Navigating the financial aspects of online trading should be as seamless as executing a trade. Funding your account efficiently and securely is paramount to seizing market opportunities and building your trading success. With Tickmill, the process of depositing funds into your trading account is designed with your convenience and peace of mind at its core. This comprehensive guide will walk you through every step, ensuring you have all the information needed to confidently manage your capital and kickstart your trading journey.

We understand that quick access to your capital, coupled with robust security, is essential for every trader. Explore our diverse range of deposit options and discover how effortless it is to empower your trading strategy. Join a community where your financial efficiency is prioritized from day one.

Ready to elevate your trading journey? Funding your account seamlessly is the first crucial step. With Tickmill Deposit, we make it incredibly straightforward to get started. You need quick, reliable ways to deposit funds into your trading account, and we deliver just that. This guide unveils everything you need to know about navigating the diverse deposit options at your fingertips.

Your trading success often hinges on quick execution and access to capital. Understanding your various funding methods ensures you can always seize market opportunities without delay. We prioritize your convenience and security, offering a range of robust solutions to support your trading activities.

- Understanding Your Deposit Options

- Popular Funding Methods

- Tickmill Minimum Deposit and Other Key Details

- Deposit at a Glance

- How to Deposit Funds: A Simple Step-by-Step Guide

- Why Choose Tickmill for Your Deposits?

- Why Choose Tickmill for Your Deposits?

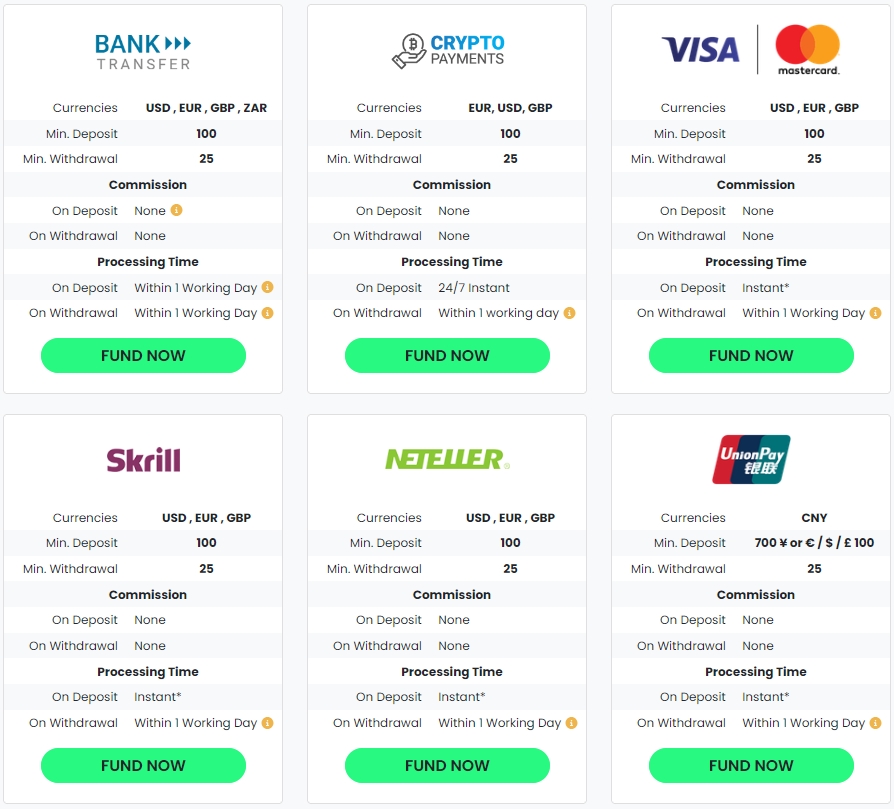

- Available Tickmill Deposit Methods

- Your Choices for Depositing Funds

- Key Details for Your Tickmill Deposit

- Bank Transfer Options for Tickmill Deposits

- E-wallet Solutions for Quick Deposits

- Credit/Debit Card Deposits: Convenience and Speed

- Accepted Card Types and Key Details

- How to Make a Tickmill Deposit: A Step-by-Step Guide

- Step 1: Access Your Client Area

- Step 2: Initiate Your Deposit

- Step 3: Choose Your Preferred Funding Method

- Step 4: Enter Deposit Details and Amount

- Step 5: Review and Confirm

- What Happens Next?

- Navigating the Tickmill Client Area

- Your Gateway to Funding: The Deposit Section

- Exploring Your Deposit Options

- Understanding the Tickmill Minimum Deposit and Other Details

- Ready to Deposit Funds?

- Completing the Deposit Form Accurately

- Minimum Tickmill Deposit Requirements

- Flexible Deposit Options and Funding Methods

- Tickmill Deposit Currencies Supported

- Deposit Processing Times Explained

- Tickmill Deposit Fees and Charges

- Tickmill’s Fee Policy on Deposits

- Understanding Potential Third-Party Charges

- Security Measures for Your Tickmill Deposit

- Protecting Your Capital: Fund Segregation and Regulatory Oversight

- Advanced Data Encryption and Transaction Security

- Rigorous Anti-Fraud Protocols and Account Protection

- Troubleshooting Common Deposit Issues

- Tickmill Deposit Bonuses and Promotions

- Comparing Tickmill Deposit Options

- Tips for a Smooth Tickmill Deposit Experience

- Prepare Your Account for Funding

- Select Your Ideal Funding Method

- Understand the Tickmill Minimum Deposit

- Address Potential Issues Promptly

- Withdrawing Funds After Your Tickmill Deposit

- Frequently Asked Questions About Tickmill Deposits

- How can I deposit funds into my Tickmill account?

- What is the tickmill minimum deposit amount?

- What deposit options are available?

- Are there any fees associated with a Tickmill Deposit?

- How quickly do my deposited funds become available for trading?

- Conclusion: Making Your Tickmill Deposit with Confidence

- Frequently Asked Questions

Understanding Your Deposit Options

Tickmill offers a comprehensive suite of deposit options designed to suit traders worldwide. Whether you prefer traditional banking methods or modern e-wallets, you will find a solution that works for you. We focus on providing flexibility and efficiency.

Popular Funding Methods

- Bank Wire Transfer: A reliable choice for larger sums.

- Credit/Debit Cards (Visa/Mastercard): Fast and widely accepted for instant deposits.

- E-Wallets (Neteller, Skrill, FasaPay, SticPay, etc.): Quick, secure, and popular for rapid transactions.

- Local Payment Solutions: Specific options tailored to various regions, ensuring accessibility.

Tickmill Minimum Deposit and Other Key Details

Before you deposit funds, understanding the tickmill minimum deposit requirement is essential. This figure ensures you have sufficient capital to engage effectively in the markets. Typically, the tickmill minimum deposit sits at $100 (or equivalent in other currencies). This accessible entry point allows both new and experienced traders to join without a substantial initial barrier.

