker review.

- Competitive Spreads: Despite offering zero commissions, the Classic Account maintains competitive spreads across a wide range of popular instruments. This combination ensures you get favorable pricing without hidden fees, allowing you to maximize potential returns.

- Access to Diverse Markets: Gain entry to a vast selection of financial markets, including major, minor, and exotic Forex pairs, along with CFDs on indices and commodities. This broad market access empowers you to diversify your portfolio and explore various trading opportunities from a single account.

- Flexible Leverage Options: Tailor your trading strategy with flexible leverage options. The Classic Account allows you to adjust leverage according to your risk tolerance and trading capital, providing greater control over your market exposure.

- Fast and Reliable Execution: Experience rapid order execution, minimizing slippage and helping you enter and exit trades at your desired prices. This reliability is crucial for effective trading and positively impacts the overall Tickmill rating from users.

Many traders asking “is Tickmill legit” find the Classic Account’s straightforward approach and clear benefits to be reassuring indicators of a reputable broker. It’s an ideal choice for those who value clarity, competitive pricing, and a robust trading environment without unnecessary complexities. Ready to experience these advantages firsthand?

| Feature | Benefit to You |

|---|---|

| No Commissions | Lower overall trading costs |

| Tight Spreads | More competitive entry/exit prices |

| Market Variety | Diverse trading opportunities |

| Flexible Leverage | Control over risk and exposure |

Pro Account Advantages

Ready to elevate your trading experience? The Tickmill Pro Account is specifically engineered for seasoned traders who demand optimal conditions and superior performance. It’s not just an account; it’s a strategic upgrade designed to sharpen your edge in the financial markets.

If you’re doing a comprehensive Tickmill review, you’ll quickly see why the Pro Account receives such high praise. It cuts straight to what serious traders value most: cost-efficiency and execution quality. This account type significantly enhances your trading strategy by offering some of the most competitive terms in the industry, truly setting it apart in any detailed broker review.

Here’s a closer look at the key advantages you gain:

- Ultra-Tight Spreads: Experience market-leading spreads starting from 0.0 pips on major currency pairs. This means significantly reduced trading costs, making every trade potentially more profitable.

- Competitive Commission Structure: Benefit from a low commission of just 2 per side per lot. This transparent and highly competitive fee structure keeps your overheads minimal, ensuring more of your gains stay with you.

- Blazing-Fast Execution: Our Pro Account offers lightning-fast execution speeds, crucial for scalpers and high-frequency traders. Minimize slippage and ensure your orders are filled precisely when you want them to be.

- Deep Liquidity Access: Tap into extensive liquidity from top-tier providers. This robust setup ensures price stability and smooth execution, even during volatile market conditions.

- Advanced Trading Platforms: Gain full access to industry-standard MetaTrader 4 and MetaTrader 5 platforms, equipped with all the tools and features you need for sophisticated analysis and strategy implementation.

Choosing the Pro Account means you are serious about optimizing your trading performance. Many find this account type a strong answer to “is Tickmill legit?” because of its transparent, professional-grade features and superior conditions that directly benefit the trader.

VIP Account for High-Volume Traders

Are you a serious trader moving significant volume? Tickmill understands your needs and rewards your dedication with its exclusive VIP Account. This top-tier offering caters specifically to high-volume participants, providing an unparalleled trading environment designed to maximize your efficiency and profitability.

When you conduct a thorough Tickmill review, you quickly see that their VIP account stands out among top brokers. It’s a testament to their commitment to all types of traders, ensuring even the most demanding professionals find their perfect fit. Many of our clients researching a solid broker review find this account type to be a significant advantage, reinforcing the idea that is Tickmill legit for serious players.

Here’s what you can expect as a VIP trader:

- Significantly Lower Spreads: Enjoy some of the tightest spreads in the industry, starting from 0.0 pips on major currency pairs. This directly impacts your trading costs, putting more profits in your pocket.

- Reduced Commissions: Benefit from even lower commission rates compared to standard accounts. It’s an immediate financial edge for active traders.

- Dedicated Account Manager: Gain personalized support from an expert who understands your trading style and can offer tailored assistance.

