Are you ready to unlock your potential in the global financial markets? For aspiring and experienced traders alike, navigating the world of forex can be both thrilling and rewarding. Here in Nigeria, the opportunity to participate in this dynamic market is bigger than ever. Choosing the right partner makes all the difference, and Tickmill Nigeria is your premier choice for a secure, efficient, and empowering trading experience. Get ready to elevate your trading journey!

- Why Tickmill Nigeria Stands Out for Traders

- Key Features Boosting Your Forex Trading in Nigeria

- Starting Your Trading Journey with Tickmill Nigeria

- Maximizing Your Success in the Forex Market

- Understanding Tickmill: A Global Broker’s Presence

- Tickmill’s Global Reach and Unwavering Standards

- Why Tickmill Resonates in Nigeria’s Trading Community

- Key Advantages for Nigerian Traders

- Why Tickmill is a Top Choice for Nigerian Traders

- Unwavering Trust and Regulation

- Competitive Trading Conditions

- Advanced Trading Platforms and Tools

- Exceptional Customer Support and Education

- Support That Understands Your Needs

- Empowering Through Knowledge

- Why Choose Tickmill for Your Trading Journey in Nigeria?

- Getting Started with Tickmill Nigeria: Account Opening

- Registration Steps and Verification

- Your Simple Registration Process

- The Verification Stage: Ensuring Your Security

- Tickmill Account Types: Finding Your Perfect Fit

- Tickmill Classic Account

- Tickmill Raw Account

- Tickmill Pro Account

- Other Account Considerations

- Making Your Choice

- Pro, Classic, and VIP Features

- Deposits and Withdrawals for Nigerian Users

- Effortless Deposit Methods

- Streamlined Withdrawal Process

- Key Considerations for Nigerian Traders

- Local Payment Solutions & Processing

- Trading Platforms: MT4, MT5, and More

- MetaTrader 4 (MT4): The Industry Standard

- MetaTrader 5 (MT5): The Next Generation Platform

- Choosing Your Ideal Platform

- Exploring Financial Instruments on Tickmill

- Unlocking Forex Trading Potential

- Diving into Stock Indices

- Commodities: Hard Assets, New Opportunities

- Government Bonds: Stability and Income

- Spreads, Commissions, and Trading Costs

- Leverage and Margin for Optimal Trading

- Benefits of Strategic Leverage:

- Risks of Excessive Leverage:

- Tickmill Nigeria Customer Support and Educational Resources

- Responsive and Reliable Customer Support

- Empowering Educational Resources for Every Trader

- Regulatory Compliance and Client Fund Security

- Protecting Your Capital: Our Key Pillars

- Licenses, Oversight, and Fund Protection

- Why Regulation Matters for Your Trading Journey

- Understanding Fund Protection Mechanisms

- Comparing Tickmill with Local Forex Brokers

- Regulatory Framework and Trust

- Trading Conditions and Instruments

- Funding and Withdrawal Convenience for Tickmill Nigeria

- Customer Support and Local Relevance

- Advanced Trading Tools and Features

- Automated Trading with Expert Advisors

- Virtual Private Server (VPS)

- Comprehensive Analytical Tools

- Economic Calendar and Market News

- Educational Resources and Support

- Mobile Trading Experience with Tickmill

- Your Trading Hub, Anywhere

- Seamless Performance and Security

- Unmatched Convenience for Tickmill Nigeria Traders

- Maximizing Profit Potential with Tickmill Nigeria

- Competitive Spreads and Low Commissions

- Advanced Trading Platforms

- Diverse Range of Instruments

- Exceptional Execution Speed

- Robust Educational Resources

- Why Tickmill Nigeria is Your Partner in Profit

- Frequently Asked Questions

Why Tickmill Nigeria Stands Out for Traders

When selecting a forex broker, you need a partner who offers reliability, advanced tools, and dedicated support. Tickmill Nigeria provides a robust platform tailored for the specific demands of forex nigeria, ensuring you have everything required to trade with confidence.

Here’s what makes Tickmill a top choice for your trading journey:

- Competitive Trading Conditions: Access some of the tightest spreads and lowest commissions in the industry. This means more of your profits stay with you.

- Regulatory Compliance: Trade with peace of mind knowing you are with a globally regulated broker, prioritizing client fund security and transparent operations.

- Cutting-Edge Technology: Leverage powerful platforms like MetaTrader 4 and MetaTrader 5, packed with advanced charting tools, indicators, and automated trading capabilities.

- Exceptional Customer Support: Our dedicated support team is ready to assist you every step of the way, ensuring your trading experience is smooth and hassle-free.

- Local Payment Solutions: Enjoy convenient and secure deposit and withdrawal options, designed with traders in Nigeria in mind.

Key Features Boosting Your Forex Trading in Nigeria

We specifically focus on features that empower your trading in Nigeria. From educational resources to account types, Tickmill Nigeria builds an environment where you can thrive.

Consider these vital aspects:

| Feature | Benefit for You |

|---|---|

| Diverse Account Types | Choose from Classic, Raw, or Pro accounts, each structured to match your trading style and capital. |

| Extensive Instrument Range | Trade major, minor, and exotic currency pairs, indices, commodities, and bonds. Diversify your portfolio effectively. |

| Educational Resources | Access webinars, tutorials, and articles designed to sharpen your trading skills, regardless of your experience level. Master crucial trading strategies. |

| Fast Execution Speeds | Experience ultra-fast order execution, critical for seizing market opportunities without delay. |

Starting Your Trading Journey with Tickmill Nigeria

Embarking on your journey with Tickmill Nigeria is a straightforward process. We’ve streamlined the account opening procedure so you can focus on what truly matters: your trading.

- Register Your Account: Visit our website and complete the simple registration form. Provide accurate details to ensure a smooth verification process.

- Verify Your Identity: Submit the necessary identification and residency documents. This crucial step ensures security and regulatory compliance for all our clients.

- Fund Your Account: Choose from our range of convenient funding methods, including local bank transfers, e-wallets, and cards. Deposit securely to start trading.

- Download Trading Platform: Install MetaTrader 4 or MetaTrader 5 on your preferred device. Log in with your account details and prepare to enter the markets.

- Start Trading: Explore the platform, analyze market trends, and place your first trade. Our resources are there to guide you.

Maximizing Your Success in the Forex Market

Successful trading requires more than just a good broker; it demands discipline, continuous learning, and a solid strategy. For trading Nigeria, understanding market nuances is key.

“Success in trading isn’t about predicting the future; it’s about preparing for every possible outcome.”

Here are some essential tips to help you thrive:

- Develop a Trading Plan: Define your goals, risk tolerance, entry/exit strategies, and money management rules before you even open a trade.

- Practice Risk Management: Never risk more than you can afford to lose. Use stop-loss orders to protect your capital and manage your exposure.

- Stay Informed: Keep an eye on global economic news, geopolitical events, and local developments that can impact currency pairs.

- Continuous Learning: The forex market constantly evolves. Dedicate time to learning new strategies, analyzing past performance, and refining your approach.

- Manage Emotions: Fear and greed are powerful emotions that can cloud judgment. Stick to your plan and avoid impulsive decisions.

Tickmill Nigeria empowers you with the tools and environment to master these principles. Join our growing community of successful traders and take control of your financial future today!

Understanding Tickmill: A Global Broker’s Presence

Tickmill stands as a globally recognized leader in the financial markets, offering exceptional trading services to a diverse clientele. With a firm commitment to transparency, competitive pricing, and cutting-edge technology, this broker has carved out a significant niche in the online trading landscape. We empower traders worldwide, from novices taking their first steps to seasoned professionals navigating complex strategies, with the tools and support they need to succeed.

