Are you ready to explore vast financial opportunities? The world of commodities trading presents a dynamic landscape for strategic investors and traders alike. At Tickmill, we open the door to a diverse range of raw materials, allowing you to participate in global economic shifts and industrial demands.

Discover how speculating on assets like crude oil, natural gas, or precious metals can add unique diversification and potential growth to your portfolio. We provide the tools and competitive conditions you need to navigate these exciting markets with confidence.

Commodities trading offers unique diversification for any portfolio.

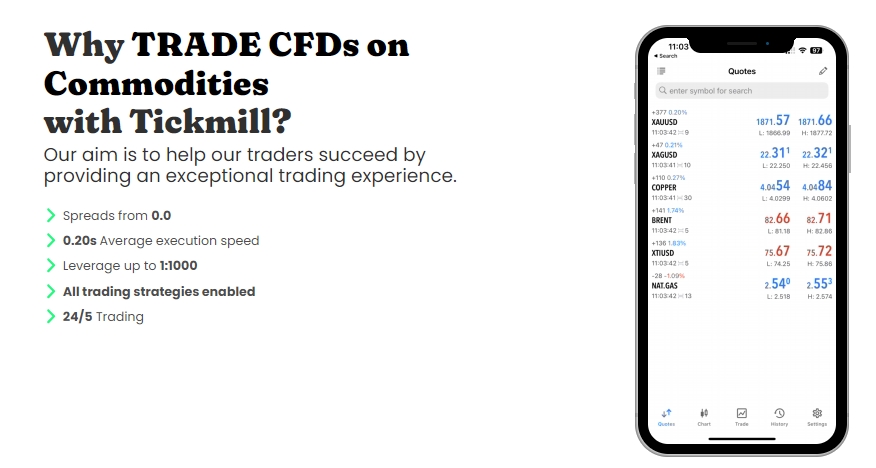

- Why Choose Tickmill for Your Commodity CFDs?

- Key Benefits of Trading Tickmill Commodities CFDs

- What are Commodity CFDs and How Do They Work?

- Why Choose Tickmill for Your Commodity Trading?

- Unrivaled Access to Diverse Commodities

- Superior Trading Conditions and Technology

- Competitive Edge with Tickmill

- A Diverse Range of Tickmill Commodities to Trade

- Precious Metals: The Enduring Allure

- Energy Trading: Fueling Your Portfolio

- Agricultural and Other Raw Materials

- Energy Commodities: Crude Oil, Natural Gas

- Precious Metals: Gold, Silver, Platinum

- Soft Commodities: Coffee, Sugar, Cotton

- Understanding Tickmill’s Competitive Trading Conditions

- Unbeatable Spreads & Low Commissions

- Lightning-Fast Execution Speed

- Diverse Product Range

- Why Our Conditions Empower You

- Advantages of Trading Commodities with Tickmill

- Leverage, Margin, and Spreads on Tickmill Commodities

- The Tickmill Trading Platforms for Commodities

- MetaTrader 4: The Trusted Choice for Commodities

- MetaTrader 5: Advanced Trading for Diverse Raw Materials

- Why Choose Tickmill Platforms for Your Commodities Trading?

- How to Open a Tickmill Commodity Trading Account

- Step 1: Start Your Registration

- Step 2: Complete Your Profile

- Step 3: Verify Your Identity

- Step 4: Fund Your Account

- Step 5: Download and Log In

- Step 6: Begin Trading

- Why Choose Tickmill for Your Commodities Trading?

- Effective Risk Management Strategies for Commodity Trading

- Key Strategies for Smarter Commodity Trading

- The Impact of Proactive Risk Management

- Fundamental and Technical Analysis for Commodities

- Unveiling Market Drivers with Fundamental Analysis

- Mastering Market Timing with Technical Analysis

- The Power of Synergy: Combining Both Approaches

- Benefits of Diversifying Your Portfolio with Commodities

- Comparing Tickmill Commodities to Forex and Indices

- Tickmill Commodities: A Deeper Dive

- Forex: The World of Currency Pairs

- Indices: Gauging Market Sentiment

- Key Differences at a Glance

- Client Support and Educational Resources for Tickmill Traders

- Navigating Volatility in the Commodity Market

- Future Outlook for Tickmill Commodities Trading

- Key Drivers Shaping the Commodities Market

- Tickmill’s Edge in the Evolving Landscape

- Spotlight on Specific Commodity Sectors

- Embracing Innovation for Smarter Trading

- Frequently Asked Questions

Why Choose Tickmill for Your Commodity CFDs?

Partnering with Tickmill for your commodities trading gives you a distinct edge:

- Access a comprehensive range of instruments, including popular choices like gold silver, alongside other crucial raw materials.

- Benefit from competitive spreads and fast execution, essential for capitalizing on market shifts.

- Leverage trading allows you to control larger positions with a smaller initial capital outlay, amplifying potential returns (and risks).

- Enjoy advanced trading platforms, robust analytical tools, and dedicated client support.

- Navigate the complexities of energy trading and agricultural markets with confidence.

Our extensive offering covers various sectors. You can engage in energy trading, capitalizing on fluctuations in oil and gas. Explore the precious metals market, with gold silver often serving as safe-haven assets. We also provide access to agricultural commodities and industrial metals, giving you diverse ways to approach the market.

Key Benefits of Trading Tickmill Commodities CFDs

| Benefit | Description |

|---|---|

| Broad Market Access | Trade a wide array of global raw materials across various sectors. |

| Flexibility | Speculate on both upward and downward price movements without asset ownership. |

| Capital Efficiency | Utilize leverage to maximize your market exposure with less upfront capital. |

| Reliable Execution | Benefit from fast, efficient order execution in dynamic markets. |

Embrace the potential of commodities trading with a trusted partner. Tickmill Commodities opens the door to opportunities found in global economic shifts and industrial demands. Join us and start exploring the vast possibilities today.

What are Commodity CFDs and How Do They Work?

Ever wondered how to participate in the dynamic world of raw materials without physically owning barrels of oil or tons of grain? Commodity Contracts for Difference (CFDs) offer an exciting and accessible way to do just that. They allow you to speculate on the price movements of various commodities, making them a popular choice for traders looking to diversify their portfolios.

A CFD is essentially an agreement between a trader and a broker to exchange the difference in the price of an asset from the time the contract is opened until it is closed. When you engage in commodities trading through CFDs, you are not buying or selling the underlying commodity itself. Instead, you are predicting whether its price will rise or fall.

The mechanism is straightforward. If you believe the price of a particular commodity, such as crude oil or natural gas in energy trading, will increase, you “buy” a CFD. If the price goes up as you predicted, you profit from the difference between your opening and closing price. Conversely, if you expect the price to fall, you “sell” a CFD. Should the price indeed drop, you gain from that downward movement. If the market moves against your prediction in either scenario, you incur a loss.

