Are you searching for a straightforward, cost-effective trading experience? The Tickmill Classic account stands out as a popular choice for many traders, offering a transparent structure designed for simplicity. It’s an excellent option whether you are just starting your trading journey or prefer a no-frills setup.

The Tickmill Classic account aims to provide a reliable environment where you can focus on your trading strategies without worrying about complex fee structures. This account type enjoys widespread appeal thanks to its clear advantages.

- Core Features of the Tickmill Classic Account

- Trader Benefits: Why Choose Tickmill Classic?

- What Defines the Tickmill Classic Account?

- Key Distinguishing Features

- Who Is the Tickmill Classic Account For?

- Core Features for Classic Account Holders

- Key Advantages of Your Classic Account:

- Competitive Spreads and Zero Commissions

- Flexible Leverage Options

- Diverse Instrument Selection

- Who Should Consider the Tickmill Classic?

- Understanding Spreads and Execution

- Why This Matters for Your Trading

- The Commission-Free Advantage of Tickmill Classic

- What Truly Means “Commission-Free”

- Why Zero Commissions Matter to Your Trading Success

- Comparing Tickmill Classic to a Standard Account

- Leverage and Margin Requirements

- Understanding Leverage: Your Trading Multiplier

- Margin Requirements: The Foundation of Your Trades

- Key Considerations for Your Trading Strategy

- Minimum Deposit and Account Funding Options

- Accessible Entry with the Tickmill Classic Account

- Your Flexible Funding Pathways

- Deposit Processing at a Glance

- Range of Tradable Instruments

- Accessing Markets via MT4 and MT5

- Benefits of Trading with Tickmill Classic

- Cost-Effectiveness for Certain Strategies

- Suitability for Beginners

- Potential Drawbacks to Note

- Step-by-Step: Opening Your Classic Account

- Your Journey to Trading Success:

- Tickmill Classic vs. Pro and VIP Accounts

- Unpacking the Tickmill Classic Account

- Exploring the Pro Account Advantages

- Delving into the VIP Account Experience

- Key Differences at a Glance

- Choosing Your Ideal Trading Partner

- Support and Educational Resources

- Dedicated Assistance, Every Step of the Way

- Unlock Your Potential with Comprehensive Education

- Common Queries About This Account Type

- Frequently Asked Questions

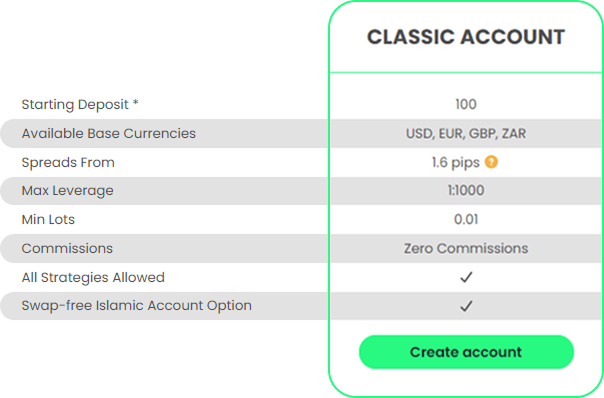

Core Features of the Tickmill Classic Account

Understanding what makes the Tickmill Classic account tick is key to appreciating its value. This account type is built around a few fundamental principles that prioritize ease of use and predictable costs.

- Commission-Free Trading: A standout feature, the Tickmill Classic account offers truly commission-free trading on all instruments. This means no per-lot charges, simplifying your cost calculations significantly.

- Competitive Spreads: You can expect spreads starting from 1.6 pips on major currency pairs. These spreads are integrated, making the pricing model easy to understand.

- Flexible Leverage: The account provides flexible leverage options, allowing you to manage your risk exposure according to your trading style and preferences.

- Wide Range of Instruments: Trade a diverse portfolio including Forex, indices, commodities, and bonds, all from a single classic account.

- Industry-Leading Platforms: Access your trades through MetaTrader 4 and MetaTrader 5, renowned for their robust tools, charting capabilities, and automated trading features.

- Minimum Deposit: Starting with an accessible minimum deposit makes the Tickmill Classic account attainable for a broad spectrum of traders.

Trader Benefits: Why Choose Tickmill Classic?

The features of the Tickmill Classic account translate directly into tangible benefits for traders. When you opt for this account type, you gain several advantages that can enhance your trading experience and potentially improve your bottom line.

Firstly, the most significant benefit is the commission-free structure. This means all your trading costs are encapsulated within the spread, offering a clear and predictable expense. For traders who calculate their profit and loss frequently, this transparency is invaluable. You won’t encounter unexpected charges cutting into your gains.

Secondly, the simplicity of the pricing model makes the classic account particularly appealing to newer traders. You do not need to factor in additional commission costs per trade, simplifying your analysis and execution. This ease of use allows you to concentrate more on market movements and less on intricate fee calculations, which can be a common hurdle with other account types, like a typical standard account that might have varying structures.

Furthermore, the competitive spreads, combined with swift execution, ensure that your trades are processed efficiently at the prices you expect. This reliable performance is crucial for day traders and scalpers who depend on precise entry and exit points.

Here’s a quick overview of some key aspects:

| Aspect | Tickmill Classic Account |

| Commission | $0 (Commission-Free) |

| Spreads From | 1.6 pips |

| Trading Platforms | MetaTrader 4, MetaTrader 5 |

| Execution Speed | Fast, industry-leading |

In essence, the Tickmill Classic account provides a balanced environment for traders who value straightforward pricing, reliable execution, and a broad range of instruments. It’s a solid foundation for building your trading success, allowing you to focus on strategy and market analysis without the complexities often found elsewhere.

What Defines the Tickmill Classic Account?

The Tickmill Classic account truly stands apart, offering a distinctive trading environment designed with specific needs in mind. When you evaluate your trading options, understanding the core characteristics of the Tickmill Classic becomes paramount.

This particular classic account focuses on simplicity and direct cost management, making it an attractive choice for many. It moves away from complex, per-trade commission structures, providing a streamlined experience.