Tickmill’s Global Reach and Unwavering Standards

Operating under robust regulatory frameworks across multiple jurisdictions, Tickmill ensures a secure and transparent trading environment. Our dedication to compliance protects client interests and fosters trust, a cornerstone of any successful trading relationship. This global footprint allows us to understand and adapt to various market dynamics, delivering localized support while maintaining international service quality. We believe in providing access to diverse markets, including forex, indices, commodities, and bonds, all from a single, powerful platform.

Why Tickmill Resonates in Nigeria’s Trading Community

For traders focusing on forex Nigeria, the name Tickmill Nigeria frequently emerges as a top choice. Our global expertise translates directly into benefits for the local market, offering a sophisticated yet accessible trading solution. As the interest in online trading continues to surge across the continent, Tickmill stands out as a reliable broker Nigeria, committed to fostering growth and providing opportunities for robust trading experiences. We understand the unique aspirations of those engaged in trading Nigeria and strive to meet those needs with tailored services and support.

Key Advantages for Nigerian Traders

Choosing the right broker is a critical decision. Tickmill offers several compelling reasons why it’s a preferred platform for many Nigerian traders:

- Competitive Spreads: Access tight spreads on major currency pairs, helping to reduce trading costs.

- Fast Execution: Benefit from ultra-fast order execution, crucial for volatile markets.

- Diverse Instruments: Trade a wide range of financial instruments, from major forex pairs to commodities and indices.

- Robust Platforms: Utilize industry-leading trading platforms like MetaTrader 4 and MetaTrader 5, available on desktop, web, and mobile.

- Educational Resources: Access a rich library of educational materials, webinars, and market analysis to sharpen your trading skills.

- Dedicated Support: Receive responsive and professional customer support, ready to assist with any queries.

At Tickmill, we believe that every trader deserves a fair and efficient environment to pursue their financial goals. Our long-standing reputation as a reliable and innovative global broker underpins our commitment to providing an exceptional service. Whether you are seeking competitive conditions for forex Nigeria or comprehensive tools for diverse trading strategies, Tickmill Nigeria offers a compelling proposition.

Why Tickmill is a Top Choice for Nigerian Traders

Navigating the dynamic world of online trading demands a partner you can trust. For those seeking a premier platform for their financial ventures, Tickmill stands out as an exceptional choice, particularly for traders in Nigeria. Its robust services and commitment to client success resonate strongly with the needs of the vibrant trading community here. Let’s explore why Tickmill has become a go-to broker for those engaged in forex trading in Nigeria.

Unwavering Trust and Regulation

Security and reliability are paramount for any serious trader. Tickmill understands this foundational need, operating under strict regulatory oversight. This commitment provides a secure trading environment, giving peace of mind to its clients. When you choose Tickmill Nigeria, you align with a broker that prioritizes the safety of your funds and data.

- Global Standards: Adherence to international financial regulations.

- Fund Segregation: Client funds are held in segregated accounts, separate from company capital.

- Negative Balance Protection: Shields traders from losing more than their deposited capital.

Competitive Trading Conditions

Success in the markets often hinges on the execution quality and the cost of trading. Tickmill offers highly competitive conditions tailored to benefit its diverse client base. This focus on advantageous terms makes it an attractive platform for trading in Nigeria.

Here’s what sets them apart:

| Feature | Benefit for Traders |

|---|---|

| Low Spreads | Reduces trading costs, maximizing potential profits. |

| Fast Execution | Minimizes slippage, crucial for volatile markets. |

| Wide Range of Instruments | Access to Forex, Indices, Commodities, and more. |

These conditions are designed to empower traders, whether they are scalping, swing trading, or engaging in longer-term strategies.

Advanced Trading Platforms and Tools

Modern traders need sophisticated yet intuitive tools at their fingertips. Tickmill provides access to industry-leading platforms that cater to both beginners and seasoned professionals. This ensures a seamless trading experience for every client.

“A powerful platform is the backbone of successful trading. Tickmill delivers robust technology that supports every trading style.”

- MetaTrader 4 (MT4): The industry-standard platform known for its user-friendly interface and extensive charting tools.

- MetaTrader 5 (MT5): Offers enhanced features, more timeframes, and additional order types for advanced strategies.

- Mobile Trading: Stay connected to the markets and manage your trades on the go with dedicated mobile apps.

Exceptional Customer Support and Education

Entering the forex market can be challenging, and having reliable support makes all the difference. Tickmill commits to providing excellent customer service, ensuring that assistance is always at hand. Furthermore, their dedication to trader education helps clients sharpen their skills and make informed decisions.

Support That Understands Your Needs

The support team at Tickmill is readily available to answer questions and resolve issues promptly. This local understanding and global expertise make them a preferred broker Nigeria.

Empowering Through Knowledge

Access a wealth of educational resources, including webinars, tutorials, and market analysis. These tools are invaluable for anyone looking to excel in trading Nigeria.

Why Choose Tickmill for Your Trading Journey in Nigeria?

Tickmill’s blend of regulatory compliance, competitive trading conditions, advanced technology, and dedicated support creates a compelling package for traders. It’s more than just a platform; it’s a partner in your financial growth. For anyone serious about forex trading, Tickmill Nigeria offers an environment where you can thrive.

Ready to experience the difference? Joining Tickmill means stepping into a world of opportunity with a trusted and respected broker.

Getting Started with Tickmill Nigeria: Account Opening

Ready to unlock the potential of the global financial markets right from Nigeria? Opening an account with Tickmill Nigeria is your crucial first step into the exciting world of forex trading. We make the process simple, secure, and swift, so you can focus on what matters most: your trading strategy.

Why Tickmill Stands Out for Traders in Nigeria

As a leading broker Nigeria trusts, Tickmill offers an unparalleled trading environment. We understand the unique needs of traders in Nigeria and provide a platform designed for success, featuring competitive spreads, fast execution, and robust regulatory compliance. Your trading journey with Tickmill Nigeria starts on solid ground.

- Competitive Conditions: Benefit from some of the tightest spreads and low commissions in the market.

- Advanced Platforms: Access industry-leading trading platforms like MetaTrader 4 and MetaTrader 5.

- Dedicated Support: Get assistance from a responsive customer service team whenever you need it.

- Educational Resources: Enhance your skills with a wealth of learning materials designed for all levels of experience in forex Nigeria.

Exploring Your Tickmill Account Options

Tickmill offers a range of account types tailored to different trading styles and experience levels. Choosing the right account is essential for optimizing your trading Nigeria experience.

| Account Type | Key Features | Ideal For |

|---|---|---|

| Pro Account | Low spreads, competitive commissions. | Experienced traders, scalpers, EAs. |

| Classic Account | Zero commissions, wider spreads. | New traders, those preferring simplicity. |

| Raw Account | Raw spreads from 0.0 pips, low commission. | Professional traders, high-volume trading. |

You can also open a Demo Account to practice trading with virtual funds before committing real capital. This is an excellent way to familiarize yourself with the platform and market conditions without risk.

Your Step-by-Step Guide to Opening an Account with Tickmill Nigeria

The process to start your trading journey with Tickmill Nigeria is straightforward. Follow these simple steps to set up your live trading account:

- Visit Our Website: Navigate to the official Tickmill Nigeria registration page.

- Fill Out the Application Form: Provide your personal details accurately. This includes your name, email, phone number, and country of residence (Nigeria).

- Choose Your Account Type: Select the live account that best suits your trading strategy and risk tolerance.

- Complete the Questionnaire: Answer a few questions about your trading experience and financial situation. This helps us ensure our services align with your profile.

- Submit for Review: Once all information is entered, submit your application.