This approach gives you exposure to a vast array of global commodities. Beyond just gold silver, the market includes:

- Energy (e.g., Crude Oil, Natural Gas)

- Metals (e.g., Gold, Silver, Copper, Platinum)

- Agriculture (e.g., Wheat, Corn, Coffee, Sugar)

- Softs (e.g., Cotton, Cocoa)

Understanding the advantages and potential drawbacks is key before you delve into commodity CFD trading. It’s a world brimming with opportunity, but also requiring careful consideration:

| Pros of Commodity CFDs | Cons of Commodity CFDs |

|---|---|

| Flexibility: Profit from both rising and falling markets. | Leverage Risk: Amplifies both gains and losses significantly. |

| Leverage: Open large positions with a fraction of the total value. | Market Volatility: Prices can move rapidly and unpredictably. |

| Diversification: Access new global markets, spreading risk across asset classes. | Overnight Fees: Incur costs for holding positions open overnight. |

| Accessibility: Trade raw materials without physical delivery logistics. | Complexity: Requires diligent market analysis and robust risk management. |

Tickmill Commodities offers a robust platform for exploring these dynamic markets. We empower you to navigate the complexities of commodity CFDs with advanced tools and competitive conditions. Ready to delve into the world of raw materials? Discover how we can support your commodities trading journey and help you make informed decisions.

Why Choose Tickmill for Your Commodity Trading?

Diving into the world of commodities trading offers unique opportunities, but selecting the right partner makes all the difference. Tickmill stands out as a premier choice for traders looking to navigate the dynamic markets of raw materials. We combine a powerful platform with exceptional trading conditions, giving you a distinct edge.

Unrivaled Access to Diverse Commodities

With Tickmill Commodities, you gain access to a broad spectrum of global raw materials. Whether your interest lies in precious metals or energy products, our platform opens doors. We provide the instruments you need to capitalize on market movements.

- Precious Metals: Trade popular assets like gold silver, seizing opportunities in their ever-shifting values.

- Energy Trading: Engage in the fast-paced energy markets, covering key oil and gas products.

- Other Raw Materials: Diversify your portfolio with a selection of other essential commodities.

Superior Trading Conditions and Technology

We understand that execution and cost are critical for successful commodities trading. Tickmill focuses on providing an environment optimized for your strategy.

Our commitment to advanced technology means ultra-fast execution speeds, minimizing slippage and ensuring your trades are processed efficiently. This responsiveness is vital when market volatility spikes.

“Tickmill offers the robust platform and competitive conditions I need to confidently trade commodities. Their dedication to client success is clear.”

Competitive Edge with Tickmill

Choosing Tickmill for your commodities trading journey offers several distinct advantages:

| Feature | Benefit to You |

|---|---|

| Low Spreads | Reduce your trading costs and increase potential profits. |

| Deep Liquidity | Ensure fast and efficient execution, even for larger trades. |

| Flexible Leverage | Manage your risk and potential returns effectively. |

We empower you with the tools and resources to make informed decisions. Our support team is always ready to assist, ensuring a smooth trading experience from start to finish. This holistic approach makes Tickmill Commodities an ideal home for your trading endeavors.

Ready to explore the vast potential of commodities trading? Join Tickmill today and experience the difference a dedicated and professional partner can make to your success.

A Diverse Range of Tickmill Commodities to Trade

Unlock a world of opportunity with Tickmill Commodities. We empower traders like you to dive into the dynamic global markets, offering a comprehensive selection of products. Building a diverse portfolio is key to navigating market fluctuations, and our platform gives you the tools to explore various asset classes with confidence.

Whether you are looking to diversify your strategy or capitalize on specific market trends, the breadth of our offerings for commodities trading is designed to meet your needs. We provide access to some of the most actively traded raw materials, ensuring you have ample options to pursue your financial goals.

Precious Metals: The Enduring Allure

Few assets capture investor interest quite like precious metals. Tickmill offers direct access to these timeless commodities, allowing you to participate in a market often seen as a safe haven during economic uncertainty. Trading gold silver, for instance, provides a classic hedge against inflation and currency devaluation. These metals frequently react to global economic indicators and geopolitical events, creating exciting opportunities for agile traders.

Energy Trading: Fueling Your Portfolio

The energy market is a powerhouse of activity, driven by global supply and demand dynamics, as well as political developments. With Tickmill, you can engage in robust energy trading, speculating on the price movements of crucial global resources. This sector offers significant liquidity and volatility, attracting traders who thrive on fast-moving markets. Understanding the factors that influence energy prices can give you a distinct edge.

Agricultural and Other Raw Materials

Beyond metals and energy, our platform extends to a variety of other essential raw materials. These include soft commodities like coffee, sugar, and cotton, along with industrial metals. Each commodity category presents unique market drivers and seasonal patterns, adding another layer of depth to your trading strategy. Diversifying across different types of raw materials can help balance risk and enhance potential returns across your overall portfolio.

Our commitment is to provide a seamless trading experience across all Tickmill Commodities. Here’s what you can expect:

- Competitive spreads for better entry and exit points.

- Robust execution speed to capitalize on market movements.

- Advanced trading platforms, including MT4 and MT5.

- Dedicated support to assist you every step of the way.

We believe in equipping our traders with a wide array of choices and the best possible conditions. Explore the rich variety of Tickmill Commodities and discover how you can expand your trading horizons today. Join us and start building a resilient and profitable trading future.

Energy Commodities: Crude Oil, Natural Gas

Step into the fast-paced world of energy commodities, where crude oil and natural gas stand as pillars of global economies. These essential raw materials fuel industries, power transportation, and light up homes around the globe. Engaging in energy trading offers unique opportunities within the broader commodities trading landscape.

Crude oil, often called “black gold,” remains one of the most actively traded raw materials. Its price influences countless sectors, from manufacturing to logistics. Global supply and demand dynamics, geopolitical events, and even seasonal shifts can cause significant price movements. Savvy traders constantly monitor inventory reports, production cuts, and world events to predict its next move.

Natural gas, a cleaner-burning energy source, offers distinct market characteristics. Weather patterns heavily influence its demand, especially during extreme temperatures. Storage levels, pipeline capacity, and liquefied natural gas (LNG) exports also play crucial roles in its market valuation. Understanding these factors provides a competitive edge in energy trading.

Why consider energy trading for your portfolio?

- High Liquidity: Both crude oil and natural gas markets see massive trading volumes, ensuring efficient entry and exit points.

- Global Impact: Price movements reflect worldwide economic health and political stability, providing diverse analysis angles.

- Volatility: Frequent price swings create numerous potential short-term and long-term trading opportunities.