- Advanced Trading Tools & Resources: Access premium analytical tools and exclusive market insights that keep you ahead of the curve.

- Priority Service: Experience expedited withdrawals and deposits, ensuring your capital is always where you need it, when you need it.

Qualifying for a VIP Account is straightforward. Generally, you need to maintain a higher account balance and achieve a certain monthly trading volume. This ensures the benefits are truly reserved for those who leverage them most effectively.

Our Tickmill rating for their VIP offering is consistently high because it genuinely delivers on its promise. If you are a high-volume trader looking for superior conditions and service, exploring Tickmill’s VIP account could be a game-changer for your trading journey. Don’t just take our word for it; experience the difference yourself.

Tickmill Spreads, Commissions, and Fees

Understanding the full spectrum of trading costs is paramount for any serious trader. It directly impacts your profitability and helps you make informed decisions about your trading strategy. When conducting a thorough Tickmill review, dissecting spreads, commissions, and other fees is a critical step, revealing much about the broker’s value proposition.

Spreads: Your Gateway to the Market

Spreads represent the difference between the bid and ask price of a currency pair or other asset. At Tickmill, you’ll find highly competitive spreads, a core component of their offering. These spreads are typically variable, reflecting real-time market conditions. Tickmill’s Pro and VIP accounts, for instance, often feature raw spreads starting from 0.0 pips on major currency pairs like EUR/USD, allowing for ultra-tight pricing that can significantly benefit high-volume traders. Even their Classic account offers competitive spreads without commissions, making it an excellent choice for those preferring an all-inclusive cost structure.

Commissions: A Transparent Approach

For traders seeking the lowest possible spreads, Tickmill’s commission-based accounts step into the spotlight. Commissions are charged in addition to the raw spread, typically per standard lot (100,000 units) traded, per side. For example, on the popular Pro account, you might encounter a commission of around $2 per side per lot ($4 round turn) on Forex and Metals. Their VIP account offers even lower commission rates, catering to those with higher trading volumes. This transparent commission structure, coupled with tight raw spreads, ensures you always know your trading costs upfront, contributing positively to its overall Tickmill rating.

Other Fees: What Else to Consider

Beyond spreads and commissions, it’s wise to be aware of any non-trading fees that might apply. A truly comprehensive broker review always examines these details:

- Withdrawal Fees: Tickmill typically offers several free withdrawal methods each month, making it convenient to access your funds. However, some specific payment methods or excessive withdrawals might incur a nominal charge, so always check their current policy.

- Inactivity Fees: Many brokers charge an inactivity fee if an account remains dormant for an extended period. Tickmill generally does not impose an inactivity fee, which is a definite plus for traders who might have sporadic trading activity.

- Currency Conversion Fees: If you deposit funds in a currency different from your trading account’s base currency, a conversion fee might apply, typically reflecting standard market rates. Choosing a base currency that matches your deposit currency can help you avoid these extra costs.

If you deposit funds in a currency different from your trading account’s base currency, a conversion fee might apply, typically reflecting standard market rates. Choosing a base currency that matches your deposit currency can help you avoid these extra costs.

The transparency around these potential charges adds weight to the question, “is Tickmill legit?” Knowing precisely what to expect financially allows you to manage your trading capital effectively. Evaluate these cost factors carefully as part of your holistic Tickmill review to ensure they align with your trading frequency and style.

Deposits and Withdrawals with Tickmill

Seamless fund management is crucial for any serious trader, and our comprehensive Tickmill Review wouldn’t be complete without a deep dive into how easily you can move money in and out of your trading account. Tickmill understands that efficiency and security in deposits and withdrawals directly impact your trading experience. This section unpacks everything you need to know, giving you clarity and confidence in their financial operations.

Funding Your Tickmill Account

Getting started with Tickmill is straightforward. They offer a diverse range of deposit methods, catering to traders globally. You’ll find options that are both convenient and secure, ensuring your funds are ready when market opportunities arise. Let’s look at the popular choices:

- Credit/Debit Cards: Visa and Mastercard are widely accepted, offering instant processing for many deposits. This is often the quickest way to fund your account.