Deposit at a Glance

| Method | Processing Time | Typical Fees |

| Credit/Debit Card | Instant | No Tickmill Fees |

| E-Wallets | Instant | No Tickmill Fees |

| Bank Wire Transfer | 1-3 Business Days | Bank fees may apply |

We believe in transparency. Tickmill does not typically charge fees for deposits, ensuring more of your capital goes directly into your trading account. However, always check with your payment provider or bank for any charges they might impose. We also employ advanced encryption and security protocols to protect your personal and financial information when you deposit funds.

How to Deposit Funds: A Simple Step-by-Step Guide

Getting your account funded is a breeze. Follow these simple steps to deposit funds and begin trading:

- Log In: Access your secure Tickmill Client Area.

- Navigate to Deposits: Locate the ‘Deposit’ or ‘Fund Account’ section within your client portal.

- Choose Your Method: Select your preferred funding method from the available deposit options.

- Enter Details: Input the desired amount and any required payment information securely.

- Confirm: Review your transaction details carefully and confirm the deposit.

- Start Trading: Once the deposit funds reflect in your account, you are ready to seize market opportunities!

Why Choose Tickmill for Your Deposits?

Our commitment to an exceptional trading experience extends to every aspect, including funding. We offer a robust infrastructure for your Tickmill Deposit, ensuring speed, security, and a wide array of funding methods. Your convenience remains our priority, so you can focus on mastering the markets.

Embark on your trading journey with confidence. A seamless Tickmill Deposit process awaits, allowing you to focus on what matters most: your trading strategy. Explore our comprehensive deposit options today and experience hassle-free funding designed for serious traders. Join the community and start trading with ease!

Why Choose Tickmill for Your Deposits?

Your trading journey deserves a financial partner that prioritizes security, efficiency, and flexibility. At Tickmill, we ensure your capital management experience is as seamless and reliable as your trading strategy. The Tickmill Deposit process is specifically designed to empower your decisions, giving you full control and peace of mind from the very first transaction.

We understand that quick and secure access to your funds is paramount. That’s why we’ve built our system around robust security protocols and a user-friendly interface. When you choose to deposit funds with Tickmill, you are choosing a platform committed to protecting your investments and facilitating your trading ambitions without unnecessary delays.

Diversity in funding methods stands as a core advantage. We offer an extensive range of deposit options to cater to your specific needs, no matter your location or preferred banking method. Whether you favor traditional banking routes or modern e-wallets, you will find a convenient way to power your trading account. Our selection includes:

- Fast bank wire transfers

- Major credit and debit cards (Visa, Mastercard)

- Popular e-wallets like Skrill, Neteller, and FasaPay

- And several other localized payment solutions

Efficiency also defines our approach. Many of our deposit methods provide instant processing, meaning your funds become available in your trading account almost immediately. This speed ensures you never miss a critical market opportunity, allowing you to react promptly to price movements and execute your trades without delay.

Accessibility is another key pillar. We believe in lowering barriers to entry, which is why our tickmill minimum deposit requirements are competitive and accommodating. This approach welcomes both new traders looking to start with a modest capital and experienced professionals who need flexible funding solutions. It makes managing your trading capital straightforward and stress-free.

Ultimately, choosing Tickmill for your deposits means opting for a trusted, efficient, and flexible service. Experience the ease and security of managing your funds with a broker dedicated to your trading success. Get started today and see the difference.

Available Tickmill Deposit Methods

Getting started with your trading capital should never be a hurdle. We know you need fast, secure, and convenient ways to manage your money. That’s why Tickmill offers a comprehensive suite of funding methods designed to make your Tickmill Deposit process incredibly straightforward.

Whether you’re looking to top up your account or make your initial investment, we provide diverse deposit options to suit every preference and location. You can quickly deposit funds and focus on what truly matters: your trading strategy.

Your Choices for Depositing Funds

Our commitment to flexibility means you have a wide array of choices when you decide to deposit funds. We categorize our main deposit options to help you find the perfect fit:

- Credit/Debit Cards: Instant and widely accepted, major cards like Visa and Mastercard offer a quick way to complete your Tickmill Deposit. Transactions process rapidly, letting you get to trading without delay.

- E-Wallets: For those who prioritize speed and convenience, popular e-wallets such as Skrill, Neteller, and others provide near-instant processing, making it effortless to deposit funds into your account. These funding methods are often preferred for their ease of use.

- Bank Wire Transfer: Ideal for larger transactions, direct bank transfers offer a robust and secure method. While processing times may be slightly longer, they remain a trusted choice for many traders ensuring significant capital moves with confidence.

- Local Payment Solutions: Depending on your region, you might find specific local funding methods tailored to your geographic needs, ensuring even greater accessibility. We strive to provide localized solutions wherever possible.

Each of these funding methods comes with its own advantages, designed to give you control over your capital. You’ll always find clear instructions and support during the process.

Key Details for Your Tickmill Deposit

Before you deposit funds, consider these key aspects that ensure a smooth transaction. Understanding the processing times and the tickmill minimum deposit for each option helps you plan effectively.

| Deposit Method | Typical Processing Time | Tickmill Minimum Deposit (Approximate) |

|---|---|---|

| Credit/Debit Cards | Instant | $100 |

| E-Wallets | Instant | $100 |

| Bank Wire Transfer | 1-3 Business Days | $200 |

Please note that the exact tickmill minimum deposit can vary slightly based on your account type and chosen currency. Always verify the latest requirements on our secure portal before you deposit funds. Our goal is to provide transparent and efficient funding methods.

We constantly work to expand our available funding methods, ensuring you always have access to the most efficient ways to manage your trading capital. Ready to make your first Tickmill Deposit? Log into your secure client area now, choose your preferred deposit option, and deposit funds with confidence. Your trading journey starts here!

Bank Transfer Options for Tickmill Deposits

Ready to power up your trading account? Exploring your bank transfer options for a seamless Tickmill Deposit is a smart move. Bank transfers remain a cornerstone among funding methods, offering a robust and secure way to deposit funds directly into your trading account. It’s a tried-and-true method that many traders trust for its reliability and directness, ensuring your capital is where it needs to be when you need it.

Whether you’re making your initial deposit or topping up your balance, Tickmill provides clear pathways for bank transfers. These deposit options typically include both local bank transfers and international wire transfers, catering to a global client base. Understanding the nuances of each helps you choose the most efficient way to get started.

How Bank Transfers Work for Your Tickmill Account:

Initiating a bank transfer for your Tickmill Deposit is straightforward. You’ll typically find the necessary bank details within your Tickmill client area. Here’s a quick overview:

- Access Details: Log into your Tickmill client portal and navigate to the ‘Deposit’ section. Select ‘Bank Transfer’ as your chosen funding method.

- Gather Information: The system will provide Tickmill’s bank account details, including the bank name, account number, SWIFT/BIC code, and beneficiary name.