Key Distinguishing Features

- Commission-Free Trading: A primary highlight, the Tickmill Classic account allows you to execute trades without paying a separate commission. This can significantly reduce your overall trading expenses, especially if you trade frequently.

- Competitive Spreads: While offering commission-free trading, it maintains competitive spreads on major currency pairs and other instruments, ensuring cost-effectiveness.

- Accessibility: This classic account often appeals to both new traders seeking a straightforward entry into the markets and experienced traders who prefer a clear, predictable fee model.

- Transparent Cost Structure: With no commissions, your primary trading cost comes from the bid-ask spread, making expense calculations much simpler and more transparent compared to a standard account.

Who Is the Tickmill Classic Account For?

The Tickmill Classic account resonates strongly with traders who prioritize a clear, upfront understanding of their costs. If you are transitioning from another broker or exploring different account types and prefer a model where commissions do not factor into your per-trade expenses, this option shines.

It’s particularly beneficial for strategies where trading volume might be high, as the commission-free nature prevents costs from accumulating rapidly. This structure empowers you to concentrate on market analysis and trade execution, free from additional per-transaction fees.

Core Features for Classic Account Holders

Stepping into the world of trading can feel overwhelming, but the Tickmill Classic account makes it remarkably straightforward. Designed for traders who value simplicity, reliability, and clear costs, this account type offers a transparent trading experience from the outset. We meticulously crafted the Tickmill Classic to provide a robust yet accessible platform for both new and experienced traders who prefer a conventional approach to the markets.

A defining characteristic of the Tickmill Classic is its pricing model. We eliminate hidden fees, ensuring you know exactly what you pay for. This means you can trade with confidence, knowing that your costs are primarily embedded within our competitive spreads, making it a truly commission-free experience. This clarity allows you to focus purely on your trading strategies without worrying about additional transaction charges on every trade. We understand the importance of cost-effectiveness, and this classic account delivers precisely that.

Beyond the cost structure, holders of a Tickmill Classic account benefit from outstanding execution speed and deep liquidity. Our robust infrastructure ensures your orders process quickly and efficiently, minimizing slippage and enhancing your trading performance. You gain access to a wide array of instruments, including Forex, indices, commodities, and more, all within a familiar and intuitive trading environment. This commitment to a superior trading environment positions the classic account as an ideal choice for a variety of trading styles, offering the reliability expected from a professional standard account.

Key Advantages of Your Classic Account:

- Commission-Free Trading: Execute trades without any per-lot commissions, simplifying your cost analysis.

- Competitive Spreads: Benefit from tight, variable spreads that reflect true market conditions.

- Rapid Order Execution: Experience ultra-fast trade processing, crucial for capturing market opportunities.

- Accessibility: Start trading with a low minimum deposit, making professional-grade tools available to more traders.

- Diverse Instruments: Trade a broad spectrum of assets on leading platforms, including MetaTrader 4.

“The Tickmill Classic represents our commitment to straightforward, efficient, and cost-effective trading. It’s built for those who appreciate clarity and performance without unnecessary complexities.”

Joining the community of Tickmill Classic account holders means choosing a path of clarity and efficiency in your trading journey. We empower you with the tools and conditions to thrive, all backed by our decade-long expertise in the financial markets.

Competitive Spreads and Zero Commissions

Unlock an exceptional trading experience where your costs are transparent and kept to a minimum. At the heart of the Tickmill Classic account lies a commitment to offer truly competitive spreads coupled with the significant advantage of zero commissions on trades. This combination empowers you to maximize your potential returns without hidden fees eating into your profits.

We understand that trading costs matter. That’s why our competitive spreads ensure you get excellent pricing directly from top-tier liquidity providers. You see the true market conditions reflected in tighter bid-ask differences, creating more favorable entry and exit points for your positions. This focus on cost-efficiency makes a tangible difference in your overall trading performance.

Imagine executing your trades without the burden of per-lot commissions. That’s precisely what you get with the classic account. Unlike many brokers or even some standard account types in the industry that charge a fee for every transaction, our model for the Tickmill Classic is entirely commission-free. This means:

- Your trading costs are predictable, primarily based on the spread.

- No extra charges are deducted when you open or close a position.

- It simplifies your trading calculations and profit analysis.

This commission-free structure is especially beneficial for traders who execute frequent trades or deal with smaller position sizes, as it significantly reduces overhead. Your capital works harder for you, focused purely on market movements rather than transaction fees.

Choosing the Tickmill Classic means opting for a clear, straightforward, and cost-effective trading environment. We prioritize transparency and fairness, giving you the tools to trade confidently. Experience the difference of truly competitive spreads without the added cost of commissions.

Flexible Leverage Options

Leverage offers a powerful tool, amplifying your trading potential in the financial markets. At Tickmill, we understand that every trader has a unique approach and risk tolerance. That’s precisely why our Tickmill Classic account provides truly flexible leverage options, empowering you to align your trading capital with your personal strategy.

Unlike many brokers who offer rigid, one-size-fits-all leverage, our classic account puts you in control. You choose the level of leverage that best suits your comfort and market outlook. This crucial flexibility is a cornerstone of the Tickmill Classic experience, designed to adapt whether you prefer a conservative strategy or aim for more dynamic market engagement.

Here’s what flexible leverage on your Tickmill Classic account means for you:

- Customized Risk Management: You can meticulously manage your exposure by adjusting leverage to match current market conditions and your individual risk appetite. This precision is vital for sustainable trading.

- Optimized Capital Efficiency: Utilize your capital more effectively. Flexible leverage allows you to control larger positions with less initial capital, freeing up funds for diversification or other investment opportunities.

- Strategic Adaptation: Markets evolve constantly. Our flexible leverage ensures you can quickly adapt your trading strategy without being constrained by fixed parameters. Your account adapts as your strategy does.

While many standard account types might limit your choices, the Tickmill Classic account provides the freedom to select leverage that aligns perfectly with your trading goals. You decide how much financial power to apply to your trades, directly influencing your potential for both reward and risk. This level of control is invaluable for discerning traders.