- Bank Wire Transfer: For larger amounts, bank transfers provide a robust and secure option. While generally taking 1-3 business days to process, they are ideal for substantial deposits.

- E-Wallets: Skrill, Neteller, and other regional e-wallets often provide instant or near-instant funding, combining speed with convenience.

Tickmill typically does not charge deposit fees, which is a significant plus in any thorough broker review. However, always verify if your payment provider imposes any charges on their end. The minimum deposit amount is also quite accessible, designed to welcome traders of all levels.

Withdrawing Your Earnings from Tickmill

When it comes to withdrawals, Tickmill prioritizes security and efficiency. Getting access to your profits should be a smooth process, and they strive to make it so. Understanding the procedure helps manage expectations:

- Matching Deposit Method: For security reasons, Tickmill usually requires you to withdraw funds using the same method you used for your deposit, up to the initial deposited amount. Profits can then be withdrawn via bank wire or other designated methods.

- Verification Process: Before your first withdrawal, Tickmill will require account verification. This standard KYC (Know Your Customer) procedure confirms your identity and financial details, solidifying the answer to “is Tickmill legit” by demonstrating their commitment to regulatory compliance and security.

- Processing Times: While Tickmill processes withdrawal requests promptly, usually within one business day, the actual time for funds to appear in your account depends on the method chosen. E-wallets are often the fastest, while bank wires can take several business days.

Withdrawal fees are also an important consideration. Tickmill aims to keep these to a minimum, and often offers free withdrawals for certain methods or above specific thresholds. Checking their official terms for the latest details is always a wise move.

Quick Look: Deposit and Withdrawal Methods & Times

To give you a clearer picture, here’s a brief overview of some common methods:

| Method | Typical Deposit Time | Typical Withdrawal Time (after processing) | Tickmill Fee |

| Credit/Debit Card | Instant | 1-3 Business Days | None |

| Bank Wire | 1-3 Business Days | 2-5 Business Days | None (may apply for small amounts) |

| Skrill/Neteller | Instant | Up to 24 hours | None |

Note: Processing times are estimates and can vary based on banking institutions and regional factors.

Final Thoughts on Tickmill’s Fund Management

Our ongoing tickmill review highlights that their approach to deposits and withdrawals contributes positively to their overall reputation. They provide a secure, transparent, and user-friendly system for managing your trading capital. The strong focus on regulatory compliance, coupled with a variety of payment options and clear communication regarding fees and processing times, certainly enhances their tickmill rating.

Ready to experience hassle-free fund management with a trusted broker? Open your Tickmill account today and take control of your trading journey.

Tickmill Regulation and Security Measures

When you’re entrusting your capital to a trading platform, the first question on your mind should always be about safety. A fundamental concern for many traders is, “is Tickmill legit?” Absolutely. This critical section of our comprehensive broker review dives deep into how Tickmill stands up to scrutiny, ensuring your peace of mind.

Regulation is the bedrock of trust in the financial industry. It sets the rules, oversees compliance, and provides a safety net for traders. Tickmill understands this responsibility and operates under the vigilant eyes of several prominent regulatory bodies worldwide. These licenses aren’t just badges; they represent a commitment to stringent financial standards and transparent operations.

Regulated Entities and Oversight

Tickmill’s operations are supervised by top-tier global regulators, ensuring a robust framework for investor protection. Here’s a look at their key licenses:

- Financial Conduct Authority (FCA): For its UK operations, Tickmill is authorized and regulated by the FCA, a gold standard in financial oversight. This offers clients access to the Financial Services Compensation Scheme (FSCS) in eligible circumstances.

- Cyprus Securities and Exchange Commission (CySEC): Tickmill operates under CySEC for its European services, adhering to the EU’s Markets in Financial Instruments Directive (MiFID II). This includes participation in the Investor Compensation Fund (ICF).

- Financial Sector Conduct Authority (FSCA): In South Africa, Tickmill holds a license from the FSCA, extending its regulated services to a key African market.

- Labuan Financial Services Authority (Labuan FSA): This provides an international brokerage license, allowing Tickmill to serve a wider global audience while maintaining regulatory compliance.