- Initiate Transfer: Use these details to initiate a transfer from your personal bank account. You can do this via online banking, mobile banking app, or by visiting your local bank branch.

- Reference Clearly: Always include your Tickmill trading account number or client ID in the transfer reference. This ensures swift allocation of your deposit funds.

- Confirm & Wait: Once the transfer is sent, it typically takes a few business days for the funds to reflect in your Tickmill account. You might need to upload a proof of payment in your client portal.

Advantages and Considerations for Bank Transfers:

While bank transfers are reliable, it’s good to weigh their benefits against potential considerations to make an informed decision when you deposit funds:

| Advantages | Considerations |

|---|---|

| High Security: Utilizes established banking networks for peace of mind. | Processing Time: Can take 1-5 business days, depending on bank and region. |

| Larger Transfers: Often the best choice for substantial deposit funds due to higher limits. | Potential Fees: Your originating bank may charge transfer fees; check with them. |

| Widely Available: Accessible globally through almost any bank. | Tickmill Minimum Deposit: Always confirm your transfer meets the minimum requirement for your account type. |

Regarding the Tickmill minimum deposit, it’s crucial to check the most current figures directly within your client area, as these can vary based on account type and geographical region. Always ensure your bank transfer amount meets or exceeds this threshold to avoid any processing delays.

Choosing bank transfer as one of your deposit options means opting for a secure and direct path to fund your trading activities. It’s a solid choice for those who prioritize security and are comfortable with standard banking lead times. Take control of your trading journey today by easily adding funds to your Tickmill account through these trusted funding methods.

E-wallet Solutions for Quick Deposits

E-wallets have become a game-changer for online financial transactions, and funding your trading account is no exception. If you prioritize speed and efficiency when you deposit funds, these digital wallets are among the best deposit options available. They offer a seamless way to manage your finances, ensuring your capital is ready for action precisely when you need it. Using e-wallet funding methods brings several distinct advantages:- Instant Transactions: Many e-wallet deposits process almost instantly, letting you seize market opportunities without delay.

- Enhanced Security: E-wallets often add an extra layer of security, as you don’t directly share your bank details with every platform.

- Global Accessibility: These funding methods are widely recognized and accessible worldwide, simplifying international transactions.

We understand the importance of diverse deposit options. That’s why Tickmill supports a range of popular e-wallet services, designed to make your Tickmill Deposit experience as smooth as possible. Forget about lengthy bank transfers; with an e-wallet, your funds are typically reflected in your account within minutes.

Here’s a quick look at what to expect:| Feature | E-wallet Deposit Experience |

|---|---|

| Processing Speed | Typically Instant |

| Security Layer | Added Anonymity for Bank Details |

| Tickmill Minimum Deposit | Varies by method; check our platform for specifics |

Selecting an e-wallet for your Tickmill Deposit means opting for convenience and speed. We encourage you to explore these efficient funding methods on our platform. Check the specific tickmill minimum deposit requirements for your chosen e-wallet and start trading sooner. It’s a smart choice for quick and secure account top-ups.

Credit/Debit Card Deposits: Convenience and Speed

For traders seeking efficiency and immediate access to the markets, credit and debit card payments stand out as a premier choice for their Tickmill Deposit. These globally recognized funding methods offer unparalleled convenience, allowing you to deposit funds quickly and securely into your trading account. It’s a straightforward process designed to get you trading without unnecessary delays.

Opting for a credit or debit card provides several distinct advantages:

- Instant Processing: Funds typically reflect in your trading account almost immediately, ensuring you can seize market opportunities as they arise.

- Widespread Acceptance: Major cards like Visa and Mastercard are accepted, making this a universally accessible deposit option for most traders worldwide.

- Robust Security: Tickmill employs advanced encryption and security protocols to protect your personal and financial information during every transaction.

- Simplicity: The process is intuitive, requiring just a few clicks to complete your transfer.

When you choose this method to deposit funds, you’ll simply navigate to the funding section of your Tickmill account. Select credit/debit card as your preferred method, enter the desired amount, and provide your card details. You’ll find clear guidelines regarding the Tickmill minimum deposit, ensuring transparency before you proceed. This seamless experience underscores why many consider it one of the most reliable deposit options available.

Accepted Card Types and Key Details

We facilitate deposits through popular card networks, ensuring broad accessibility for our traders.

| Card Type | Availability | Processing Time |

| Visa | Global | Instant |

| Mastercard | Global | Instant |

Remember, while we aim for instant processing, occasional delays might occur due to banking network verifications. Rest assured, our support team is always ready to assist if you encounter any issues with your Tickmill Deposit.

How to Make a Tickmill Deposit: A Step-by-Step Guide

Ready to take control of your trading journey? Making a Tickmill Deposit is your gateway to the global markets. We understand the importance of a smooth, secure process for you to deposit funds into your trading account. Our aim is to make funding your account as straightforward as possible, letting you focus on what matters most: your trading strategy. This guide breaks down each step, ensuring you experience an effortless start.

Step 1: Access Your Client Area

Your first move involves logging into your secure Tickmill client area. This personalized dashboard is your central hub for all account management, including making deposits. Use your registered credentials to gain access. If you’re new, a quick account registration is all it takes to get started.

Step 2: Initiate Your Deposit

Once inside your client area, navigate to the ‘Deposit’ or ‘Fund Account’ section. You’ll find this prominently displayed, designed for easy access. This action opens up the various deposit options available to you.

Step 3: Choose Your Preferred Funding Method

Tickmill offers a diverse array of secure funding methods tailored to meet different needs. Whether you prefer traditional banking or modern e-wallets, you’ll find a suitable choice. We aim to provide flexibility and convenience, ensuring you can quickly and efficiently add capital. Each of these deposit options comes with its own set of characteristics, such as processing times.

- Bank Wire Transfer: Ideal for larger amounts, offering high security.

- Credit/Debit Cards: Instant and widely accepted, perfect for quick transfers.

- E-wallets (e.g., Skrill, Neteller, FasaPay): Fast, secure, and convenient for many traders globally.

- Local Payment Solutions: Region-specific options providing tailored accessibility.

Step 4: Enter Deposit Details and Amount

After selecting your desired funding method, you will need to specify the amount you wish to deposit. Carefully input the figures and select your trading account. It’s crucial here to be aware of the tickmill minimum deposit requirement, which can vary slightly depending on the chosen method and your account currency. Our system clearly indicates these thresholds to help you complete the transaction without hitches.

Step 5: Review and Confirm

Before finalizing your Tickmill Deposit, take a moment to review all the entered information. Check the amount, the selected funding method, and the target trading account. A quick review helps prevent any errors. Once you’re satisfied everything is correct, confirm the transaction. Our robust security protocols safeguard your deposit funds throughout this entire process.

What Happens Next?

Upon successful confirmation, the processing time for your deposit begins. While some funding methods offer instant crediting, others, like bank transfers, may take a few business days. We always strive for the fastest possible processing times so you can start trading without unnecessary delays.