Diverse Instrument Selection

Unlock vast opportunities across global markets with an impressive array of trading instruments. Our platform provides you with the power to diversify your portfolio and execute various strategies, all from a single, intuitive interface. Whether you are an experienced trader or just starting, having access to a broad selection of assets is crucial for robust risk management and maximizing potential returns.

For traders utilizing a classic account, this diverse selection means incredible flexibility. You can confidently explore different markets without feeling limited, making the most of your trading capital and seizing opportunities as they emerge.

Expand your trading horizons with these key instrument categories:

- Forex Majors, Minors, and Exotics: Dive into the world’s most liquid market with over 60 currency pairs. Capitalize on global economic events and currency fluctuations with tight spreads.

- Indices: Gain exposure to leading global stock markets through major indices. Trade the performance of entire economies like the S&P 500, DAX, and FTSE 100 without holding individual stocks.

- Commodities: Tap into the raw materials market. Trade precious metals like Gold and Silver, energy commodities such as Crude Oil, and various soft commodities.

- Bonds: Access government bonds and diversify your portfolio with fixed-income instruments, providing another avenue for market participation and hedging strategies.

This extensive range ensures that no matter your market preference or strategy, you find the right instruments to match. The fact that many of these instruments are available with a commission-free structure on the Tickmill Classic account further enhances your trading efficiency, allowing you to focus purely on market movements and strategy execution.

Consider the strategic advantage this diversity offers:

| Benefit | Impact on Trading |

|---|---|

| Portfolio Diversification | Spread risk across various asset classes and reduce concentration. |

| Strategy Flexibility | Implement multiple trading approaches (e.g., trend following, hedging, arbitrage) confidently. |

| Market Opportunity | Always find active markets and potential setups, regardless of economic cycles. |

This comprehensive selection sets a high benchmark, even when compared to a typical standard account offered elsewhere. It ensures you have the tools to navigate any market condition. Choose an environment where your trading ambitions meet a comprehensive selection, providing endless possibilities and supporting your journey to trading success.

Who Should Consider the Tickmill Classic?

Are you exploring your trading options and wondering which account suits your style best? The Tickmill Classic account might be exactly what you need. It’s specifically tailored for traders who value simplicity, straightforward costs, and a clear trading environment. Forget complex fee structures; this account type puts clarity first.

Here’s a closer look at the types of traders who stand to gain the most from choosing the Tickmill Classic:

- New and Developing Traders: If you’re just starting your journey in the financial markets, the Tickmill Classic offers an excellent entry point. Its predictable cost structure means you can focus more on learning strategies and market dynamics without worrying about commission fees eating into your small profits or adding to your learning curve. This classic account simplifies your initial experience.

- Cost-Conscious Investors: For those who meticulously track every expense, the commission-free aspect of the Tickmill Classic is a major draw. You’ll only pay through the spread, which means no additional per-trade charges. This makes budgeting and calculating potential profits much more straightforward, a stark contrast to some accounts that add commissions on top of spreads.

- Traders Prioritizing Simplicity: Do you prefer a clean, uncluttered trading experience? The Tickmill Classic removes the complexity often associated with tiered commission structures or varying fee schedules. It’s a no-frills, efficient option for getting straight to trading.

- High-Volume Traders with Specific Strategies: While some high-volume strategies benefit from raw spreads and commissions, many others thrive on the simplicity of the Tickmill Classic. If your strategy accounts for spread costs and you appreciate not having an extra commission layer, this account provides consistent execution and a transparent pricing model.

“The Tickmill Classic truly shines for traders who want a clear, commission-free path to the markets. It simplifies the cost equation, allowing you to focus purely on your trading decisions.”

Unlike a standard account with varied conditions, the Tickmill Classic is designed to be a reliable and accessible option for a broad spectrum of traders seeking clarity and value. If you appreciate knowing your costs upfront and prefer not to deal with commissions, this account is certainly worth your consideration.

Understanding Spreads and Execution

Every seasoned trader knows that success hinges on two critical factors: the spread you pay and how quickly your orders execute. These aren’t just technical terms; they are fundamental to your trading success, directly impacting your profitability and overall experience.

A spread is simply the difference between the buy (ask) and sell (bid) price of a financial instrument. It’s the primary transaction cost you incur in a trade. On many accounts, like the Tickmill Classic account, where trading is commission-free, spreads are how the broker profits. You want these spreads tight and consistent, especially when navigating active markets.

Beyond spreads, execution quality is paramount. This refers to the speed and reliability with which your broker processes your trade orders. Fast execution means your order fills at or very close to your intended price. Slow execution, on the other hand, can lead to slippage, where your order gets filled at a less favorable price, eating into your potential profits. Precision matters in volatile markets.

The Tickmill Classic account is specifically engineered to provide a balanced trading environment where competitive spreads meet robust execution. We understand that traders value clarity and consistency. Our model for the classic account prioritizes delivering market spreads, ensuring you always see transparent pricing without hidden fees.

Why This Matters for Your Trading

When you choose the Tickmill Classic account, you benefit from a trading environment designed with your needs in mind:

- Predictable Costs: With commission-free trading, you clearly understand your transaction costs upfront through the spread.

- Minimized Slippage: Our fast execution minimizes the chance of your orders filling at unwanted prices, giving you greater control.

- Fair Access to Markets: You access real-time market pricing, empowering you to make informed decisions confidently.

- Enhanced Profit Potential: Tight spreads and efficient execution combine to preserve your capital and maximize potential returns on every trade.

The Commission-Free Advantage of Tickmill Classic

Ever felt bogged down by hidden fees and complex commission structures when trading? The Tickmill Classic account changes that narrative entirely. It’s a straightforward approach designed for traders who value transparency and efficiency.

What Truly Means “Commission-Free”

With Tickmill Classic, what you see is truly what you get. You trade without any per-lot commission charges. This means your trading costs are primarily limited to the spread, offering a transparent and straightforward pricing model. The Tickmill Classic account is built on the principle of clear cost visibility.