- Portfolio Diversification: Energy commodities often respond differently to market forces compared to other asset classes, enhancing your overall commodities trading strategy.

At Tickmill Commodities, we empower you to navigate these dynamic markets with confidence. Our robust platform provides the tools and resources you need to analyze crude oil and natural gas price action effectively. Access real-time data and execute your energy trading strategies seamlessly.

Ready to explore the powerful potential of these vital raw materials? Join Tickmill Commodities today and begin your journey in energy trading. Seize the opportunities presented by crude oil and natural gas in the global commodities trading arena.

Precious Metals: Gold, Silver, Platinum

Precious metals consistently capture the attention of traders and investors worldwide. These enduring raw materials offer unique opportunities within the commodities trading landscape, serving as both safe-haven assets and crucial industrial components. Understanding their distinct characteristics helps you navigate these dynamic markets effectively.

Gold: The Timeless Store of Value

-

Gold shines brightest during times of economic uncertainty or geopolitical tension. Investors often turn to gold as a reliable store of value, protecting their capital when traditional markets face volatility.

- Inflation Hedge: Many view gold as a strong hedge against inflation, maintaining its purchasing power over the long term. This makes it a foundational asset for diversifying your portfolio.

- Investment Demand: Beyond physical demand, gold attracts significant investment through futures, ETFs, and other derivatives, influencing its price movements daily. Tickmill Commodities provides excellent avenues to explore these trading options.

Silver: The Versatile Dual-Purpose Metal

Silver holds a unique position, acting as both an investment metal and a vital industrial raw material. Its appeal comes from this dual nature. You find silver in electronics, solar panels, and medical applications, driving consistent industrial demand. At the same time, like gold, it acts as a precious metal, attracting investors seeking exposure to commodities. Many traders actively watch gold silver price ratios for key market insights.

Platinum: Rarity and Industrial Reliance

Platinum stands out for its extreme rarity and high value. It’s significantly scarcer than both gold and silver, with production concentrated in just a few regions globally. This scarcity often leads to more volatile price movements, creating distinct trading opportunities.

Industrial demand primarily drives platinum’s market. Its catalytic properties make it indispensable in automotive catalytic converters, a major consumer. Other uses include jewelry and medical devices. Understanding these supply and demand dynamics is crucial when considering platinum within your commodities trading strategy, offering diversification beyond typical energy trading options.

| Metal | Primary Role | Market Driver |

|---|---|---|

| Gold | Safe-Haven Asset | Geopolitical events, inflation fears |

| Silver | Industrial & Investment | Economic growth, tech demand |

| Platinum | Industrial & Scarce | Automotive industry, mining supply |

Exploring these precious metals through Tickmill Commodities offers a robust way to diversify and potentially enhance your trading outcomes. We empower you to access these vital raw materials with confidence.

Soft Commodities: Coffee, Sugar, Cotton

Ever wondered about the hidden forces moving our daily essentials? Soft commodities like coffee, sugar, and cotton are more than just agricultural products; they are pivotal raw materials driving global economies and market trends. Their markets are vibrant, influenced by a unique blend of weather, geopolitics, and shifting consumer demand. Exploring these dynamic assets offers fascinating insights into commodities trading.

Coffee: The Global Brew

Coffee is a truly global commodity, with millions relying on its daily ritual. Price movements often reflect harvest conditions in major producing regions like Brazil and Vietnam, alongside currency fluctuations. Supply disruptions, driven by drought or frost, can send ripples through the market. Understanding these dynamics is key for anyone interested in the coffee market.

- Demand Drivers: Global consumption, new trends (e.g., specialty coffee).

- Supply Challenges: Weather patterns, pest outbreaks, labor costs.

Sugar: Sweetening the World

Sugar, derived primarily from sugarcane and sugar beet, plays a dual role in the global economy. It’s a staple food ingredient and a vital component in ethanol production, particularly in Brazil. This link to energy markets can introduce additional volatility and complex price relationships. Government policies regarding subsidies and import tariffs also significantly sway sugar prices.

| Primary Use | Key Influencer |

|---|---|

| Food & Beverages | Global demand, health trends |

| Biofuel Production | Crude oil prices, government mandates |

Cotton: Fabric of Commerce

Cotton stands as one of the world’s most important natural fibers, essential for textiles, apparel, and industrial products. Its cultivation spans diverse climates, making it highly susceptible to weather events from droughts in the US to monsoon failures in India. Economic growth also plays a huge part; stronger economies typically mean higher demand for clothing and textiles, impacting cotton prices.

Factors Affecting Cotton Prices:

- Weather conditions in major growing regions.

- Global economic health and consumer spending.

- Competition from synthetic fibers.

- Inventory levels and government agricultural policies.

Engaging with soft commodities provides an exciting avenue for portfolio diversification. Their distinct market drivers often behave differently from other asset classes. Tickmill Commodities offers a robust platform to explore these dynamic agricultural markets, giving you the tools to participate confidently. Discover the fascinating world of coffee, sugar, and cotton, and see how these essential raw materials move the markets.

Understanding Tickmill’s Competitive Trading Conditions

Ready to elevate your trading experience? At Tickmill, we know that truly competitive conditions are the bedrock of successful trading. We’ve meticulously crafted an environment designed to give you the edge, whether you’re diving into forex or exploring the dynamic world of Tickmill Commodities.

Unbeatable Spreads & Low Commissions

One of our core commitments is transparent and cost-effective trading. We provide ultra-tight spreads, starting from 0.0 pips on major pairs. This means lower transaction costs for you, directly impacting your potential profitability. Our commission structure is equally clear and competitive, ensuring you always understand your overhead.

Lightning-Fast Execution Speed

In the fast-paced markets, every millisecond counts. Tickmill’s state-of-the-art infrastructure ensures lightning-fast order execution. We pride ourselves on minimal latency and an almost zero re-quote policy, giving you confidence that your trades execute at your intended prices. This precision is vital, especially when engaging in high-volume commodities trading.

Diverse Product Range

Expand your portfolio with Tickmill’s extensive array of instruments. Beyond forex, our Tickmill Commodities offering allows you to access a broad spectrum of global markets. Trade precious metals like gold silver, or explore diverse raw materials. We also provide robust opportunities in energy trading, letting you capitalize on market movements across various sectors.

Our competitive conditions extend to:

- Flexible Leverage: Tailor your risk management with appropriate leverage options.

- Advanced Platforms: Access powerful tools like MetaTrader 4 and 5 for a superior trading experience.

- Deep Liquidity: Benefit from robust liquidity providers, ensuring smooth order flow even during volatile periods.