- Financial Services Authority (FSA) Seychelles: For certain global clients, Tickmill operates under the regulation of the FSA Seychelles, providing another layer of oversight.

Each of these regulatory bodies imposes strict requirements on capital adequacy, financial reporting, and client asset segregation, directly answering the “is Tickmill legit” query with a resounding yes.

Safeguarding Client Funds

Your money’s security isn’t just about regulation; it’s about the practical measures Tickmill implements daily. These robust procedures are a cornerstone of any positive Tickmill rating:

- Segregated Bank Accounts: All client funds are held in separate bank accounts, entirely distinct from Tickmill’s operational capital. This means your money is protected even if unforeseen circumstances were to affect the company.

- Negative Balance Protection: Retail clients receive negative balance protection, ensuring your trading account can never fall below zero. You cannot lose more than your deposited capital, offering an essential layer of risk management.

- Investor Compensation Schemes: As mentioned, regulations by the FCA and CySEC mean eligible clients are covered by respective compensation funds, providing an extra layer of security for their investments.

- Leading Financial Institutions: Tickmill partners with reputable, investment-grade banks for holding client funds, adding another layer of security to your capital.

Operational Security Measures

Beyond financial safeguards, Tickmill employs advanced technological and operational security protocols to protect your data and trading environment:

- Data Encryption: All sensitive information exchanged between you and Tickmill is encrypted using industry-standard SSL technology, safeguarding your personal and financial data.

- Robust IT Infrastructure: The company invests in resilient server architecture and cybersecurity measures to ensure platform stability, prevent unauthorized access, and protect against cyber threats.

- Privacy Policy Adherence: Tickmill maintains a strict privacy policy, outlining how your data is collected, stored, and processed, adhering to global data protection regulations.

These comprehensive measures collectively form a strong foundation for trust and security, contributing positively to a strong Tickmill rating and reinforcing its standing in any thorough Tickmill review. When you choose Tickmill, you’re choosing a broker committed to your safety and the integrity of your trading experience.

Customer Support and Service Quality

When evaluating any trading platform, the quality of customer support stands as a critical pillar. Our comprehensive Tickmill review wouldn’t be complete without a deep dive into how Tickmill handles client inquiries and resolves issues. A reliable support system isn’t just a convenience; it’s a necessity for traders navigating fast-paced markets.

Tickmill offers multiple avenues for traders to connect with their support team, ensuring help is available when you need it. They understand that different situations call for different communication methods, and this flexibility is a significant positive in our broker review.

- Live Chat: This is often the quickest way to get answers for immediate questions. We found agents responsive during operational hours, providing real-time assistance for urgent queries.

- Email Support: Ideal for more complex inquiries that require detailed explanations or attachment sharing. You can typically expect a thorough response within one business day, which is suitable for non-urgent matters.

- Phone Support: For direct, verbal communication, a dedicated phone line is available. This channel proves particularly useful for urgent account discussions or when you prefer to speak directly with a representative.

Beyond just availability, the speed and accuracy of responses are paramount. Our assessment indicates that Tickmill prioritizes efficient service. Agents consistently demonstrate a solid understanding of the platform, trading conditions, and common technical issues. This competence instills confidence, subtly addressing the question many ask: “is Tickmill legit” when it comes to supporting its clients effectively and reliably. We observed their support team handles a range of topics, from account setup queries to technical troubleshooting and platform navigation with clarity and professionalism.

In a global market, offering support in multiple languages is a testament to a broker’s commitment to its diverse client base. Tickmill provides multilingual assistance, ensuring traders from various regions can communicate effectively without language barriers. This global reach significantly enhances accessibility and comfort for international users, making the platform more inclusive.

The consistent feedback we’ve gathered points to a generally positive experience with Tickmill’s customer service. While no service is flawless, the consistent availability, helpfulness, and professional demeanor of their support staff contribute positively to the overall Tickmill rating. Traders can typically expect prompt and professional assistance, which is vital for maintaining smooth trading operations. This level of dedication to client success solidifies Tickmill’s standing as a user-focused brokerage.