Embark on your trading journey with confidence. Making a Tickmill Deposit is a clear, secure process, designed with your convenience in mind. If you ever have questions, our dedicated support team is ready to assist. Join us and experience seamless financial management for your trading endeavors.

Navigating the Tickmill Client Area

The Tickmill Client Area is your personalized control center, designed to give you seamless command over your trading journey. It’s where you manage accounts, track performance, and, most importantly, handle all your financial operations with ease and confidence. Getting around is straightforward, ensuring you spend less time on administration and more on what truly matters: trading.

Your Gateway to Funding: The Deposit Section

- Look for the prominent “Deposits” or “Funds” tab, usually located in the main navigation menu or dashboard sidebar.

- Clicking this will take you directly to the funding hub, where all your deposit options are presented clearly.

- This dedicated area empowers you to swiftly deposit funds into your trading account whenever you need to seize market opportunities.

Exploring Your Deposit Options

Tickmill understands that traders have diverse needs, which is why we offer a comprehensive suite of funding methods. We ensure each method is secure, reliable, and convenient, giving you flexibility.

We provide various deposit options to cater to your preferences. Whether you prefer traditional banking or modern e-wallets, you will find a method that suits you.

Popular Funding Methods Include:

| Method Category | Key Features |

| Bank Transfers | Secure, suitable for larger amounts, global reach. |

| Credit/Debit Cards | Instant processing, widely accepted, convenient. |

| E-Wallets | Fast transactions, low fees, high security. |

Understanding the Tickmill Minimum Deposit and Other Details

Before you proceed to deposit funds, it’s always smart to be aware of the specific requirements. Each of our deposit options comes with its own set of details, including processing times and any applicable fees. The Tickmill minimum deposit can vary depending on the chosen funding method and your account type.

We make sure all this information is transparently displayed within the Client Area. You get full clarity upfront, allowing you to choose the most suitable method for your financial strategy. Our goal is to make your funding experience as seamless and predictable as possible.

Ready to Deposit Funds?

- Select your preferred deposit option from the available list.

- Enter the amount you wish to deposit, keeping the Tickmill minimum deposit in mind.

- Follow the on-screen instructions specific to your chosen funding method.

- Confirm the transaction.

Our Client Area provides real-time updates on your transaction status, so you always know where your funds are. This transparent approach ensures peace of mind, allowing you to focus on your trading activities without unnecessary distractions.

Completing the Deposit Form Accurately

Accuracy is paramount when you complete your Tickmill Deposit form. Getting every detail correct ensures your deposit funds move smoothly and reach your trading account without any unnecessary delays. A small error can lead to frustrating hold-ups and extra work, so let’s get it right the first time.

Before you even begin filling out the form, take a moment to gather all necessary information. This proactive step streamlines the entire process. Here are the key details you’ll typically need to provide:

- Personal Information: Your full name, address, and contact details must match your registered account precisely.

- Payment Method Details: Whether using a bank transfer, credit/debit card, or e-wallet, ensure you have the correct account numbers, card details, or login information ready.

- Deposit Amount: Clearly state the exact amount you intend to deposit. Double-check for any typos.

Tickmill provides a variety of convenient funding methods to choose from. Carefully select the one that best suits your needs and region. Each of our trusted deposit options may have slightly different processing times and potential fees, so a quick review can save you time later.

Always pay close attention to the Tickmill minimum deposit requirement. This amount can vary depending on the chosen funding method. Entering an amount below the specified minimum will result in a failed transaction, triggering delays as you correct and resubmit. Make sure your intended deposit meets or exceeds this critical threshold.

“Haste makes waste, especially when handling your finances. A few extra seconds of verification can save hours of frustration.”

Finally, before you hit that “submit” button, take a deep breath and review every single field on the form. Are your account details correct? Is the amount accurate? Did you select the right funding method? A quick, thorough double-check is your best defense against errors. Once submitted accurately, our system processes your Tickmill Deposit swiftly, and your deposit funds will reflect in your account according to the chosen method’s typical processing time.

Minimum Tickmill Deposit Requirements

Ready to kickstart your trading journey with Tickmill? Understanding the minimum deposit requirements is a crucial first step. We believe in making trading accessible, and our requirements reflect that commitment. You’ll find it straightforward to get started, whether you’re a seasoned trader or just beginning.

The good news is that the Tickmill minimum deposit is designed to be highly accessible. For most standard account types, you can begin trading with a modest amount. This approach ensures more traders can engage with global markets without a prohibitive initial financial commitment. It’s about opening doors, not closing them.

“Starting small can lead to big achievements. Our accessible deposit structure empowers you to begin your trading journey with confidence.”

Flexible Deposit Options and Funding Methods

While the initial tickmill minimum deposit sets a low entry bar, we also offer exceptional flexibility in how you deposit funds. Tickmill supports a diverse range of deposit options, ensuring you can choose the method that best suits your needs and location. Our goal is to make the process of adding capital to your account as seamless and secure as possible.

We partner with various trusted payment providers to offer multiple funding methods. This means you have choices when you decide to deposit funds. Here are some of the common avenues you can expect:

- Bank Wire Transfer

- Credit/Debit Cards (Visa, MasterCard)

- Popular e-Wallets (like Skrill, Neteller, FasaPay, SticPay)

- Local payment solutions, depending on your region

Each of these funding methods comes with its own processing times and, occasionally, currency conversion implications. However, rest assured that the fundamental Tickmill Deposit minimum remains consistent across most of these options, maintaining our promise of accessibility.

Getting Started with Your Tickmill Deposit

Depositing funds into your Tickmill account is designed to be hassle-free. Once you’ve chosen your preferred funding method, simply follow the clear instructions on our secure client portal. Our systems are built for efficiency, ensuring your funds are processed quickly so you can focus on what matters most: trading. We encourage you to explore our platform and experience firsthand how easy it is to manage your trading capital. Join our thriving community today and take control of your financial future!

Tickmill Deposit Currencies Supported

Understanding the supported currencies is vital for a smooth and cost-effective trading journey. Tickmill makes it incredibly convenient to manage your funds by offering a robust selection of major global currencies for your Tickmill Deposit. This flexibility ensures you can seamlessly deposit funds without unnecessary conversion hassles.

We recognize that traders come from diverse backgrounds, each with preferred currencies. That’s why we’ve streamlined our deposit options to cater to a global audience. Whether you’re topping up your account or making your initial Tickmill minimum deposit, having your local or preferred currency readily available simplifies the process immensely.

Here are the primary currencies you can use to deposit funds into your Tickmill account:

| Currency | Symbol |

|---|---|

| United States Dollar | USD |

| Euro | EUR |

| British Pound | GBP |

| Polish Zloty | PLN |

| Czech Koruna | CZK |

Choosing to deposit in one of these supported currencies offers significant advantages:

- Reduced Conversion Costs: Avoid hefty currency conversion fees often associated with transferring funds in unsupported denominations.