Why Our Conditions Empower You

We understand that competitive conditions aren’t just about numbers; they’re about empowering your strategy. Here’s what our environment offers:

| Benefit | How Tickmill Delivers |

|---|---|

| Cost Efficiency | Low spreads and commissions reduce your trading overhead. |

| Precision Trading | Fast execution minimizes slippage, maximizing your entry/exit accuracy. |

| Market Access | Broad instrument selection, including Tickmill Commodities, opens up diverse opportunities. |

Choose Tickmill and experience a trading environment where your success is our priority. We give you the tools and the conditions to navigate the markets with confidence.

Advantages of Trading Commodities with Tickmill

Are you ready to unlock powerful market potential? Trading commodities offers an exciting avenue for portfolio diversification and strategic growth. With Tickmill, you gain access to a world-class platform designed to elevate your trading experience. Let’s explore the distinct advantages that make Tickmill the preferred choice for trading raw materials and more.

First, consider the **extensive market access and diversity** you gain. Tickmill provides a robust gateway to a vast range of raw materials. You can capitalize on market movements across various sectors, ensuring you always have opportunities at your fingertips. From precious metals like gold silver pairs to crucial energy trading products, our platform supports your strategic decisions.

- Broad Selection: Access popular commodities including precious metals, energy, and agricultural products.

- Global Reach: Tap into international demand and supply dynamics that drive commodity prices worldwide.

- Portfolio Diversification: Spread your risk and seek new profit avenues away from traditional assets.

Next, experience **exceptional trading conditions**. Tickmill is committed to providing an environment where your strategies can thrive, backed by competitive pricing and swift execution for all your commodities trading.

- Ultra-Low Spreads: We offer some of the tightest spreads in the industry, significantly reducing your potential trading costs.

- Rapid Execution: Benefit from lightning-fast order execution, helping you enter and exit trades precisely when it matters most.

- Transparent Pricing: Enjoy clear and straightforward pricing without hidden fees, giving you full control over your capital.

You also benefit from **flexible leverage and advanced tools**. Leverage can be a powerful tool when trading Tickmill Commodities. We empower you with flexible leverage options, allowing you to amplify your market exposure with managed risk. Our platforms are equipped with advanced tools to help you analyze markets, plan your trades, and manage your positions effectively. You can harness sophisticated charting capabilities and a suite of technical indicators to gain an edge.

Finally, count on **robust security and dedicated support**. Your security and peace of mind are paramount. Tickmill operates under strict regulatory frameworks, ensuring a safe and transparent trading environment for all clients. We pride ourselves on providing robust infrastructure and dedicated customer support. Should you have any questions or require assistance with your account, our expert team is ready to help you navigate the markets with confidence.

Ready to experience these advantages firsthand? Join Tickmill today and discover a world of opportunity in commodities trading.

Leverage, Margin, and Spreads on Tickmill Commodities

Understanding the core mechanics of leverage, margin, and spreads is fundamental for any successful venture into commodities trading. These aren’t just technical terms; they are critical tools that shape your trading experience, risk exposure, and potential profitability. With Tickmill Commodities, you gain access to a powerful platform, but mastering these concepts empowers you to make smarter, more strategic decisions.

Unlocking Potential with Leverage

Leverage allows you to control a much larger position in the market with a relatively small amount of capital. Think of it as a financial magnifier. For instance, with 1:100 leverage, a $1,000 deposit can control a $100,000 position. This amplification means you can potentially generate significant returns from even small price movements in raw materials or energy trading. However, this sword cuts both ways.

Here’s what to consider about leverage:

- Amplified Gains: Small market moves can lead to substantial profits.

- Increased Risk: Losses are also magnified, potentially exceeding your initial deposit if not managed carefully.

- Market Access: It enables participation in markets that would otherwise require much larger capital.

Tickmill provides competitive leverage options, allowing you to tailor your risk appetite to your trading strategy.

The Role of Margin in Your Trading Account

Margin is the collateral required to open and maintain a leveraged position. It is not a fee but rather a portion of your capital set aside by your broker. When you use leverage, you are effectively borrowing funds to open a larger trade, and margin acts as a performance bond. For example, if you want to trade gold silver with a 1% margin requirement, you need to have 1% of the total trade value in your account.

Always maintain sufficient margin. A margin call occurs when your account equity falls below the required margin, potentially leading to automatic position closures to protect your account from further losses.

Understanding margin requirements is key to preventing unexpected position closures and managing your overall account health. Tickmill clearly outlines margin requirements for all its commodity instruments, ensuring transparency.

Navigating Spreads on Tickmill Commodities

The spread is the difference between the bid (sell) and ask (buy) price of a commodity. It represents the cost of entering a trade. When you open a position, you immediately start at a slight loss equal to the spread. A tighter spread means lower transaction costs and can significantly impact your profitability, especially for frequent traders.

Tickmill is renowned for its competitive spreads across various commodities. Here’s a simple look at how spreads work:

| Commodity | Bid Price | Ask Price | Typical Spread (Units) |

|---|---|---|---|

| Crude Oil | 75.20 | 75.23 | 0.03 |

| Gold | 2305.50 | 2305.80 | 0.30 |

The type of spread can vary. Some instruments might have fixed spreads, while others, common in commodities trading, have variable spreads that fluctuate with market volatility and liquidity. Tickmill strives to offer some of the industry’s tightest spreads, enhancing your trading potential.

Mastering These Pillars for Smart Commodities Trading

Leverage, margin, and spreads are not isolated concepts; they interlink to define your trading landscape. High leverage requires careful margin management, and both directly influence how spreads impact your net profitability. Understanding this dynamic is crucial for strategic commodities trading, whether you are focusing on gold silver, crude oil, or other raw materials. Join Tickmill today to experience transparent conditions and robust tools designed to support your trading journey.

The Tickmill Trading Platforms for Commodities

Unlock the dynamic world of commodities trading with Tickmill’s powerful and intuitive platforms. We understand that success in trading requires not just market insight but also superior tools at your fingertips. That’s why we offer industry-leading platforms designed to give you a distinct edge when dealing with essential raw materials, precious metals like gold silver, and the volatile yet exciting sphere of energy trading.

Our platforms provide direct access to global markets, ensuring you can react swiftly to price movements and seize every opportunity in Tickmill Commodities. Whether you’re a seasoned trader or just beginning your journey, you’ll find a robust environment built for performance.