Tickmill Research and Analytical Tools

Successful trading hinges on informed decisions. At Tickmill, we understand this fundamental truth, which is why we provide an expansive suite of research and analytical tools designed to give you a genuine edge in the fast-paced financial markets. These resources are crucial for anyone conducting a thorough broker review, revealing the depth of support available to traders.

Our commitment extends beyond just offering a trading platform; we empower you with the insights needed to navigate market complexities. Let’s explore the powerful tools at your fingertips:

Comprehensive Market Analysis

Stay ahead of market movements with our expert-driven analysis. We deliver daily insights, breaking down key market events and potential trading opportunities. This isn’t just news; it’s actionable intelligence:

- Daily Fundamental Analysis: Understand the economic drivers behind market trends, from central bank decisions to geopolitical events.

- Technical Outlooks: Gain perspective on price patterns, support, and resistance levels across various assets, helping you pinpoint entry and exit points.

- Expert Commentary: Our seasoned analysts offer their views on the markets, providing context and foresight that enriches your trading strategy.

Economic Calendar

Never miss a market-moving event again. Our dynamic economic calendar tracks crucial economic releases from around the globe, complete with expected impact and historical data. This tool is indispensable for planning trades around high-volatility announcements and managing risk effectively.

Advanced Trading Calculators

Precision is key in trading. Our set of intuitive calculators helps you manage risk and plan your trades with accuracy. These tools are often highlighted in a positive Tickmill review, showcasing practical utility:

| Calculator Type | What It Does |

|---|---|

| Pip Calculator | Determines the value of a single pip for any currency pair, helping you assess potential profits or losses. |

| Margin Calculator | Estimates the margin required for your trades, aiding in proper position sizing and risk management. |

| Profit Calculator | Projects potential profits or losses based on your entry and exit points, fostering clearer trade planning. |

| Currency Converter | Quickly converts between different currencies at current market rates. |

Robust Charting Capabilities

Visualizing market data is critical for technical analysis. Our platforms offer sophisticated charting tools with a wide array of indicators, drawing tools, and customizable timeframes. You can perform in-depth technical analysis directly within your trading environment, spotting trends, identifying patterns, and making data-driven decisions.

Educational Resources

Beyond the tools, we provide educational content to help you master them. Our extensive library includes webinars, video tutorials, and articles covering various trading strategies and market concepts. This educational support ensures you maximize the utility of every tool, further solidifying why many consider “is Tickmill legit” a resounding yes.

“Empowering traders with knowledge and cutting-edge tools is central to our mission. A strong Tickmill rating is built on the foundation of transparency, reliability, and unparalleled support.”

These research and analytical tools are more than just features; they are essential components designed to enhance your trading experience and improve your decision-making process. Explore them today and discover how they can transform your approach to the markets.

Educational Resources for Traders

Starting your trading journey or looking to sharpen your skills demands access to top-notch educational resources. A thorough Tickmill review often highlights the quality of a broker’s learning materials, and for good reason. We believe an informed trader is a successful trader. That’s why we pour significant effort into providing a wealth of educational content designed to empower you at every stage.

Our commitment goes beyond just offering a platform. We equip you with the knowledge needed to navigate the dynamic financial markets confidently. From understanding basic concepts to mastering advanced strategies, our resources are comprehensive and easily accessible. Many ask, is Tickmill legit? Our dedicated educational suite demonstrates our transparency and commitment to your growth.

Here’s a glimpse into the learning opportunities waiting for you:

- Engaging Webinars & Seminars: Join live sessions led by industry experts. These interactive events cover market analysis, trading strategies, risk management, and platform tutorials. You get to ask questions in real-time.

- In-Depth Articles & Guides: Dive into our extensive library of written content. Find explanations for complex trading concepts, market insights, and practical tips. Perfect for self-paced learning.

- Practical Video Tutorials: Visual learners will appreciate our step-by-step video guides. These cover everything from setting up your account to executing trades and using advanced features on our platforms.

- Comprehensive Glossary: Never feel lost with jargon again. Our detailed glossary provides clear definitions for all financial and trading terms you encounter.

- Economic Calendar & Analysis Tools: Learn how to interpret market-moving events and use various analytical tools to make informed decisions. A crucial part of any robust broker review focuses on these support systems.