- Faster Processing: Transactions in primary currencies often clear quicker, getting you ready to trade sooner.

- Simplified Accounting: Managing your trading capital becomes more straightforward when your base currency aligns with your account currency.

- Greater Control: You maintain better oversight of your capital without fluctuations caused by multiple currency conversions.

This extensive range of supported currencies underscores our commitment to providing efficient and accessible funding methods. We strive to make your experience with us as straightforward as possible, from the moment you decide to deposit funds right through to your trading activities. Start your seamless funding experience today!

Deposit Processing Times Explained

Understanding how long it takes for your funds to become available is crucial for effective trading. At Tickmill, we prioritize efficiency, ensuring your Tickmill Deposit process is as smooth and swift as possible. However, the exact time your funds take to reflect in your trading account can vary. Let’s break down what influences these times and what you can expect.

When you decide to deposit funds, several factors come into play. These include the specific funding method you choose, the processing policies of your bank or payment provider, and any necessary security checks. Our goal is always to process your transaction quickly, allowing you to focus on your trading strategies without unnecessary delays.

Exploring Our Deposit Options and Processing Speeds

We offer a variety of deposit options designed to suit your needs. Each of our trusted funding methods comes with its own typical processing timeframe. Here’s a general overview:

- Electronic Wallets (e.g., Skrill, Neteller): Often the fastest route. Deposits usually process instantly or within a few minutes after confirmation.

- Credit/Debit Cards (Visa, Mastercard): These are also typically very quick. Most card deposits are processed instantly, but occasionally, depending on your bank, it might take up to a few hours.

- Bank Wire Transfers: While reliable for larger amounts, bank transfers generally take longer. Expect these to process within 1-3 business days, as they involve interbank transfers and reconciliation processes.

- Local Payment Solutions: Availability and processing times for these can vary by region. We strive for quick processing, but local bank holidays or specific regional banking practices might affect the speed.

Understanding “Instant” Deposits and Potential Delays

When we say a deposit processes “instantly,” it means Tickmill immediately receives notification and credits your trading account. For most electronic funding methods, this is the reality. However, external factors can sometimes introduce slight delays:

“While many of our deposit options are instant, please allow for potential external bank or payment provider processing times that are outside of our immediate control.”

Potential reasons for a delay:

- Bank Holidays: National or international bank holidays can pause processing for bank wires and sometimes affect card transactions.

- Verification Requirements: If your account or deposit requires additional verification (e.g., identity checks for large deposits, or if it’s your first deposit with a new method), this will naturally extend the processing time. This is part of our commitment to security and regulatory compliance.

- Incorrect Details: Always double-check your deposit details. Even a small error can lead to significant delays as the payment is reconciled or returned.

Considering the Tickmill Minimum Deposit

Regardless of the tickmill minimum deposit requirement, our commitment to efficient processing remains the same. Whether you’re funding a smaller amount to start or making a larger capital injection, the outlined processing times for your chosen funding methods generally apply universally. We make sure every deposit is handled with the same level of priority and security.

What to Do if Your Deposit is Delayed

If your deposit takes longer than the stated average processing time, don’t worry. First, check your payment provider’s transaction status. If everything seems fine there, gather your transaction ID or payment proof and reach out to our dedicated support team. They are available to assist you and help track your deposit efficiently.

We understand that timely access to your funds is paramount. Our team works hard to ensure your Tickmill Deposit experience is seamless, secure, and as fast as current payment technologies allow. Join us and experience reliable funding methods designed with your trading needs in mind.

Tickmill Deposit Fees and Charges

Understanding the costs associated with funding your trading account is crucial. When you initiate a Tickmill Deposit, clarity on potential fees helps you manage your capital effectively. Our goal is to ensure you know exactly what to expect, making your experience smooth and transparent.

Tickmill prides itself on offering a highly competitive and transparent trading environment. You will be pleased to know that for the vast majority of popular funding methods, Tickmill imposes no direct deposit fees. This means more of your capital goes directly into your trading account, not towards transaction charges.

However, it is vital to recognize that while Tickmill often waives its own fees, external payment providers might impose their own charges. These third-party costs are outside Tickmill’s control. Here’s a general overview:

| Funding Method | Tickmill Charge | Potential Third-Party Charge |

|---|---|---|

| Bank Wire Transfer | None | Yes (Intermediary bank fees) |

| Credit/Debit Cards | None | Rarely (Check with your bank) |

| E-Wallets (Skrill, Neteller, etc.) | None | Rarely (Check with provider) |

| Other Local Payment Solutions | None | Yes (Varies by provider) |

When you prepare to deposit funds, always check with your specific bank or payment service provider. They can confirm any charges they might apply for transferring money. For instance, international bank wire transfers commonly incur fees from intermediary banks, even if Tickmill itself does not charge for the Tickmill Deposit.

Tickmill sometimes offers to cover small bank wire transfer fees above a certain deposit amount, further easing the process for clients. This commitment underscores their dedication to providing a cost-effective solution for all your deposit options. Always review the latest information directly on their platform.

Knowing the Tickmill minimum deposit for your account type is a great start. Coupled with an understanding of fee structures for various funding methods, you can make informed decisions. We encourage you to always confirm the specific details for your chosen deposit options before you proceed. This approach helps ensure a hassle-free experience every time you add capital to your trading account.

Tickmill’s Fee Policy on Deposits

At Tickmill, we believe in straightforward and transparent trading. That philosophy extends directly to our fee policy regarding your funds. When you make a Tickmill Deposit, our primary aim is to ensure your capital reaches your trading account without unexpected deductions from our side. This means we generally absorb transfer fees, making it cost-effective for you to deposit funds.

- Bank Transfer Fees: Your personal bank might levy charges for processing wire transfers, especially for international transactions.

- Currency Conversion Costs: If your chosen deposit currency differs from your trading account’s base currency, your bank or payment service provider may apply a conversion fee. This ensures the funds are converted correctly before reaching your account.

- Intermediary Bank Charges:

Understanding Potential Third-Party Charges

When you prepare to deposit funds into your Tickmill account, it’s crucial to understand that external fees might apply. While Tickmill prides itself on offering commission-free deposits for many funding methods, various third parties involved in the transaction might levy their own charges. These aren’t fees from Tickmill directly, but rather from the financial institutions or payment processors handling your money transfer.

Think of it this way: your bank, the intermediary bank, or the specific payment gateway you choose among the available deposit options could impose a service charge. These charges vary widely based on your chosen method, your geographic location, and even your bank’s specific policies. For instance, a bank wire transfer, while robust, often incurs fixed fees from both the sending and receiving banks, regardless of the amount you transfer.

How do you identify these potential costs before you complete your Tickmill Deposit?

- Review your chosen funding method: Always check the terms and conditions of your bank or payment service provider before initiating a transfer. They typically outline any fees for sending money internationally or converting currency.

- Consider currency conversion: If your local currency differs from your trading account’s base currency, your bank or payment processor might charge a conversion fee, often with an unfavorable exchange rate.