Why Zero Commissions Matter to Your Trading Success

Embracing a commission-free environment brings significant benefits that can impact your bottom line and overall trading experience. Here are some key advantages:

- Direct Cost Savings: Every dollar not spent on commissions is a dollar that stays in your account, boosting your potential profitability over time.

- Simplified Trade Planning: Forget complex calculations that factor in commissions. You only need to consider the spread when evaluating potential trades, making decision-making faster and clearer.

- Increased Trading Frequency Potential: For strategies involving frequent trades, the absence of commissions can significantly reduce cumulative costs, making such approaches more viable.

- Unwavering Transparency: You gain clear visibility over your trading expenses from the outset. No surprises, just honest pricing.

Comparing Tickmill Classic to a Standard Account

While many brokers offer a “standard account,” the Tickmill Classic specifically champions a true commission-free model. This distinct approach sets it apart, especially for those who prioritize predictable costs.

| Feature | Tickmill Classic Account | Typical Standard Account (with commissions) |

|---|---|---|

| Trading Commissions | None (Commission-Free) | Per-lot or percentage charges |

| Primary Cost Factor | Spread only | Spread + commissions |

| Cost Transparency | High and predictable | Moderate (requires calculating commissions) |

The commission-free nature of Tickmill Classic makes it an ideal choice for a wide range of traders, from beginners taking their first steps to experienced professionals seeking a streamlined, cost-effective solution. Experience the confidence that comes with clear, predictable trading costs.

Leverage and Margin Requirements

Imagine amplifying your trading power to seize market opportunities, even with a modest initial deposit. That’s the core promise of leverage and margin in the financial markets. These fundamental concepts empower traders, but understanding them fully is crucial for effective risk management and successful trading, especially when you trade with a Tickmill Classic account.

Understanding Leverage: Your Trading Multiplier

Leverage is essentially a temporary loan extended by your broker, allowing you to control a much larger position in the market than your actual capital would typically permit. Think of it as a financial multiplier. For example, if you use 1:500 leverage, every $1 of your capital can control a position worth $500. This amplification means even small price movements can translate into significant potential profits. However, it’s vital to remember that leverage amplifies both gains and losses equally. This makes prudent risk management an absolute necessity.

With a Tickmill Classic account, you access competitive leverage options tailored to different instruments and market conditions. This flexibility empowers you to align your trading strategy with your risk appetite, giving you greater control over your market exposure.

Margin Requirements: The Foundation of Your Trades

To utilize leverage, you commit a portion of your capital as “margin.” This is not a fee or a cost; instead, it’s a good-faith deposit or collateral that you pledge to open and maintain your leveraged positions. Your broker reserves this amount from your account balance to cover any potential losses that might arise from your trades. The specific margin required depends on several factors, including the trading instrument, the volume of your trade, and the leverage ratio you employ.

For your classic account, Tickmill provides clear and transparent margin requirements. We ensure you always understand the capital needed to support your open positions. This clarity is essential for managing your available funds and avoiding unexpected situations like margin calls, where you might need to deposit more capital to keep your trades open. By combining competitive leverage with our commission-free trading structure, the Tickmill Classic account offers a compelling environment for traders.

Key Considerations for Your Trading Strategy

Leverage and margin are powerful tools, but they demand respect and a clear strategy. Here’s what you need to consider:

- Risk Management is Paramount: Never overleverage. Always choose a leverage level that aligns with your comfort zone and risk tolerance. Higher leverage means higher risk.

- Monitor Your Margin: Keep a close eye on your equity and available margin. Know when a margin call might be approaching and have a plan to address it.

- Understand the Market: Different markets and instruments may have varying margin requirements. Familiarize yourself with these specifics for your chosen assets.

- Strategic Advantage: Used wisely, the leverage on your Tickmill Classic account can offer a significant strategic advantage, allowing you to diversify your portfolio or capitalize on short-term movements without tying up excessive capital.

By mastering the interplay of leverage and margin, you gain a significant edge. Your classic account is built to support your trading journey with robust tools and clear conditions, helping you navigate the markets with confidence.

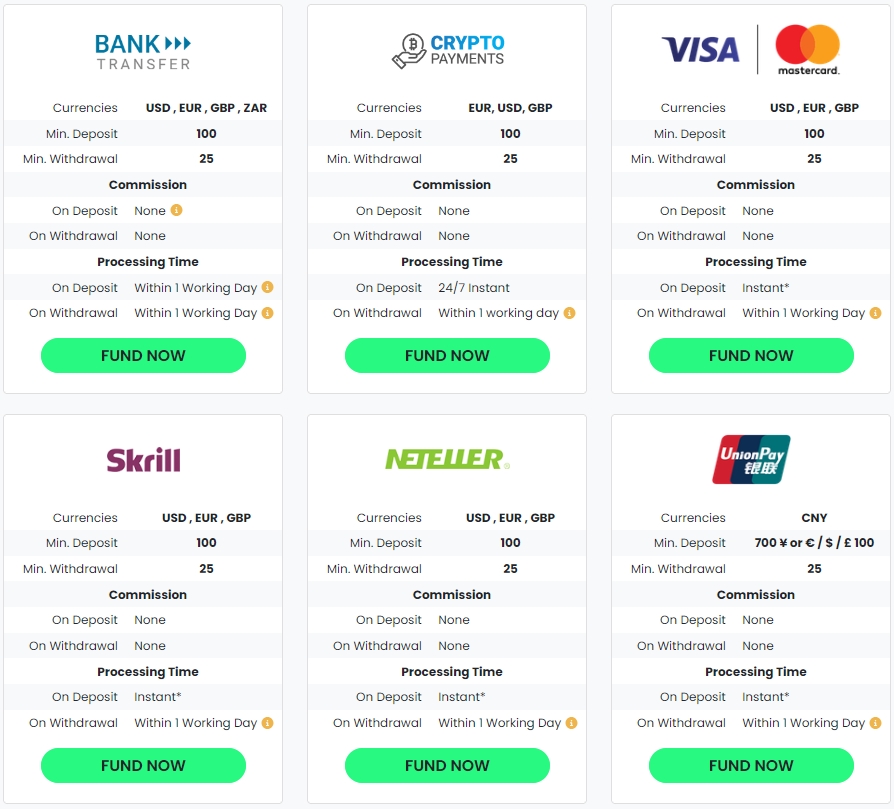

Minimum Deposit and Account Funding Options

You’re ready to dive into the markets, and we understand that starting out should be as straightforward as possible. That’s why Tickmill makes funding your trading account simple and accessible, especially for those looking at the popular Tickmill Classic offering. Getting started is easy, giving you quick access to trading opportunities.