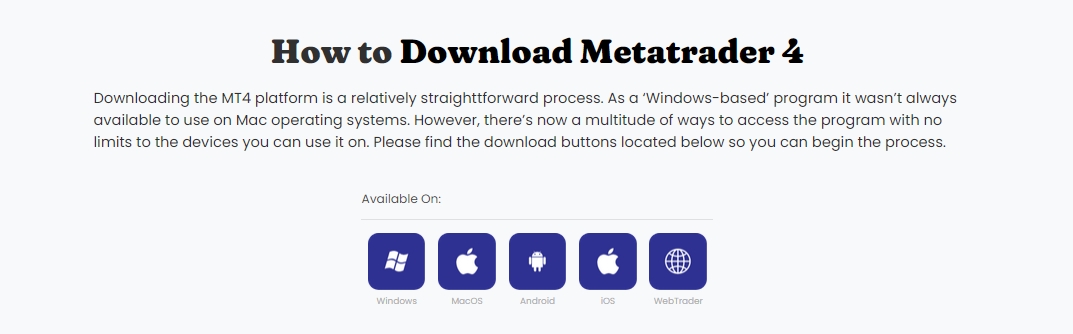

MetaTrader 4: The Trusted Choice for Commodities

MetaTrader 4 (MT4) stands as a beacon of reliability for traders worldwide, and it’s an excellent gateway for your commodities trading endeavors. Its user-friendly interface makes executing trades straightforward, even amidst fluctuating market conditions.

- Comprehensive Charting Tools: Analyze price action with an extensive suite of charting options, indicators, and graphical objects. This helps you dissect market trends for various raw materials.

- Expert Advisors (EAs): Automate your strategies for commodities like gold silver. MT4’s robust support for EAs allows for continuous market monitoring and automated execution.

- Customizable Interface: Personalize your trading environment to suit your preferences, keeping your focus sharp on the commodities that matter most to you.

MetaTrader 5: Advanced Trading for Diverse Raw Materials

For those seeking even more advanced features and analytical capabilities, MetaTrader 5 (MT5) is your go-to platform. It offers an expanded array of tools perfect for deep market analysis and diversified commodities trading portfolios.

- Enhanced Technical Analysis: Access more timeframes and technical indicators, providing deeper insights into market behavior for everything from agricultural goods to complex energy trading instruments.

- Depth of Market (DOM): Gain a clearer view of market liquidity and price levels, crucial for understanding demand and supply dynamics in various raw materials.

- Faster Processing: Enjoy improved processing speeds, ensuring your trades on Tickmill Commodities are executed with precision and minimal latency.

Why Choose Tickmill Platforms for Your Commodities Trading?

Both MT4 and MT5, available through Tickmill, are engineered for high performance and offer distinct advantages for trading raw materials:

| Feature | Benefit for Commodities Trading |

|---|---|

| Low Latency Execution | Rapid order processing ensures you get your desired price for gold silver and other commodities. |

| Tight Spreads | Minimize trading costs, enhancing your potential profitability in energy trading and other markets. |

| Mobile Trading Apps | Manage your commodities trading on the go, staying connected to global markets from anywhere. |

| Robust Security | Trade with peace of mind, knowing your data and funds are protected by industry-leading security protocols. |

Ready to experience superior commodities trading? Our platforms are built to empower your decisions and streamline your trading process. Explore the possibilities with Tickmill Commodities and take control of your financial future.

How to Open a Tickmill Commodity Trading Account

Ready to dive into the exciting world of commodities trading? Opening an account with Tickmill Commodities is straightforward and puts you directly in touch with global markets. You can access a wide range of raw materials, from precious metals to energy. We make the process simple so you can focus on your trading strategy.

Follow these clear steps to set up your Tickmill Commodity Trading Account:

-

Step 1: Start Your Registration

Visit the Tickmill website and locate the “Open Account” button. You will provide basic information like your email address and country of residence. This initial step is quick and gets your application moving.

-

Step 2: Complete Your Profile

Fill out the full application form. This includes personal details, financial information, and your trading experience. Be honest and thorough; accurate data helps speed up the process. We need this information to ensure you meet suitability requirements for commodities trading.

-

Step 3: Verify Your Identity

Tickmill needs to verify your identity and residency. Prepare clear copies of a valid ID (passport, driver’s license) and a proof of address (utility bill, bank statement). Upload these documents securely through your client area. This is a standard regulatory requirement for your security and to maintain compliance.

-

Step 4: Fund Your Account

Once verified, you can deposit funds into your new Tickmill Commodity Trading Account. Tickmill offers various convenient payment methods, including bank transfers, credit/debit cards, and e-wallets. Choose what works best for you to get your trading capital ready.

-

Step 5: Download and Log In

Access your preferred trading platform, such as MetaTrader 4 or MetaTrader 5. Use the account credentials provided by Tickmill to log in. You are now ready to explore the markets with robust tools at your fingertips.

-

Step 6: Begin Trading

With funds in your account and platform access, you can start placing trades. Explore opportunities in diverse markets, whether you are interested in gold silver, crude oil, or other forms of energy trading. Your Tickmill Commodities journey begins now.

Why Choose Tickmill for Your Commodities Trading?

Beyond the simple account opening process, Tickmill offers a robust environment tailored for serious traders. We empower you with the tools and conditions you need to succeed.

- Competitive Spreads: Experience tight spreads on major commodities, helping you maximize your potential returns.

- Diverse Instruments: Trade a broad spectrum of raw materials, including popular choices like gold silver, Brent crude, WTI oil, and more, enabling comprehensive energy trading strategies.

- Robust Platforms: Access industry-leading MetaTrader 4 and MetaTrader 5 platforms, known for their powerful tools and user-friendly interfaces.

- Strong Regulation: Tickmill operates under strict regulatory frameworks, ensuring a secure and transparent trading environment for your Tickmill Commodities account.

- Dedicated Support: Receive professional, multilingual customer support whenever you need assistance, ensuring a smooth trading experience.

Taking your first step into commodities trading has never been easier. The process to open your Tickmill Commodity Trading Account is designed for efficiency, getting you market-ready quickly. Don’t miss out on potential opportunities in the raw materials market. Open your account today and start exploring the world of Tickmill Commodities.

Effective Risk Management Strategies for Commodity Trading

Commodities trading offers exciting opportunities, but successful navigation of these dynamic markets demands a robust approach to risk. Ignoring risk management is like sailing without a compass – you might get lucky for a while, but ultimately, disaster looms. Mastering these strategies empowers you to protect your capital and pursue consistent profitability. Let’s explore the essential tactics that keep your trading journey on track.

Every trader aims for profit, yet the seasoned professional understands that safeguarding capital comes first. Volatility is inherent in raw materials, from agricultural products to precious metals like gold silver. Effective risk management isn’t just about limiting losses; it’s about making smarter, more calculated decisions that enhance your overall trading performance.

Key Strategies for Smarter Commodity Trading

Implement these core principles to build resilience into your commodities trading activities:

- Define Your Risk Tolerance: Before placing any trade, understand how much capital you are comfortable risking on a single position. Never risk more than a small percentage of your total trading account on one trade. This foundational step dictates your position sizing.