We constantly update our materials, ensuring you always have access to relevant and current information. Our goal is to boost your trading capabilities and help you make smarter decisions. This dedication to trader success significantly contributes to a positive Tickmill rating among the trading community.

Mobile Trading Experience with Tickmill

In today’s fast-paced world, mobile trading isn’t just a luxury; it’s a necessity. Traders demand flexibility, and Tickmill delivers a robust mobile experience designed to keep you connected to the markets no matter where you are. We’ve taken a deep dive into their mobile platform, offering insights that form a crucial part of any comprehensive broker review.

Tickmill understands the need for seamless access. You can manage your trades and monitor market movements directly from your smartphone or tablet, utilizing the highly popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) applications. These native apps are available for both iOS and Android devices, ensuring broad compatibility and a familiar interface for most traders.

What the Tickmill Mobile App Offers

The mobile trading apps from Tickmill are far more than just stripped-down versions of their desktop counterparts. They pack significant power and functionality:

- Full Trading Capabilities: Execute market, limit, stop, and trailing stop orders with ease. One-click trading makes quick market entries and exits a breeze.

- Advanced Charting Tools: Access a wide array of technical indicators, multiple timeframes, and various chart types (candlesticks, bars, lines) for in-depth analysis on the go.

- Real-time Quotes: Stay updated with live prices for all available assets, ensuring you never miss a potential opportunity.

- Account Management: Perform essential tasks like checking your trading history, managing open positions, and overseeing your account balance.

- Market News & Analysis: Some versions of the app integrate news feeds or access to analytical tools, providing vital market insights.

Performance and Reliability

When it comes to performance, the Tickmill mobile apps stand out. We experienced swift order execution and minimal latency, even during volatile market conditions. The stability of the connection and the responsiveness of the interface contribute significantly to a positive user journey. This reliability is key, especially when considering whether “is Tickmill legit?” – a question that robust, secure, and high-performing platforms consistently answer with a resounding yes.

Mobile Trading at a Glance

| Feature | Benefit to Trader | User Experience |

|---|---|---|

| Order Execution | Rapid, minimizing slippage | Smooth and intuitive |

| Charting Functions | Comprehensive analysis anywhere | Responsive and customizable |

| Security Protocols | Protects funds and data | High-grade encryption |

| Account Management | Full control over finances | Easy access and navigation |

Overall, the mobile trading experience offered by Tickmill is genuinely impressive. It’s a powerful tool that complements their overall offering, reinforcing a strong Tickmill rating in our comprehensive Tickmill Review. Whether you’re a casual trader or constantly on the move, their mobile platform empowers you to trade with confidence and convenience.

Tickmill vs. Competitors: A Comparison

Navigating the competitive landscape of online brokers requires a keen eye and a thorough approach. When you undertake a comprehensive broker review, it quickly becomes clear that each platform has its strengths and weaknesses. Understanding where Tickmill stands against its rivals is crucial for making an informed decision about your trading partner.

Regulation and Trust: Is Tickmill Legit?

One of the first questions any savvy trader asks is, “Is Tickmill legit?” The answer lies in robust regulation. Tickmill boasts oversight from top-tier financial authorities, including the FCA in the UK, CySEC in Cyprus, FSCA in South Africa, and Labuan FSA. This multi-jurisdictional regulation is a significant trust factor, often matching or exceeding the regulatory frameworks of many competitors.

- Tickmill: Strong multi-tier regulation, offering investor protection schemes in relevant jurisdictions.

- Competitors: While many rivals also hold strong licenses, some may only operate under one or two key regulators, potentially offering less global coverage for certain trader demographics.

Trading Costs: Spreads and Commissions

Cost efficiency is paramount for active traders. Tickmill is well-known for its highly competitive pricing structure, particularly its raw spreads and low commissions on its Pro and VIP accounts. This often gives it an edge when stacked against brokers that might have wider spreads or higher per-trade fees.

| Feature | Tickmill (Pro/VIP) | Typical Competitor |

|---|---|---|

| EUR/USD Spreads | From 0.0 pips + commission | From 0.5-1.0 pips (often with higher commissions) |

| Commissions (per lot, round turn) | $4 – $2 | $6 – $8 (or higher for raw spreads) |

| Swap Fees | Industry average | Varies, some offer swap-free accounts |

This transparent fee structure helps traders understand their true costs, a feature that stands out in any detailed Tickmill review.