Accessible Entry with the Tickmill Classic Account

For traders opting for the Tickmill Classic, the barrier to entry is kept low. A minimum deposit of just $100 USD (or the equivalent in EUR, GBP, or PLN) is all you need to open your account. This approachable threshold ensures that both new traders and those transitioning from a standard account can easily begin their trading journey without a significant initial capital commitment. It’s designed to be an inclusive option, paving the way for you to experience a robust trading environment with the Tickmill Classic.

Your Flexible Funding Pathways

We provide a comprehensive suite of secure and convenient methods to fund your trading account. Our goal is to make the deposit process seamless, allowing you to focus on what matters most: your trading strategy. You have diverse options to choose from, catering to various preferences and geographical locations.

- Bank Wire Transfers: A traditional and highly secure method for larger deposits. While it might take a few business days for funds to reflect, it’s a reliable choice.

- Credit/Debit Cards: Instant deposits are available via Visa and MasterCard. This is often the fastest way to get funds into your account and start trading.

- E-Wallets: Popular digital payment solutions like Skrill, Neteller, FasaPay, UnionPay, and WebMoney offer swift and secure transactions. These methods typically process deposits instantly or within a few hours.

Deposit Processing at a Glance

Understanding the typical processing times for your deposits can help you plan your trading activity effectively. Here’s a quick overview:

| Deposit Method | Typical Processing Time | Tickmill Deposit Fee |

|---|---|---|

| Credit/Debit Cards | Instant | None |

| Skrill & Neteller | Instant | None |

| FasaPay, UnionPay, WebMoney | Up to 1 Business Day | None |

| Bank Wire Transfer | 2-7 Business Days | None |

We do not charge any fees for deposits. However, please be aware that your bank or payment provider may impose their own charges, so it’s always wise to check with them directly. The funds you deposit are quickly available for trading on your classic account, putting you in control of your financial moves. This commitment to transparency extends throughout our services, including the transparent, commission-free trading experience you can expect with Tickmill Classic.

Range of Tradable Instruments

Exploring the financial markets demands access to a diverse set of instruments. At Tickmill, we understand this crucial need and provide a comprehensive selection through accounts like the Tickmill Classic. This diversity empowers you to build a robust portfolio, mitigate risks, and capitalize on various market movements. Whether you’re a beginner or an experienced trader, the wide array of options available helps shape your trading strategy.

When you choose a classic account, you unlock opportunities across major asset classes. Our platform ensures you have access to what matters most for effective market engagement. We simplify market access, allowing you to focus on your trading decisions rather than navigating complex account structures. Many traders look for a straightforward standard account, and the Tickmill Classic delivers exactly that, with distinct advantages.

Here’s a glimpse at the extensive range of instruments readily available:

- Forex Majors and Minors: Trade over 60 currency pairs, from highly liquid majors like EUR/USD and GBP/USD to a broad selection of minors and exotic pairs. This breadth offers constant opportunities regardless of your preferred trading style.

- Indices: Gain exposure to global economies by trading CFDs on major world indices. Track the performance of leading markets across the US, Europe, and Asia, capitalizing on broader market trends.

- Commodities: Diversify your portfolio with popular energies like Crude Oil and precious metals such as Gold and Silver. These instruments often offer unique hedging capabilities and speculative potential, acting as safe havens or inflation hedges.

- Bonds: Engage with government bonds, providing another avenue for portfolio diversification. Bonds can offer lower correlation to other assets, helping to balance your overall risk exposure.

A significant benefit when trading these instruments via your Tickmill Classic account is our commitment to a commission-free structure on many assets, particularly Forex and Metals. This transparency helps you retain more of your potential profits, making your trading experience more cost-effective.

| Instrument Type | Key Features & Benefits |

|---|---|

| Forex | Access to over 60 currency pairs, competitive spreads, and commission-free trading on most pairs. |

| Indices | Global market exposure through major indices CFDs, often with no commissions. |

| Commodities | Trade Gold, Silver, Crude Oil; diversify with assets that can act as inflation hedges, often commission-free. |

| Bonds | Opportunity to trade government bonds for portfolio diversification and managing risk. |

This comprehensive selection ensures that your trading ambitions are well-supported. Take control of your financial journey and explore the markets with confidence, knowing you have the tools and choices necessary for effective trading through your Tickmill Classic account.

Accessing Markets via MT4 and MT5

Get ready to navigate the global financial markets with unparalleled precision! At Tickmill, we understand that having the right tools makes all the difference. That’s why we empower our traders with the industry’s most popular and robust platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These powerful platforms put the world of trading at your fingertips, offering a seamless and intuitive experience.

MetaTrader 4 remains a firm favorite among forex traders worldwide. Its reputation for reliability and user-friendliness is unmatched. With MT4, you access a comprehensive suite of charting tools, analytical indicators, and the ability to deploy Expert Advisors (EAs) for automated trading. This platform provides a stable environment, perfect for executing your strategies with confidence, especially when you’re focusing on a clear trading approach, much like what the classic account offers. You enjoy full control over your trades, viewing real-time quotes and managing positions effortlessly.