- Implement Stop-Loss Orders: These are your safety nets. A stop-loss order automatically closes a trade once it reaches a predetermined price, limiting your potential downside. Set them strategically based on technical analysis, not emotion. This discipline is crucial in fast-moving markets like energy trading.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Spreading your investments across different raw materials, sectors, or even various types of commodities trading (e.g., combining agriculture with gold silver) can mitigate the impact of adverse movements in a single market.

- Conduct Thorough Market Analysis: Knowledge is power. Understand the fundamental drivers influencing supply and demand for your chosen commodity. Combine this with technical analysis to identify entry and exit points. Informed decisions reduce speculative risk significantly.

- Manage Your Leverage Wisely: Leverage amplifies both gains and losses. While it can enhance returns, excessive leverage dramatically increases your exposure. Use it judiciously and understand the margin requirements.

- Maintain Emotional Discipline: Fear and greed are powerful emotions that often lead to poor trading decisions. Stick to your trading plan. Avoid impulsive trades based on market chatter or short-term swings. A clear head is your best asset.

The Impact of Proactive Risk Management

Embracing these risk management strategies transforms your trading approach. It shifts your focus from hoping for big wins to consistently protecting your capital and making sustainable progress. You’ll experience:

| Benefit | Description |

|---|---|

| Capital Preservation | Maintains your trading capital for future opportunities, even after losing trades. |

| Reduced Stress | Knowing your maximum potential loss brings peace of mind, fostering better decision-making. |

| Improved Consistency | Focus on small, controlled losses prevents catastrophic setbacks, leading to more stable growth. |

| Enhanced Learning | You learn from smaller losses without being wiped out, improving your future strategies. |

Developing effective risk management is an ongoing process. It requires continuous learning, self-assessment, and discipline. By incorporating these strategies into your routine, you are not just limiting your downside; you are setting yourself up for long-term success in the exciting world of Tickmill Commodities. Start trading smarter, not harder.

Fundamental and Technical Analysis for Commodities

Navigating the dynamic world of commodities trading requires a sharp understanding of market drivers. Professional traders often rely on two powerful analytical approaches: fundamental and technical analysis. Each offers a unique lens through which to view market opportunities, and combining them provides a robust framework for making informed decisions on platforms like Tickmill Commodities.

Unveiling Market Drivers with Fundamental Analysis

Fundamental analysis delves into the underlying factors that influence the supply and demand of raw materials. It’s about understanding the “why” behind price movements. This approach considers a broad range of economic, geopolitical, and environmental data to forecast future price direction.

Here are key elements fundamental analysts scrutinize:

- Supply and Demand: This is the bedrock. For agricultural commodities, weather patterns, crop yields, and disease outbreaks heavily impact supply. For crude oil or natural gas, production cuts, inventory levels, and global economic growth influence demand.

- Economic Indicators: Inflation reports, interest rate changes, GDP growth, and employment data can signal broader economic health, directly affecting industrial demand for raw materials and the investment appeal of assets like gold silver.

- Geopolitical Events: Political instability in major producing regions, trade disputes, or international agreements can swiftly alter supply chains and market sentiment.

- Technological Advancements: New extraction methods, renewable energy innovations, or changes in manufacturing processes can shift the long-term outlook for specific commodities.

By understanding these forces, you gain insight into the intrinsic value of a commodity, rather than just its current market price. This long-term perspective is crucial for strategic positioning in commodities trading.

Mastering Market Timing with Technical Analysis

While fundamental analysis focuses on value, technical analysis zeroes in on price action and market behavior. This approach believes that all available information is already reflected in the price. Technical analysts use charts to identify patterns, trends, and support/resistance levels, aiming to predict future price movements based on historical data.

Consider these core aspects of technical analysis:

- Chart Patterns: Head and shoulders, double tops/bottoms, triangles – these visual formations often precede significant price shifts.

- Indicators: Moving Averages, Relative Strength Index (RSI), MACD, and Bollinger Bands help measure momentum, volatility, and overbought/oversold conditions. These are widely used across various markets, including energy trading.

- Volume Analysis: High trading volume accompanying a price move lends credibility to the trend or breakout.

- Support and Resistance: These are price levels where a trend is expected to pause or reverse, providing potential entry and exit points.

Technical analysis offers a dynamic toolkit for identifying optimal entry and exit points, managing risk, and capitalizing on short to medium-term price swings. It provides the “when” to complement fundamental analysis’s “why.”

The Power of Synergy: Combining Both Approaches

The most successful commodities traders rarely rely on just one analysis type. Instead, they synthesize both fundamental and technical insights to form a comprehensive trading strategy. Fundamental analysis helps identify commodities with strong underlying value or impending catalysts, while technical analysis helps pinpoint precise moments to enter or exit positions.

For example, a strong fundamental outlook for gold silver due to inflation concerns might be confirmed by technical indicators showing an upward trend and a breakout from a resistance level. This dual confirmation strengthens conviction and improves decision-making.

| Feature | Fundamental Analysis | Technical Analysis |

|---|---|---|

| Focus | Intrinsic Value, “Why” | Price Action, “When” |

| Tools | Economic Reports, Supply Data, News | Charts, Indicators, Patterns |

| Time Horizon | Long-term | Short to Medium-term |

| Goal | Identify Value & Trends | Time Entries & Exits |

By integrating both fundamental and technical analysis, traders on platforms like Tickmill Commodities gain a holistic view of the market, allowing them to ride major trends and react effectively to market shifts.

Benefits of Diversifying Your Portfolio with Commodities

Ready to unlock new potential for your investment strategy? Diversifying your portfolio with commodities offers a robust pathway to strengthen your financial position. It’s about moving beyond conventional assets like stocks and bonds, adding a dynamic layer of protection and growth to your holdings. Many savvy investors recognize the unique role commodities play in a well-rounded portfolio.

Adding commodities trading to your investment mix provides several distinct advantages:

-

Inflation Hedge: Commodities, often tied to the cost of raw materials, historically perform well during inflationary periods. When the purchasing power of currency declines, the value of essential goods like crude oil, precious metals, or agricultural products typically rises. This natural hedge helps protect your wealth from erosion, preserving your capital’s true worth.

-

Portfolio Diversification: Commodities offer low correlation with traditional asset classes. This means their prices often move independently of stocks and bonds. When equity markets experience volatility, commodities might trend differently, reducing overall portfolio risk. This reduced correlation is a cornerstone of sound investment planning, smoothing out returns over time.

-

Opportunity in Various Market Cycles: The commodities market offers potential for profit in both rising and falling economies. Factors like supply shortages, geopolitical events, or increased industrial demand can significantly impact prices, creating opportunities for strategic investors. For instance, strong global demand can drive up prices for energy trading assets, irrespective of broader stock market sentiment.