- Small deposits: Be mindful that for a smaller Tickmill minimum deposit, a fixed third-party fee can represent a significant percentage of your funds. Always calculate the total cost.

We empower our clients with clear information. Always consult with your chosen payment provider for a complete breakdown of any fees associated with sending your deposit funds. Being proactive ensures a smoother, more transparent funding experience without any unexpected surprises.

Security Measures for Your Tickmill Deposit

When you embark on your trading journey, the safety of your capital is paramount. We understand this deeply. That’s why every Tickmill Deposit benefits from a comprehensive, multi-layered security framework designed to protect your funds and personal information. We make sure you can deposit funds with complete peace of mind, knowing robust measures guard your investment.

Protecting Your Capital: Fund Segregation and Regulatory Oversight

One of the cornerstones of our security strategy is strict regulatory compliance and the segregation of client funds. We operate under the stringent oversight of top-tier financial authorities, which mandate the highest standards of financial conduct and client protection. This means:

- Your deposit funds are held in separate bank accounts, entirely distinct from Tickmill’s operational capital. This ensures that your money is safe, even in unforeseen circumstances concerning the company.

- We adhere to strict capital requirements and internal controls, regularly audited by independent bodies. This commitment to transparency and accountability means all funding methods meet rigorous standards.

- Should you ever have questions regarding your Tickmill Deposit or our financial stability, our dedicated support team provides clear, prompt answers.

Advanced Data Encryption and Transaction Security

The digital age demands advanced protection for your sensitive data. When you initiate a Tickmill Deposit or manage your account, your information is shielded by state-of-the-art encryption technologies. We employ Secure Socket Layer (SSL) encryption, the industry standard for secure online transactions.

This means:

“Every piece of information you transmit – from personal details to payment credentials – is encrypted, making it unreadable to unauthorized parties. Your financial integrity is our priority.”

Our secure payment gateways handle all deposit options. These systems undergo continuous monitoring and updates to counteract evolving cyber threats, guaranteeing the integrity of every transaction, whether it’s the Tickmill minimum deposit or a larger transfer.

Rigorous Anti-Fraud Protocols and Account Protection

Preventing fraud and unauthorized access is critical for safeguarding your Tickmill Deposit. We implement robust Anti-Money Laundering (AML) and Know Your Customer (KYC) procedures. These vital processes verify the identity of our clients and ensure that all deposit funds originate from legitimate sources, protecting both you and the broader financial ecosystem.

Additionally, we empower you with tools to enhance your personal account security:

- Two-Factor Authentication (2FA): Add an extra layer of security to your account login, requiring a code from your mobile device in addition to your password.

- Secure Password Policies: We encourage strong, unique passwords and provide guidance on best practices for password management.

- Constant Monitoring: Our security teams continuously monitor for suspicious activity, proactively identifying and mitigating potential threats to your account and your deposit options.

Rest assured, from the moment you consider your Tickmill Deposit through every step of your trading journey, we commit to safeguarding your assets with the highest level of security.

Troubleshooting Common Deposit Issues

Even with the most streamlined financial platforms, occasional hiccups can occur when you attempt to deposit funds. While your Tickmill Deposit experience is designed to be seamless, knowing how to navigate common issues quickly saves you time and frustration. Let’s explore some frequent challenges and direct solutions to get your capital moving.

Payment Declines and Failures: One of the most common issues users face is a payment decline. Several factors can lead to this, and recognizing them is the first step to resolution.

- Incorrect Details: Always double-check your card number, expiration date, CVV, or bank account information. A single typo can prevent a successful transaction.

- Insufficient Funds: Ensure your bank account or card has enough money to cover your intended Tickmill Deposit amount.

- Bank Restrictions: Some banks might flag international transactions or online brokerage deposits for security reasons. Contact your bank to pre-authorize the payment or verify its legitimacy.

- Expired Card: Verify your card is still valid.

Quick Fix: Re-enter details carefully, check your balance, or contact your bank directly. If issues persist, consider trying an alternative among the available deposit options.

Funds Not Appearing in Account: You’ve initiated your transfer, but your trading account doesn’t reflect the new balance. What gives? It often comes down to processing times or pending checks.

- Processing Times: Different funding methods have varying processing speeds. Bank transfers might take 1-3 business days, while e-wallets are often instant. Check the typical processing time for your chosen method.

- Bank Holidays/Weekends: Transfers initiated close to or during non-business days can experience delays.

- Pending Verification: Sometimes, new deposits or larger amounts trigger additional security checks, temporarily delaying fund allocation.

Quick Fix: Allow the stated processing time to elapse. Check your email for any verification requests from Tickmill. Keep your transaction reference number handy.

Understanding Deposit Limits: Every platform has parameters, and Tickmill is no exception when it comes to managing your funds effectively. Ensure your transfer aligns with these limits.

| Issue | What to Check | Solution |

|---|---|---|

| Below Tickmill minimum deposit | Is your amount less than required? | Increase your deposit to meet the minimum. |

| Exceeding maximums | Are you trying to deposit too much in one go? | Break your deposit into smaller transactions or consider alternative funding methods with higher limits. |

Familiarize yourself with the specific limits for each of the available deposit options before initiating a transfer.

Account Verification Delays: Sometimes, the delay isn’t with the transaction itself, but with your account’s verification status, especially for new users or when using new deposit options. This is a crucial security step.

Security is paramount. Ensuring your account is fully verified protects your investments and complies with regulatory standards. Timely document submission speeds up this process.

Make sure all your submitted identification and proof of address documents are clear, valid, and match your registration details. Any discrepancies can pause your ability to deposit funds or withdraw them later.

When to Contact Support: You’ve tried the above steps, but your issue persists. This is the moment to reach out to the Tickmill support team. They are ready to assist.

- Provide all relevant details: transaction ID, amount, date, method used, and any error messages received.

- Be clear and concise about the problem you are experiencing with your Tickmill Deposit.

- Support agents are equipped to investigate deeper and offer personalized solutions.

Proactive checks and quick action mean you can get back to trading faster, ensuring your capital is where it needs to be when you need it. We’re here to help you every step of the way.

Tickmill Deposit Bonuses and Promotions

Unlocking extra value when you fund your trading account makes the journey even more rewarding. At Tickmill, we believe in empowering our traders from the very beginning, and our suite of deposit bonuses and promotions stands as a testament to that commitment. These carefully crafted offers provide excellent opportunities to enhance your trading capital, giving you more flexibility and potential in the markets.

When you decide to deposit funds with Tickmill, you’re not just adding to your account; you’re often opening the door to various enticing benefits. We regularly update our promotional landscape to ensure fresh, exciting incentives are available for both new and loyal clients.

Explore Our Diverse Promotions: Our promotions vary, designed to cater to different trading styles and needs. While specific offers change, here are common types you might encounter:

- Deposit Bonus Programs: Receive a percentage of your Tickmill deposit as bonus credit, directly boosting your trading power. These are fantastic for growing your initial capital.