Ready for an upgrade? MetaTrader 5 brings even more to the table. While retaining the core strengths of MT4, MT5 expands your trading horizons with additional asset classes, more technical indicators, and extra timeframes for deeper market analysis. You also get an economic calendar built right in, plus a multi-threaded strategy tester for EAs, offering enhanced backtesting capabilities. For traders who demand advanced features and a broader market scope beyond just forex, MT5 delivers a cutting-edge experience.

| Feature | MetaTrader 4 | MetaTrader 5 |

|---|---|---|

| Markets | Forex, CFDs | Forex, CFDs, Stocks, Futures |

| Indicators | 30 built-in | 38 built-in |

| Pending Orders | 4 types | 6 types |

| Timeframes | 9 | 21 |

No matter which platform you choose, Tickmill ensures a superior trading environment. When you opt for the Tickmill Classic account, you gain immediate access to these industry-leading platforms, allowing you to trade with precision. This classic account is specifically designed for straightforward, commission-free trading, providing transparent pricing and excellent execution. We make sure your focus stays on the markets, not on complex fee structures. Start your trading journey today and experience the difference of a truly optimized setup.

Benefits of Trading with Tickmill Classic

Choosing the right trading account sets the stage for your success. The Tickmill Classic account is a popular choice for traders seeking a straightforward and cost-effective experience. It delivers a unique blend of advantages designed to empower both beginners and seasoned professionals. Let’s delve into what makes this particular account stand out.

One of the most compelling reasons traders gravitate towards the classic account is its truly commission-free structure. This means you trade without paying any commissions per lot, a significant benefit that simplifies your overall trading costs. Instead, all expenses are neatly integrated into highly competitive spreads. For active traders, this model is incredibly advantageous, allowing for clearer calculation of potential profits and losses without the complication of extra fees.

Transparency forms a core pillar of the Tickmill Classic experience. With no hidden charges or complex commission tiers, you always have a clear understanding of your trading expenses. This clarity helps you manage your risk and capital more effectively, making it easier to execute your trading strategies with unwavering confidence. It offers a simpler, more predictable environment compared to some standard account types that might introduce variable commission structures.

The Tickmill Classic is designed for accessibility, making it an excellent option whether you are just embarking on your trading journey or bringing years of experience to the table. It especially appeals to those who prefer to focus their energy on market analysis and strategy development, free from the distraction of intricate commission calculations. The intuitive nature of the Tickmill Classic helps you concentrate on what truly matters: making informed and profitable trading decisions across a diverse range of instruments.

Here’s a quick overview of the advantages you gain:

- Zero Commissions: Enjoy trading without per-lot commission fees, simplifying your cost analysis.

- Transparent Spreads: All trading costs are clearly presented within tight, competitive spreads.

- Predictable Trading: Benefit from a clear cost structure, making it easier to plan and manage your trades.

- Broad Accessibility: Ideal for traders of all experience levels, from novices to experts.

- Diverse Market Access: Trade a wide array of financial instruments.

The Tickmill Classic embodies a commitment to providing a fair, efficient, and user-friendly trading environment. Its emphasis on clear costs and straightforward trading conditions ensures you can dedicate your full attention to achieving your trading goals. Ready to discover a more streamlined way to trade? Explore the Tickmill Classic and enhance your trading journey today.

Cost-Effectiveness for Certain Strategies

Thinking about trading costs? The Tickmill Classic stands out for its cost-effectiveness when paired with specific trading strategies. Its structure avoids common pitfalls, preventing profit erosion and giving traders a distinct advantage.

This classic account design centers on offering a commission-free trading environment. Instead of paying a fixed fee for each trade you open or close, your costs are primarily integrated into the spread. For many traders, this direct approach simplifies expense tracking and optimizes profit margins.

Which strategies thrive under this model? Consider these:

- High-Volume Trading: If your strategy involves numerous small trades, avoiding per-lot commissions can save substantial amounts. Imagine executing dozens of trades daily; those small commissions quickly add up.

- Short-Term Strategies: Day traders or scalpers, who often enter and exit positions within minutes, find the absence of commissions highly beneficial. It allows them to capitalize on smaller price movements without the burden of additional fees.

- Beginner Traders: Newcomers to the market often start with smaller capital. A standard account that is commission-free helps them manage their budget more effectively, allowing them to focus on learning without the added stress of per-trade costs.

- Cost-Sensitive Strategies: Any strategy where tight profit margins are the norm benefits immensely. Removing the commission barrier means more of your realized gains stay in your pocket.

The core benefit of the Tickmill Classic model lies in its predictability. You know your trading costs upfront through the spread, making risk-reward calculations clearer and more straightforward. This clarity empowers you to execute your trading plan with confidence, knowing exactly what your transactional expenses entail.

Suitability for Beginners

Stepping into the world of online trading can feel daunting, but finding the right platform and account type makes all the difference. The Tickmill Classic account stands out as an excellent choice for those new to the markets. We designed this classic account with simplicity and ease of use in mind, removing common hurdles that often discourage new traders.

Newcomers appreciate a straightforward trading environment, and that’s precisely what the Tickmill Classic delivers. It offers a clear path to begin your trading journey without getting bogged down in intricate features or complicated fee structures.

- Simple Cost Structure: Enjoy a completely commission-free trading experience. This means you don’t pay a separate fee on each trade, making it much easier to calculate your costs and manage your capital.

- User-Friendly Interface: Experience a seamless setup that mimics the simplicity of a standard account. Its intuitive design helps you focus on learning the ropes of trading rather than navigating complex platforms.

- Accessible Entry: The low barrier to entry for the Tickmill Classic makes it accessible for traders starting with smaller capital. This empowers you to gain practical experience without significant initial investment.

- Clear Trading Conditions: Understand your trading conditions upfront. This transparency helps build confidence as you learn and execute your first trades.

Choosing Tickmill Classic means you’re selecting an account type that supports your growth from day one. It removes unnecessary complexity, allowing you to concentrate on developing your trading skills in a supportive environment. Ready to explore trading with confidence?

Potential Drawbacks to Note

Even the most robust trading solutions come with specific characteristics that might not align with every single trader’s unique strategy. Understanding these nuances helps you make a truly informed decision about the Tickmill Classic account.