“Starting your trading journey with Tickmill Nigeria is more than just opening an account; it’s gaining access to a world-class trading environment supported by a trusted broker.”

Essential Account Verification Steps

To comply with regulatory requirements and ensure the security of your funds, we require identity verification. This is a standard practice across the financial industry and protects both you and us. Complete these steps quickly to activate your trading account:

- Proof of Identity (POI): Provide a clear copy of a valid government-issued ID (e.g., international passport, driver’s license, national ID card).

- Proof of Residence (POR): Submit a recent utility bill, bank statement, or other official document showing your name and current address in Nigeria.

Our team processes verification documents efficiently, often within a few hours. This ensures you can move swiftly to fund your account and begin trading Nigeria markets.

Funding Your Tickmill Nigeria Trading Account

Once your account is verified, you can deposit funds using a variety of secure and convenient payment methods suitable for forex trading Nigeria. Tickmill offers numerous options to ensure a hassle-free deposit experience, allowing you to start trading without delay.

We pride ourselves on providing a seamless account opening experience. Join the growing community of successful traders in Nigeria who choose Tickmill for their forex and CFD needs.

Registration Steps and Verification

Starting your trading journey with Tickmill Nigeria is a straightforward process designed for simplicity and security. We want to get you into the market swiftly, but always with your safety as our top priority. Here’s a clear guide to help you register and verify your account without a hitch.

Your Simple Registration Process

Opening an account with Tickmill Nigeria takes just a few moments. Follow these easy steps:

- Access the Registration Form: Head to our website and click the ‘Open Account’ button. This leads you directly to the application.

- Provide Personal Details: We ask for basic information like your name, email, phone number, and country of residence. Ensure all details are accurate to avoid delays later.

- Choose Your Account Type: Select the trading account that best suits your needs, whether it’s a Classic, Raw, or Pro account. Consider your trading style and experience level.

- Set Up Your Trading Password: Create a strong, unique password to secure your new account.

- Agree to Terms: Review and accept our terms and conditions. Once done, you complete the initial registration.

The Verification Stage: Ensuring Your Security

After initial registration, a crucial verification step follows. This process is standard for all reputable financial institutions and ensures compliance with global regulatory standards, safeguarding your funds and personal information. It also confirms your eligibility to trade on our platform, a vital part of being a trusted broker Nigeria.

To verify your account, you will need to submit a few documents. This helps us confirm your identity and residency, making your trading Nigeria experience secure:

- Proof of Identity (POI):

- A clear, color copy of a valid government-issued photo ID (passport, national ID card, or driver’s license).

- Make sure the document is current, with all four corners visible, and all text legible.

- Proof of Residency (POR):

- A recent utility bill (electricity, water, gas, internet), bank statement, or government-issued residency certificate.

- This document must be dated within the last six months and clearly show your full name and residential address. P.O. box addresses are not accepted.

You can easily upload these documents directly through your secure client area. Our dedicated compliance team reviews each submission carefully. We aim to process all verification requests swiftly, usually within one business day. Once approved, you gain full access to deposit funds and begin trading forex Nigeria markets confidently. This diligent process underpins our commitment to providing a safe and reliable environment for everyone.

Tickmill Account Types: Finding Your Perfect Fit

Choosing the right trading account is a crucial step for anyone navigating the financial markets, especially for those looking into forex Nigeria. Tickmill offers a selection of account types, each designed with different trader profiles and strategies in mind. Understanding these options helps you align your trading goals with the most suitable conditions, ensuring you maximize your potential with a top-tier broker Nigeria.

Let’s explore the distinct features of each Tickmill account, helping you pinpoint the perfect fit for your trading Nigeria journey.

Tickmill Classic Account

The Classic Account serves as an excellent starting point for new traders and those who prefer a straightforward trading environment. It’s built for simplicity and transparency, making it easy to understand your costs without complex calculations. You experience commission-free trading, with all costs integrated into the spread.

- Ideal For: Beginners, swing traders, and those who prioritize ease of use.

- Key Feature: No commissions on trades, keeping your cost structure simple.

- Spreads: Competitive floating spreads starting from 1.6 pips.

- Minimum Deposit: Accessible entry point, allowing traders to start with a lower capital outlay.

Tickmill Raw Account

For more experienced traders and those employing strategies like scalping or high-frequency trading, the Raw Account presents a compelling choice. This account offers incredibly tight spreads, often starting from 0.0 pips, with a small, transparent commission per trade. It’s engineered for precision and speed, catering to strategies that demand minimal spread impact.

- Ideal For: Scalpers, day traders, and algorithmic traders who need the lowest possible spreads.

- Key Feature: Ultra-low spreads, with commissions clearly defined.

- Spreads: Raw, interbank spreads starting from 0.0 pips.

- Commissions: A competitive commission per standard lot traded.

- Minimum Deposit: Slightly higher than the Classic, reflecting its professional orientation.

Tickmill Pro Account

The Pro Account is another excellent option for professional traders seeking the best possible execution and pricing. Similar to the Raw account, it boasts ultra-tight spreads, but with a slightly different commission structure that can be advantageous for very high-volume traders. It provides a robust platform for serious market participants.

- Ideal For: Professional traders, high-volume participants, and those with advanced trading strategies.

- Key Feature: Extremely low spreads combined with an optimized commission structure for high turnover.

- Spreads: Spreads from 0.0 pips.

- Commissions: Industry-leading low commissions.

- Minimum Deposit: Geared towards traders ready to commit more capital.

Here’s a quick overview to help you compare the core features:

| Feature | Classic Account | Raw Account | Pro Account |

|---|---|---|---|

| Spreads From | 1.6 pips | 0.0 pips | 0.0 pips |

| Commissions | None | Low per side per lot | Very Low per side per lot |

| Minimum Deposit | Accessible | Moderate | Higher |

| Execution | ECN/STP | ECN/STP | ECN/STP |

Other Account Considerations

Beyond these core offerings, Tickmill Nigeria also provides a Demo Account. This is invaluable for practicing strategies without risking real capital, perfect for testing the waters before committing funds. For traders with specific religious beliefs, an Islamic Account (swap-free) is available upon request, ensuring compliance with Sharia law.

Making Your Choice

Your ideal Tickmill account ultimately depends on your individual trading style, experience level, and capital. If you’re new to forex Nigeria, the Classic account offers a great starting point. For those with advanced strategies and a focus on tight spreads, the Raw or Pro accounts stand out. We encourage you to evaluate your needs carefully. Consider experimenting with a demo account first to find the environment that truly fits your approach. Make an informed decision that empowers your trading journey.

Pro, Classic, and VIP Features

Choosing the right trading account is crucial for success in the dynamic forex market. At Tickmill Nigeria, we understand that every trader has unique needs and strategies. That’s why we offer a range of account types, each designed to empower your trading Nigeria journey with competitive features and exceptional conditions. Let’s explore which option best suits your style.

The Classic Account: Ideal for Beginners and Simplicity Seekers

If you are new to the world of forex Nigeria or prefer a straightforward trading experience, our Classic account is an excellent starting point. It’s built for ease, allowing you to focus on your strategy without complex fee structures.

- Commission-Free Trading: Enjoy transparent trading with no commissions on your trades.

- Competitive Spreads: Access reliable spreads, perfect for general market participation.

- Accessibility: A fantastic entry point for anyone looking to engage with a reputable broker Nigeria without high initial commitments.

The Pro Account: Designed for Experienced Traders and Active Strategies

For those who demand tighter pricing and a more advanced environment, the Pro account at Tickmill Nigeria delivers. It’s the preferred choice for seasoned traders, scalpers, and those employing expert advisors who thrive on minimal costs.