- Trading Contests: Participate in competitive events where your trading performance can earn you significant prizes, often tied to specific funding levels.

- Referral Programs: Share the Tickmill experience with others and earn rewards when your friends or colleagues deposit funds and start trading.

- Loyalty Schemes: Long-term traders often benefit from exclusive perks, lower spreads, or rebates, sometimes activated after a certain volume of trades or deposits.

Qualifying for Tickmill’s Offers: Claiming these valuable promotions is usually straightforward. The primary step involves depositing funds into your live trading account. However, always review the specific terms. Some offers might have a Tickmill minimum deposit requirement, while others could be tied to particular account types or funding methods. Understanding these details ensures you don’t miss out.

We provide a range of secure and efficient deposit options, allowing you to choose the method that best fits your convenience and speed requirements. From bank transfers to e-wallets, the process of adding funds to your account is designed to be seamless.

Essential Considerations Before You Claim: To make the most of any bonus or promotion, keep these points in mind:

| Consideration | Description |

|---|---|

| Terms & Conditions | Always read the full terms and conditions for each specific promotion. This covers eligibility, withdrawal rules, and any trading requirements. |

| Time Limits | Some bonuses come with an expiry date. Ensure you activate and utilize them within the specified timeframe. |

| Eligibility | Confirm your region and account type qualify for the chosen promotion. |

These bonuses are an excellent way to enhance your trading journey, providing additional resources as you navigate the markets. We encourage you to explore the current promotions page to see what exciting opportunities await your next Tickmill Deposit.

Comparing Tickmill Deposit Options

Starting your trading journey with Tickmill means more than just opening an account; it involves confidently funding it. Understanding the various Tickmill Deposit options available is crucial for a smooth and efficient experience. We know that every trader has unique needs, which is why Tickmill provides a diverse array of funding methods designed for convenience and security. Let’s break down these choices so you can decide the best way to deposit funds into your trading account.

When you’re ready to add capital, you’ll find that Tickmill offers flexibility, allowing you to choose a method that aligns with your priorities. Whether you value speed, minimal fees, or a lower tickmill minimum deposit, there’s an option for you. Consider the following key factors when evaluating your choices:

- Processing Time: How quickly will your funds be available for trading?

- Fees: Are there any charges associated with the deposit method?

- Accessibility: Is the method commonly used and easy for you to access?

- Minimum Deposit: What is the lowest amount you can deposit using this method?

To give you a clearer picture, here’s a quick comparison of some popular deposit options:

| Deposit Method | Typical Processing Time | Common Fee Structure | Key Advantage |

|---|---|---|---|

| Credit/Debit Cards (Visa, MasterCard) | Instant | Usually zero/low fees from Tickmill | Immediate access to funds |

| E-wallets (Skrill, Neteller, FasaPay) | Instant | Often zero fees from Tickmill | Fast, secure, and private transactions |

| Bank Wire Transfer | 1-3 Business Days | Varies (bank fees may apply) | Suitable for larger deposits |

Selecting the right deposit method can significantly impact your trading efficiency. For instance, if you’re looking to start trading immediately, options that offer instant processing times are ideal. If you’re planning to make a substantial initial investment, a bank wire might be more suitable, despite the longer processing period.

Tickmill strives to make the process of depositing funds as straightforward as possible. We encourage you to review all available deposit options directly within your client area to ensure you select the one that best fits your individual trading strategy and financial preferences. Make an informed decision and confidently manage your trading capital.

Tips for a Smooth Tickmill Deposit Experience

Navigating your financial transactions should always be straightforward, especially when you want to fund your trading account. A seamless Tickmill Deposit process allows you to focus on what truly matters: your trading strategy. As an experienced content creator, I understand the value of efficiency. Here are some expert tips to ensure your experience adding funds is always smooth and hassle-free.

Prepare Your Account for Funding

Before you initiate any Tickmill Deposit, a little preparation goes a long way. This step significantly reduces potential delays and ensures a quick transaction.- Verify Your Account: Complete all necessary identity verification steps beforehand. An unverified account can pause your deposit funds indefinitely. Tickmill prioritizes security, so completing this upfront is crucial.

- Check Your Details: Double-check that your personal information on your Tickmill account matches the details of your chosen funding method. Mismatches often trigger security checks, slowing down the process.

- Review Terms and Conditions: Quickly read through the deposit terms. Understanding any specific requirements for different deposit options prevents surprises.

Select Your Ideal Funding Method

Tickmill offers a variety of funding methods to suit diverse needs. Choosing the right one for your Tickmill Deposit impacts speed and convenience.Consider these factors when picking from the available deposit options:

| Factor | Consideration |

|---|---|

| Speed | How quickly do you need funds in your account? E-wallets are often instant. |

| Fees | Are there any transaction fees from your bank or the payment provider? Tickmill often covers certain fees. |

| Convenience | Which method is easiest for you to access and use regularly? |

| Currency | Does your chosen method support your preferred account currency to avoid conversion fees? |

Popular choices include bank transfers, credit/debit cards, and various e-payment systems. Each option provides a secure way to deposit funds.

Understand the Tickmill Minimum Deposit

Every broker sets a minimum amount required to open and fund an account. Knowing the Tickmill minimum deposit is essential before you proceed.“Always confirm the current minimum deposit requirement. This ensures your transaction processes without needing additional top-ups or corrections, saving you valuable time.”

This threshold ensures you can access all account features and begin trading effectively. If your initial transfer falls below this amount, you might need to deposit more, which delays your market entry.

Address Potential Issues Promptly

Even with the best preparation, unforeseen issues can arise. Knowing how to react helps keep your Tickmill Deposit smooth.If your deposit funds face a snag:

- Review Transaction Status: First, check the status within your Tickmill client area. It often provides real-time updates.

- Check Your Payment Provider: Confirm the transaction status with your bank or e-wallet provider. Sometimes, issues originate on their end.

- Contact Support: If you cannot resolve the issue yourself, reach out to Tickmill’s dedicated customer support. Provide all transaction details, including time, amount, and method used. Their expert team can quickly diagnose and help resolve deposit options related queries.

A proactive approach to any issue ensures your capital reaches your trading account swiftly. We empower you to make informed decisions and experience seamless financial operations. Embark on your trading journey with confidence, knowing your Tickmill Deposit is always in capable hands.

Withdrawing Funds After Your Tickmill Deposit

You’ve successfully navigated the markets, made strategic trades, and now it’s time to enjoy the fruits of your labor. After a successful Tickmill Deposit, understanding the withdrawal procedure ensures a smooth experience. Getting your earnings from Tickmill is a straightforward process, designed with your security and convenience in mind.

Tickmill prioritizes the safety of your capital. Adhering to strict regulatory standards, the platform employs a “same source” rule for withdrawals. This means your funds typically return to the original funding methods you used to deposit funds. This policy safeguards against fraud and money laundering, providing an extra layer of protection for your assets.