Consider the timeless appeal of assets like gold silver, often viewed as safe-haven investments during economic uncertainty. Beyond precious metals, the world of commodities trading encompasses an immense variety of assets, from vital agricultural products to industrial metals and energy resources. Each category presents unique market drivers and opportunities, allowing you to tailor your exposure based on global economic outlooks and specific industry trends.

At Tickmill Commodities, we empower you to explore these compelling opportunities with confidence. Engaging in commodities trading through our platform means accessing diverse markets with competitive conditions and robust support. It is a strategic move for anyone committed to building a resilient, growth-oriented investment portfolio. Join us and discover how commodities can enhance your financial future.

Comparing Tickmill Commodities to Forex and Indices

Navigating the financial markets requires a sharp understanding of the diverse instruments available. While many traders are familiar with Forex and Indices, exploring Tickmill Commodities opens up a world of opportunities driven by fundamental supply and demand. Let’s break down the distinct characteristics of each to help you make informed trading decisions.

When you engage in commodities trading, you’re tapping into the essential raw materials that power the global economy. Unlike currencies or stock baskets, commodities react to very specific drivers, offering unique market dynamics.

Tickmill Commodities: A Deeper Dive

Trading commodities on Tickmill means accessing markets for vital raw materials. This category includes everything from precious metals like gold silver to energies and agricultural products. The primary appeal of Tickmill Commodities lies in their distinct market drivers:

- Supply and Demand: Prices largely reflect global supply levels, production output, and consumer demand. Geopolitical events, weather patterns, and economic policies often have a direct and immediate impact.

- Inflation Hedge: Commodities, especially precious metals, often serve as a hedge against inflation and economic uncertainty.

- Tangible Assets: Unlike abstract financial instruments, commodities represent tangible goods with real-world applications.

- Market Volatility: While sometimes volatile due to external factors, this also presents significant opportunities for shrewd traders. Consider the dynamic movements in energy trading, for instance.

Forex: The World of Currency Pairs

The Forex market, or foreign exchange, is the largest and most liquid financial market globally. Here, traders speculate on the price movements of currency pairs, such as EUR/USD or GBP/JPY. Key features include:

- High Liquidity: Massive trading volumes ensure narrow spreads and efficient execution.

- Economic Indicators: Currency values primarily respond to interest rate differentials, inflation data, GDP reports, and central bank policies.

- 24/5 Market: Forex markets operate around the clock during the week, offering continuous trading opportunities.

- Leverage: High leverage is common, amplifying both potential profits and losses.

Indices: Gauging Market Sentiment

Stock market indices represent a basket of stocks from a particular exchange or sector. They provide a broad measure of market performance and investor sentiment. Popular indices include the S&P 500, FTSE 100, and DAX 40.

- Economic Barometer: Indices often reflect the overall health and direction of an economy or a specific industry.

- Diversification: Trading an index allows for exposure to multiple companies within a single position, offering a degree of inherent diversification compared to individual stocks.

- Corporate Earnings: Major drivers include corporate earnings reports, economic forecasts, and broader geopolitical developments that impact investor confidence.

- Lower Volatility: While still susceptible to large swings, indices can sometimes exhibit less volatility than individual stocks due to their diversified nature.

Key Differences at a Glance

Understanding the fundamental distinctions between these asset classes is crucial for building a robust trading strategy. Here is a quick comparison:

| Feature | Tickmill Commodities | Forex | Indices |

|---|---|---|---|

| Underlying Asset | Raw Materials (e.g., gold, oil) | Currency Pairs (e.g., EUR/USD) | Basket of Stocks |

| Primary Drivers | Supply, demand, geopolitics, weather | Interest rates, inflation, central banks | Corporate earnings, economic outlook |

| Market Focus | Tangible goods, global production | National economies, monetary policy | Company performance, investor sentiment |

| Volatility Influence | Often high, event-driven | Can be high, driven by news events | Moderate, reflects broad market mood |

Each asset class presents unique advantages and challenges. Understanding these differences allows you to diversify your portfolio effectively and align your trading strategies with the specific market conditions of Tickmill Commodities, Forex, or Indices. Smart traders recognize that each market responds to different signals, offering distinct pathways to potential success.

Client Support and Educational Resources for Tickmill Traders

Embarking on the dynamic world of commodities trading demands not just a robust platform but also unwavering support and deep insights. At Tickmill, we understand this crucial need. Our commitment extends far beyond just offering access to the markets; we empower you with comprehensive client support and a wealth of educational resources. Whether you are navigating the intricacies of Tickmill Commodities for the first time or refining your strategies, we stand ready to assist your journey.

Experience responsive and knowledgeable assistance whenever you need it. Our dedicated support team works tirelessly to ensure your trading experience remains smooth and efficient. We pride ourselves on clear communication and timely resolutions, helping you stay focused on your trading goals:

- Multilingual Experts: Connect with our team in your preferred language, ensuring no question goes unanswered.

- Multiple Contact Methods: Reach us via live chat for instant queries, email for detailed requests, or phone for direct assistance. We make sure help is always just a click or call away.

- 24/5 Availability: Our support desk operates around the clock during trading hours, mirroring the global nature of commodities trading itself.

Successful commodities trading hinges on continuous learning and adaptation. We provide a rich suite of educational tools designed to elevate your understanding and sharpen your decision-making. From fundamental concepts to advanced strategies, our resources cover everything you need to confidently approach raw materials markets, including precious metals like gold silver, and opportunities in energy trading. Explore our comprehensive educational offerings:

| Resource Type | What You Gain |

|---|---|

| Webinars & Seminars | Live sessions with market experts, deep diving into market trends, strategies, and risk management specific to Tickmill Commodities. |

| In-Depth Articles & Guides | Comprehensive written content covering market fundamentals, technical analysis, and specific asset class insights, like understanding price movements in gold and silver. |

| Video Tutorials | Step-by-step guides on platform navigation, order execution, and utilizing various trading tools efficiently. |

| Market Analysis & News | Stay informed with daily market updates, expert analysis on key raw materials, and insights into global economic factors impacting commodities. This includes specialized reports on energy trading outlooks. |

| Glossaries & FAQs | Quick access to definitions of trading terminology and answers to common questions, streamlining your learning curve. |

“Knowledge is your most powerful tool in the market. We equip you with it.”

— Tickmill Education Team

By leveraging these invaluable resources, you gain a significant edge, transforming complex market data into actionable insights. We encourage you to explore everything Tickmill offers, empowering you to make informed decisions and thrive in the exciting world of commodities trading. Join us today and experience the difference dedicated support and world-class education can make.