Here are a few key considerations for this account type:

- Wider Spreads:

A primary feature of the Tickmill Classic offering is its commission-free trading. This structure means that instead of paying a direct fee per trade, the broker’s compensation is typically incorporated into a slightly wider spread. While highly competitive within its category, traders accustomed to raw spreads found in ECN-style accounts (which usually charge a separate commission) might notice this difference. It’s a common industry model, representing a different cost structure rather than an inherent flaw.

- Execution Model Nuances:

While Tickmill is known for its fast execution, some ultra-high-frequency traders or those needing absolute direct market access might prefer other account types designed specifically for that purpose. The classic account delivers excellent execution for the vast majority of retail traders. However, if your strategy demands micro-second differences and a raw interbank feed, exploring all options is always a wise move.

Ultimately, what one trader views as a drawback, another sees as a significant benefit. The Tickmill Classic is specifically designed for straightforward, commission-free trading, appealing to those who prefer simplicity in their cost structure. If you prioritize minimal upfront costs and predictable trading expenses without separate commissions, this might be exactly what you need.

We believe in full transparency, empowering you to choose the best fit for your trading journey. Ready to explore a standard account experience that prioritizes clarity?

Step-by-Step: Opening Your Classic Account

Ready to unlock a trading experience designed for straightforward execution and clear pricing? Opening your Tickmill Classic account is a seamless process. We’ve simplified it into a few easy steps, ensuring you can quickly get started in the markets with confidence.

Many traders choose the classic account for its distinct advantages, notably its often commission-free trading on forex and metals. It’s an excellent option for those who appreciate simplicity and direct cost structures, setting it apart from more complex setups you might find with a typical standard account.

Your Journey to Trading Success:

- Visit the Tickmill Website: Your first step is simple. Navigate directly to the official Tickmill website. You’ll find all the resources you need to begin your trading adventure.

- Initiate Account Registration: Look for the prominent “Open Account” button, usually located at the top of the homepage. Clicking this will lead you to the initial registration page.

- Select Your Classic Account: On the account selection page, actively choose the Tickmill Classic option. Confirm this selection to ensure you benefit from its specific features, including the attractive commission-free trading environment on many instruments.

- Complete the Registration Form: Fill in the required personal details accurately. This step includes providing your name, contact information, and answering a few questions about your trading experience. Precision here speeds up the verification process.

- Verify Your Identity: To comply with regulatory standards and ensure your account’s security, submit the necessary identification and residency documents. This is a crucial step for protecting your funds and maintaining a secure trading environment.

- Fund Your Trading Account: Once Tickmill verifies your documents, you can deposit funds into your classic account. Choose from a variety of secure funding methods tailored to your convenience.

- Start Trading with Confidence: With your funds successfully deposited into your Tickmill Classic account, you are now ready to access the markets. Explore trading opportunities with excellent execution and transparent conditions.

That’s it! In just a few straightforward steps, you can set up your classic account and begin exploring the global markets. We’ve made the process quick and easy, so you can focus on what matters most: your trading strategy.

Tickmill Classic vs. Pro and VIP Accounts

Choosing the right trading account is a pivotal decision that shapes your trading experience and potential profitability. At Tickmill, we understand that traders have diverse needs, strategies, and capital levels. That’s why we offer a range of account types, each crafted to provide specific advantages. Understanding the distinctions between the **Tickmill Classic** account, Pro, and VIP options empowers you to make an informed choice that aligns perfectly with your trading goals.

Unpacking the Tickmill Classic Account

The **Tickmill Classic** account is often the starting point for many traders, particularly those newer to the markets or who prefer a straightforward, predictable cost structure. It operates as a **commission-free** model, meaning you won’t incur additional charges per trade on top of the spread. This makes calculating potential costs quite simple. Spreads on the **classic account** start from 1.6 pips, offering a balance between accessibility and execution quality. Many consider this a robust **standard account** for its simplicity.

Exploring the Pro Account Advantages

Moving up, the Pro account caters to more active traders who prioritize tighter spreads. With the Pro account, you can expect spreads starting from as low as 0.0 pips on major currency pairs. The trade-off for these ultra-low spreads is a commission fee of 2 per side per lot ($4 per standard lot round turn). This model often appeals to scalpers, day traders, and those employing strategies that benefit significantly from minimal price slippage.

Delving into the VIP Account Experience

The VIP account sits at the pinnacle, designed for professional traders with substantial trading volumes. It offers the tightest spreads available, often starting from 0.0 pips, coupled with an even lower commission structure than the Pro account—typically 1 per side per lot ($2 per standard lot round turn). To qualify for a VIP account, you generally need to maintain a higher account balance or demonstrate significant trading activity. This exclusive account type provides superior conditions for high-frequency trading and large position sizes, ensuring optimal cost efficiency.

Key Differences at a Glance

To help you quickly grasp the core distinctions, here’s a comparative overview:

| Feature | Tickmill Classic Account | Pro Account | VIP Account |

|---|---|---|---|

| Commission | Commission-free | $4 per standard lot (round turn) | $2 per standard lot (round turn) |

| Spreads (starts from) | 1.6 pips | 0.0 pips | 0.0 pips |

| Minimum Deposit | 100 USD/EUR/GBP | 100 USD/EUR/GBP | 50,000 USD/EUR/GBP (or equivalent) |

| Target Trader | Beginners, simplicity seekers | Active traders, scalpers, algo traders | High-volume, professional traders |

Choosing Your Ideal Trading Partner

Your choice between the **Tickmill Classic**, Pro, or VIP account should stem from a clear understanding of your trading style, capital, and priorities.

- Opt for the Tickmill Classic if: You are new to trading, prefer predictable costs without commissions, or trade less frequently. The simplicity of a **commission-free** **standard account** makes it an excellent entry point.

- Consider the Pro Account if: You are an active trader who values razor-thin spreads and is comfortable paying a small commission for superior execution conditions.

- Select the VIP Account if: You are a high-volume, experienced trader with significant capital, seeking the absolute best pricing structure and customized support.