- Ultra-Low Spreads: Benefit from incredibly tight spreads, often starting from 0.0 pips.

- Transparent, Small Commissions: A small, fixed commission applies, ensuring ultra-competitive overall trading costs.

- Direct Market Access: Experience superior execution speeds crucial for time-sensitive strategies in trading Nigeria.

The VIP Account: Exclusivity and Premium Conditions for High-Volume Traders

Our VIP account is tailored for high-volume traders who require the absolute best in market conditions and personalized service. When you trade significant volumes, every pip counts, and the VIP account is engineered to maximize your potential within the forex Nigeria market.

- Even Tighter Spreads: Get access to the most competitive spreads available, further reducing your trading expenses.

- Dedicated Account Manager: Receive personalized support and insights from your own dedicated account manager.

- Exclusive Benefits: Enjoy bespoke services designed to enhance your trading experience with Tickmill Nigeria.

To help you compare at a glance, here’s a quick overview of some key distinctions:

| Account Type | Typical Spreads | Commissions | Ideal For |

|---|---|---|---|

| Classic | Competitive, from 1.6 pips | None | New traders, simplicity |

| Pro | Ultra-low, from 0.0 pips | Low, per side per lot | Experienced traders, scalpers |

| VIP | Very tight, from 0.0 pips | Very low, per side per lot | High-volume traders |

Each account at Tickmill Nigeria is crafted to support your trading ambitions. Ready to elevate your forex Nigeria experience? Explore these options and find your perfect fit with us.

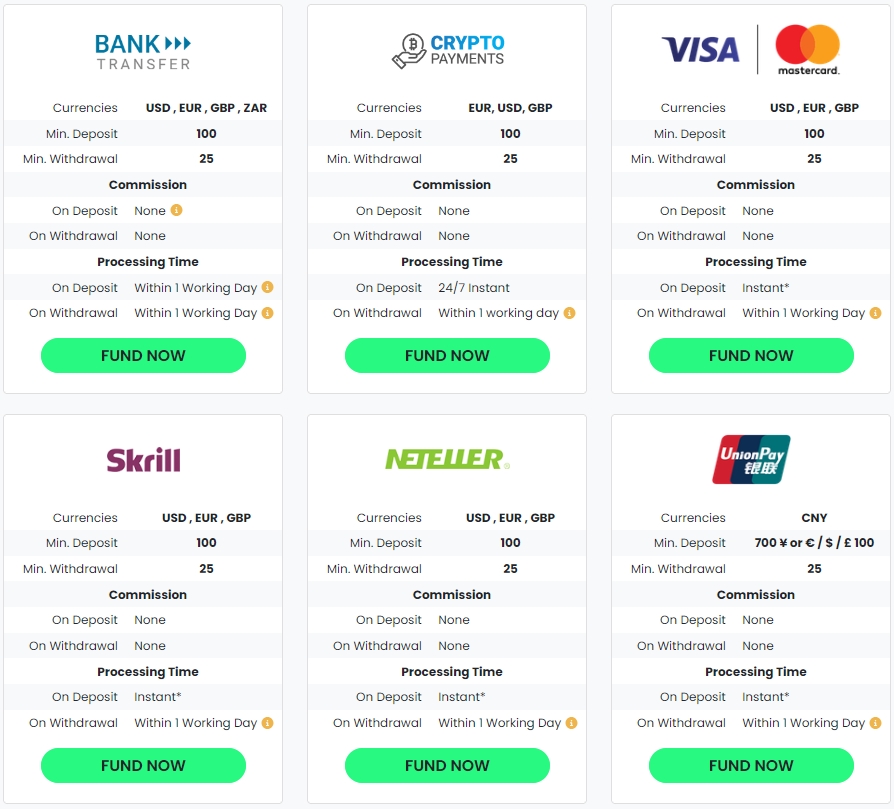

Deposits and Withdrawals for Nigerian Users

Navigating the financial landscape for online trading demands secure and efficient deposit and withdrawal options. At Tickmill Nigeria, we understand the unique needs of traders in the region, providing tailored solutions for effortless fund management. Our commitment ensures you focus on your trading strategy, not transaction hassles.

Effortless Deposit Methods

Funding your trading account with Tickmill Nigeria is straightforward and secure. We offer a variety of popular methods, catering specifically to the preferences of our clients across Nigeria. Your funds become available swiftly, allowing you to seize market opportunities without delay.- Local Bank Transfers: A highly favored option for traders in Nigeria. This method allows direct transfers from your local bank account, making it convenient and familiar.

- E-wallets (Skrill, Neteller, FasaPay): For those who prefer speed and digital convenience, e-wallets offer instant deposits. These platforms are widely recognized and used for forex Nigeria transactions.

- International Wire Transfer: Suitable for larger deposits, this traditional method provides a robust and secure way to fund your account directly from your bank.

- Credit/Debit Cards: Fund your account instantly using major credit or debit cards, a quick and secure option for immediate access to the markets.

Streamlined Withdrawal Process

Accessing your profits should be as simple as making a deposit. Tickmill Nigeria streamlines the withdrawal process, enabling you to receive your earnings quickly and reliably. We process withdrawals efficiently, adhering to strict security protocols to protect your funds.When you initiate a withdrawal, we aim to process your request promptly. The time it takes for funds to reach your account depends on the method chosen. We advise using the same method for withdrawal as you used for deposit, which often speeds up the process and enhances security measures.

Our dedicated support team is always ready to assist with any questions you may have regarding your withdrawal status, ensuring a smooth experience every time you decide to take profits from your trading in Nigeria.

Key Considerations for Nigerian Traders

Successful online trading in Nigeria also involves understanding the nuances of financial transactions. Tickmill Nigeria ensures clarity on these aspects:| Aspect | Details for Nigerian Users |

|---|---|

| Processing Times | While deposits are often instant, withdrawals can take 1-3 business days depending on the method. |

| Fees | We strive for zero deposit fees. Withdrawal fees vary by method, but we maintain transparency. |

| Currency Conversion | Accounts are typically denominated in USD. Local currency conversions happen via your payment provider. |

| Security | All transactions are encrypted and protected with advanced security protocols. |

Local Payment Solutions & Processing

Navigating financial transactions smoothly is paramount for any successful trading journey, especially in the vibrant market of Nigeria. We understand that quick, secure, and accessible funding options are not just a convenience, but a necessity for our clients.

That is precisely why Tickmill Nigeria dedicates significant effort to provide robust local payment solutions tailored for traders in Nigeria. Forget the hassle of complicated international transfers; we bring the solutions directly to you, making your funding and withdrawal process straightforward and stress-free. This commitment ensures you can focus on what truly matters: making informed trading decisions.

Our focus on localized processing means you experience faster transaction times and often lower fees, allowing you to manage your capital effectively. Whether you are funding your account to engage in forex Nigeria or withdrawing profits, our systems are optimized for the local financial ecosystem. This approach makes us a preferred broker Nigeria among serious traders.

We support a range of popular local payment methods to make your trading experience seamless:

- Bank Transfers: Utilize direct bank transfers from major Nigerian banks, a widely trusted and convenient method.

- Local Online Payment Gateways: Benefit from popular local payment processors, ensuring rapid and secure transactions.

- Card Payments: Fund your account using local debit cards, offering instant deposits and easy access.

We consistently review and enhance our payment infrastructure to ensure you have the best possible experience when trading Nigeria. This dedication means high-level security protocols safeguard every transaction, giving you peace of mind with every deposit and withdrawal.

Choosing a platform with efficient local payment solutions removes a significant barrier to entry and ongoing participation in the financial markets. We believe your focus should remain on market analysis and strategy, not on how to fund your account. Join a community that values your time and provides the practical tools you need to succeed.