Platform Offerings and Tools

Tickmill primarily offers the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, known for their industry-standard charting, analytical tools, and algorithmic trading capabilities. While some competitors might offer proprietary platforms with unique interfaces, the familiarity and widespread support for MT4/MT5 remain a strong draw for many traders.

Tickmill also supplements these with useful trading tools like Autochartist, Myfxbook AutoTrade, and various expert advisors, enhancing the overall trading experience. Competitors might offer their own suite of tools, but often, they are less universally recognized than those integrated with MetaTrader.

Asset Diversity and Market Access

The range of tradable instruments is another key differentiator. Tickmill focuses strongly on Forex, Stock Indices, Commodities, Bonds, and Cryptocurrencies via CFDs. While this covers major markets, some larger multi-asset brokers might offer a broader selection of individual stocks, ETFs, or a greater depth of less common commodities.

“Tickmill excels for traders focused on key global markets and major asset classes, providing ample choice without overwhelming you with obscure instruments,” notes a market analyst.

Customer Support and Educational Resources

Access to reliable customer support and quality educational resources can significantly impact a trader’s journey. Tickmill provides multilingual customer support across various channels, along with a decent array of educational articles, webinars, and market analysis. When considering a holistic Tickmill rating, the support experience often contributes positively.

Some competitors might offer more extensive in-house training programs or dedicated account managers for higher-tier clients. However, Tickmill’s commitment to responsive support and foundational education holds its own, especially for those who value direct assistance and practical insights.

Pros and Cons of Trading with Tickmill

Understanding the full picture is crucial when evaluating any trading platform. Our detailed Tickmill review dives deep, and here we lay out the key advantages and potential drawbacks you should consider before making a decision. This balanced perspective helps you determine if Tickmill aligns with your trading style and expectations. Many traders wonder, “is Tickmill legit?” and a closer look at its strengths and weaknesses can provide clarity, offering a holistic broker review.

| Pros of Trading with Tickmill | Cons of Trading with Tickmill |

|---|---|

|

|

Who is Tickmill Best Suited For?

Curious if Tickmill is the right fit for your trading journey? This broker shines for specific types of traders, offering an environment tailored to particular strategies and experience levels. When you delve into a comprehensive broker review, it becomes clear that Tickmill excels in certain areas, making it a strong contender for those who prioritize specific features.

Tickmill truly comes into its own for:

- The Cost-Conscious Trader: If minimizing trading costs is your top priority, Tickmill deserves a closer look. They are renowned for their highly competitive spreads and low commissions, particularly on their Pro and VIP accounts. This makes a significant difference for active traders, helping to preserve profit margins over many trades.

- Active Day Traders and Scalpers: For those who engage in high-frequency trading and require lightning-fast execution, Tickmill’s infrastructure is built to deliver. Their deep liquidity and no-requotes policy mean your trades execute precisely when you want them to, which is critical for these demanding strategies.

- Algorithmic and EA Users: Automated trading strategies thrive on reliable execution and robust platform support. Tickmill provides excellent conditions for Expert Advisors (EAs) with low latency servers and API access, allowing automated systems to operate efficiently without hindrance.

- Experienced Traders Seeking Advanced Tools: While beginner-friendly in some aspects, seasoned traders will appreciate the access to advanced charting tools, diverse market instruments, and the overall professional trading environment. They can leverage the tight spreads and varied account types to optimize their strategies.

- Beginners Focused on Skill Development: Although Tickmill offers a professional environment, beginners committed to learning can also benefit. They provide educational resources and a demo account to practice without risk. However, newer traders should ideally have a basic understanding of forex and CFD trading before diving in.

Understanding what makes Tickmill a preferred choice also involves considering its trustworthiness. Many ask, “Is Tickmill legit?” Absolutely. Its strong regulatory framework across multiple jurisdictions provides a secure and transparent trading environment, which is a key factor in any thorough tickmill review.