Consider these key principles for your withdrawal journey:

- Security First: Tickmill verifies all withdrawal requests to protect your account.

- Source Matching: Funds always return to the original source you used to deposit.

- Clarity and Transparency: We clearly communicate all potential fees and processing times.

Just as you had a range of deposit options when you initially funded your account, Tickmill offers various methods for withdrawing your profits. These generally mirror the ways you can put money into your trading account.

| Withdrawal Method | Typical Processing Time | Important Considerations |

|---|---|---|

| Bank Wire Transfer | 1-3 business days | May incur bank charges; ideal for larger amounts. |

| Credit/Debit Cards | Up to 1 business day | Withdrawals typically cap at the amount deposited via card. |

| E-wallets (e.g., Skrill, Neteller) | Within minutes to a few hours | Usually the fastest option; ensure your e-wallet account is verified. |

Please remember, the precise availability of certain methods might depend on your region and the specific entity you trade with.

To ensure a smooth and swift withdrawal process, consider these crucial points before initiating your request:

“A well-prepared withdrawal request is a swift one. Double-check your details and ensure your account is fully verified for an unimpeded process.”

- Account Verification: Make sure your trading account is fully verified with all necessary KYC (Know Your Customer) documents submitted and approved.

- Matching Details: The name on your chosen withdrawal method must precisely match the name on your Tickmill trading account.

- Currency Conversion: Be aware of potential currency conversion fees if your withdrawal currency differs from your account’s base currency.

- Flexible Withdrawals: While there’s a Tickmill minimum deposit to start trading, withdrawals typically have very low or no minimums, allowing you to access your earnings flexibly.

Ready to manage your funds with confidence? Our platform makes it simple to access your earnings after every successful Tickmill Deposit. Join our community of traders who value transparency and efficiency in every financial transaction.

Frequently Asked Questions About Tickmill Deposits

Navigating the world of online trading often starts with a clear understanding of how to manage your capital. We know you have questions about funding your account, and we are here to provide clear, concise answers. Our aim is to make your experience seamless, allowing you to focus on your trading strategies with confidence.

Here are some of the most common questions our traders ask about making a Tickmill Deposit:

How can I deposit funds into my Tickmill account?

Adding funds to your Tickmill account is a straightforward process designed for convenience. Once you log into your Client Area, you will find a dedicated ‘Deposit’ section. There, you can select your preferred funding method from a range of secure deposit options. Simply follow the on-screen instructions, enter the desired amount, and confirm your transaction. We prioritize security and ease of use for every Tickmill Deposit.

What is the tickmill minimum deposit amount?

The tickmill minimum deposit is set at a highly accessible level to ensure that traders of all experience levels can get started. For most account types, you can begin trading with just 100 USD (or equivalent in another currency). This low entry barrier reflects our commitment to making the markets accessible to a wider audience, empowering more individuals to explore trading opportunities.

What deposit options are available?

We offer a comprehensive selection of funding methods to suit your needs, ensuring you can deposit funds with ease and security. Our goal is to provide flexibility and convenience for every Tickmill Deposit. Here are some of the popular deposit options you can use:

- Bank Wire Transfer

- Credit/Debit Cards (Visa, MasterCard)

- Skrill

- Neteller

- Fasapay

- UnionPay

Each method is designed for efficiency, ensuring your funds are processed securely. You can view the full list and specific details within your Client Area.

Are there any fees associated with a Tickmill Deposit?

At Tickmill, we believe in transparency and want you to keep more of your hard-earned capital for trading. We cover all deposit fees charged by electronic payment systems. This means when you make a Tickmill Deposit, the amount you transfer is the amount that lands in your trading account. Bank wire transfers, however, might incur charges from intermediary banks, which are beyond our control. We encourage you to check with your bank regarding any potential fees from their side.

How quickly do my deposited funds become available for trading?

We understand that timely access to your capital is crucial for effective trading. The processing time for your Tickmill Deposit largely depends on the funding method you choose:

| Funding Method | Typical Processing Time |

|---|---|

| Credit/Debit Cards | Instant |

| Skrill, Neteller, Fasapay, UnionPay | Instant |

| Bank Wire Transfer | 1-3 business days |

Instant methods allow you to deposit funds and start trading almost immediately, giving you swift access to market opportunities. For bank wire transfers, the timing can vary based on your bank and international banking systems. Rest assured, we process all incoming funds as quickly as possible upon receipt.

Conclusion: Making Your Tickmill Deposit with Confidence

You now possess a clear understanding of the streamlined process for making a Tickmill Deposit. Our aim is always to empower your trading journey by ensuring every step, especially funding your account, is as transparent and secure as possible. We know that convenience and reliability are paramount when you decide to deposit funds into your trading account.

Tickmill provides a robust framework for managing your capital, offering a variety of secure funding methods designed to suit your preferences. From the moment you consider your initial Tickmill minimum deposit to exploring the diverse deposit options available, we prioritize your peace of mind.

Here’s why you can proceed with absolute assurance:

- Unwavering Security: Tickmill employs advanced encryption and security protocols to protect your transactions and personal data.

- Flexible Choices: A wide range of deposit methods means you can choose what works best for you, ensuring quick and efficient transfers.

- Dedicated Support: Our team stands ready to assist you with any queries, ensuring a smooth experience from start to finish.

- Accessibility: With competitive minimum deposit requirements, Tickmill opens up opportunities for traders at various levels.

It’s time to translate your trading strategies into action. Take advantage of Tickmill’s dependable deposit system and focus on what matters most: your trading success. We make it simple for you to fund your account and begin trading with a brokerage that truly values your confidence.

Frequently Asked Questions

What is the minimum deposit amount for a Tickmill account?

The Tickmill minimum deposit is generally $100 (or its equivalent in other currencies) for most standard account types, making it accessible for a wide range of traders.

What are the available deposit options at Tickmill?

Tickmill offers various funding methods including Bank Wire Transfer, Credit/Debit Cards (Visa/Mastercard), and popular E-Wallets like Neteller, Skrill, and FasaPay. Local payment solutions are also available depending on your region.

Does Tickmill charge fees for deposits?

Tickmill typically does not charge fees for deposits, meaning the full amount you transfer often reaches your trading account. However, third-party payment providers or banks might impose their own charges, especially for bank wire transfers or currency conversions.

How long does it take for deposited funds to appear in my Tickmill account?

Processing times vary by method. E-wallets and Credit/Debit Card deposits are usually instant. Bank Wire Transfers typically take 1-3 business days. Local payment solutions’ times can vary.

What security measures does Tickmill have in place for deposits?

Tickmill employs robust security measures including segregation of client funds from company capital, advanced SSL encryption for all transactions, strict Anti-Money Laundering (AML) and Know Your Customer (KYC) protocols, and offers Two-Factor Authentication (2FA) for account protection.