Trading Platforms: MT4, MT5, and More

Choosing the right trading platform is crucial for success in the dynamic financial markets. For traders in Nigeria, having access to robust, reliable, and user-friendly platforms is not just a convenience; it’s a necessity. At Tickmill Nigeria, we understand this deeply, offering a suite of industry-leading platforms designed to empower your trading journey.

Whether you are new to forex trading or an experienced professional, our platforms provide the tools, speed, and reliability you need to execute your strategies effectively.

MetaTrader 4 (MT4): The Industry Standard

MetaTrader 4 remains the most popular platform for retail forex trading worldwide, and for good reason. It offers a powerful blend of ease of use and advanced functionality. MT4 is renowned for its stability and comprehensive charting tools, making it a favorite among forex Nigeria traders.

- User-Friendly Interface: Navigate the markets with an intuitive design.

- Advanced Charting: Utilize multiple timeframes, analytical objects, and technical indicators for in-depth market analysis.

- Expert Advisors (EAs): Automate your trading strategies with custom-built EAs.

- Mobile Trading: Stay connected to the markets and manage your trades on the go with dedicated mobile apps.

- Security: Enjoy robust data encryption, ensuring your trading activities are secure.

For those focused purely on forex and CFD trading, MT4 offers a refined and direct experience, proven over many years in the trading community.

MetaTrader 5 (MT5): The Next Generation Platform

MT5 takes everything you love about MT4 and elevates it to the next level. While MT4 specializes in forex and CFDs, MT5 expands your trading horizons. It’s an all-in-one multi-asset platform that supports a wider range of financial instruments.

Key advancements you will find in MT5:

- Expanded Asset Classes: Trade not only forex and CFDs but also stocks, futures, and options.

- More Timeframes: Access 21 timeframes compared to MT4’s 9, allowing for more granular market analysis.

- Additional Indicators: Benefit from 38 built-in technical indicators, enhancing your analytical capabilities.

- Advanced Order Types: Utilize new order types like “Buy Stop Limit” and “Sell Stop Limit.”

- Market Depth: Get deeper insights into market liquidity with the Depth of Market (DOM) feature.

- Faster Processing: Experience improved processing speeds for quick trade execution.

If you seek broader market access and enhanced analytical tools, MT5 is an excellent choice for your trading Nigeria needs. As a leading broker Nigeria, Tickmill ensures seamless integration with both platforms.

Choosing Your Ideal Platform

Deciding between MT4 and MT5, or exploring other options, depends entirely on your personal trading style and goals. Consider these points when making your decision:

| Feature | MetaTrader 4 | MetaTrader 5 |

|---|---|---|

| Primary Focus | Forex, CFDs | Forex, CFDs, Stocks, Futures, Options |

| Timeframes | 9 | 21 |

| Technical Indicators | 30 | 38 |

| Pending Order Types | 4 | 6 |

| Economic Calendar | No | Yes |

Ultimately, both MT4 and MT5 offer robust environments for trading. Tickmill Nigeria provides both options because we believe in empowering you with choice. Explore each platform with a demo account to discover which one best aligns with your trading approach and helps you achieve your financial objectives.

Exploring Financial Instruments on Tickmill

Venturing into the world of online trading opens up a universe of possibilities, and understanding the financial instruments at your disposal is paramount. Tickmill offers a sophisticated gateway to global markets, providing traders with a robust selection of assets to build a diversified portfolio. Whether you’re new to the scene or an experienced investor in Nigeria, Tickmill Nigeria presents a compelling platform designed for your success.

Unlocking Forex Trading Potential

Forex, or foreign exchange, remains a cornerstone of global financial markets. It offers unparalleled liquidity and round-the-clock trading opportunities. At Tickmill, you can access a vast array of major, minor, and exotic currency pairs, giving you the flexibility to trade your preferred markets. This is particularly appealing for those engaged in forex Nigeria, seeking direct access to international currency fluctuations.

- Major Pairs: Trade highly liquid pairs like EUR/USD, GBP/USD, and USD/JPY with competitive spreads.

- Minor Pairs: Explore opportunities with pairs such as EUR/GBP, CAD/JPY, and NZD/JPY.

- Exotic Pairs: Discover potential in less common pairs that can offer unique market dynamics.

Diving into Stock Indices

Stock indices offer a convenient way to trade the performance of an entire economy or a specific sector without having to invest in individual stocks. They represent a basket of leading companies from a particular region or industry. Trading indices allows you to speculate on broad market movements, providing a different dimension to your trading strategy.

Tickmill provides access to a range of global indices, letting you capitalize on market trends from various parts of the world. As a reliable broker Nigeria, Tickmill ensures seamless execution for these complex instruments.

Commodities: Hard Assets, New Opportunities

Commodities are fundamental raw materials that play a crucial role in the global economy. Trading commodities, such as precious metals and energies, can serve as a hedge against inflation or simply provide alternative trading opportunities separate from traditional equities and currencies. The appeal of tangible assets often draws traders looking for diversification.

| Commodity Type | Examples | Market Impact |

|---|---|---|

| Precious Metals | Gold, Silver | Safe-haven status, inflation hedge |

| Energies | Crude Oil, Natural Gas | Geopolitical events, supply/demand |

Government Bonds: Stability and Income

While often seen as a more conservative asset, government bonds can be an excellent addition to a diversified portfolio. They represent a loan made by an investor to a government, offering periodic interest payments and the return of principal at maturity. For a complete trading Nigeria experience, understanding and potentially incorporating bonds can provide stability and a different risk profile compared to more volatile instruments.

Exploring the full spectrum of financial instruments on Tickmill empowers you to craft a trading strategy tailored to your goals and risk tolerance. With diverse options available, your journey to market success starts here.

Spreads, Commissions, and Trading Costs

Understanding your trading costs is crucial for long-term success in the dynamic world of forex. When you choose Tickmill Nigeria, you gain access to a transparent and competitive pricing structure designed to support your trading journey. We believe in clarity, ensuring you always know the costs associated with your trades in forex Nigeria.

Decoding Spreads

Spreads represent the difference between the bid and ask price of a currency pair. They are a primary component of trading costs. Tickmill is renowned for its ultra-low spreads, especially on major currency pairs, which is a significant advantage for active traders across nigeria.

- Raw Spreads: Enjoy spreads from 0.0 pips on our Raw Spread accounts, making them highly competitive for scalpers and high-frequency traders.

- Classic Accounts: For those preferring a simpler model, our Classic account offers zero commissions with slightly wider, but still competitive, spreads.

- Typical Spreads: You’ll find consistently tight spreads on popular pairs like EUR/USD, GBP/USD, and USD/JPY, directly impacting your profitability.

Commissions: When and How

While some of our accounts offer commission-free trading, others, particularly those with raw spreads, incorporate a nominal commission. This model often results in a lower overall cost for high-volume traders compared to wider-spread, commission-free alternatives.

Our commission structure is straightforward:

| Account Type | Spread Model | Commission per Side per Lot |

|---|---|---|

| Pro Account | Raw Spreads | $2 per 100,000 traded |

| Classic Account | Fixed Markup | $0 (Commission-Free) |

| VIP Account | Raw Spreads | $1 per 100,000 traded (for eligible clients) |

This transparent approach helps you calculate potential costs accurately before executing a trade, empowering your trading Nigeria strategy.

Other Essential Trading Costs

Beyond spreads and commissions, other factors can influence your overall trading expenses. It’s important to be aware of these to manage your capital effectively as a discerning broker nigeria client.

Here’s what else to consider:

- Swap Fees (Overnight Financing): These are charges or credits applied to positions held open overnight. They reflect the interest rate differential between the two currencies in a pair. Tickmill provides detailed swap rates for all instruments directly on its platform.