Here’s a quick look at who fits best:

| Trader Profile | Key Benefit at Tickmill |

|---|---|

| High-Volume Traders | Ultra-low spreads & commissions |

| Scalpers / Day Traders | Fast execution, deep liquidity |

| Algo Traders | EA support, low latency, API |

| Experienced Professionals | Advanced tools, diverse instruments |

Ultimately, a strong Tickmill rating often stems from its dedication to providing a cost-effective, high-performance platform for active and strategic traders. If these characteristics align with your trading style and expectations, you’ll likely find Tickmill to be an excellent choice. Our full Tickmill review further details these aspects.

Final Verdict on This Tickmill Review

After an exhaustive exploration into every aspect, our comprehensive Tickmill review reaches its conclusive chapter. We meticulously examined its platforms, scrutinizing the regulatory standing, fee structures, and customer support. We aimed to provide you with an unbiased, crystal-clear understanding of what Tickmill genuinely offers traders worldwide.

So, what is our definitive take? Tickmill stands out for several compelling reasons. It cultivates a highly competitive trading environment, particularly appealing to those who prioritize low costs and efficient execution. The robust regulatory framework surrounding Tickmill operations provides a critical reassurance when you ask, “is Tickmill legit” for your trading capital.

Here are the key strengths we observed during this broker review:

- Exceptional Regulatory Oversight: Multiple top-tier licenses ensure a secure and trustworthy trading environment. This directly addresses concerns about “is Tickmill legit.”

- Competitive Spreads: Traders consistently benefit from tight spreads, significantly enhancing cost-effectiveness in their strategies.

- Diverse Platform Options: Access to industry-leading MetaTrader platforms (MT4 and MT5) provides superb flexibility and powerful tools.

- Superior Execution Speed: Fast and reliable order execution offers a significant advantage, especially for active traders.

While the overall experience proves largely positive, potential users should consider a few points:

- Focused Product Range: Some traders might find the selection of available instruments less extensive compared to larger, multi-asset brokers offering a broader array of markets.

- Educational Resources: Although available, the educational content, while useful, might not be as comprehensive for absolute beginners as some competitors provide.

Regarding the crucial question, “is Tickmill legit”? Based on its strong adherence to strict regulatory compliance with major financial authorities and a transparent operational history, we confidently affirm its legitimacy. Traders can expect a reliable and secure environment for their investment capital.

Our overall Tickmill rating reflects its strong performance as a specialized forex and CFD broker. It presents an excellent choice for experienced traders and those looking for a cost-efficient platform backed by robust regulatory supervision. While user-friendly, new traders might encounter a slightly steeper learning curve for some advanced platform features.

In conclusion, this detailed broker review highlights Tickmill as a formidable option in the online trading landscape. If you seek a trusted partner offering competitive conditions and a secure environment, Tickmill certainly warrants serious consideration for your trading endeavors.

Frequently Asked Questions

Is Tickmill a regulated broker?

Yes, Tickmill is regulated by multiple top-tier financial authorities, including the FCA (UK), CySEC (Cyprus), FSCA (South Africa), FSA (Seychelles), and Labuan FSA (Malaysia), ensuring high standards of client protection and operational integrity.

What trading platforms does Tickmill offer?

Tickmill provides access to the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, known for their advanced charting tools, automated trading capabilities, and user-friendly interfaces. They also offer a WebTrader and mobile apps.

What types of trading accounts are available at Tickmill?

Tickmill offers several account types to suit different traders: Classic (zero commission, wider spreads), Pro (low commission, tight spreads), VIP (even lower commissions for high-volume traders), and Islamic (swap-free) accounts. A demo account is also available for practice.

What trading instruments can I trade with Tickmill?

Traders can access a diverse range of instruments including Forex currency pairs, Stock Indices, Commodities (like Gold and Oil), Bonds, and Cryptocurrencies (as CFDs).

Does Tickmill offer negative balance protection?

Yes, Tickmill provides negative balance protection for retail clients, ensuring that your account balance cannot fall below zero, safeguarding you from losing more than your deposited capital.