Each account offers distinct advantages. By carefully evaluating your personal trading profile against these options, you empower yourself to select the Tickmill account that best serves your journey to financial markets success.

Support and Educational Resources

Navigating the dynamic world of trading demands more than just access to markets; it requires reliable support and a rich source of knowledge. We understand this deeply. That is why we commit to empowering you with exceptional assistance and an extensive library of educational resources, ensuring you always feel confident and informed on your trading journey.

Dedicated Assistance, Every Step of the Way

Our expert support team stands ready to assist you around the clock, five days a week. We believe in providing personalized, human-centric help that addresses your specific needs, whether you have a question about your Tickmill Classic account settings or need clarification on market hours. We equip our support professionals with the tools and knowledge to deliver swift, effective solutions.

You can reach our team through various convenient channels:

- Live Chat: Get instant answers to your pressing questions directly on our platform.

- Email Support: Send us detailed inquiries and receive comprehensive responses.

- Phone Assistance: Speak directly with a representative for immediate, clear communication.

Our commitment ensures that help is always just a click or a call away, making your trading experience smooth and hassle-free.

Unlock Your Potential with Comprehensive Education

Knowledge truly is power in the financial markets. We provide an extensive educational hub designed to elevate your trading skills and understanding, regardless of your experience level. Whether you are exploring the benefits of a classic account or curious about the specifics of a standard account, our resources cover a broad spectrum of topics to sharpen your edge.

Our educational offerings include:

| Resource Type | What You Gain |

|---|---|

| In-Depth Guides & Articles | Understand fundamental concepts, technical analysis, and market psychology. |

| Webinars & Video Tutorials | Learn practical strategies from industry experts through engaging visual content. |

| Market Analysis & News | Stay informed with daily insights, helping you identify opportunities and risks. |

| Trading Glossary & FAQs | Demystify complex terminology and find quick answers to common queries. |

We craft these resources to help you master everything from basic trading mechanics to advanced strategies, including how to capitalize on commission-free trading opportunities. Our goal is to transform complex financial concepts into actionable insights, making you a more confident and strategic trader.

“An investment in knowledge pays the best interest.”

Leverage our dedicated support and rich educational content to maximize your trading potential. Join us and experience the confidence that comes from being well-supported and thoroughly informed.

Common Queries About This Account Type

Navigating the world of trading accounts can feel complex, but understanding your options is key to a successful journey. Here, we tackle the most frequent questions about the Tickmill Classic account, designed to give you clarity and confidence.

What makes the Tickmill Classic different? The Tickmill Classic account stands out primarily for its straightforward cost structure. Unlike some other account types that charge commissions on trades, the classic account is commission-free. This means your trading costs are embedded within the spread, offering a predictable expense model for every trade you execute. It’s an ideal choice for traders who prefer simplicity.

Who does the classic account suit best? Newer traders and those who prefer a more traditional trading experience particularly favor this account type, as it avoids separate commission calculations. If you’re looking for an accessible entry point to the markets or a transparent fee structure, the classic account could be your perfect match. It accommodates various trading strategies, from scalping to long-term positions.

What are the minimum deposit requirements for the Tickmill Classic? Tickmill aims to keep market access open and inclusive. You can typically open a Tickmill Classic account with a relatively low minimum deposit, making it accessible for a wide range of budgets. We encourage you to check the specific requirements on our website, as these can vary slightly by region or promotional offers.

What instruments can I trade with this account? With the Tickmill Classic, you gain access to a diverse range of financial instruments. This typically includes major, minor, and exotic Forex pairs, along with various CFDs on indices, commodities, and more. This breadth of choice allows you to diversify your portfolio and explore different market opportunities, all within the robust framework of the classic account.

How do spreads compare on the Tickmill Classic versus other accounts? Spreads on the Tickmill Classic are competitive and reflect its commission-free nature. While spreads might appear slightly wider compared to some ECN-style accounts that charge a separate commission, remember you’re not paying an additional fee per lot. This integrated cost model provides clarity, as it consolidates all your trading expenses within the spread. For comparison, a standard account often operates similarly, but Tickmill ensures attractive pricing across its offerings.

Key Benefits of Choosing the Tickmill Classic:

- Commission-Free Trading: Simplify your cost calculations.

- Transparent Spreads: All costs are integrated into the spread.

- Accessibility: Low minimum deposit makes it easy to start.

- Diverse Instruments: Trade Forex, indices, commodities, and more.

- User-Friendly: Ideal for new traders and those seeking straightforward execution.

Ready to experience the clarity and efficiency of the Tickmill Classic? Join a community of savvy traders who value transparency and a solid trading environment. We’re here to support your journey every step of the way.

Frequently Asked Questions

What is the primary characteristic of the Tickmill Classic account?

The Tickmill Classic account is primarily characterized by its commission-free trading structure, meaning there are no per-lot charges. Trading costs are integrated into competitive spreads, offering a transparent and predictable expense model.

Who is the Tickmill Classic account best suited for?

It is ideal for new and developing traders, cost-conscious investors, and those who prioritize simplicity in their trading experience. Its straightforward pricing makes it easy to focus on strategy without complex fee calculations.

What trading instruments are available with the Tickmill Classic account?

Traders with a Tickmill Classic account can access a diverse range of instruments, including over 60 Forex pairs (majors, minors, exotics), CFDs on major global indices, commodities (like Gold, Silver, Crude Oil), and government bonds.

What are the minimum deposit requirements and funding options for this account?

The Tickmill Classic account requires a minimum deposit of just $100 USD (or equivalent). Funding options are flexible and secure, including bank wire transfers, credit/debit cards (Visa, MasterCard), and popular e-wallets such as Skrill, Neteller, FasaPay, UnionPay, and WebMoney.

How does the Tickmill Classic account compare to Tickmill’s Pro and VIP accounts?

The Classic account is commission-free with spreads starting from 1.6 pips, suitable for beginners. Pro and VIP accounts offer tighter spreads (0.0 pips) but charge commissions per lot ($4 and $2 round turn, respectively) and cater to active or high-volume professional traders with higher capital requirements for VIP.