- Inactivity Fees: We do not impose inactivity fees, ensuring your funds remain yours even if you take a break from trading.

- Deposit/Withdrawal Fees: Tickmill typically covers deposit fees for most popular payment methods. Withdrawal fees are generally minimal or non-existent, depending on the method chosen. Always check the funding section for specific details relevant to nigeria.

“Transparent trading costs are the cornerstone of a fair and sustainable trading environment. We are committed to providing competitive pricing without hidden surprises, fostering trust with our clients in Nigeria.”

Why Tickmill Nigeria’s Cost Structure Benefits You

Choosing a broker nigeria with a favorable cost structure can significantly impact your bottom line. Tickmill is dedicated to offering an environment where your trading potential is maximized, not diminished by excessive fees.

- Cost-Effective Trading: Our low spreads and competitive commissions mean more of your potential profits stay with you.

- Fairness and Transparency: No hidden charges. All costs are clearly outlined, allowing you to make informed decisions.

- Flexibility: Account options cater to different trading styles and capital sizes, ensuring you find a cost model that suits you.

Join the many traders in forex Nigeria who benefit from Tickmill’s commitment to low-cost, high-value trading. Understanding these costs is your first step towards smarter trading.

Leverage and Margin for Optimal Trading

Navigating the dynamic world of forex trading requires a keen understanding of powerful tools. For traders in Nigeria, two concepts stand out as particularly impactful: leverage and margin. They can significantly amplify your trading potential, but also carry inherent risks. Mastering them is key to optimal trading, allowing you to maximize opportunities while maintaining responsible capital management.

Leverage acts like a financial amplifier. It allows you to control a much larger position in the market with a relatively small amount of capital. For example, with 1:500 leverage, a $100 deposit could effectively control a $50,000 position. This is a game-changer for many trading Nigeria participants, enabling access to markets that would otherwise require substantial upfront capital. It truly opens doors for more robust engagement with opportunities presented by forex Nigeria.

Margin, on the other hand, is the actual amount of capital required to open and maintain a leveraged position. Think of it as a good-faith deposit or collateral held by your broker Nigeria. This amount covers potential losses should the market move against your position. When your account equity falls below a certain percentage of the margin required, you might face a ‘margin call.’ This signals a need to deposit more funds to cover your open positions, or some positions might face automatic closure. Responsible capital management is paramount to avoid such situations.

Benefits of Strategic Leverage:

- Increased Potential Profits: Leverage allows you to capitalize on smaller price movements, potentially generating significant returns on your initial capital.

- Capital Efficiency: You can open larger positions with less personal capital, freeing up funds for other investments or diversification.

- Market Access: It provides access to markets and trade sizes that might otherwise be out of reach for many traders in Nigeria.

Risks of Excessive Leverage:

- Magnified Losses: Just as profits are amplified, so are losses. A small market movement against your position can quickly deplete your account.

- Increased Pressure: The potential for quick losses can lead to emotional decision-making and poor trading habits.

- Higher Margin Call Risk: Aggressive leverage increases the likelihood of receiving margin calls, potentially forcing you to add funds or close positions at unfavorable times.

Just as profits are amplified, so are losses. A small market movement against your position can quickly deplete your account.

| Feature | Leverage | Margin |

|---|---|---|

| Purpose | Amplify buying power | Required collateral for leveraged positions |

| Action | Multiplies your capital’s reach | Locks up a portion of your capital |

| Impact on Risk | Magnifies both potential profits and losses | Protects the broker; risk of margin call for the trader |

Using leverage effectively is about striking the right balance. It is not about taking on excessive risk, but rather about strategically allocating capital based on your risk tolerance and trading strategy. A reputable broker Nigeria, like Tickmill Nigeria, provides clear information and robust tools to help you manage these aspects responsibly. They emphasize education and disciplined risk management, which are crucial for sustainable success in forex Nigeria.

Understanding how leverage and margin interact is a cornerstone of sophisticated trading. It empowers you to make informed decisions and manage your exposure intelligently. Embrace these tools with a disciplined approach, and you will set yourself up for a more robust and potentially profitable journey in the vibrant forex Nigeria market.

Tickmill Nigeria Customer Support and Educational Resources

Embarking on your trading journey with Tickmill Nigeria means more than just accessing market opportunities; it signifies joining a community committed to your success. We understand that top-tier customer support and comprehensive educational resources are critical for traders in nigeria, whether you are a novice or a seasoned professional navigating the complexities of forex nigeria.

Our commitment extends beyond just offering a platform; we empower you with the knowledge and assistance you need to make informed decisions and thrive in the market. Let’s explore how Tickmill Nigeria stands by its traders every step of the way.

Responsive and Reliable Customer Support

When you encounter a question or need assistance, swift and effective support is paramount. Our dedicated customer service team provides timely help, ensuring your focus remains on your trading strategies. We pride ourselves on offering easily accessible and highly responsive support channels designed for traders across nigeria.

| Channel | Availability | Benefit |

|---|---|---|

| Live Chat | Business Hours | Instant responses for quick queries. |

| Email Support | 24/5 | Detailed answers for complex issues. |

| Phone Support | Business Hours | Personalized assistance directly from our team. |

We make sure you get the support you need precisely when you need it. Our team consists of experienced professionals ready to assist with account management, platform navigation, technical issues, and general inquiries, establishing us as a reliable broker nigeria for your trading needs.

Empowering Educational Resources for Every Trader

Knowledge is your most powerful tool in the fast-paced world of trading. Tickmill Nigeria provides an extensive library of educational content, carefully curated to help you develop your skills and deepen your understanding of the financial markets. We believe in building confident traders through practical and relevant learning materials.

Our educational hub includes:

- Trading Guides & E-books: Comprehensive resources covering fundamental concepts, advanced strategies, and risk management techniques essential for successful trading nigeria.

- Webinars & Seminars: Live interactive sessions led by industry experts, offering insights into market analysis, trading psychology, and real-time strategy application.

- Video Tutorials: Step-by-step visual guides on using our trading platforms, placing trades, and utilizing various tools and indicators.

- Market Analysis & Insights: Daily and weekly analyses providing expert commentary on market movements, economic events, and potential trading opportunities.

- Glossary of Terms: A helpful reference for understanding key financial terms and jargon, making complex concepts more accessible.

Whether you are just starting your journey into forex nigeria or looking to refine your existing strategies, our educational resources offer a structured path to continuous learning and improvement. We equip you with the insights necessary to approach the markets with greater confidence and competence.

Regulatory Compliance and Client Fund Security

Choosing a reliable forex broker is paramount, especially when navigating the dynamic markets in Nigeria. Your peace of mind as a trader hinges on the assurance that your investments are safe and that your broker operates with integrity. At Tickmill Nigeria, we place regulatory compliance and robust client fund security at the core of our operations, building a foundation of trust for every trader.

We understand the importance of safeguarding your capital. That’s why Tickmill adheres to stringent global regulatory standards, extending these high levels of protection to our clients engaging in forex Nigeria trading. This commitment ensures a secure and transparent trading environment, allowing you to focus on your strategies with confidence.

Protecting Your Capital: Our Key Pillars

- Segregated Client Accounts: Your funds are held in separate bank accounts from the company’s operational capital. This means your money remains yours, even in unforeseen circumstances. This crucial measure protects your funds against any insolvency of the broker Nigeria.

- Regulatory Oversight: We operate under the watchful eye of leading financial authorities. This independent scrutiny ensures adherence to strict financial conduct rules and transparency.

- Negative Balance Protection: This vital feature prevents your trading account from falling into a negative balance. You can never lose more than your deposited capital, a significant safeguard for anyone involved in trading Nigeria.