Navigating Volatility in the Commodity Market

The commodity market pulsates with dynamic energy, offering incredible opportunities alongside significant risks. Mastering commodities trading in such an environment demands sharp insight and robust strategies. Volatility, while daunting, is simply part of the landscape for anyone involved with raw materials.

Understanding what drives these price swings is your first step. Factors from geopolitical events to weather patterns can send markets reeling. For instance, disruptions in supply for key energy trading assets, or shifts in global demand for precious metals like gold silver, directly impact their value.

Key drivers of commodity market volatility include:

- Supply and Demand Imbalances: Sudden shifts in production or consumption create immediate price pressure.

- Geopolitical Tensions: Conflicts or policy changes affecting major producing regions can disrupt supply chains.

- Economic Data Releases: Inflation reports, GDP figures, and interest rate decisions influence industrial demand and investment flows into various raw materials.

- Weather Events: Directly impacts agricultural commodities and can affect energy infrastructure, causing price spikes.

- Technological Advancements: New tech can create fresh demand or reduce reliance on existing raw materials, shifting market dynamics.

So, how do you navigate these turbulent waters? It begins with a disciplined approach and access to comprehensive resources. At Tickmill Commodities, we empower traders with the tools and information needed to make informed decisions, even when markets are unpredictable.

“In the world of commodities, preparedness isn’t just an advantage – it’s a necessity for thriving amidst market shifts.”

Implementing effective risk management strategies is paramount. Consider these crucial elements for any commodities trading endeavor:

| Strategy Focus | Benefit in Volatile Markets |

|---|---|

| Diversification | Spreads risk across various raw materials, like balancing energy trading with gold silver positions. |

| Technical Analysis | Identifies trends and potential turning points based on price action and volume. |

| Fundamental Analysis | Evaluates underlying supply and demand factors, economic reports, and geopolitical developments. |

| Stop-Loss Orders | Limits potential losses on individual trades, protecting capital from sharp reversals. |

Engaging in commodities trading requires not just courage, but also a commitment to continuous learning and adaptation. By understanding market mechanisms and employing strategic foresight, you can transform volatility from a threat into an opportunity for growth.

Ready to sharpen your skills and confidently approach the dynamic world of raw materials? Explore the robust platform and extensive resources available at Tickmill Commodities. Join a community where informed decisions lead the way to potential success.

Future Outlook for Tickmill Commodities Trading

The world of commodities trading is constantly evolving, driven by global events, technological advancements, and shifting market dynamics. For those looking at Tickmill Commodities, understanding the future landscape is key to informed decisions and successful strategies. We see a vibrant, albeit complex, period ahead for raw materials and energy trading, offering both challenges and substantial opportunities.

Global economic trends, geopolitical shifts, and environmental policies will continue to shape supply and demand across various sectors. Tickmill is uniquely positioned to help traders navigate these intricate market movements, providing robust platforms and comprehensive insights into the future of commodities trading.

Key Drivers Shaping the Commodities Market

Several significant factors are set to influence the trajectory of commodities:

- Global Economic Resurgence: As economies recover and develop, demand for various raw materials, from industrial metals to agricultural products, typically increases.

- Supply Chain Resilience: Lessons learned from recent disruptions will lead to greater emphasis on resilient supply chains, potentially impacting commodity prices and availability.

- Energy Transition: The global push towards cleaner energy sources will profoundly affect energy trading, creating new demands for specific metals vital for renewable technologies while reshaping traditional fossil fuel markets.

- Technological Innovation: Advancements in areas like AI and data analytics will offer deeper insights into market trends, helping traders identify emerging opportunities and risks.

- Climate Change Impacts: Extreme weather events can significantly affect agricultural commodities and even energy infrastructure, introducing volatility and requiring agile trading strategies.

Tickmill’s Edge in the Evolving Landscape

Tickmill Commodities is prepared for this dynamic future. Our commitment to providing competitive spreads, low commissions, and advanced trading tools ensures our clients are well-equipped. We understand the importance of diverse portfolio options, from precious metals like gold silver to a broad spectrum of energy trading instruments.

Our platform’s stability and advanced features cater to both seasoned traders and newcomers, allowing everyone to participate confidently in the intricate world of commodities. We empower you with the resources to analyze market movements and execute trades with precision, whether you are hedging against inflation or capitalizing on price fluctuations.

Spotlight on Specific Commodity Sectors

While the entire commodities market holds promise, certain sectors warrant particular attention:

| Commodity Sector | Future Outlook |

|---|---|

| Precious Metals (Gold & Silver) | Expected to retain their role as safe-haven assets amidst economic uncertainty and inflation concerns. Industrial demand for silver in green technologies also supports its future. |

| Energy Trading (Oil, Gas, Renewables) | Will remain highly volatile due to geopolitical factors, Opec+ decisions, and the accelerating transition towards renewable energy. Opportunities exist in both traditional and emerging energy markets. |

| Agricultural Commodities | Increasingly influenced by climate patterns, global population growth, and evolving dietary preferences. Supply chain efficiencies and technological advancements in farming will play crucial roles. |

Embracing Innovation for Smarter Trading

The future of commodities trading on Tickmill also involves continuous innovation. We are constantly enhancing our platform with new features, better analytical tools, and educational resources to keep our traders ahead of the curve. This focus on technology ensures you have the sharpest instruments for market analysis and trade execution, making your experience with Tickmill Commodities truly superior.

Ready to explore the future of commodities trading with a trusted partner? Discover the vast potential within raw materials and seize opportunities in gold silver and other key assets. Tickmill offers the robust platform and insightful resources you need to thrive in this exciting market.

Frequently Asked Questions

What are Tickmill Commodities CFDs?

Tickmill Commodities CFDs allow traders to speculate on the price movements of various raw materials, such as crude oil, natural gas, or precious metals, without actually owning the underlying physical assets. This offers flexibility to potentially profit from both rising and falling markets.

What types of commodities can I trade with Tickmill?

Tickmill offers access to a broad range of commodities, including precious metals like gold, silver, and platinum; energy products such as crude oil and natural gas; and agricultural commodities like coffee, sugar, and cotton, along with industrial metals.

What are the key benefits of trading commodities with Tickmill?

Trading commodities with Tickmill provides broad market access, competitive spreads, fast execution, flexible leverage, advanced trading platforms like MT4 and MT5, and robust security with dedicated client support.

How do leverage, margin, and spreads work in commodities trading on Tickmill?

Leverage allows you to control larger positions with less capital, amplifying potential gains (and losses). Margin is the collateral required to open a leveraged position. Spreads are the difference between bid and ask prices, representing the cost of a trade, which Tickmill aims to keep competitive.

What platforms does Tickmill offer for commodities trading?

Tickmill provides access to industry-leading MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, both equipped with comprehensive charting tools, expert advisors support, and advanced analytical features for efficient commodities trading.