- Robust Internal Controls: We implement rigorous internal policies and procedures designed to protect your assets and maintain the highest standards of operational integrity.

Our commitment to these measures goes beyond mere obligation; it reflects our dedication to your financial security. For anyone seeking to participate in the thriving forex market in Nigeria, knowing your broker upholds these standards is essential.

“Security is not merely a feature; it’s the bedrock of a successful trading partnership. We prioritize your funds’ safety above all else.”

We believe transparency is key to fostering trust. Our operational practices are clear, ensuring you understand exactly how your funds are handled and protected. This dedication to security makes Tickmill Nigeria a preferred choice for traders across the nation.

| Security Aspect | Benefit to You |

|---|---|

| Fund Segregation | Your capital is separate from company funds. |

| Negative Balance Protection | You cannot lose more than you deposit. |

| Regulatory Compliance | Assurance of fair and ethical practices. |

Choosing Tickmill means partnering with a broker Nigeria clients can trust. We empower you to trade with assurance, knowing your funds are managed with the utmost care and in full compliance with established financial regulations.

Licenses, Oversight, and Fund Protection

Entering the financial markets, especially for active trading, demands complete confidence in your chosen brokerage. For traders navigating the dynamic landscape of forex Nigeria, understanding a broker’s regulatory standing is not just advisable; it is absolutely essential. A robust regulatory framework provides the bedrock of security, ensuring your funds are protected and operations remain transparent. This is particularly true for those considering platforms like Tickmill Nigeria, where adherence to international standards directly impacts your trading experience.

Why Regulation Matters for Your Trading Journey

Choosing a regulated broker Nigeria is paramount. Regulation provides a critical layer of oversight, safeguarding client interests against potential misconduct or operational failures. It ensures the broker operates within strict guidelines, maintaining financial stability and ethical practices. For anyone involved in trading Nigeria, this translates into peace of mind and a secure environment for your investments.

Key benefits of trading with a regulated entity include:

- Enhanced Security: Your funds are often held in segregated accounts, separate from the broker’s operational capital.

- Fair Trading Practices: Regulators enforce rules that prevent market manipulation and ensure fair pricing.

- Dispute Resolution: Clear channels exist for addressing complaints, offering an independent avenue for resolution.

- Transparency: Regulated brokers must provide clear terms, conditions, and risk disclosures.

Understanding Fund Protection Mechanisms

Beyond basic licensing, reputable brokers implement specific measures to protect client funds. These mechanisms are crucial for mitigating risks and ensuring that your capital remains secure, even in unforeseen circumstances. For traders in Nigeria, knowing these protections exist can greatly influence your choice of platform.

“Security in trading isn’t just about protecting your account from hackers; it’s fundamentally about the integrity of the broker and the regulatory bodies overseeing them.”

Here’s a quick look at common fund protection features:

| Protection Mechanism | How it Works |

|---|---|

| Segregated Accounts | Client funds are kept in separate bank accounts from the company’s operating funds, preventing their use for broker expenses. |

| Investor Compensation Schemes | These schemes offer a layer of protection, compensating clients up to a certain amount in the unlikely event of broker insolvency. |

| Negative Balance Protection | This policy ensures clients cannot lose more than their deposited capital, protecting them from falling into debt due to market volatility. |

By prioritizing a broker with robust licenses, diligent oversight, and strong fund protection, you empower yourself with confidence. This allows you to focus on developing your trading strategies, knowing your capital is in secure hands.

Comparing Tickmill with Local Forex Brokers

Navigating the vibrant landscape of forex nigeria presents a crucial choice: opting for an internationally recognized platform like Tickmill or engaging with local broker nigeria firms. Both paths offer unique advantages, and understanding these differences empowers your trading decisions. Let’s break down how Tickmill stands up against local alternatives, helping you find the right fit for your trading nigeria journey.

Regulatory Framework and Trust

Regulatory oversight forms the bedrock of secure online trading. Tickmill operates under strict international regulatory bodies, offering clients robust protection and transparency. This level of global compliance often provides significant peace of mind for traders.

- Tickmill: Boasts a strong regulatory profile from highly respected authorities, ensuring client fund segregation and adherence to best practices.

- Local Brokers: Their regulatory compliance primarily falls under local jurisdictions. While some are well-regulated locally, the scope and stringency might differ significantly from international standards.

Trading Conditions and Instruments

The core of any trading experience lies in the conditions offered. Tickmill is renowned for its competitive spreads and low commissions, which can be a game-changer for active traders looking to minimize costs. They also provide access to a broad array of instruments.

Consider these points:

| Feature | Tickmill | Local Forex Brokers (Nigeria) |

|---|---|---|

| Spreads & Commissions | Typically very tight spreads, low commissions across account types. | Can vary widely; some offer higher spreads or different commission structures. |

| Available Instruments | Extensive range: Forex, Indices, Commodities, Cryptocurrencies, Bonds. | Often a more focused selection, primarily on major forex pairs. |

| Leverage Options | Flexible leverage options, compliant with international regulations. | Leverage can be more restricted or vary based on local guidelines. |

| Platform Diversity | Industry-standard MetaTrader 4 & 5, WebTrader. | Often limited to MetaTrader 4 or a proprietary platform. |

Funding and Withdrawal Convenience for Tickmill Nigeria

Seamless deposit and withdrawal processes are critical for any trader. Tickmill Nigeria strives to offer diverse payment methods catering to the local market, alongside standard international options. This ensures you can fund your account and access your profits efficiently.

Pros of Tickmill’s approach to funding:

- Multiple deposit and withdrawal channels, including bank transfers, e-wallets, and potentially local payment solutions.

- Fast processing times, aiming for quick access to your funds.

- Support for various base currencies for accounts, offering flexibility.

Local brokers often specialize in direct local bank transfers, which can be convenient but may lack the broader range of international options available through global platforms.

Customer Support and Local Relevance

Quality customer service makes a difference. Tickmill offers multilingual support, often available 24/5, addressing queries promptly. While global, their commitment to specific regions means they often have resources tailored for markets like Nigeria.

When evaluating support:

- Assess response times and availability (e.g., 24/5 vs. business hours).

- Consider language support beyond English, if needed.

- Evaluate the depth of knowledge regarding local market specifics.

Ultimately, your choice depends on your priorities: the robust international regulatory framework and advanced trading conditions of Tickmill, or the localized focus of a domestic broker. Both paths offer unique advantages for your forex journey in Nigeria.

Advanced Trading Tools and Features

Mastering the dynamic financial markets in Nigeria demands more than just capital; it requires sophisticated tools at your fingertips. At Tickmill Nigeria, we equip you with an arsenal of advanced trading instruments and features designed to elevate your trading experience. We empower you to make informed decisions and execute strategies with precision.

Experience the industry-leading MetaTrader 4 and MetaTrader 5 platforms. These robust platforms offer unparalleled flexibility and power for forex trading. Customize your charts, access a vast array of technical indicators, and manage your positions with ease. Whether you are a beginner or a seasoned professional in forex Nigeria, these platforms provide the foundation for successful trading.

Automated Trading with Expert Advisors

Unlock the full potential of automated trading with Expert Advisors (EAs). Our platforms fully support EAs, allowing you to implement your strategies around the clock, even when you’re away from your screen. This is a game-changer for many engaged in trading Nigeria, providing consistency and discipline to your approach.

Virtual Private Server (VPS)

Maintain uninterrupted trading with our Virtual Private Server (VPS) solutions. A VPS ensures your EAs and trading platforms run continuously, minimizing latency and maximizing reliability. For serious traders across Nigeria, this provides peace of mind and crucial uptime for time-sensitive strategies.

Comprehensive Analytical Tools

Gain deeper insights into market movements with our comprehensive analytical tools. From advanced charting packages to real-time market data, these resources help you identify trends, assess risk, and pinpoint optimal entry and exit points. Understanding market dynamics is crucial for every broker Nigeria user.

Economic Calendar and Market News

Stay ahead of the curve with our integrated Economic Calendar and live market news feeds. Key economic releases and geopolitical events can significantly impact currency pairs. Our tools keep you informed, helping you anticipate market shifts and adjust your trading strategy accordingly.

Educational Resources and Support

Knowledge is power. Tickmill Nigeria provides extensive educational resources, including webinars, tutorials, and market analysis. We ensure you have the support and information needed to navigate the complexities of forex trading. Our dedicated support team understands the unique needs of traders in Nigeria, offering assistance whenever you need it.

| Advanced Feature | Your Direct Benefit |

|---|---|

| MetaTrader Platforms | Powerful, customizable interface for precision trading |

| Expert Advisors (EAs) | Automated, disciplined strategy execution 24/7 |

| VPS Hosting | Uninterrupted, reliable trading and minimal latency |

| Economic Calendar | Informed decision-making based on market-moving events |

These advanced tools are not just features; they are your partners in navigating the dynamic world of forex. Tickmill Nigeria is committed to providing a superior trading environment, empowering you with everything necessary for success. Join us and experience the difference these capabilities make to your trading journey.

Mobile Trading Experience with Tickmill

In today’s fast-paced world, your trading platform needs to keep up. Gone are the days of being tethered to a desktop. Serious traders, especially those navigating the dynamic world of forex Nigeria, demand flexibility. This is where Tickmill steps in, offering a robust and intuitive mobile trading experience designed to empower you wherever you are.

Your Trading Hub, Anywhere

Imagine having full control over your trading decisions right from the palm of your hand. The Tickmill mobile app transforms your smartphone into a comprehensive trading station. We understand the unique needs of traders in Nigeria, and our app delivers the performance and features you expect from a leading broker Nigeria.

Here’s what you can expect:

- Real-Time Market Data: Stay updated with live quotes and instant price movements across various instruments, crucial for timely decisions in trading Nigeria.

- Advanced Charting Tools: Utilize a full suite of technical indicators and charting types directly on your mobile device. Analyze trends and spot opportunities with precision.

- One-Click Trading: Execute trades swiftly with just a tap. Speed is paramount in the forex market, and our app ensures you never miss a beat.

- Full Account Management: Monitor your balance, equity, margin, and open positions effortlessly. Manage your funds, including deposits and withdrawals, with ease.

- Personalized Watchlists: Keep an eye on your preferred assets without clutter. Customize your view to focus on what matters most to your strategy.

Seamless Performance and Security

Performance and security are non-negotiable for mobile trading. Our app provides a smooth, lag-free experience, even during volatile market conditions. We know that reliability builds trust, especially for those engaging in forex trading in Nigeria.

We prioritize your safety:

| Feature | Benefit to You |

|---|---|

| Data Encryption | Protects your personal and financial information during every transaction. |

| Secure Login | Multiple layers of security ensure only you can access your trading account. |

| Regular Updates | Continuous enhancements keep the app secure and running optimally. |

Unmatched Convenience for Tickmill Nigeria Traders

The Tickmill mobile experience is all about giving you freedom. Whether you are at home, commuting, or simply away from your desk, you maintain complete oversight and control of your trading activities. This level of accessibility is invaluable for anyone serious about growing their portfolio.

Experience the power of a world-class trading platform optimized for your mobile device. Join Tickmill Nigeria and take your trading journey to the next level.

Maximizing Profit Potential with Tickmill Nigeria

Ready to unlock your full trading potential in the dynamic Nigerian market? Tickmill Nigeria stands out as a premier partner for traders seeking to maximize their profits. We understand the unique landscape of forex Nigeria and offer a robust platform designed to empower your trading journey, focusing on efficiency and opportunity.

Maximizing profit isn’t just about strategy; it’s about having the right tools and support. Here’s how Tickmill Nigeria helps you achieve your financial goals:

Competitive Spreads and Low Commissions

Experience ultra-tight spreads and low commissions, directly reducing your trading costs. This means more of your successful trades translate into higher net profits. As a leading broker Nigeria, we prioritize your bottom line, ensuring every pip counts in your favor.

Advanced Trading Platforms

Access industry-leading platforms like MetaTrader 4 and 5. These platforms come packed with advanced charting tools, technical indicators, and automated trading capabilities, giving you the edge in your trading Nigeria activities. Intuitive interfaces mean you spend less time navigating and more time executing profitable strategies.

Diverse Range of Instruments

Diversify your portfolio across a wide array of instruments, opening up more opportunities for profit generation. This breadth allows you to respond to various market conditions and expand your trading horizons.

- Major and Minor Currency Pairs

- Global Indices from leading markets

- Popular Commodities like oil and gold

- Treasury Bonds for portfolio diversification

Exceptional Execution Speed

In the fast-paced world of forex, every millisecond counts. Benefit from lightning-fast execution speeds, ensuring your trades are placed at the desired prices. This precision is crucial for capitalizing on fleeting market opportunities and minimizing slippage, a key factor in maximizing returns.

Robust Educational Resources

Knowledge is power. Tickmill Nigeria provides extensive educational materials, from insightful webinars to comprehensive guides. We help you refine your skills and make informed decisions, whether you’re new to forex Nigeria or a seasoned professional looking to sharpen your edge. Continuous learning is a cornerstone of sustained success.

Why Tickmill Nigeria is Your Partner in Profit

Choosing the right broker is a critical step towards maximizing your trading success. Tickmill Nigeria offers a blend of superior trading conditions, advanced technology, and dedicated support, making it an ideal choice for traders across the nation. Our commitment to transparency and trader empowerment sets us apart.

Don’t just trade; thrive. Join Tickmill Nigeria today and start your journey towards maximizing your profit potential in the dynamic forex market. Experience the difference a dedicated and high-performance broker can make.

Frequently Asked Questions

What makes Tickmill Nigeria a top choice for traders?

Tickmill Nigeria stands out due to its competitive trading conditions, robust regulatory compliance, cutting-edge MetaTrader platforms, exceptional customer support, and convenient local payment solutions, all tailored for the Nigerian market.

What account types does Tickmill Nigeria offer, and for whom are they best suited?

Tickmill Nigeria offers Classic, Raw, and Pro accounts. The Classic is ideal for beginners and those preferring simplicity (zero commissions). The Raw account suits experienced traders and scalpers needing ultra-low spreads. The Pro account is for professional, high-volume traders seeking optimal execution and pricing. A Demo Account is also available for practice.

How can I deposit and withdraw funds with Tickmill Nigeria?

Tickmill Nigeria provides several convenient and secure methods, including local bank transfers, popular e-wallets (Skrill, Neteller, FasaPay), international wire transfers, and credit/debit cards. Withdrawals are processed efficiently, ideally using the same method as the deposit for security and speed.

What trading platforms are available through Tickmill Nigeria?

Tickmill Nigeria offers MetaTrader 4 (MT4) and MetaTrader 5 (MT5). MT4 is the industry standard for forex and CFDs with powerful charting. MT5 is a multi-asset platform expanding to stocks, futures, and options, with more timeframes and indicators for advanced analysis.

How does Tickmill Nigeria ensure client fund security and regulatory compliance?

Tickmill Nigeria adheres to stringent global regulatory standards, including segregated client accounts (funds held separately from company capital), regulatory oversight by leading financial authorities, and negative balance protection, ensuring traders cannot lose more than their deposited capital.